Although U.S. stocks finished the week on a slightly higher note, they ended the month lower. August recorded the first monthly loss for the S&P 500 in quite some time.

Part of that monthly drop has been due to the overall mixed economic environment and corporate earnings picture. Several major retailers this week showed that all is not well with consumers. This contrasted with federal data showing personal spending and income rising by 0.8% and 0.2%, respectively. Labor data showed a bit of a deterioration with the JOLTs report revealing available jobs fell below the 9 million mark for the first time in over a year. Initial jobless claims came in lower-than-expected as well. The biggest data on the week was the Fed’s favorite measure of inflation– the Core PCE Price Index. The measure, which excludes food and energy prices, grew by an annualized rate of 3.7% in the second quarter, easing from the 4.9% increase seen in the first quarter of the year. This provided confusion for investors given the mixed data. Overall, the Fed does have cause to potentially raise or pause interest rates given the current environment. Finally, the U.S. economy expanded at an annualized rate of just 2.1% in the second quarter of 2023, above the 2% for Q1, but below the 2.4% expected number.

Heading into the first week of September and a shortened trading session due to the Labor Day holiday, economic data will be relatively light. Investors will be focusing on the services economy with the release of the ISM Services PMI on Wednesday. In July, the figure sank to 52.7, pointing to a slowdown in services growth. For August, analysts expect demand for various services to dip further to 52.4. Elsewhere, investors will also focus on the labor market and go over the latest initial jobless claims. While jobless claims have ticked up in recent readings, the pace has been slower, highlighting the robustness of the labor market. The Energy Information Industry (EIA) will release a torrid of storage data, with oil, gasoline, and many other energy commodities expected to show storage declines amid lower production levels.

