Last year, tech stocks fell sharply as the Federal Reserve began hiking interest rates to combat runaway inflation. Despite predictions for a recession, the U.S. economy remains resilient, with unemployment near record lows and expectations for robust first-quarter GDP growth. As a result, there’s a sense the economy can cope with higher rates.

Large-cap companies are uniquely positioned to navigate these markets. For example, they tend to have more cash on their balance sheets, eliminating the need to raise debt capital at higher interest rates. Larger companies also tend to have a more diverse customer base and revenue streams, making them less susceptible to short-term market fluctuations.

In this edition, we look at trending Large-Cap Growth Equity Funds investors may want to consider to capitalize on the rebound.

Be sure to check out the Large-Cap Growth Equity Funds page to learn more about the other funds within this investment theme as well.

Trending Funds

1. American Funds International Vantage Fund (AIVBX)

The American Funds International Vantage Fund (AIVBX) comes in first place with an 18.64% return over the trailing 12 months. With a 1.00% expense ratio and a 0.9% yield, the fund is the highest-yielding option on the list.

The fund focuses on international strategies pursuing prudent capital growth and principal conservation. By investing in companies predominantly based in developed markets, the managers seek to provide a smoother return profile over a full market cycle with less volatility and lower downside capture than the overall market.

The fund’s portfolio has broad diversification across information technology (15.6%), industrials (14.8%), healthcare (13.6%), financials (11.6%), and consumer staples (11.2%). The most significant individual components include large international companies like Novo Nordisk (3.7%), AstraZeneca (2.9%), ASML (2.3%), and Safran (2.3%).

Want to know more about portfolio rebalancing? Click here.

Source: BarChart.com.

