Last week, stocks hit new record highs with the S&P 500 crossing the 5000 mark for the first time.

Investors digested new dividend information from both Walmart and Meta as well as positive earnings from many major bellwethers. This helped create a bullish attitude on Wall Street. Also helping was the week’s economic data. The ISM Services PMI jumped to 53.4 in January 2024, up from a 50.5 reading in December. Investors also tuned into the various Fed governor speeches during the week. The FOMC meeting provided plenty of commentary, with several Fed governors showing a preference for rate cuts later this year, if appropriate. Investors cheered this news. However, the bullishness on equities was muted somewhat as concerns about China and its stock market hit enthusiasm for emerging markets and some growth stocks.

Next week, the old foe of inflationary data will be on deck. Growth in the Consumer Price Index (CPI) has fallen significantly since 2022. However, it remains stubbornly high. On Tuesday, analysts expect the trend to continue in January with the month-over-month inflation rate estimated to clock in at 0.2%. This would push the annual inflation rate down to 3%, still significantly above the Fed’s 2% target. The prolonged environment of elevated prices is set to hurt consumers, with January’s retail sales expected to grow at just 0.1%, below December’s 0.6% increase. On Friday, the University of Michigan consumer sentiment report is set to be flat for February, matching January’s reading at 79. However, one bright spot could be housing. On Friday, both building permits and housing starts are likely to show an improving trend for January. Consumers seem to be taking the higher mortgage rate environment in stride, buying houses and beginning plans for construction.

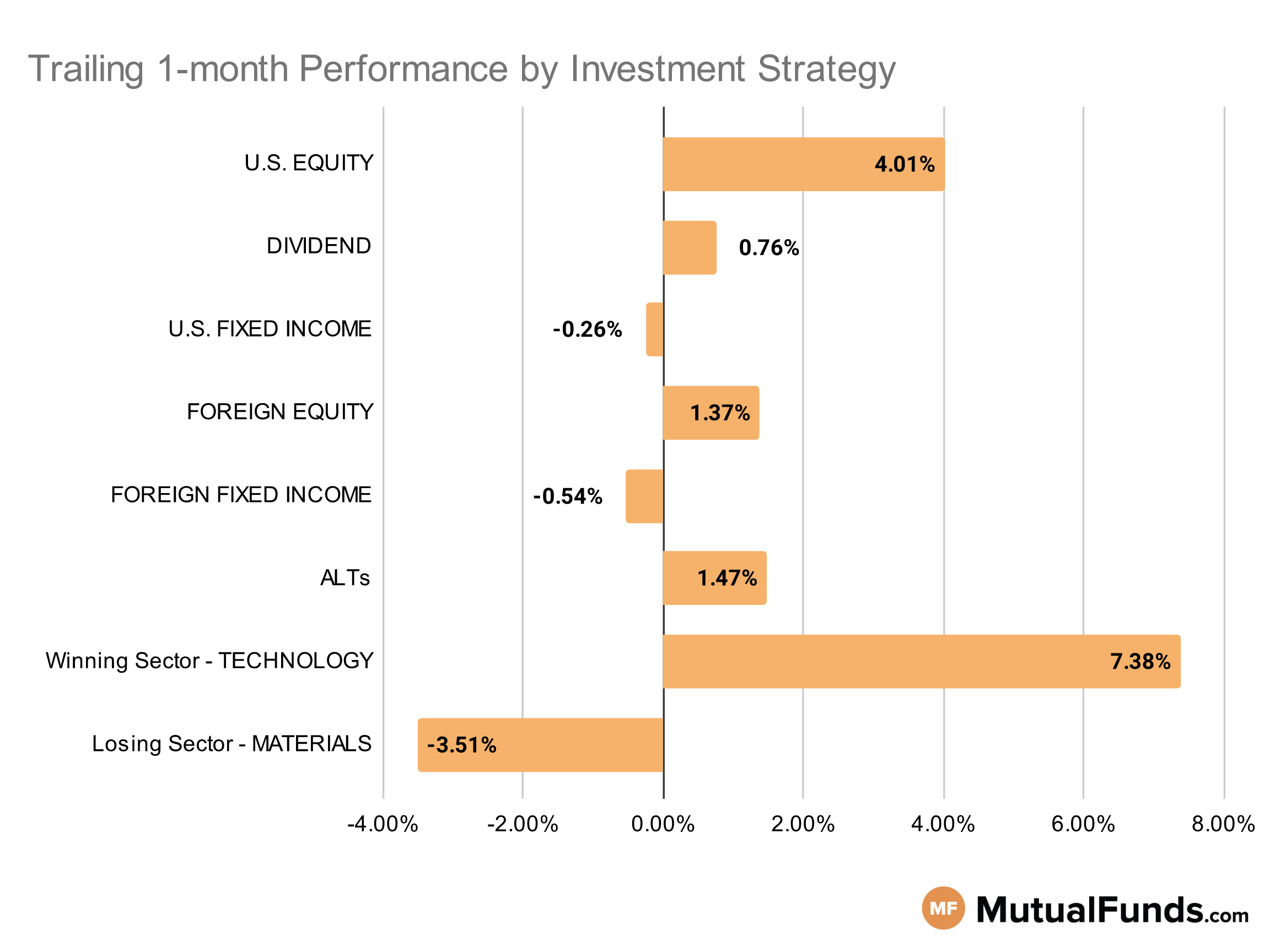

Given this economic backdrop, let us see how this impacts the performance of various investment strategies.

Investment Strategy Scorecard

Overall, the U.S. stock markets continue to be in the positive territory for the rolling month.

Growth focused strategies, especially cannabis and semiconductors, continue to outperform other strategies, Meanwhile, rare earth and battery material strategies posted some of the biggest losses over the rolling month.

