Stocks declined during the first half of this week, only to rebound and hit new record highs towards the second half.

The key to that resurgence was a speech by Federal Reserve Chairman Jerome Powell to the Congress. In his semiannual Monetary Policy Report, Powell reiterated that that the current 5.5% benchmark rate was most likely this cycle’s peak and that the economic outlook is uncertain. To that end, the central bank would respond accordingly if conditions change and the economy needs help, sending stocks higher on the week. A mixed Job Openings and Labor Turnover Survey (JOLTS) reading and ADP’s employment report helped on this front. Also helping stocks was a surprise uptick to the unemployment rate, which reached 3.9%, exceeding expectations of 3.7% and registering the highest level since January of 2022. A slight dip in the latest Services Purchasing Managers Index (PMI) reading also painted a picture that the Federal Reserve is still on the path to cut rates sooner than later.

After this week’s focus on key labor market economic indicators, investors will be monitoring inflationary trends next week. U.S. consumer prices rose by 0.3% in January, keeping the overall rate at 3.1% annually. However, the continued uptick in prices has raised the expectation that inflation will continue to remain elevated, with the metric likely to rise by 0.4% on a monthly basis in February, boosting the annual pace of inflation to 3.2%. This could lead to the Fed keeping interest rates steady and not acting upon its predicted cuts. Investors will also see how higher prices are impacting consumer activity with the latest retail sales figures. After a big 0.8% decline in January, investors are expecting a sharp rebound in February, considering the resilience of the labor market. Finally, the latest jobless claim figures will be released, which are expected to show a bullish reading.

Given this economic backdrop, let us see how this impacts the performance of various investment strategies.

Investment Strategy Scorecard

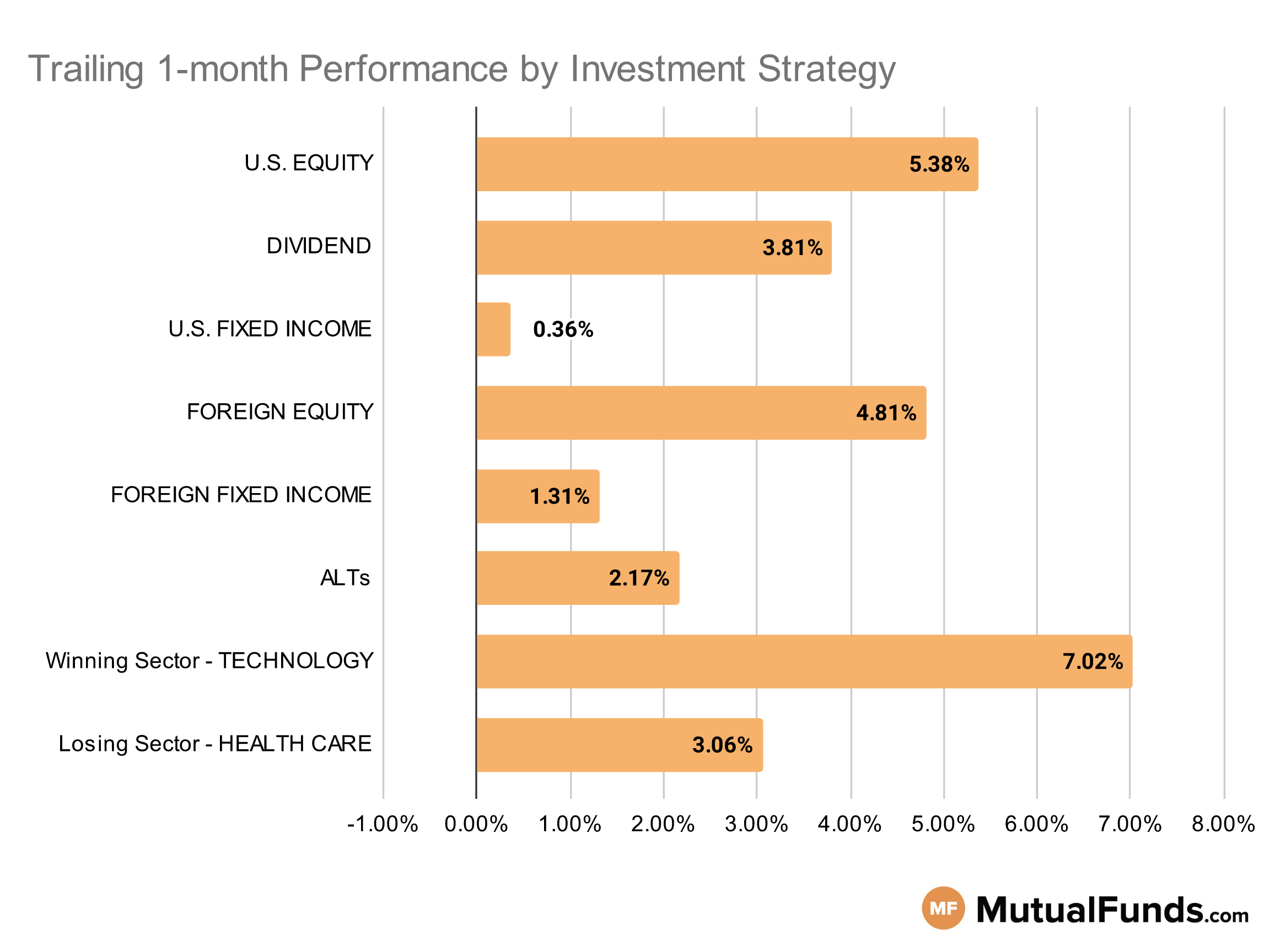

Overall, the U.S. stock markets continue to be in the positive territory for the rolling month.

Growth focused strategies, especially technology, continued to post solid results. Meanwhile, cannabis and uranium focused strategies struggled over the rolling month.

