Arguably, the biggest risk facing investors these days has to be the upcoming U.S. presidential election. Given the key differences between the two major political parties, it’s easy to see why investors tend to be on edge when it comes to election time. After all, wide-sweeping social and business policy changes mean that business and investors need to adapt to new rules, which could benefit on the profit front.

And while generally election cycles have a predictable pattern of gains and losses for the overall market, digging deeper can result in some lumpy returns.

The truth is that some individual sectors do better under certain parties than others. It’s here that investors – especially those looking for dividends – can succeed in getting additional gains and income. Depending on the outcome of the election, investors may want to shift some of their holdings to take advantage of the disparities in sectors.

Don’t forget to check out our Portfolio Management Channel to know more about different ways to manage your portfolio.

Major Differences

Oil and water could be the best way to describe the discourse in U.S. politics right now – and it only seems to be getting worse. Both Republicans and Democrats have historically been on different sides of various key issues. This year is no different. From trade and the handling of China to renewable energy and labor practices, the Biden and Trump campaigns couldn’t be more different.

It’s no wonder volatility has risen ten-fold since Biden received the nomination and the election season has officially gone underway. Meanwhile, returns have continued to follow a grinding upward pattern. This is typical before a major presidential election. The effect is more exacerbated as there is no clear frontrunner to this year’s election cycle and the COVID-19 pandemic is still raging.

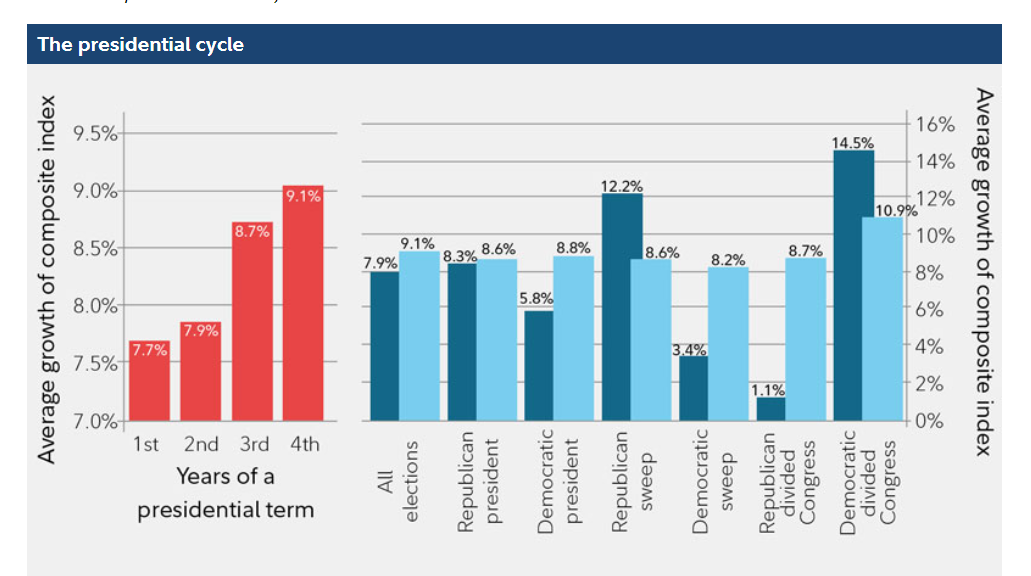

Now, despite all the differences on taxes, public spending and direction of the courts, the long-term picture shows that the market will move higher no matter who wins. You can see by this chart from investment manager Fidelity that during the first two years of a president’s term, the S&P 500 averages a 7% return, while over a full four years that number jumps to 9%.

Source: Fidelity

The reality is that staying the course has its benefits. Remaining invested in a broad basket of index funds and ignoring the election noise can produce strong returns.

Being Better Than Average

However, digging deeper into that return data shows that not all sectors in the market drive it higher. This is one of the basic tenets of the sector rotation strategy. A presidential cycle and election can be considered sector rotation on steroids. Depending on the outcome of the election, headwinds and tailwinds can change on a dime – and those changes can come quickly based on a party’s differentials.

