Stocks were mixed last week as inflation data caused plenty of volatility.

The CPI rose by 0.3% in January on a seasonally adjusted basis, after rising 0.2% in December. This was the strongest growth seen in four months. The number was also higher than market expectations. However, the overall annual pace of inflation dropped to 3.1%. This led to volatility in the markets as investors began to question the Fed’s ability to cut rates in the near term. Disappointing retail sales data, which declined 0.8% in January compared to market forecasts for a 0.3% rise, also hit stocks. Building permits and housing starts also declined. Additionally, news that Warren Buffett and Berkshire Hathaway trimmed their position in Apple sent many investors out of tech stocks and into bonds/cash on the week.

Next week will be a shortened trading week due to the President’s Day holiday on Monday. As such, overall economic data will be light. However, investors will be curious to go over the latest FOMC meeting minutes on Wednesday. After the uptick in inflation and the Fed’s continued pause on interest rates, investors have already started pricing in the likelihood that the Fed won’t cut rates as early as they previously assumed. Expectations of a rate increase have started to grow as well. The meeting minutes will be an important window into the Fed’s thinking and any clues here could send the markets surging or dropping. Investors will also tune into jobless claims data on Thursday, which has continued to support the bullish labor market. A bright spot on the week could be the existing home sales report on Thursday, which is projected to increase to a seasonally adjusted annualized rate of 3.9 million, following a drop in December 2023 to the lowest level since August 2010. Meanwhile, consumers continue to take the higher mortgage rate environment in strides.

Given this economic backdrop, let us see how this impacts the performance of various investment strategies.

Investment Strategy Scorecard

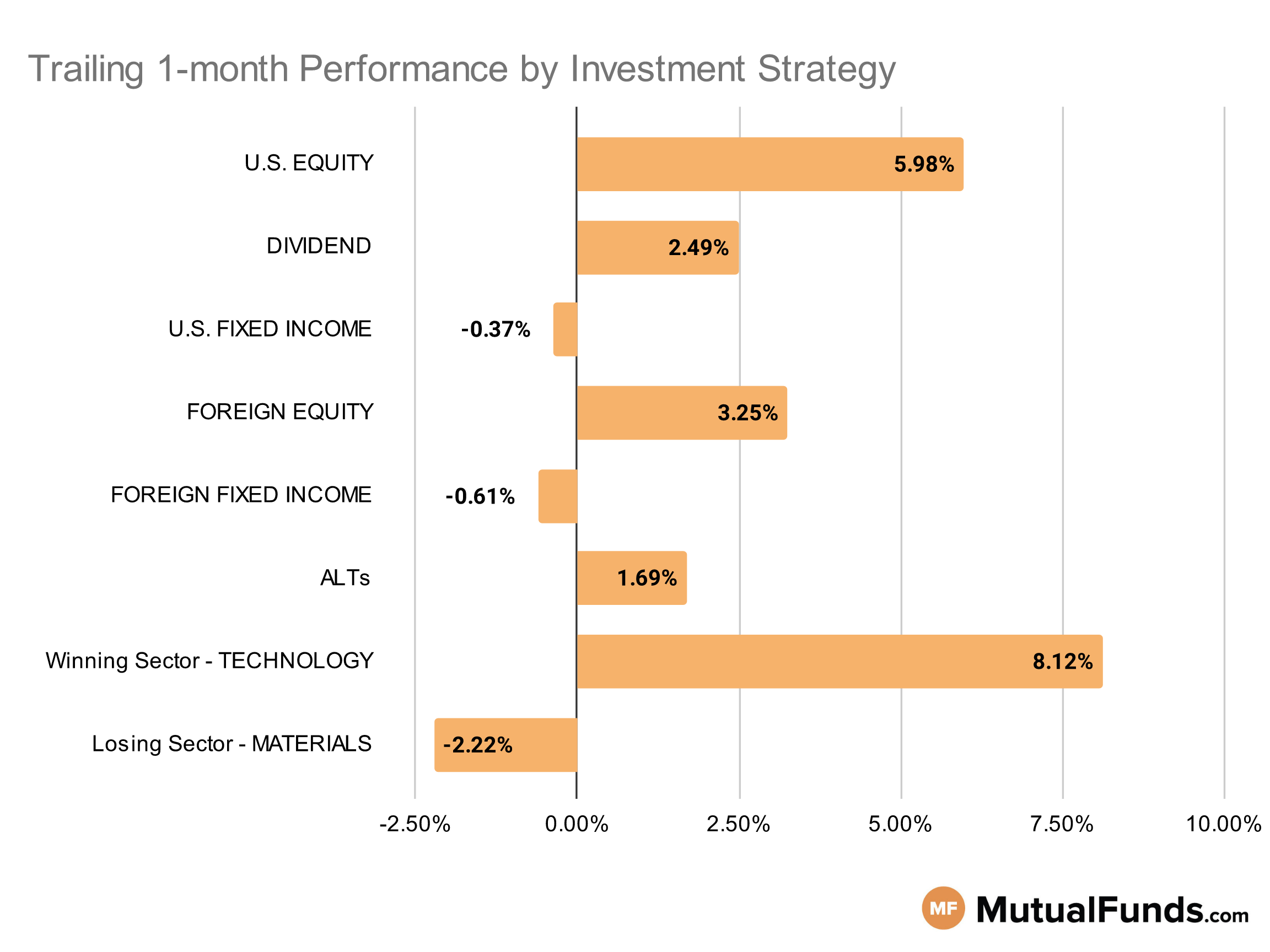

Overall, the U.S. stock markets continue to be in the positive territory for the rolling month.

