In order to cater to a wider audience, a new fund was created – the target-date fund. Originally designed in the early 1990s by Donald Luskin and Larry Tint of Wells Fargo Investment Advisors, these funds didn’t really catch on until 2006 when the Pension Protection Act was passed. This act allowed for auto-enrollment of target-date funds into defined contribution plans and set the stage for QDIAs (Qualified Default Investment Alternatives), which strongly supported the growth of these funds.

Investors have welcomed the new fund type with open arms. Many prefer it over traditional mutual funds because of how target-date funds work. Unlike regular mutual funds, which have a set guideline for investment choices based on the fund type, target-date funds are an all-encompassing product that invests in multiple assets types, including stocks and bonds, all at once. Furthermore, the fund actually changes how assets are allocated between stocks and bonds over time, becoming more conservative as the fund approaches the pre-set retirement date. The maturation date of the fund is displayed prominently with the year following the name of the target-date fund, such as Vanguard’s Target Retirement 2035 Fund.

Arguably, the biggest benefit for investors in target-date funds is that rebalancing becomes unnecessary. As the fund grows over time, the allocation settings between stocks and bonds change along a glide path. Each target-date fund has a different glide-path strategy in mind and may approach a more conservative portfolio quicker than others. Investors should pay careful attention to how a fund’s glide-path strategy could affect their retirement goals.

Follow our dedicated section on Target-Date Funds to learn more about these funds.

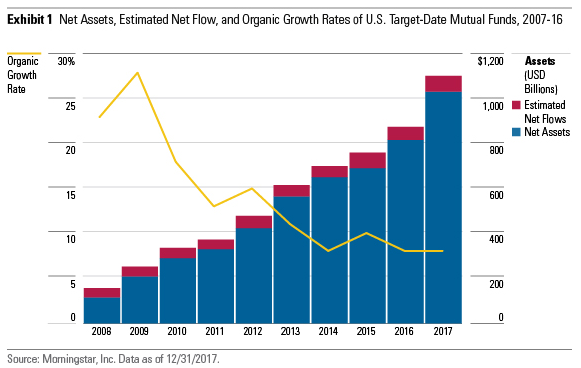

The Current State of the Target-Date Fund Industry

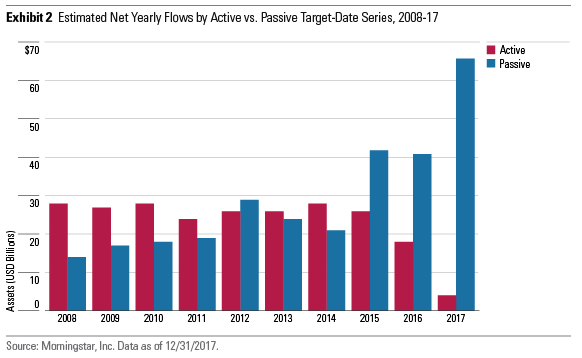

The trend toward passive funds began in 2015 when inflows to passive funds exceeded significantly compared to those going into actively managed funds. As investor needs change, investment companies are offering more alternatives. As of the end of 2017, there were 60 different target-date funds available, but only 41 different fund providers meaning that some companies offer more than one type of target-date fund.

Rise in Popularity Over Low Cost

One of the reasons for the trend is the fact that investors tend to prefer a less expensive alternative wherever its offered. Most fund’s most popular offering is the cheapest in regards to the expense ratio, and passively managed funds that invest in index funds have the lowest fees associated with them. Actively managed funds, while providing a similar service, come with a higher expense ratio and have been largely passed over by investors who are simply seeking the cheapest alternative.

The trend toward lower expense ratios correlated with the growth in passively managed target-date funds. Increased competition between firms has also helped expenses come down, letting investors reap the benefits.

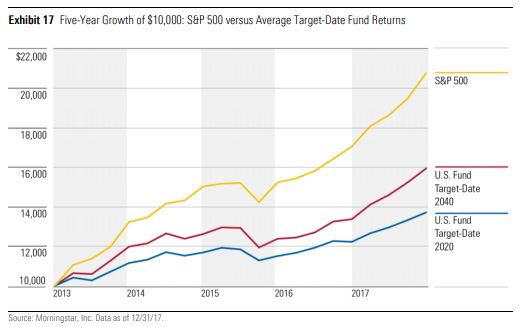

How About Performance?

Take a look at how target-date funds have performed over the past five years compared to the S&P 500:

Target-date funds are quickly becoming the retirement asset of choice for investors, and with more firms offering more than one type of target-date fund, they could pose a risk to standard mutual fund offerings in a defined benefit package. As their popularity grows, investment companies may cater more to the everyday investor and those who are used to keeping a hand on the wheel of their own portfolio could start seeing their options reduced.

Worried about the potential risks associated with these funds? Click here to learn more about how to conduct due diligence for these funds.

Find out about the most important criteria for selecting a mutual fund here.

The Bottom Line

Be sure check our News section to keep track of the recent fund performances.

Don’t forget to sign up for our free newsletter to get the latest news on mutual funds.