U.S. stocks finished January on a positive note, registering their third straight month of gains.

However, tech stocks continued to whipsaw over the week. Part of the reason for the volatility was the latest FOMC decision to keep the benchmark interest rate at 5.5% as inflation remained stubborn amidst a moderating economy. During his press conference, Federal Reserve Chair Jerome Powell said that rate cuts may be appropriate this year, but the central bank continues to make decisions on a meeting-by-meeting basis. Growth stocks traded lower when Powell mentioned that a rate cut in March was unlikely. Other economic data on the week continued to paint a bullish picture for the economy. Upticks to construction spending and manufacturing data showed that the economy is still cooking, while 9 million available jobs (highlighted by the latest JOLTS report) reinforced the ongoing strength in the labor market. A steady unemployment rate of 3.7% also added to the week’s bullishness.

Next week, economic data releases will be light. One of the key readings to watch will be Monday’s ISM Services PMI report, which has continued to show expansion with a reading of 50.6 in December. However, the measure has fallen in recent readings, indicating that consumers and businesses are spending less on services. On Thursday, we’ll also get to see initial jobless claims for the week ending February 3. Initial filers for unemployment are set to come in at 227K, roughly inline with previous readings and showing the robustness of the labor economy. The average 30-year mortgage rate, which stood at 6:63% as of February 1 (close to a six-month high), will also be released on Thursday.

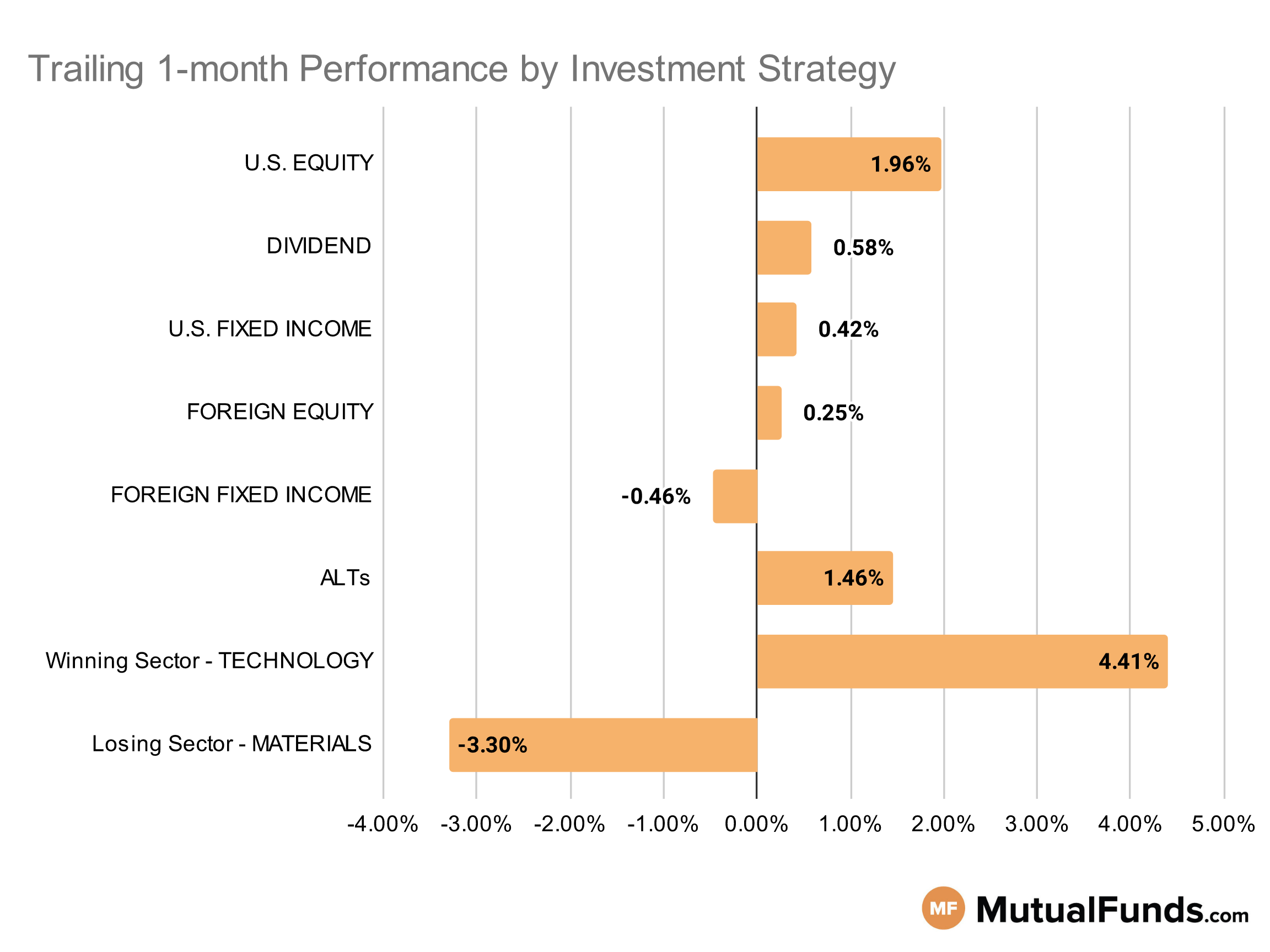

Given this economic backdrop, let us see how this impacts the performance of various investment strategies.

