Stocks spent much of this week trending lower as the Federal Reserve threw cold water on interest rate cut expectations.

The central bank left the Fed Funds rate steady at a 23-year high of 5.25%-5.5% for a fifth consecutive meeting in March. However, several key speeches last week, including one from Chair Jerome Powell, indicated that the Fed wasn’t ready to start cutting rates in the near term. In their view, inflation remains too high for the central bank to act. This sent many growth sectors lower on the week. Meanwhile, other economic data indicates that the economy is still going strong. The official unemployment rate dipped to 3.8%, while the economy added 303,000 jobs in March – the most in ten months. Likewise, the ISM Manufacturing PMI jumped to 50.3 in March – the highest and first reading above 50 since September 2022. This highlights that the industrial economy is moving into expansion territory once again. Month-over-month factory orders confirmed this trend, with a 1.4% increase in February, reversing recent declines.

After last week’s Fed-induced volatility, next week’s focus will be on inflation. And given the Fed’s recent stance on interest rate cuts, any stubbornly high inflation data could cause increased volatility. Analysts expect the consumer price index (CPI) to increase by 0.3% in March, for an annual rate of 3.2%. In addition, investors will be treated to the most recent Federal Open Market Committee (FOMC) meeting minutes. The window into the central bank’s thinking could paint a dour picture of the potential for rate cuts this year. Finally, jobless claims are expected to remain strong, indicating a bullish labor market. Once again, investors may take this negatively, believing that the economy is still moving along, thereby preventing any easing of monetary policy in the near future.

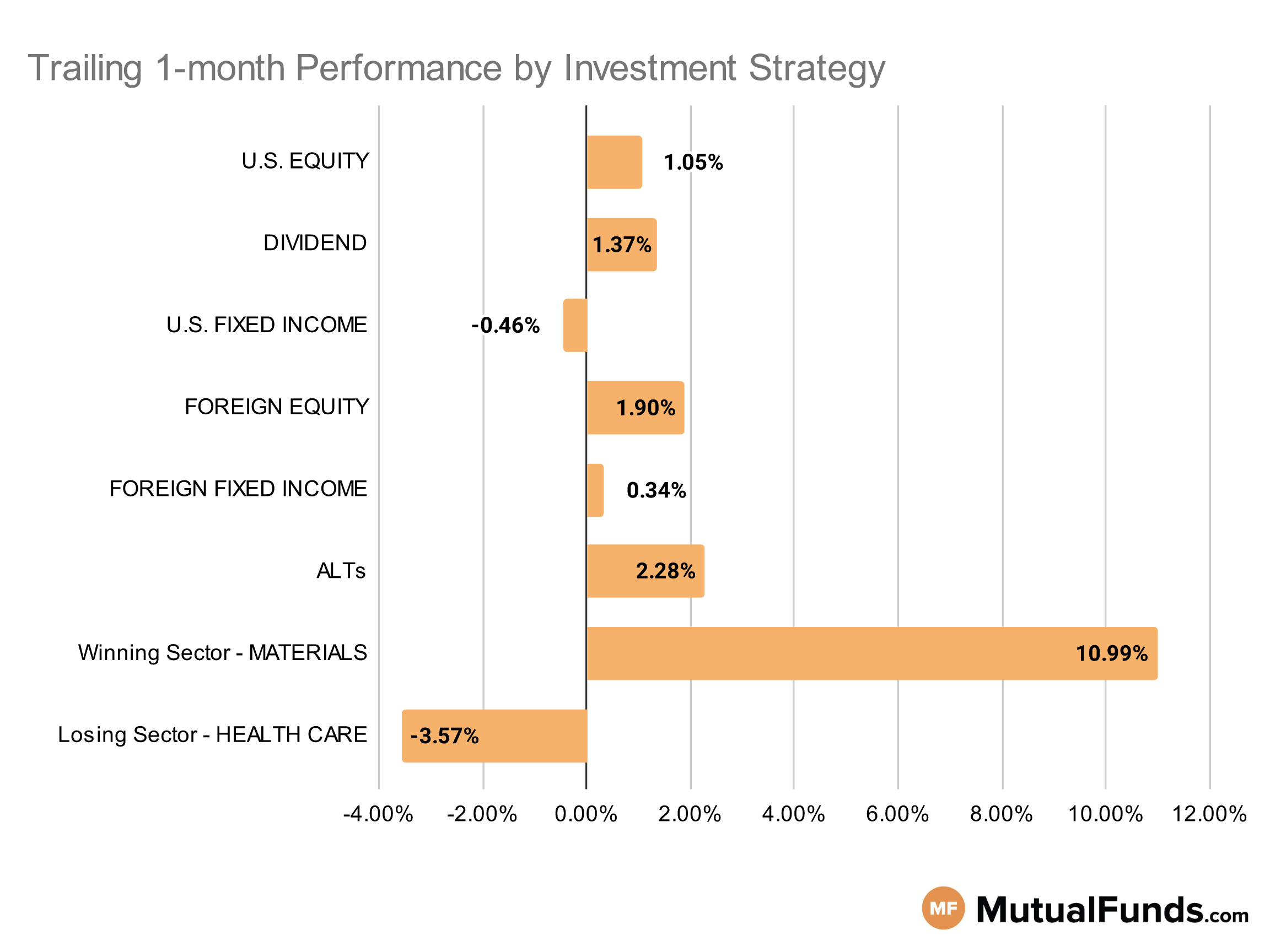

Given this economic backdrop, let us see how this impacts the performance of various investment strategies.

Investment Strategy Scorecard

Overall, the U.S. stock markets maintained their positive momentum for the rolling month.

