Amidst a mixed economic picture, stocks initially rose during the week but fell on Friday as investors tried to make sense of a mixed batch of economic data ahead of the Fed’s policy meeting next week.

Inflation data, via the CPI, showed a surprise up-tick, rising 0.6% on a month-over-month basis, boosting the annual inflation rate to 3.7% in August. Along similar lines, the producer price index (PPI) reading also showed an unexpected 0.7% jump in August, higher than the 0.4% estimated by analysts. While this could potentially throw cold water on the Fed’s presumed decision to pause rates next week, investors were excited about growth once again. Stocks surged on the recent IPO of semiconductor design stock ARM Holdings, with the stock seeing large gains on its first day of trading. This prompted grocery delivery startup Instacart to raise its IPO target price. Also bullish was the continued strength shown by the labor and consumer segments of the economy. On one hand, initial jobless claims rose by 3000 to come in at 220,000 for the week ending September 9, below estimates and roughly in line with previous measures. On the other hand, retail sales jumped by 0.6% month-over-month, beating estimates and previous readings. Both measures indicate that the economy is doing well even with higher borrowing costs.

It’s Fed Week once again, with all eyes on the central bank’s latest decision on interest rates. Investors remain uncertain about the direction the Fed is likely to take in the coming days. Speaking at the Jackson Hole Symposium, Chair Jerome Powell emphasized that more hikes could be in order to stem strong inflation. However, data has suggested that the economy is slowing and that inflationary pressures have been easing. There is a good chance that the Fed will pause rate hikes when it announces its decision on Wednesday. Investors won’t really get much additional economic data next week, with the focus being on the Fed. However, month-over-month housing starts and building permits data will be released on Tuesday. Both measures have shown an upward trend in recent readings as would-be home buyers have taken the plunge despite higher mortgage rates. Analysts expect the end of the summer home-buying season to cause the figures to dip, with housing starts notably declining by 2.5%. Investors will also look towards initial jobless claims on Thursday, which continue to show a robust labor market. Nevertheless,

