Stocks spent the shortened trading week moving higher as the tech sector dominated the market.

Social media company Reddit filed for an IPO, while shares of AI-focused company NVIDIA surged after beating analysts’ earning expectations. The Federal Reserve certainly helped equities as well, with the latest FOMC meeting minutes showing that policymakers believed that current interest rates were at the peak for this tightening cycle. However, they were at odds over when policy easing could start, with some predicting that current rates will last longer than the markets expect. Additionally, bullish weekly jobless claims and existing home sales data, both of which came in above expectations, supported overall optimism in the markets.

Next week will feature several pieces of key economic data that could provide a framework for the Fed to make its next decision on interest rates. On Wednesday, we’ll get to see the latest reading of the Core PCE Price Index. This is the Federal Reserve’s favorite measure of inflation and the number recently clocked in at 0.2%, higher than the previous reading and above expectations. Continued growth in the index could mean that the Fed’s pause will last longer and could even increase expectations for a rate hike. On Thursday, personal spending and income data will be released. Both metrics showed increases in December, with spending jumping by 0.7%. Analysts predict the trend to continue in January as consumers still feel confident about their prospects. This fact should be reinforced by the latest GDP number, which grew by 3.3% in Q4.

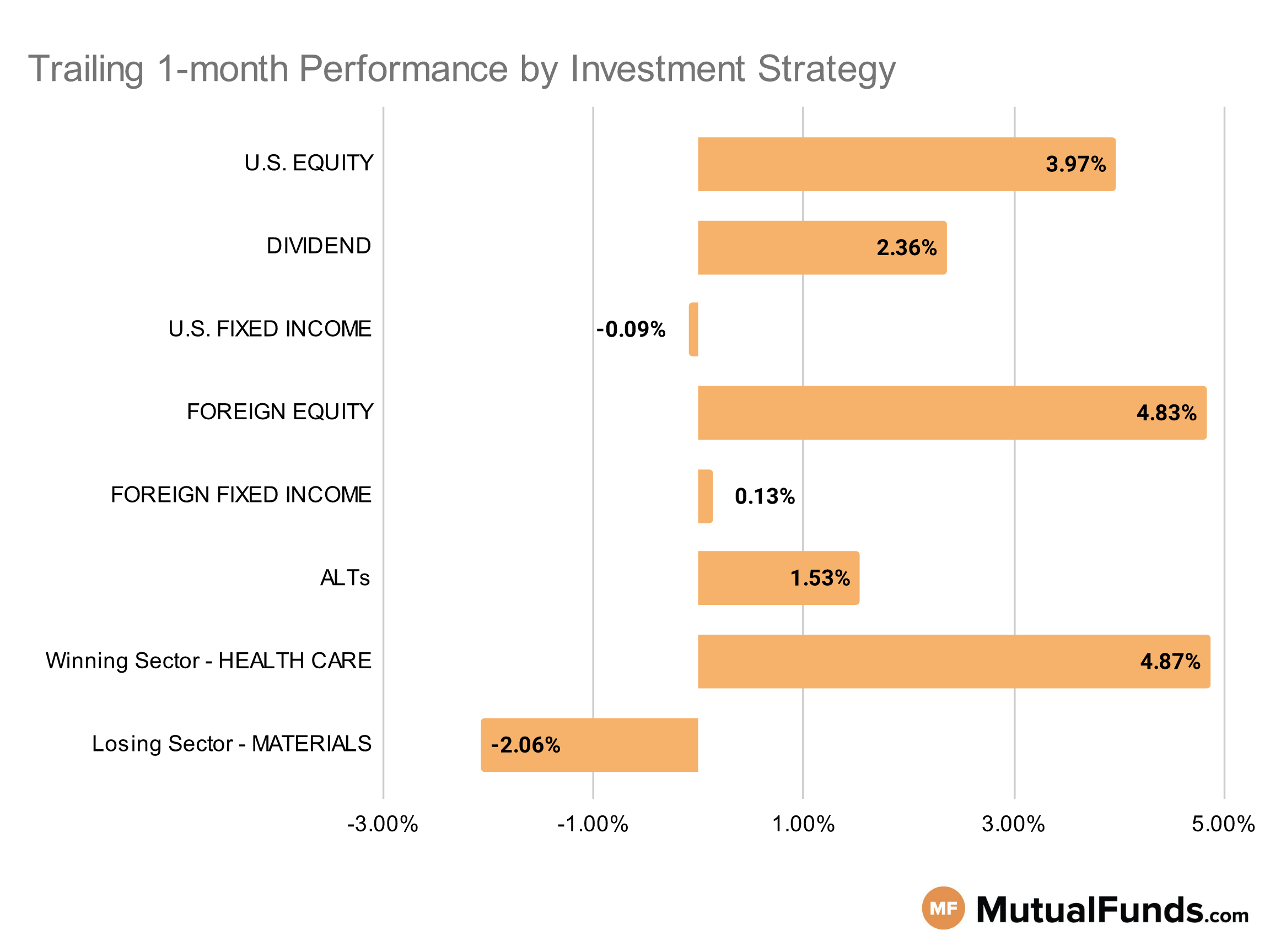

Given this economic backdrop, let us see how this impacts the performance of various investment strategies.

Investment Strategy Scorecard

Overall, the U.S. stock markets continue to be in the positive territory for the rolling month.

Growth-focused strategies, especially technology and healthcare, continue to post solid results. Meanwhile, precious metals, including silver and gold, continue to struggle over the rolling month.

U.S Equity Strategies

Overall, growth strategies continue to outperform value strategies.