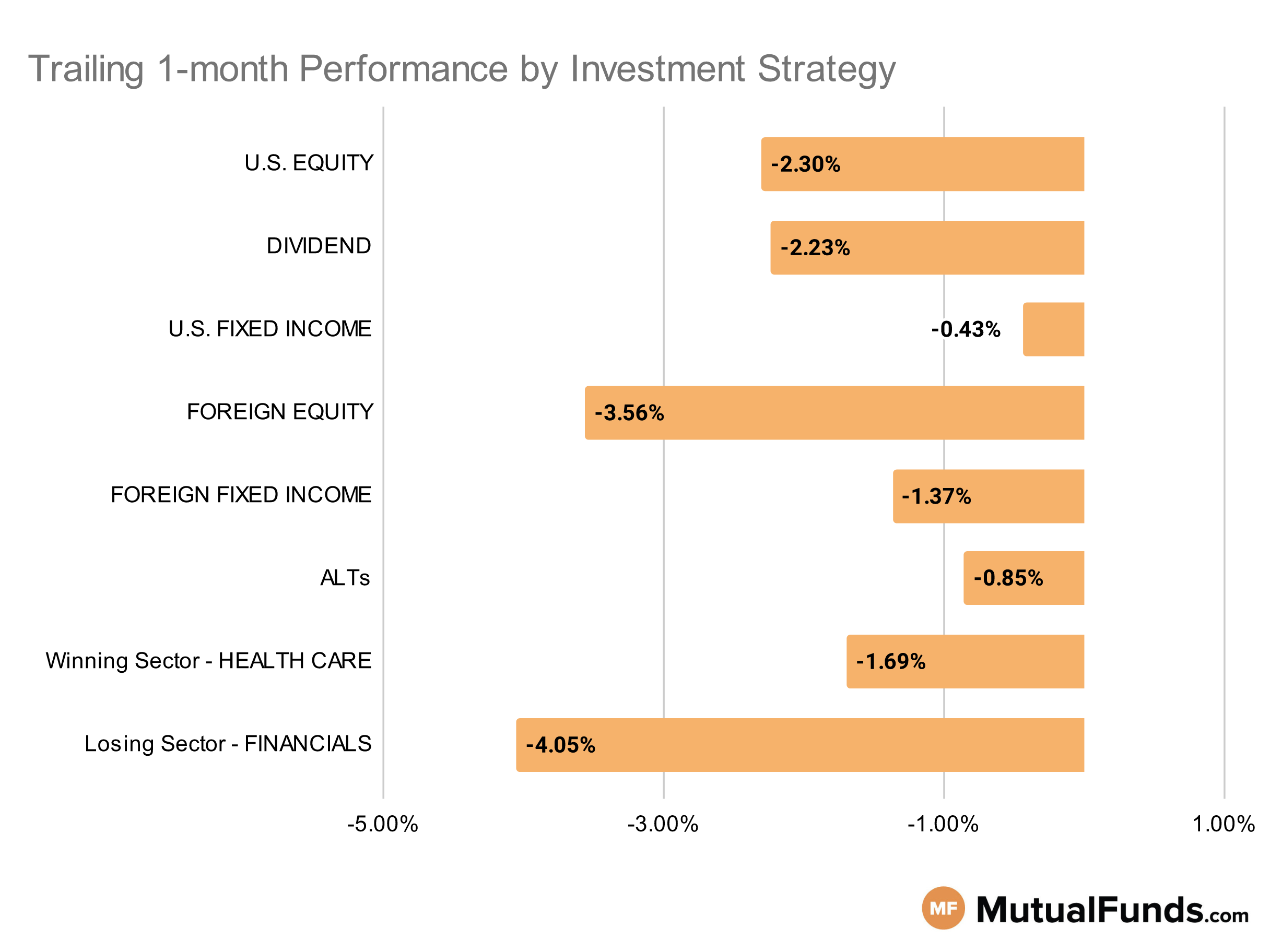

Given this economic backdrop, let us see how this impacts the performance of various investment strategies.

Investment Strategy Scorecard

Overall, the U.S. stock markets were down for the rolling month, despite posting one of the biggest weekly gains, this week, in recent memories.

Several cannabis ETFs surged over the last trailing month on legalization hopes, while several growth focussed funds suffered losses.

U.S Equity Strategies

Majority of the key U.S. equity strategies struggled to post gains over the last trailing month. However, larger cap strategies performed better than smaller cap strategies.

Winning

- Pioneer Fundamental Growth Fund (FUNYX) , up 1.66%

- BlackRock Event Driven Equity Fund (BILPX), up 1.13%

- Invesco Dynamic Large Cap Growth ETF (PWB) , up 0.18%

Losing

- iShares Core S&P U.S. Growth ETF (IUSG), down -0.4%

- First Trust US Equity Opportunities ETF (FPX) , down -5.94%

- iShares Micro-Cap ETF (IWC), down -6.47%

- Voya Index Solution 2045 Portfolio (ISVLX) , down -11.17%

- Lazard US Equity Concentrated Portfolio (LEVOX), down -13.99%

Dividend Strategies

Majority of the dividend strategies failed to post gains over the last trailing month. However, high yielding strategies continue to perform better than strategies focused on managing volatility.

Winning

- Invesco High Yield Equity Dividend Achievers™ ETF (PEY) , up 3.61%

Losing

- Lord Abbett Dividend Growth Fund (LAMYX), down -0.32%

- iShares Core High Dividend ETF (HDV) , down -0.63%

- JPMorgan Equity Premium Income Fund (JEPRX), down -0.65%

- Delaware Ivy Mid Cap Income Opportunities Fund (IVOYX) , down -4.08%

- Invesco S&P Ultra Dividend Revenue ETF (RDIV), down -4.39%

- Legg Mason Low Volatility High Dividend ETF (LVHD) , down -5.3%

- Hartford Dividend and Growth HLS Fund (HIADX), down -10.36%

U.S. Fixed Income Strategies

In US fixed income, long-duration strategies continued to suffer.

