*When it comes to bonds, a strong core is where it’s at. Investment-grade bonds such as the U.S. Treasuries and bread & butter corporate bonds form the backbone of modern fixed income portfolios — and it’s easy to see why. These bonds feature low default rates — zero in the case of Treasuries — good yields, and generally low volatility. So, it’s no wonder many of the major bond benchmarks follow these sorts of assets. *

However investors solely focusing on investment-grade (IG) bonds may be doing their portfolios a disservice.

It turns out that swapping out for a touch of “junk” could produce better long-term outcomes on a variety of metrics. For investors looking strictly at IG bonds, it’s time to reevaluate your core bond portfolio.

Billions of Dollars

Just like you and me, bonds have credit scores. The cream of the crop of these ratings is considered IG. To be considered an IG, the bond must be rated BBB or higher by Standard and Poor’s or Baa or higher by Moody’s. The idea is that IG bonds feature a lower risk of default, and are therefore safer for investors than other non-IG debt.

Some examples of IG debt include bonds issued by the U.S. government, government-sponsored entities like Ginnie Mae, municipalities, and corporate bonds.

With this definition in tow, IG debt often forms the basis of a so-called “core bond portfolio,” with investors holding these sorts of bonds as their largest allocation. Hundreds of billions of dollars are benchmarked to the IG-focused Bloomberg U.S. Aggregate Bond Index, while many institutional investors have mandates limiting their bond exposure to IG debt.

At the end of the day, IG bonds are the main building blocks of a fixed income portfolio.

Moving Down the Ladder

While there is nothing wrong with focusing on IG debt, investors may be selling themselves short by not moving down the ladder into the world of non-IG or high-yield bonds. It turns out that swapping out junk bonds for corporate bonds in a core fixed income portfolio adds plenty of benefits. That’s the gist according to a new white paper from investment manager AllianceBernstein.

One major benefit is higher income potential. Because of the higher risk of default of non-IG bonds, they often yield more than IG corporate bonds or U.S. Treasuries. Today, the junk bond market is paying just north of 8% compared to the 4.68% yield on the Bloomberg Agg. Overall, the U.S. high-yield market offers the most income per unit of risk versus other major bond types.

That yield is incredibly important to total returns. Looking at historical data, income payments to bondholders have been the largest component of total returns rather than capital appreciation. For high-yield bonds, this has been especially true. Over the last twenty years, high-yield bonds’ annual return due to income has slightly exceeded the annual total return. Investors have essentially gotten more in coupon payments to make up for losses on bond prices/defaults.

Secondly, high-yield bonds have less interest rate risk. When comparing the duration of the Agg to the Bloomberg High Yield Very Liquid Index, the junk bond index provides a much lower duration than either Treasuries or IG corporate bonds. This makes them less sensitive to changes in the Federal Reserve policy.

At the same time, high-yield bonds and IG bonds are inversely correlated. When high-yield bonds fall, government and IG bonds tend to rise. This is because high-yield bonds are often tied to the state of the economy and Treasuries are seen as a safe asset. This inverse relationship provides true diversification for a bond portfolio. Both IG corporate bonds and Treasuries tend to move in the same direction, albeit at different magnitudes.