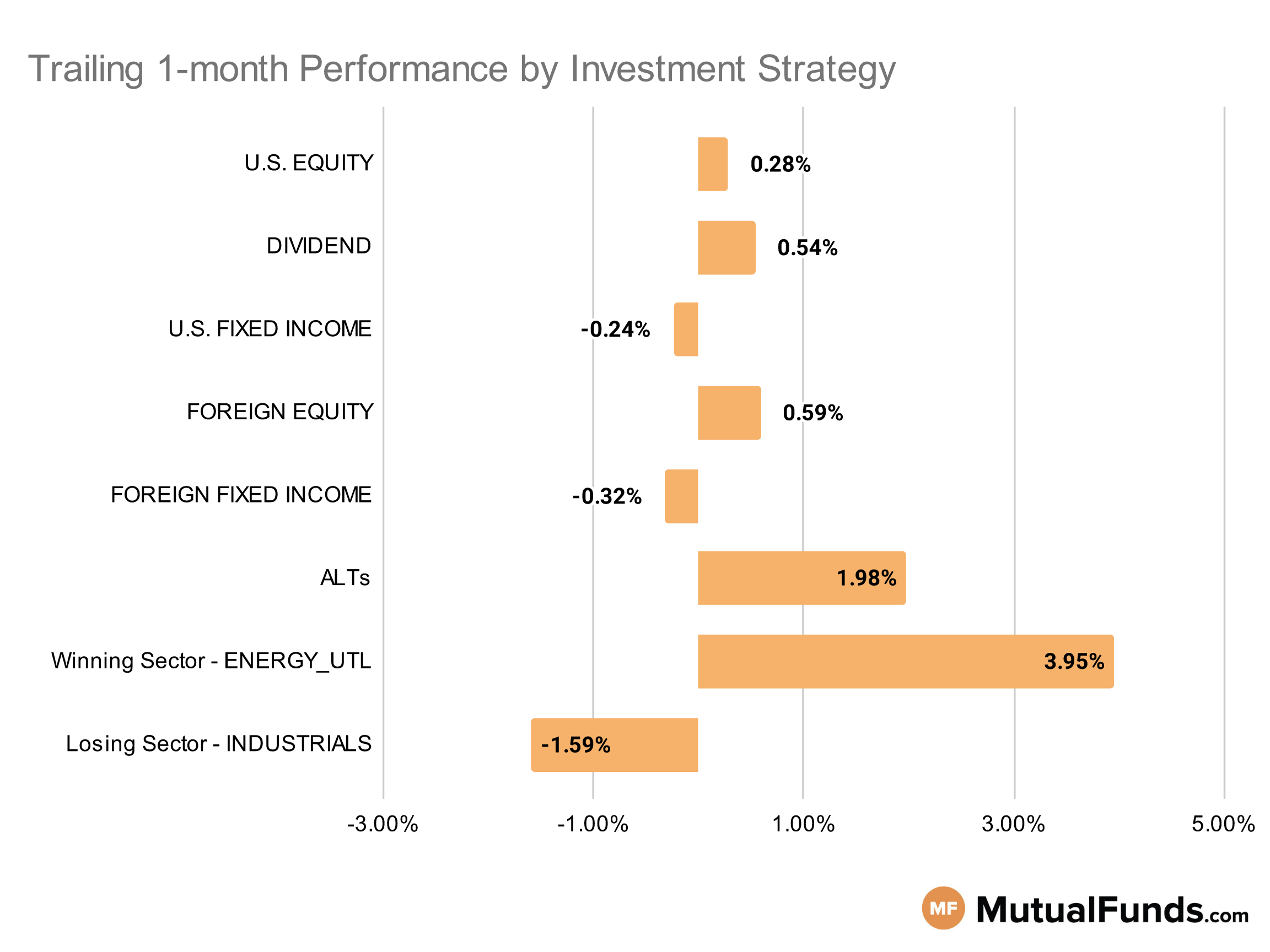

Given this economic backdrop, let us see how this impacts the performance of various investment strategies.

Investment Strategy Scorecard

Overall, the U.S. stock markets were slightly up for the rolling month.

Several canabis ETFs continue to outperform others on a rolling month basis. At the same time, strategies focused on emerging markets also continued their strong performance. However, several small-cap strategies struggled.

U.S Equity Strategies

Overall, strategies focused on growth continue to outperform their value counterparts among key U.S. equity strategies. Small cap strategies struggled.

Winning

- Morgan Stanley Institutional Fund, Inc. Growth Portfolio (MSEGX) , up 5.7%

- Virtus Zevenbergen Innovative Growth Stock Fund (SCATX), up 5.03%

- Schwab U.S. Large-Cap Growth ETF™ (SCHG) , up 2.86%

- Fidelity® Nasdaq Composite Index® ETF (ONEQ), up 2.58%

Losing

- SPDR® S&P 600 Small Cap Value ETF (SLYV) , down -2.77%

- iShares Micro-Cap ETF (IWC), down -3.18%

- Wells Fargo Premier Large Company Growth Fund (EKJAX) , down -11.03%

- Lazard US Equity Concentrated Portfolio (LEVOX), down -12.31%

Dividend Strategies

Dividend strategies reversed course over the last trailing month, with several international strategies posting marginal gains. However, small cap dividend strategies continued their struggle.

Winning

- First Trust Dow Jones Global Select Dividend Index Fund (FGD) , up 2.84%

- SPDR® S&P International Dividend ETF (DWX), up 2.51%

- Thornburg Investment Income Builder Fund (TIBAX) , up 2.49%

- HCM Dividend Sector Plus Fund (HCMNX), up 2.26%

Losing

- WisdomTree U.S. SmallCap Dividend Fund (DES) , down -1.72%

- Ivy Mid Cap Income Opportunities Fund (IVOSX), down -2.01%

- ProShares Russell 2000 Dividend Growers ETF (SMDV) , down -2.47%

- Hartford Dividend and Growth HLS Fund (HIADX), down -7.37%

U.S. Fixed Income Strategies

In US fixed income, floating rate and interest rate hedging strategies managed to post marginal gains while muni bond strategies struggled.