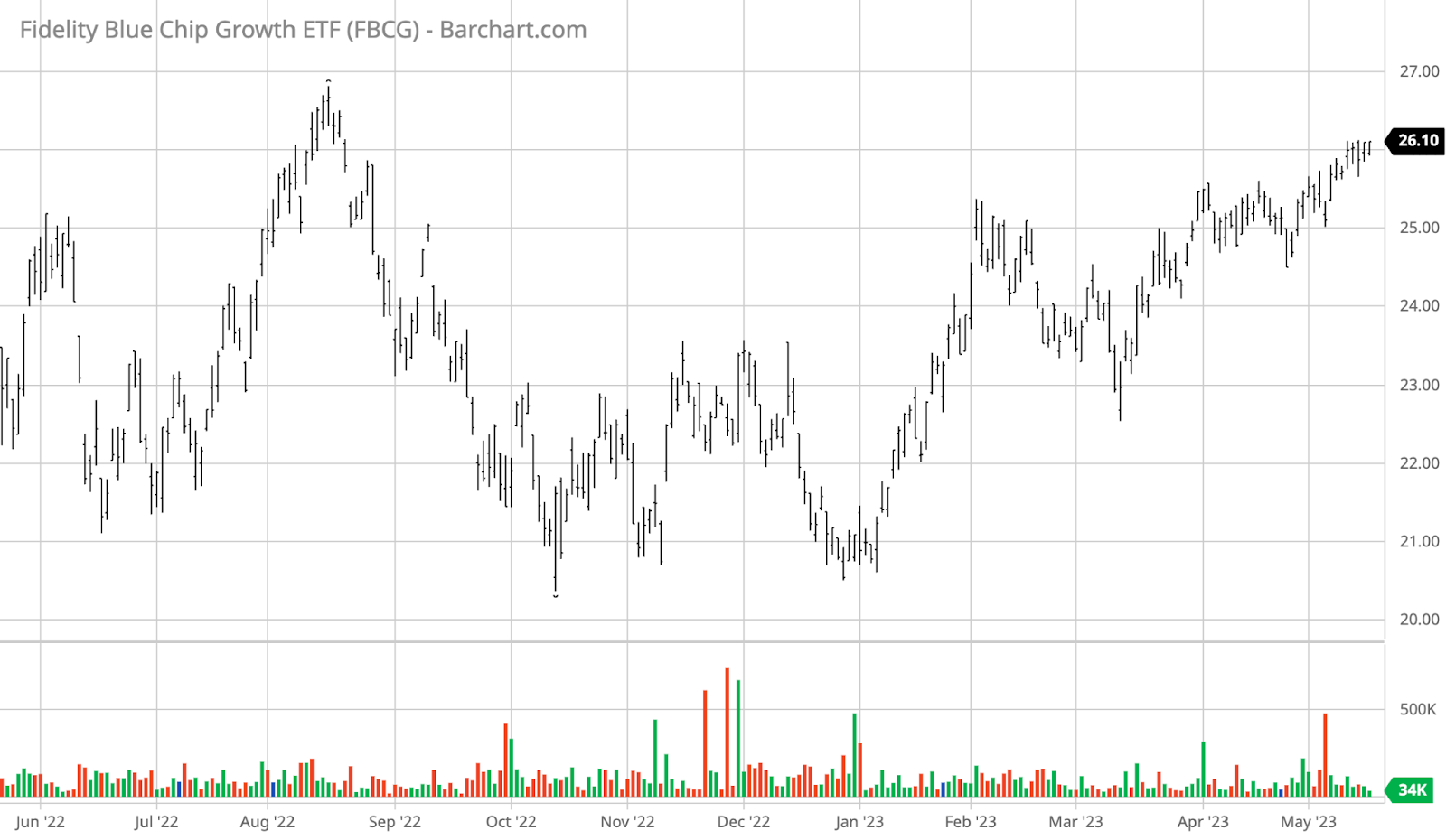

2. Fidelity Blue Chip Growth ETF (FBCG)

The Fidelity Blue Chip Growth ETF (FBCG) comes in second place with a 13.27% return over the past 12 months. With a 0.59% expense ratio and no yield, the fund’s expense comes between the two other options on our list.

The fund seeks long-term growth by investing in well-known, established, and capitalized blue-chip companies. In particular, the fund managers focus on companies they believe have above-average growth potential with sustainable business models. They also look for events that might provide a catalyst, such as product cycles or turnaround situations.

The fund’s portfolio is concentrated in information technology (40.89%), consumer discretionary (22.85%), and communication services (13.87%). While the semi-transparent fund doesn’t disclose its holdings in real-time, its largest recent holdings have been NVIDIA Corp. (4.78%), Meta Platforms Inc. (3.29%), and Alphabet Inc. (2.64%).

Find funds suitable for your portfolio using our free Fund Screener.

Source: BarChart.com.