U.S Equity Strategies

Among U.S. equities, growth strategies continue to lead the pack.

Winning

- AB Discovery Growth Fund (CHCZX), up 12.11%

- Hood River Small-Cap Growth Fund (HRSMX), up 11.88%

- SPDR® S&P 400 Mid Cap Growth ETF (MDYG), up 11.34%

- iShares S&P Mid-Cap 400 Growth ETF (IJK), up 11.29%

- SPDR® S&P 600 Small Cap Value ETF (SLYV), up 3.52%

- iShares S&P Small-Cap 600 Value ETF (IJS), up 3.48%

Losing

- Brown Capital Management Small Company Fund (BCSIX), down -0.71%

- VALIC Company I Stock Index Fund (VSTIX), down -2.73%

Dividend Strategies

Several dividend growth focused strategies continued to post positive performances over the rolling month.

Winning

- Fidelity® Dividend Growth Fund (FDGFX), up 8.11%

- Fidelity Advisor® Dividend Growth Fund (FDGTX), up 7.96%

- ProShares S&P MidCap 400 Dividend Aristocrats ETF (REGL), up 6.37%

- WisdomTree U.S. MidCap Dividend Fund (DON), up 5.9%

- O’Shares U.S. Quality Dividend ETF (OUSA), up 1.74%

- Invesco High Yield Equity Dividend Achievers™ ETF (PEY), up 0.35%

- Principal Global Diversified Income Fund (PGBAX), up 0.34%

Losing

- VALIC Company I Dividend Value Fund (VCIGX), down -2.93%

U.S. Fixed Income Strategies

In US fixed income, longer duration and high yield strategies posted positive results, while some short term and interest-rate hedged strategies struggled.

Winning

- PIMCO StocksPLUS® Long Duration Fund (PSLDX), up 4.77%

- Nuveen High Yield Municipal Bond Fund (NHCCX), up 2.18%

- Invesco CEF Income Composite ETF (PCEF), up 1.79%

- SPDR® Nuveen S&P High Yield Municipal Bond ETF (HYMB), up 1.67%

Losing

- T. Rowe Price Dynamic Global Bond Fund (TRDZX), down -0.52%

- Eaton Vance Short Duration Government Income Fund (EILDX), down -0.55%

- iShares Interest Rate Hedged Long-Term Corporate Bond ETF (IGBH), down -0.66%

- ProShares Short 20+ Year Treasury (TBF), down -0.69%

Foreign Equity Strategies

Among foreign equities, Asian equity strategies led the pack while Mexican and Brazilian equity strategies struggled over the rolling month.

Winning

- First Trust International Equity Opportunities ETF (FPXI), up 10.54%

- Matthews Japan Fund (MJFOX), up 10.29%

- Matthews Asia Growth Fund (MPACX), up 9.36%

- iShares MSCI Intl Momentum Factor ETF (IMTM), up 8.91%

- Vanguard Emerging Markets Government Bond Index Fund (VGAVX), up 1.34%

Losing

- Virtus Vontobel Emerging Markets Opportunities Fund (VREMX), down -1.07%

- iShares MSCI Brazil ETF (EWZ), down -1.37%

- iShares MSCI Mexico ETF (EWW), down -4.83%

Foreign Fixed Income Strategies

Emerging market debt strategies continue to lead the pack, among foreign fixed income strategies/

Winning

- Stone Harbor Emerging Markets Debt Fund (SHMDX), up 2.25%

- Vanguard Emerging Markets Bond Fund (VEMBX), up 2.14%

- iShares International Treasury Bond ETF (IGOV), up 1.92%

- iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB), up 1.62%

- SPDR® Bloomberg Barclays Emerging Markets Local Bond ETF (EBND), up 0.34%

- Janus Henderson Developed World Bond Fund (HFARX), up 0.26%

- Invesco International Bond Fund (OIBIX), up 0.23%

Losing

- VanEck J.P. Morgan EM Local Currency Bond ETF (EMLC), down -0.04%

Alternatives

Among alternatives, hedged Japanese strategies continued to post strong results over the rolling month, while cannabis strategies struggled.

Winning

- iShares Currency Hedged MSCI Japan ETF (HEWJ), up 8.49%

- Fidelity® Contrafund® Fund (FCNKX), up 6.32%

- Fidelity® Select Gold Portfolio (FSAGX), up 6.29%

- SPDR® Russell 1000 Low Volatility Focus ETF (ONEV), up 5.79%

- Neuberger Berman Long Short Fund (NLSAX), flat 0%

Losing

- Janus Henderson Mortgage-Backed Securities ETF (JMBS), down -0.22%

- Victory Market Neutral Income Fund (CBHAX), down -0.82%

- ETFMG Alternative Harvest ETF (MJ), down -19.29%

Sectors

Among the sectors technology strategies posted strong results, while strategies focused on cannabis and uranium were in red.

Winning

- Amplify Transformational Data Sharing ETF (BLOK), up 27.76%

- VanEck Vectors Semiconductor ETF (SMH), up 21.5%

- Fidelity Advisor® Semiconductors Fund (FIKGX), up 21.1%

- Fidelity® Select Semiconductors Portfolio (FSELX), up 20.8%

- Fidelity® Select Software & IT Services Portfolio (FSCSX), up 0.35%

Losing

- VALIC Company I Nasdaq-100 Index Fund (VCNIX), down -0.12%

- Global X Uranium ETF (URA), down -5.17%

- AdvisorShares Pure US Cannabis ETF (MSOS), down -25.27%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietary system to scan through thousands of relevant mutual funds and ETFs. Fund performance data is calculated for the trailing one month, based on the change in NAV.

Here is a summary of the different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed-income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.