Winning

- ProShares Short 20+ Year Treasury (TBF) , up 2.06%

- PIMCO 0-5 Year High Yield Corporate Bond Index Exchange-Traded Fund (HYS), up 0.88%

- Invesco Senior Floating Rate Fund (OOSAX) , up 0.76%

- Osterweis Strategic Income Fund (OSTIX), up 0.75%

Losing

- Invesco CEF Income Composite ETF (PCEF) , down -2.4%

- PIMCO StocksPLUS® Long Duration Fund (PSLDX), down -2.65%

- iShares Convertible Bond ETF (ICVT) , down -2.87%

- Pioneer High Income Municipal Fund (HIMYX), down -3.4%

Foreign Equity Strategies

Majority of the key foreign equity strategies continued to struggle over the last trailing month. However, some Indian equity focused strategies managed to perform better than others at minimising losses.

Winning

- PGIM Jennison Emerging Markets Equity Opportunities Fund (PDEZX) , up 0.74%

Losing

- Artisan International Fund (APHIX), down -0.3%

- SPDR® S&P Emerging Markets Small Cap ETF (EWX) , down -0.55%

- WisdomTree India Earnings Fund (EPI), down -0.6%

- WisdomTree China ex-State-Owned Enterprises Fund (CXSE) , down -7.7%

- iShares MSCI China ETF (MCHI), down -7.8%

- Baillie Gifford International Growth Fund (BGEUX) , down -7.89%

- Artisan Developing World Fund (APHYX), down -8.72%

Foreign Fixed Income Strategies

Majority of the key foreign debt strategies continued their struggles over the last trailing month. However, in terms of minimizing losses, emerging market debt strategies continue to post better performance compared to international treasury strategies.

Winning

- DFA World ex U.S. Government Fixed Income Portfolio (DWFIX) , up 0.96%

Losing

- Janus Henderson Developed World Bond Fund (HFARX), down -0.13%

- VanEck Emerging Markets High Yield Bond ETF (HYEM) , down -0.61%

- iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB), down -0.86%

- SPDR® Bloomberg Barclays International Treasury Bond ETF (BWX) , down -1.47%

- SPDR® Bloomberg Barclays Emerging Markets Local Bond ETF (EBND), down -1.7%

- Ashmore Emerging Markets Total Return Fund (EMKIX) , down -2.27%

- PIMCO Emerging Markets Local Currency and Bond Fund (PELPX), down -2.36%

Alternatives

Among alternatives, cannabis and managed futures focused strategies performed better than volatility and contrarian strategies.

Winning

- ETFMG Alternative Harvest ETF (MJ) , up 8.64%

- AQR Managed Futures Strategy Fund (AQMIX), up 3%

- IQ Merger Arbitrage ETF (MNA) , up 1.42%

- The Arbitrage Fund (ARBCX), up 1.14%

Losing

- American Beacon AHL Managed Futures Strategy Fund (AHLYX) , down -3.73%

- VanEck Vectors Agribusiness ETF (MOO), down -3.75%

- iShares MSCI Emerging Markets Min Vol Factor ETF (EEMV) , down -3.79%

- Janus Henderson Contrarian Fund (JCNCX), down -4.55%

Sectors

Among the sectors, cannabis focused strategies outperformed others by a significant margin. However, clean energy and innovative technology based strategies struggled.

Winning

- AdvisorShares Pure US Cannabis ETF (MSOS) , up 21.84%

- Global X Uranium ETF (URA), up 6.52%

- Fidelity® Select Energy Portfolio (FSENX) , up 3.02%

- Vanguard Energy Index Fund (VENAX), up 2.42%

Losing

- John Hancock Regional Bank Fund (FRBAX) , down -7.21%

- American Beacon ARK Transformational Innovation Fund (ADNYX), down -11.42%

- Amplify Transformational Data Sharing ETF (BLOK) , down -14.31%

- Invesco WilderHill Clean Energy ETF (PBW), down -15.69%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietary system to scan through thousands of relevant mutual funds and ETFs. Fund performance data is calculated for the trailing one month, based on the change in NAV.

Here is a summary of the different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.