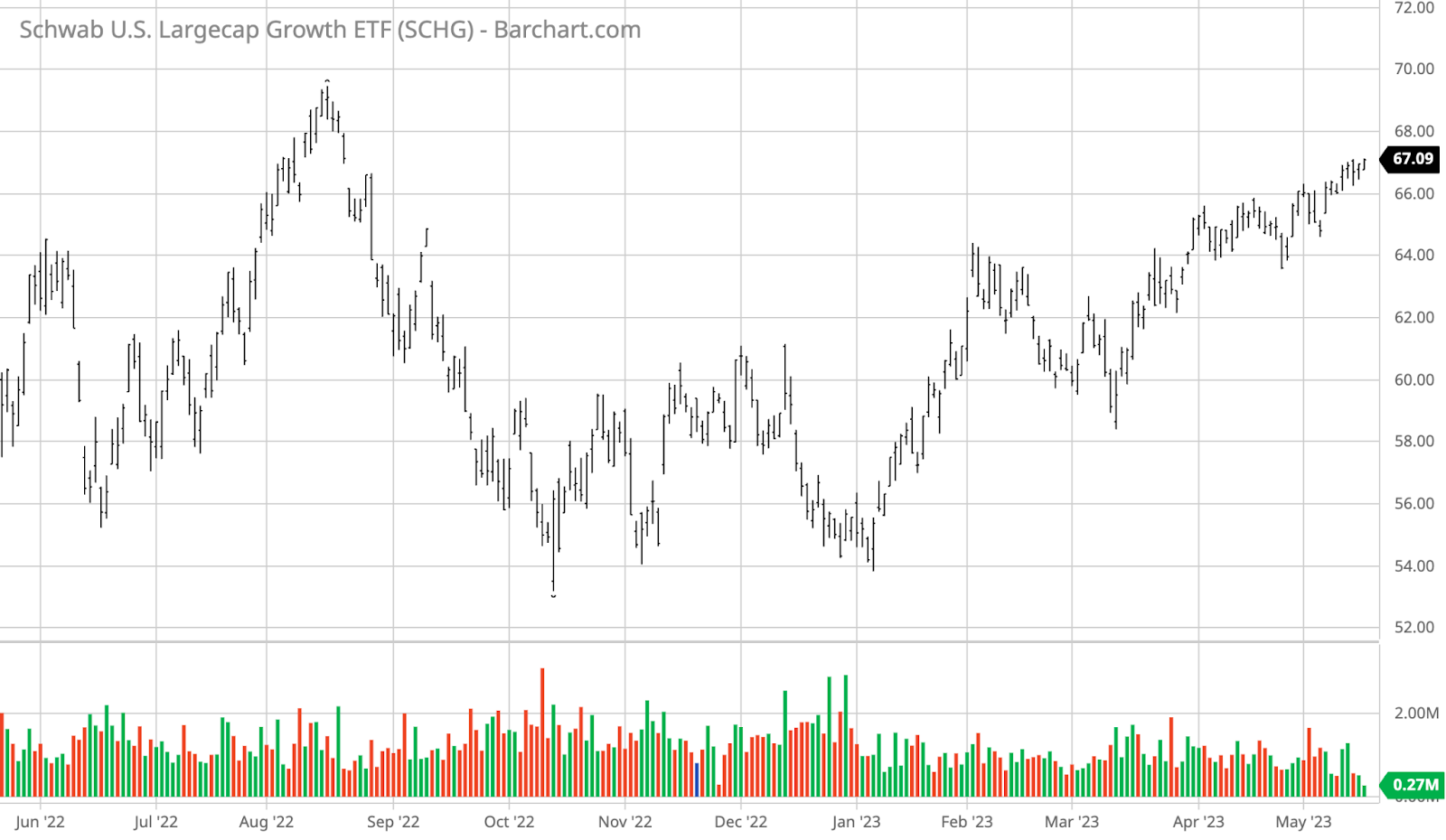

3. Schwab U.S. Large-Cap Growth ETF (SCHG)

The Schwab U.S. Large-Cap Growth ETF (SCHG) comes in third place with a 13.04% return. With a 0.04% expense ratio and 0.49% yield, the fund is the lowest-cost option on today’s list.

The passively-managed fund tracks the Dow Jones U.S. Large-Cap Growth Total Stock Market Index. Rather than trying to pick specific stocks, the fund offers simple access to large-cap U.S. equities that exhibit growth-style characteristics with a minimal expense ratio, serving as a core part of a diversified portfolio.

The fund is heavily weighted toward information technology (44.74%), healthcare (14.83%), communication services (12.43%), and consumer cyclical (11.38%). The largest components include Apple Inc. (14.21%), Microsoft Corp. (12.79%), Amazon.com Inc. (5.50%), and NVIDIA Corp. (3.96%), making it less diversified than the other funds on our list.

Source: BarChart.com.

The Bottom Line

Check out our last edition of trending theme here

All data as of May 11, 2023.

Methodology

MutualFunds.com analyzes the search patterns of our visitors every two weeks to find the top trending funds. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

First, we select the top trending theme from more than 200 themes listed on MutualFunds.com based on the percentage increase in monthly viewership. Then, we choose the top three funds with the highest one-year trailing total returns from the top trending theme. To ensure funds’ quality and staying power, we only look at those mutual funds with a minimum of $100 million in assets and a track record of at least three years.

We also remove those mutual funds closed to new investors and unavailable for investment outside registered accounts such as retirement or 529.

Fund performances are reported based on trailing 12-month total returns.