For example, take a look at the energy sector. One of the key points of Joe Biden’s campaign has been the support of the Green New Deal: a widespread plan to bring more renewable energy into the grid and reduce the use of fossil fuels. Obviously, a Biden win would have significant impacts on top dividend stocks like Exxon (XOM) or Chevron (CVX). The onus and spending would favor renewable-focused energy stocks like NextEra (NEE). You can actually see this live as NEE briefly became more valuable of a company than XOM on recent poll surges for Biden.

And this is just one example.

Find out more about energy stocks here.

While Biden isn’t anti-military, he has called for lower spending. Conversely, a Trump re-election could boost the fortunes of Lockheed Martin (LMT), Honeywell (HON) and other defense contractors. Already Trump has opened the floodgates with record military budgets. A lame-duck session could boost these numbers even further.

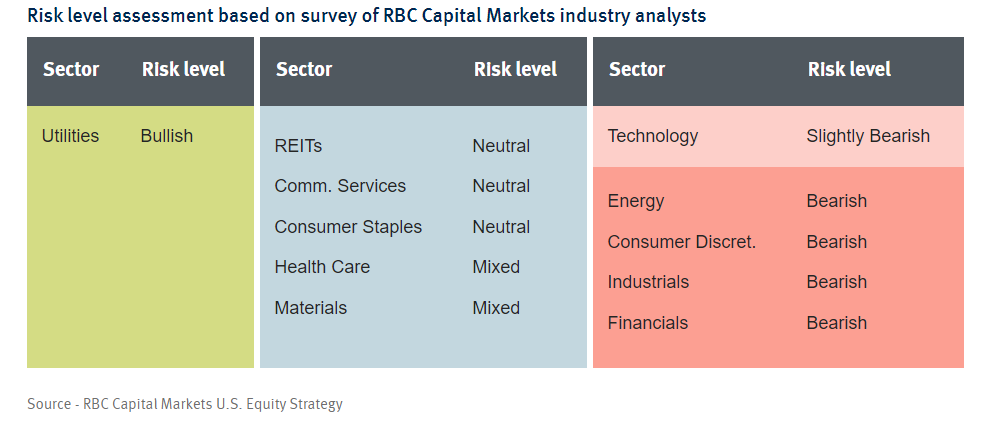

Given the differences between the two parties, analysts have already begun to size up what sectors could win under a Biden or Trump presidency. All in all, a Biden win would be considered bullish for utilities, neutral for real-estate investment trusts and communications services as well as consumer staples and slightly bearish for technology. It would be equally bearish for energy, consumer discretionary, industrials and financials. RBC Wealth Management sums up the winners/losers in this handy chart below.

Source: RBC Wealth Management

Conversely, a Trump win would flip-flop many of these sectors and keep what’s currently working the market moving higher, namely technology, financials and discretionary names.

What’s key to this picture is also what happens to the Senate during the election. A complete so-called Blue Wave – where the Democrats take the Senate, keep control of the House and Biden is elected – would mean that the bullish/bearish chart has the most impact. A mixed Congress scenario under either presidential nominee would mute the effects of different sectors winning.

Making the Portfolio Play

So, should you watch the poll numbers and buy/sell based on every tick higher or lower? Of course not, but understanding how the election plays out could be critical from an income investor’s point of view. And as such, making some tweaks after the results are known and the new year starts could be prudent.

As we said before, if Biden wins and there’s a major sweep selling top energy stocks like XOM or Valero (VLO) could make sense as we push toward a renewable future. Cash flows certainty won’t be what they used to be. Likewise, Biden’s stance toward limited big tech’s power could hit Apple (AAPL) or other dividend stocks like Microsoft (MSFT) a bit harder than others.

Conversely, buying consumer staples like Procter & Gamble (PG) or healthcare names like Becton Dickinson (BDX) may also see higher sales from new government stimulus programs under Biden.

The real mantra – and the same could be for Trump – is “follow the money.” If a sector has the potential to see their profits decline due to a nominee’s policies, you may want to back off or avoid it for the time being. The reverse is also true. This could ensure that dividend sectors get the most cash flow possible under various presidential outcome scenarios.

Use the Dividend Screener to find the security that meet your investment criteria.

The Bottom Line

Presidential elections are volatile events as shifts in policies change market outcomes. And while the market tends to gain no matter who is in charge, some sectors do better than others. It’s here that dividend investors can hone in and potentially gather better returns or dividend increases.

Be sure to check out Dividend.com’s News section for more information, investing tips and daily features such as our Market Wrap.