U.S Equity Strategies

Overall, growth strategies continue to outperform value strategies.

Winning

- Lord Abbett Growth Leaders Fund (LGLIX), up 13.14%

- The Hartford Growth Opportunities Fund (HGOCX), up 11.93%

- Invesco Dynamic Large Cap Growth ETF (PWB), up 11.13%

- iShares Core S&P U.S. Growth ETF (IUSG), up 8.78%

Losing

- iShares S&P Small-Cap 600 Value ETF (IJS), down -2.08%

- SPDR® S&P 600 Small Cap Value ETF (SLYV), down -2.17%

- Virtus NFJ Mid-Cap Value Fund (PQNAX), down -2.25%

- Nuance Mid Cap Value Fund (NMAVX), down -4.06%

Dividend Strategies

Several quality and growth focused dividend strategies continue to post positive performances over the rolling month, while high yield strategies continued to struggle.

Winning

- HCM Dividend Sector Plus Fund (HCMNX), up 6.29%

- Lord Abbett Dividend Growth Fund (LAMYX), up 5.67%

- WisdomTree U.S. Quality Dividend Growth Fund (DGRW), up 3.79%

- O’Shares U.S. Quality Dividend ETF (OUSA), up 3.54%

Losing

- The Hartford Equity Income Fund (HQIRX), down -1.95%

- Federated Hermes Strategic Value Dividend Fund (SVAIX), down -4.67%

- Legg Mason Low Volatility High Dividend ETF (LVHD), down -5%

- Invesco High Yield Equity Dividend Achievers™ ETF (PEY), down -5.43%

U.S. Fixed Income Strategies

In US fixed income,some long duration and convertible bond strategies posted positive results.

Winning

- PIMCO StocksPLUS® Long Duration Fund (PSLDX), up 3.31%

- ProShares Short 20+ Year Treasury (TBF), up 3.14%

- Miller Convertible Bond Fund (MCIFX), up 2.72%

- Invesco CEF Income Composite ETF (PCEF), up 1.54%

Losing

- SPDR® Portfolio Long Term Treasury ETF (SPTL), down -2.43%

- iShares 20+ Year Treasury Bond ETF (TLT), down -2.67%

- Vanguard Extended Duration Treasury Index Fund (VEDIX), down -3.7%

- PIMCO Extended Duration Fund (PEDPX), down -3.83%

Foreign Equity Strategies

Among foreign equities, Indian and Taiwanese equity strategies outperformed Chinese counterparts for the rolling month.

Winning

- PGIM Jennison International Opportunities Fund (PWJQX), up 9.94%

- Lord Abbett Developing Growth Fund (LADVX), up 7.4%

- WisdomTree India Earnings Fund (EPI), up 6.22%

- iShares MSCI Taiwan ETF (EWT), up 5.41%

Losing

- Dodge & Cox International Stock Fund (DODFX), down -3.02%

- Columbia Overseas Value Fund (COSZX), down -3.41%

- SPDR® Dow Jones International Real Estate ETF (RWX), down -4.33%

- WisdomTree China ex-State-Owned Enterprises Fund (CXSE), down -5.31%

Foreign Fixed Income Strategies

Emerging market debt strategies continue to outperform relatively better than broadly diversified international debt strategies.

Winning

- VanEck Emerging Markets High Yield Bond ETF (HYEM), up 1.51%

- Eaton Vance Emerging Markets Debt Opportunities Fund (EIDOX), up 1.33%

- Stone Harbor Emerging Markets Debt Fund (SHMDX), up 1.27%

- iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB), up 0.6%

Losing

- T. Rowe Price International Bond Fund (PAIBX), down -2.11%

- Templeton Global Bond Fund (TGBAX), down -2.39%

- iShares International Treasury Bond ETF (IGOV), down -2.4%

- SPDR® Bloomberg Barclays International Treasury Bond ETF (BWX), down -2.64%

Alternatives

Among alternatives, hedged Japanese equity and contrarian strategies posted strong results over the rolling month, while gold and natural resource focused strategies continue to struggle.

Winning

- ETFMG Alternative Harvest ETF (MJ), up 14.2%

- Fidelity® Contrafund® Fund (FCNKX), up 10.84%

- WisdomTree Japan Hedged Equity Fund (DXJ), up 8.03%

- Catalyst/Millburn Hedge Strategy Fund (MBXAX), up 6.16%

Losing

- Victory Market Neutral Income Fund (CBHAX), down -2.98%

- Fidelity® Select Gold Portfolio (FSAGX), down -3.99%

- FlexShares Morningstar Global Upstream Natural Resources Index Fund (GUNR), down -4.3%

- VanEck Vectors Agribusiness ETF (MOO), down -4.96%

Sectors

Among the sectors cannabis and semiconductor strategies continue to post strong results, while strategies focused on rare earth materials were in red.

Winning

- AdvisorShares Pure US Cannabis ETF (MSOS), up 29.46%

- VanEck Vectors Semiconductor ETF (SMH), up 15.67%

- Fidelity® Select Semiconductors Portfolio (FSELX), up 15.26%

- Fidelity Advisor® Semiconductors Fund (FIKGX), up 15.05%

Losing

- John Hancock Regional Bank Fund (FRBAX), down -7.19%

- MFS Utilities Fund (MMUFX), down -8.53%

- Global X Lithium & Battery Tech ETF (LIT), down -12.16%

- VanEck Rare Earth/Strategic Metals ETF (REMX), down -15.76%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietary system to scan through thousands of relevant mutual funds and ETFs. Fund performance data is calculated for the trailing one month, based on the change in NAV.

Here is a summary of the different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed-income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.