As of the end of 2016, there were over 42 million IRA accounts in the United States, equal to over $7.9 trillion in total assets. Individuals that are looking to save for their retirement should consider researching the different types of IRA plans to determine which is the most beneficial for their retirement goals.

For the purpose of this article, small business IRAs like the SEP, SIMPLE and SARSEP will be excluded.

Click here to learn all that you wanted to know about 401(k) retirement plans.

Types of IRA Plans

This is the most common form of IRA account that allows any contributions to be deductible on that year’s tax return, up to a maximum of $5,500. For individuals that are 50 years or older, they can contribute an additional $1,000, for a total of $6,500. However, in order to be eligible for the deduction, there are limits based on adjusted gross income. Since contributions are deductible, any distributions or withdrawals from a Traditional IRA are considered taxable as ordinary income.

In case you want to know more about the different deductibility limits, you can click here if you are covered under an employer retirement plan. If not, you can click here.

Roth IRA

The Roth IRA is another type of retirement account that came out in 1997 and has been growing rapidly in terms of usage. As of 2016, there were over 21 million Roth IRAs in the U.S., totaling $660 million in assets. Unlike a Traditional IRA that allows contributions to be deductible, Roth contributions are not. Instead, Roth IRA distributions and withdrawals are tax-free. Roth IRAs also have the same contribution limits of $5,500 with a $1,000 catch-up for people over 50 years old. Roth IRAs also have a contribution limit based on adjusted gross income.

In case you want to know more details about your contribution eligibility limits for a Roth IRA, click here.

Benefits of an IRA Account

Both Traditional and Roth IRAs are also considered tax-deferred investment accounts, where all profits and dividends are not taxed in the year received. In taxable brokerage accounts, anytime an investment is sold for a profit, a capital gain is triggered. This gain is taxed either at long-term capital gains rates or short-term capital gains rates, which is basically your marginal tax rate. Dividends paid, such as those from mutual funds, within a taxable brokerage account, are also taxed at a similar rate as the long-term capital gains rate, regardless if it is reinvested or not.

Find out about the most important criteria for selecting a mutual fund here.

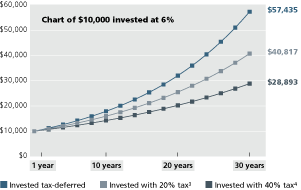

In the chart below, the benefits of tax deferral are shown. If $10,000 was invested with a 6% return, in a tax-deferred account – an account with 20% tax and an account with 40% tax – the tax-deferred account has the best return in any time period.

Investment Options

Be sure to follow our Mutual Funds Education section to learn more about mutual funds.

IRAs can be opened at any brokerage firm or bank, where the firm or bank will act as the custodian. Self-directed IRAs are considerably less common but can be opened at a handful of companies.

Distributions and Withdrawal Implications

Any distribution made from a Traditional IRA is taxed at the marginal tax bracket of the account owner. The idea of a Traditional IRA stemmed from the idea that the account owner would contribute during their working years, when they were in a considerably higher tax bracket. Upon retirement, their tax bracket would be considerably lower and, therefore, the tax savings would be greater.

Traditional IRAs also have something called the required minimum distribution (RMD). This is a defined amount that Traditional IRA holders must withdraw by December 31 after they turn 70½ years old. If you look at the official source of calculating the RMDs here, you would realize that this depends on both the total value of all traditional IRAs (as of December 31) and your life expectancy as determined by the IRS. Another benefit to having Roth IRAs is that they are not subject to RMDs.

The Bottom Line

There has been a long debate on whether a Traditional or Roth is the better of the two types, but really it depends on the specific circumstances of the individual. Either way, IRAs are a great tool to help someone save for their retirement.

Sign up for our free newsletter to get the latest news on mutual funds.