Growth-focused strategies, especially semiconductors, continue to outperform other strategies, Meanwhile, silver, gold and battery material strategies posted some of the biggest losses over the rolling month.

U.S Equity Strategies

Overall, growth strategies continue to outperform value strategies.

Winning

- Morgan Stanley Institutional Fund, Inc. Growth Portfolio (MSEGX), up 13.24%

- Spyglass Growth Fund (SPYGX), up 12.68%

- First Trust US Equity Opportunities ETF (FPX), up 10.73%

- Invesco Dynamic Large Cap Growth ETF (PWB), up 9.96%

- SPDR® S&P 400 Mid Cap Value ETF (MDYV), up 2.18%

- iShares S&P Mid-Cap 400 Value ETF (IJJ), up 2.14%

- American Century Mid Cap Value Fund (AMVRX), up 0.85%

Losing

- Nuance Mid Cap Value Fund (NMAVX), down -1.85%

Dividend Strategies

Several sector and quality-focused dividend strategies continue to post positive performances over the rolling month, while high-yield strategies continue to struggle.

Winning

- HCM Dividend Sector Plus Fund (HCMNX), up 7.7%

- Vanguard Diversified Equity Fund (VDEQX), up 6.14%

- WisdomTree U.S. Quality Dividend Growth Fund (DGRW), up 3.99%

- WisdomTree U.S. SmallCap Dividend Fund (DES), up 3.96%

Losing

- Principal Global Diversified Income Fund (PGBAX), down -0.5%

- Federated Hermes Strategic Value Dividend Fund (SVAIX), down -2.01%

- SPDR® S&P International Dividend ETF (DWX), down -2.16%

- Legg Mason Low Volatility High Dividend ETF (LVHD), down -2.2%

U.S. Fixed Income Strategies

In US fixed income, some long-duration and convertible bond strategies continued to post positive results, while some inflation-protected strategies struggled.

Winning

- PIMCO StocksPLUS® Long Duration Fund (PSLDX), up 4.22%

- Miller Convertible Bond Fund (MCIFX), up 3.43%

- Invesco CEF Income Composite ETF (PCEF), up 2.99%

- ProShares Short 20+ Year Treasury (TBF), up 1.95%

Losing

- American Funds Strategic Bond Fund (ANBFX), down -1.73%

- Vanguard Extended Duration Treasury Index Fund (VEDIX), down -1.76%

- SPDR® Portfolio Long Term Corporate Bond ETF (SPLB), down -1.84%

- PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund (LTPZ), down -2.24%

Foreign Equity Strategies

Among foreign equities, developing market equity strategies outperformed international real estate strategies for the rolling month.

Winning

- Lord Abbett Developing Growth Fund (LADVX), up 12.38%

- PGIM Jennison International Opportunities Fund (PWJQX), up 10.48%

- iShares MSCI South Korea ETF (EWY), up 8.14%

- iShares MSCI Taiwan ETF (EWT), up 8.11%

Losing

- Pear Tree Polaris Foreign Value Small Cap Fund (QUSIX), down -0.85%

- iShares MSCI Brazil ETF (EWZ), down -1.91%

- Columbia Overseas Value Fund (COSZX), down -2.3%

- SPDR® Dow Jones International Real Estate ETF (RWX), down -3.06%

Foreign Fixed Income Strategies

Emerging market debt strategies continue to outperform relatively better than broadly diversified international debt strategies.

Winning

- VanEck Emerging Markets High Yield Bond ETF (HYEM), up 1.18%

- Eaton Vance Emerging Markets Debt Opportunities Fund (EIDOX), up 1.05%

- iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB), up 0.11%

- JPMorgan Emerging Markets Debt Fund (JEDAX), flat 0%

Losing

- iShares International Treasury Bond ETF (IGOV), down -1.2%

- SPDR® Bloomberg Barclays International Treasury Bond ETF (BWX), down -1.38%

- Janus Henderson Developed World Bond Fund (HFARX), down -1.42%

- Ashmore Emerging Markets Total Return Fund (EMKIX), down -1.99%

Alternatives

Among alternatives, contrarian and managed futures strategies posted strong results over the rolling month, while gold strategies were in red.

Winning

- Fidelity® Contrafund® Fund (FCNKX), up 10.96%

- AQR Managed Futures Strategy Fund (AQMIX), up 7.16%

- WisdomTree Japan Hedged Equity Fund (DXJ), up 6.65%

- iShares Currency Hedged MSCI Eurozone ETF (HEZU), up 5.57%

Losing

- VanEck Vectors Agribusiness ETF (MOO), down -1.24%

- Janus Henderson Mortgage-Backed Securities ETF (JMBS), down -1.36%

- Victory Market Neutral Income Fund (CBHAX), down -3.11%

- Fidelity® Select Gold Portfolio (FSAGX), down -4.75%

Sectors

Among the sectors semiconductor strategies continue to post strong results, while strategies focused on silver and gold were in red.

Winning

- Amplify Transformational Data Sharing ETF (BLOK), up 19.28%

- VanEck Vectors Semiconductor ETF (SMH), up 15.32%

- Fidelity Advisor® Semiconductors Fund (FIKGX), up 15.27%

- Fidelity® Select Semiconductors Portfolio (FSELX), up 15.21%

Losing

- First Eagle Gold Fund (FEGIX), down -5.51%

- Franklin Gold and Precious Metals Fund (FGPMX), down -5.64%

- Global X Lithium & Battery Tech ETF (LIT), down -7.79%

- ETFMG Prime Junior Silver Miners ETF (SILJ), down -9.73%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietary system to scan through thousands of relevant mutual funds and ETFs. Fund performance data is calculated for the trailing one month, based on the change in NAV.

Here is a summary of the different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed-income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.