Winning

- The Hartford Growth Opportunities Fund (HGOCX), up 9.62%

- Fidelity Advisor® Series Equity Growth Fund (FMFMX), up 8.67%

- Invesco Dynamic Large Cap Growth ETF (PWB), up 7.24%

- SPDR® S&P 400 Mid Cap Growth ETF (MDYG), up 6.52%

Losing

- iShares S&P Small-Cap 600 Value ETF (IJS), down -0.71%

- SPDR® S&P 600 Small Cap Value ETF (SLYV), down -0.73%

- Bridgeway Omni Small-Cap Value Fund (BOSVX), down -0.98%

- Nuance Mid Cap Value Fund (NMAVX), down -1.05%

Dividend Strategies

Several sector and dividend growth-focused dividend strategies posted positive performances over the rolling month, while high-yield and small-cap strategies struggled.

Winning

- HCM Dividend Sector Plus Fund (HCMNX), up 5.77%

- Fidelity® Dividend Growth Fund (FDGFX), up 5.51%

- WisdomTree U.S. LargeCap Dividend Fund (DLN), up 3.5%

- JPMorgan Diversified Return U.S. Equity ETF (JPUS), up 3.36%

Losing

- Principal Global Diversified Income Fund (PGBAX), down -0.34%

- Federated Hermes Strategic Value Dividend Fund (SVAIX), down -0.55%

- ProShares Russell 2000 Dividend Growers ETF (SMDV), down -2.93%

- Invesco High Yield Equity Dividend Achievers™ ETF (PEY), down -3.29%

U.S. Fixed Income Strategies

In US fixed income, some long duration and convertible bond strategies continued to post positive results, while some strategies focused on mortgage-backed securities (MBS) struggled.

Winning

- PIMCO StocksPLUS® Long Duration Fund (PSLDX), up 3.36%

- Miller Convertible Bond Fund (MCIFX), up 2.46%

- Invesco CEF Income Composite ETF (PCEF), up 1.99%

- ProShares Short 20+ Year Treasury (TBF), up 1.75%

Losing

- SPDR® Portfolio Long Term Corporate Bond ETF (SPLB), down -1.51%

- iShares 10-20 Year Treasury Bond ETF (TLH), down -1.54%

- DWS GNMA Fund (GRRGX), down -1.8%

- Columbia Quality Income Fund (AUGAX), down -1.88%

Foreign Equity Strategies

Among foreign equities, South Korean equity strategies continue to lead the pack while international real estate strategies continued their struggle for the rolling month.

Winning

- iShares MSCI South Korea ETF (EWY), up 10.54%

- PGIM Jennison International Opportunities Fund (PWJQX), up 10.52%

- PIMCO RAE Emerging Markets Fund (PEIFX), up 9.75%

- WisdomTree Europe Hedged Equity Fund (HEDJ), up 9.56%

- Invesco International Dividend Achievers ETF (PID), up 0.5%

Losing

- Columbia Overseas Value Fund (COSZX), down -0.29%

- Wasatch International Growth Fund® (WAIGX), down -0.3%

- SPDR® Dow Jones International Real Estate ETF (RWX), down -1.45%

Foreign Fixed Income Strategies

Emerging market debt strategies continue to outperform relatively better than broadly diversified international debt strategies.

Winning

- VanEck Emerging Markets High Yield Bond ETF (HYEM), up 1.83%

- Eaton Vance Emerging Markets Debt Opportunities Fund (EIDOX), up 1.58%

- Stone Harbor Emerging Markets Debt Fund (SHMDX), up 1.13%

- iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB), up 0.64%

Losing

- VanEck J.P. Morgan EM Local Currency Bond ETF (EMLC), down -0.48%

- SPDR® Bloomberg Barclays International Treasury Bond ETF (BWX), down -0.67%

- Janus Henderson Developed World Bond Fund (HFARX), down -1.17%

- Ashmore Emerging Markets Total Return Fund (EMKIX), down -1.41%

Alternatives

Among alternatives, contrarian and managed futures strategies continued to post strong results over the rolling month, while gold strategies remained in the red.

Winning

- Fidelity® Contrafund® Fund (FCNKX), up 9.5%

- AQR Managed Futures Strategy Fund (AQMIX), up 8.29%

- WisdomTree Japan Hedged Equity Fund (DXJ), up 8.13%

- iShares Currency Hedged MSCI Eurozone ETF (HEZU), up 6.56%

Losing

- SPDR® Bloomberg Barclays Convertible Securities ETF (CWB), down -1.01%

- Janus Henderson Mortgage-Backed Securities ETF (JMBS), down -1.55%

- Victory Market Neutral Income Fund (CBHAX), down -2.43%

- Fidelity® Select Gold Portfolio (FSAGX), down -7.41%

Sectors

Among the sectors technology and healthcare strategies continue to post strong results, while strategies focused on precious metals continue to be in red.

Winning

- Amplify Transformational Data Sharing ETF (BLOK), up 20.62%

- Invesco DWA Healthcare Momentum ETF (PTH), up 12.56%

- Fidelity® Select Semiconductors Portfolio (FSELX), up 10.84%

- Fidelity Advisor® Semiconductors Fund (FIKGX), up 10.69%

Losing

- Franklin Gold and Precious Metals Fund (FGPMX), down -6.82%

- First Eagle Gold Fund (FEGIX), down -7.8%

- Global X Silver Miners ETF (SIL), down -10.02%

- ETFMG Prime Junior Silver Miners ETF (SILJ), down -11.39%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietary system to scan through thousands of relevant mutual funds and ETFs. Fund performance data is calculated for the trailing one month, based on the change in NAV.

Here is a summary of the different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed-income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.