Precious metal strategies, especially silver and gold, continued to post solid performances for the rolling month. Meanwhile, biotechnology strategies struggled.

U.S Equity Strategies

Among U.S. equities, several value strategies continued to outperform their growth counterparts over the rolling month.

Winning

- Invesco Small Cap Value Fund (VSMIX), up 5.38%

- ClearBridge Value Trust (LGVAX), up 4.59%

- Schwab Fundamental U.S. Large Company Index ETF (FNDX), up 2.21%

- Dimensional U.S. Targeted Value ETF (DFAT), up 2.08%

Losing

- iShares S&P Small-Cap 600 Value ETF (IJS), down -0.44%

- iShares Russell 2000 Growth ETF (IWO), down -0.96%

- VALIC Company I Mid Cap Index Fund (VMIDX), down -3.53%

- VALIC Company I Stock Index Fund (VSTIX), down -5.35%

Dividend Strategies

Several dividend growth focused strategies continued to post positive performances over the rolling month.

Winning

- DWS CROCI Equity Dividend Fd (KDHSX), up 3.94%

- Fidelity Advisor® Dividend Growth Fund (FDGTX), up 3.56%

- Invesco BuyBack Achievers ETF (PKW), up 3.33%

- First Trust Rising Dividend Achievers ETF (RDVY), up 2.94%

Losing

- O’Shares U.S. Quality Dividend ETF (OUSA), down -0.15%

- ProShares Russell 2000 Dividend Growers ETF (SMDV), down -0.32%

- Vanguard Dividend Growth Fund (VDIGX), down -2.32%

- VALIC Company I Dividend Value Fund (VCIGX), down -4.08%

U.S. Fixed Income Strategies

In US fixed income, investment-grade and global bond strategies posted positive results, while several longer duration bond strategies struggled..

Winning

- ProShares Short 20+ Year Treasury (TBF), up 2.65%

- ProShares Investment Grade—Interest Rate Hedged (IGHG), up 0.98%

- T. Rowe Price Dynamic Global Bond Fund (TRDZX), up 0.78%

- BlackRock Dynamic High Income Portfolio (BDHAX), up 0.59%

Losing

- iShares 20+ Year Treasury Bond ETF (TLT), down -2.88%

- PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund (LTPZ), down -3.13%

- PIMCO Extended Duration Fund (PEDPX), down -3.8%

- Vanguard Extended Duration Treasury Index Fund (VEDIX), down -4.84%

Foreign Equity Strategies

Among foreign equities, some Asian and emerging market strategies posted solid performances, except Indian and Brazilian equity strategies.

Winning

- iShares Asia 50 ETF (AIA), up 6.45%

- Horizon Kinetics Inflation Beneficiaries ETF (INFL), up 5.66%

- Pear Tree Polaris Foreign Value Small Cap Fund (QUSIX), up 5.49%

- Fidelity Advisor® Focused Emerging Markets Fund (FAMKX), up 5.29%

Losing

- WisdomTree India Earnings Fund (EPI), down -1.3%

- Grandeur Peak International Opportunities Fund (GPIIX), down -1.77%

- iShares MSCI Brazil ETF (EWZ), down -2.31%

- Morgan Stanley Institutional Fund, Inc. Global Franchise Portfolio (MSGFX), down -2.39%

Foreign Fixed Income Strategies

Several emerging market debt strategies continue to post positive results over the rolling month.

Winning

- Eaton Vance Emerging Markets Debt Opportunities Fund (EIDOX), up 1.94%

- Fidelity Advisor® New Markets Income Fund (FNMIX), up 1.78%

- iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB), up 0.64%

Losing

- VanEck Emerging Markets High Yield Bond ETF (HYEM), down -0.21%

- T. Rowe Price International Bond Fund (PAIBX), down -0.57%

- VanEck J.P. Morgan EM Local Currency Bond ETF (EMLC), down -0.93%

- SPDR® Bloomberg Barclays Emerging Markets Local Bond ETF (EBND), down -0.97%

- Templeton Global Bond Fund (TGBAX), down -1.22%

Alternatives

Among alternatives, gold and commodity strategies posted strong results over the rolling month.

Winning

- ETFMG Alternative Harvest ETF (MJ), up 27.58%

- Fidelity® Select Gold Portfolio (FSAGX), up 12.9%

- Invesco DB Agriculture Fund (DBA), up 11.76%

- BlackRock Commodity Strategies Portfolio (BCSAX), up 8.19%

Losing

- Janus Henderson Mortgage-Backed Securities ETF (JMBS), down -0.64%

- IQ Merger Arbitrage ETF (MNA), down -0.7%

- Columbia Mortgage Opportunities Fund (CLMAX), down -0.75%

- Loomis Sayles Strategic Alpha Fund (LASNX), down -0.96%

Sectors

Among the sectors industrial and precious metal strategies continued to post strong results, while biotech strategies suffered.

Winning

- Global X Copper Miners ETF (COPX), up 23.87%

- ETFMG Prime Junior Silver Miners ETF (SILJ), up 23.85%

- Franklin Gold and Precious Metals Fund (FGPMX), up 15.74%

- Invesco Gold & Special Minerals Fund (OPGSX), up 14.02%

Losing

- Franklin Biotechnology Discovery Fund (FTDZX), down -6.49%

- VALIC Company I Blue Chip Growth Fund (VCBCX), down -9.76%

- ARK Genomic Revolution ETF (ARKG), down -9.82%

- SPDR® S&P Biotech ETF (XBI), down -10.02%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietary system to scan through thousands of relevant mutual funds and ETFs. Fund performance data is calculated for the trailing one month, based on the change in NAV.

Here is a summary of the different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed-income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.