A 50/50 Core Portfolio

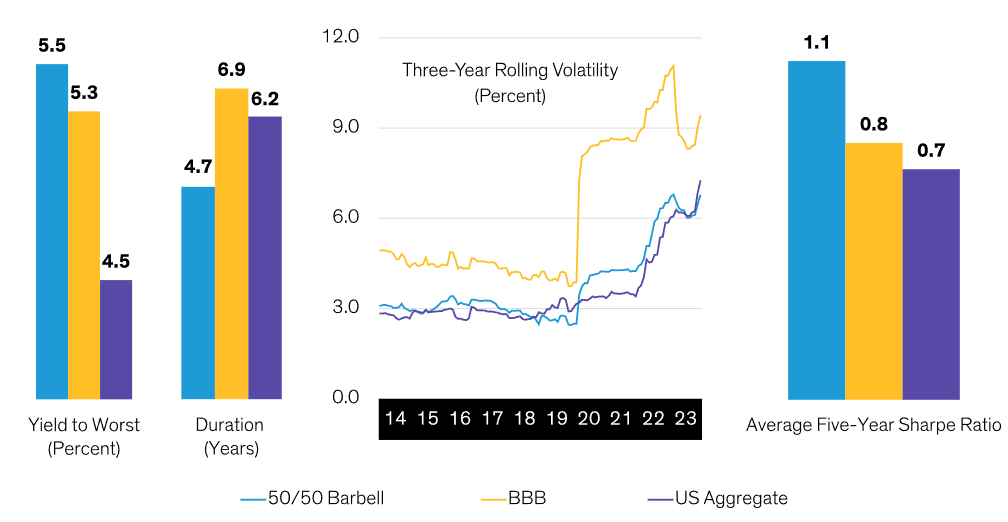

Putting it all together, investors can yield some impressive results. According to AllianceBernstein, a 50/50 passive barbell of Treasuries and high-yield bonds provides a strong yield (5.5%), lower duration (4.7 years), lower rolling volatility, and better risk-adjusted returns than the Agg or IG corporate bonds alone. This chart sums up their research. 1

Source: AllianceBernstein

The key to their findings is that top-tier high-yield bonds aren’t as risky as they may seem or given credit to be. Looking at the Bloomberg High Yield Index, more than 79% of all junk bond defaults have historically come from CCC or lower-rated debt.

So, how do we build a new core bond portfolio? AllianceBernstein suggests using this white paper as a framework for investors’ risk tolerance. A simple 50/50 split could be the right mix for investors with high income requirements and a high risk tolerance. Meanwhile, a 65% Treasuries/35% high-yield allocation could be for an investor looking for a more balanced approach.

The beauty is that this passive core can be created using many low-cost ETFs. Both U.S. Treasury and junk bonds are plentiful, with many offering expense ratios in terms of pennies on the dollar. Swapping out Agg for the combo of Treasury/high-yield bonds is easy. Investors can also simply add junk to their bond portfolios. While the results won’t be exactly the same, they will be similar, as the benefits of high-yield bonds will also still work.

Core Bond ETFs

These ETFs were selected based on their exposure to junk bonds and Treasury debt. They cover a wide range of maturities and exposures. They are sorted by their YTD total returns, which range from -3.9% to 1.1%. They have assets under management of $369M to $105B and expenses of 0.03% to 0.49%. They are currently yielding between 2.9% and 8.1%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| USHY | iShares Broad USD High Yield Corporate Bond ETF | $11.8B | 1.1% | 7.3% | 0.08% | ETF | No |

| HYG | iShares iBoxx $ High Yield Corporate Bond ETF | $16.9B | 0.7% | 6.9% | 0.49% | ETF | No |

| HYBB | iShares BB Rated Corporate Bond ETF | $369M | 0.7% | 6.3% | 0.25% | ETF | No |

| SPHY | SPDR Portfolio High Yield Bond ETF | $3.88B | 0.6% | 8.1% | 0.05% | ETF | No |

| JNK | SPDR® Bloomberg High Yield Bond ETF | $8.73B | 0.3% | 6.8% | 0.40% | ETF | No |

| IEI | iShares 3-7 Year Treasury Bond ETF | $13.4B | -2.1% | 2.9% | 0.15% | ETF | No |

| VGIT | Vanguard Intermediate-Term Treasury Index Fund | $32.6B | -2.6% | 3.1% | 0.04% | ETF | No |

| AGG | iShares Core U.S. Aggregate Bond ETF | $105B | -2.8% | 3.6% | 0.03% | ETF | No |

| GOVT | iShares U.S. Treasury Bond ETF | $22.6B | -2.8% | 2.9% | 0.05% | ETF | No |

| IEF | iShares 7-10 Year Treasury Bond ETF | $27.8B | -3.9% | 3.3% | 0.15% | ETF | No |

While we tend to focus solely on IG bonds, that’s outdated thinking. High-yield bonds can provide a top-notch core bond portfolio element and enhance overall returns. Higher yields, lower volatility and less duration risk are just some of the hallmarks of using junk bonds as part of your core.

Bottom Line

It’s easy to see why investors focus on IG corporate bonds and U.S. Treasuries for their core bond portfolios. But new research suggests that high-yield bonds need to enter the chat. Adding them to a core provides a host of winning benefits for a portfolio over the long haul.

1 AllianceBernstein (February 2024). Why High Yield Belongs in Your Investment-Grade Income Portfolio