Winning

- ProShares Short 20+ Year Treasury (TBF) , up 1.44%

- Franklin Floating Rate Daily Access Fund (FCFRX), up 1.18%

- City National Rochdale Fixed Income Opportunities Fund (RIMOX) , up 1.04%

- ProShares Investment Grade—Interest Rate Hedged (IGHG), up 0.77%

Losing

- SPDR® Nuveen Bloomberg Barclays Municipal Bond ETF (TFI) , down -1.53%

- Invesco CEF Income Composite ETF (PCEF), down -2.38%

- Pioneer High Income Municipal Fund (HIMYX) , down -2.62%

- Delaware Tax Free USA Fund (DTFIX), down -2.63%

Foreign Equity Strategies

Emerging market strategies, especially Indian and Brazilian equities, outperformed other foreign equity strategies, while Chinese strategies continued to struggle.

Winning

- WisdomTree India Earnings Fund (EPI) , up 6.91%

- iShares MSCI Brazil ETF (EWZ), up 5.81%

- PGIM Jennison Emerging Markets Equity Opportunities Fund (PDEZX) , up 5%

- GQG Partners Emerging Markets Equity Fund (GQGIX), up 4.63%

Losing

- WisdomTree China ex-State-Owned Enterprises Fund (CXSE) , down -2.26%

- iShares MSCI Mexico ETF (EWW), down -2.96%

- Morgan Stanley Institutional Fund, Inc. International Advantage Portfolio (MFAIX) , down -3.81%

- Baillie Gifford International Growth Fund (BGEUX), down -4.19%

Foreign Fixed Income Strategies

Foreign fixed income strategies reversed course over the rolling month, with several emerging market debt fund posting marginal gains. However emerging market local currency based bond strategies continued to be on the losing end.

Winning

- DFA World ex U.S. Government Fixed Income Portfolio (DWFIX) , up 1.7%

- Stone Harbor Emerging Markets Debt Fund (SHMDX), up 1.01%

- VanEck Emerging Markets High Yield Bond ETF (HYEM) , up 0.39%

- iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB), up 0.36%

Losing

- T. Rowe Price International Bond Fund (PAIBX) , down -1.32%

- SPDR® Bloomberg Barclays International Treasury Bond ETF (BWX), down -1.41%

- Eaton Vance Emerging Markets Local Income Fund (EEIIX) , down -1.7%

- VanEck J.P. Morgan EM Local Currency Bond ETF (EMLC), down -1.8%

Alternatives

Among alternatives, cannabis focused strategies performed better than volatility and preferred stock based strategies.

Winning

- ETFMG Alternative Harvest ETF (MJ) , up 47.16%

- WisdomTree Japan Hedged Equity Fund (DXJ), up 8.67%

- PIMCO CommoditiesPLUS® Strategy Fund (PCLAX) , up 7.06%

- Invesco Balanced-Risk Commodity Strategy Fund (BRCCX), up 5.16%

Losing

- Cohen & Steers Preferred Securities and Income Fund, Inc. (CPXIX) , down -0.35%

- VanEck Vectors Agribusiness ETF (MOO), down -0.67%

- Invesco S&P SmallCap Low Volatility ETF (XSLV) , down -0.94%

- PIMCO Preferred and Capital Securities Fund (PFPNX), down -1.18%

Sectors

Among the sectors, cannabis-focused strategies continue to outperform others by a signiifcant margin. However, healthcare and innovative technology based strategies continued to be on the losing end.

Winning

- AdvisorShares Pure US Cannabis ETF (MSOS) , up 84.02%

- Global X Uranium ETF (URA), up 19.95%

- Fidelity® Select Energy Portfolio (FSENX) , up 7.53%

- Vanguard Energy Index Fund (VENAX), up 6.53%

Losing

- Fidelity® Select Defense & Aerospace Portfolio (FSDAX) , down -4.55%

- Fidelity® Real Estate Investment Portfolio (FRESX), down -4.55%

- Amplify Transformational Data Sharing ETF (BLOK) , down -6.86%

- SPDR® S&P Health Care Equipment ETF (XHE), down -7.32%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietary system to scan through thousands of relevant mutual funds and ETFs. Fund performance data is calculated for the trailing one month, based on the change in NAV.

Here is a summary of the different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.