Arguably one of the biggest game-changing trends has been the rise of artificial intelligence and the rise of ChatGPT. Usage of the application has exploded across a variety of use cases. And that includes finance and portfolio advising.

This may leave financial advisors a bit puzzled.

Can ChatGPT & A.I. replace the human touch when it comes to advising and portfolio management? The pros and cons of each side continue to get louder. And the answer may be a resounding no. At least not yet.

The Rise of the Machines

OpenAI’s ChatGPT chatbot seemed to come out of nowhere. Within a short period of time, the application added more than 100 million users and quickly cemented A.I. as the year’s theme for tech.

ChatGPT uses so-called Generative A.I. models. Here, massive amounts of data are fed into the model. With that, the A.I. is able to make its own predictions and calculations, all without a human hand. The beauty is that ChatGPT managed to take A.I. and package it into a user-friendly application. Complex queries can be solved via simple text.

With this, use cases for the application have exploded. A variety of corporations, healthcare, creatives, and other sectors of the economy have been upended and enhanced via the usage of the program.

And that includes financial advising.

According to a recent Smart Asset survey as reported by the National Association of Plan Advisors, 27% of financial advisor respondents replied that they “are using or testing it out in some capacity.” Another 30% of respondents said they “haven’t used ChatGPT but want to test it out.” All in all, a majority of advisors are looking into or actively using the technology. 1

Clearly, ChatGPT and A.I. have come to roost for the planning community.

What are those advisors exactly using it for?

For the most part, it’s been all about client retention. This includes using the application for emails, client communications, blog content, and solving marketing issues. Only a small percentage have started to use it for other purposes.

A.I.-Driven Investment Portfolios?

The future for financial advisors looks a bit bleaker when it comes to A.I. and ChatGPT. Two of the biggest functions that current advisors have for clients is portfolio design/construction and tax/withdrawal strategies. It’s here that many fintech pundits are looking to move the technology next.

Right now, if you ask ChatGPT for financial advice, it gives you a canned answer about how it “cannot provide personalized financial advice.” However, ChatGPT isn’t the only game in town, and soon investors will be able to plug into A.I.-designed models to build portfolios, maximize gains, and drive efficiency based on goals, all without a human advisor. For example, J.P. Morgan is working on a new application called IndexGPT 2, which will directly provide financial advice and pick stocks/bonds for a portfolio. J.P. Morgan has more than 5,000 advisors alone.

Moreover, A.I. may be able to provide tax-loss harvesting and tax-efficient withdrawal advice for portfolios. Already, many advisors use software to help on these fronts and these are data-driven decisions. A.I. could replace the middleman role of financial advisors and allow investors to build, grow, and then withdraw their assets without the help of a human.

A Human Touch May Still Be Needed

So, should advisors worry and panic? Perhaps not yet. There are still plenty of limitations for the software and its potential.

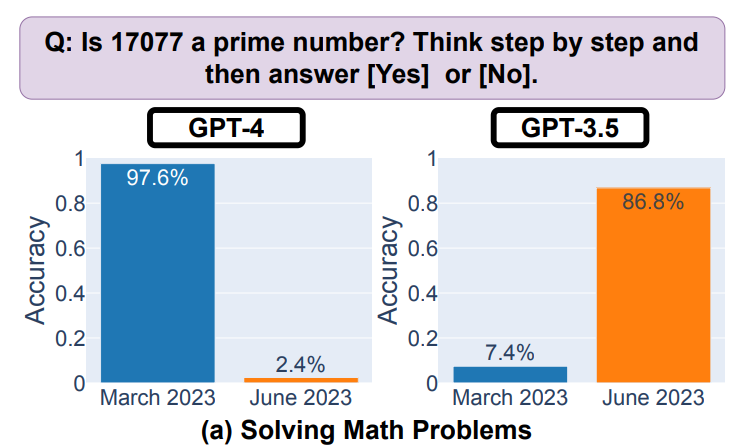

For one thing, ChatGPT is only as good as its data set and we’re seeing that happen in real time. Generative A.I. models rely on the quality of the data they’re fed. And as the models have grown in popularity, enough poor data has started to infect them. According to a Stanford University study, the accuracy of ChatGPT 4, which is more sophisticated than ChatGPT 3.5, on certain math problems went from being as high as 97% down to just 2.4%.

Source: Stanford University

The study also found that the application’s ability to write code and do visual patterns also saw wide drifts lower. In a nutshell, we’ve made it dumber by using it. That could be a massive issue if instead of writing jokes we’re now using it for financial advice. 3

Second, while a computer can analyze all the data it wants, human beings are able to find nuance and emotion. Good financial planners get to know their clients as more than account numbers. They can see goals as more than just numbers on a page. There’s more to good planning than simply optimizing a portfolio based on a static set of inputs. Good advisors are able to guide clients in other life possibilities as well. This is simply irreplicable by a machine.

Finally, there’s the regulation aspect to be had. The federal government requires many jobs within the financial sector to have various licenses and certifications to do their job. At the end of the day, the government may prevent these programs from ever evolving into actual advice-giving machines.

Human Touch & A.I. Together

In the end, advisors may not need to fear A.I. and ChatGPT just yet. In fact, they may want to embrace it. By using the software for more back-end and repetitive tasks, it could free up more time for actual goals-based advising. It’s here that financial advisors can provide real value to their clients.

While ChatGPT and A.I. is revolutionary and it has the potential to become an essential tool in the years to come, advisors that truly focus on client interaction and relationships shouldn’t have anything to fear.

1 NAPA (June 2023). Why Financial Advisors Are Using ChatGPT (or Not)

2 CNBC (May 2023). JPMorgan is developing a ChatGPT-like A.I. service

3 Stanford University (June 2023). How Is ChatGPT’s Behavior Changing over Time?