Investment Strategy Scorecard

Overall, the U.S. stock markets continue to be in the positive territory for the rolling month.

Growth focused strategies, especially cannabis and semiconductors, along with Japanese equity continue to outperform other strategies, Meanwhile, Chinese equity strategies posted some of the biggest losses over the rolling month.

U.S Equity Strategies

Overall, growth strategies continue to outperform value strategies.

Winning

- Lord Abbett Growth Leaders Fund (LGLIX), up 10.28%

- Invesco Dynamic Large Cap Growth ETF (PWB), up 8.96%

- Wells Fargo Large Cap Growth Fund (STFFX), up 8.86%

- iShares Core S&P U.S. Growth ETF (IUSG), up 5.93%

Losing

- SPDR® S&P 600 Small Cap Value ETF (SLYV), down -4%

- Vanguard S&P Small-Cap 600 Value Index Fund (VSMVX), down -4.01%

- iShares S&P Small-Cap 600 Value ETF (IJS), down -4.1%

- Mercer US Large Cap Equity Fund (MLCGX), down -19.06%

Dividend Strategies

Several quality focused dividend strategies continue to post positive performances over the rolling month, while small cap and high yield strategies struggled.

Winning

- Lord Abbett Dividend Growth Fund (LAMYX), up 3.88%

- O’Shares U.S. Quality Dividend ETF (OUSA), up 3.78%

- HCM Dividend Sector Plus Fund (HCMNX), up 3.63%

- WisdomTree U.S. Quality Dividend Growth Fund (DGRW), up 2.55%

Losing

- Federated Hermes Strategic Value Dividend Fund (SVAIX), down -1.62%

- The Hartford Equity Income Fund (HQIRX), down -2.43%

- ProShares Russell 2000 Dividend Growers ETF (SMDV), down -4.25%

- Invesco High Yield Equity Dividend Achievers™ ETF (PEY), down -4.86%

U.S. Fixed Income Strategies

In US fixed income, long duration bond strategies posted positive results, while certain municipal strategies struggled.

Winning

- PIMCO StocksPLUS® Long Duration Fund (PSLDX), up 4.02%

- Thompson Bond Fund (THOPX), up 2.54%

- Invesco CEF Income Composite ETF (PCEF), up 2.33%

- SPDR® Nuveen S&P High Yield Municipal Bond ETF (HYMB), up 2.11%

Losing

- iShares Short-Term National Muni Bond ETF (SUB), down -0.14%

- iShares Convertible Bond ETF (ICVT), down -0.31%

- The Hartford Balanced Income Fund (HBLVX), down -0.55%

- Pioneer High Income Municipal Fund (HIMYX), down -0.65%

Foreign Equity Strategies

Among foreign equities, international growth and Japanese strategies outperformed Chinese counterparts for the rolling month.

Winning

- WCM Focused International Growth Fund (WCMRX), up 6.2%

- PGIM Jennison International Opportunities Fund (PWJQX), up 6.12%

- iShares MSCI Intl Momentum Factor ETF (IMTM), up 5.37%

- JPMorgan BetaBuilders Japan ETF (BBJP), up 5.34%

Losing

- Matthews Pacific Tiger Fund (MAPTX), down -3.83%

- Harding Loevner Institutional Emerging Markets Portfolio (HLEZX), down -4.19%

- SPDR® S&P China ETF (GXC), down -8.52%

- WisdomTree China ex-State-Owned Enterprises Fund (CXSE), down -11.08%

Foreign Fixed Income Strategies

Emerging market debt strategies continue to outperform relatively more diversified international debt strategies.

Winning

- VanEck Emerging Markets High Yield Bond ETF (HYEM), up 1.52%

- Eaton Vance Emerging Markets Debt Opportunities Fund (EIDOX), up 0.8%

- Invesco International Bond Fund (OIBIX), up 0.23%

- iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB), up 0.19%

Losing

- iShares International Treasury Bond ETF (IGOV), down -1.22%

- T. Rowe Price International Bond Fund (PAIBX), down -1.39%

- SPDR® Bloomberg Barclays International Treasury Bond ETF (BWX), down -1.48%

- Templeton Global Bond Fund (TGBAX), down -1.7%

Alternatives

Among alternatives, hedged Japanese equity and contrarian strategies posted strong results over the rolling month, while gold and natural resource focused strategies struggled.

Winning

- ETFMG Alternative Harvest ETF (MJ), up 22.4%

- WisdomTree Japan Hedged Equity Fund (DXJ), up 9.49%

- Fidelity® Contrafund® Fund (FCNKX), up 7.12%

- Columbia Contrarian Core Fund (SMGIX), up 3.75%

Losing

- BlackRock Commodity Strategies Portfolio (BCSAX), down -2.22%

- Fidelity® Select Gold Portfolio (FSAGX), down -3.94%

- SPDR® S&P Global Natural Resources ETF (GNR), down -4.89%

- VanEck Vectors Agribusiness ETF (MOO), down -4.91%

Sectors

Among the sectors cannabis and semiconductor strategies continue to post strong results, while strategies focused on precious metals and Chinese equities were in red.

Winning

- AdvisorShares Pure US Cannabis ETF (MSOS), up 48.82%

- Global X Uranium ETF (URA), up 18.72%

- MFS Technology Fund (MTCIX), up 9.88%

- Fidelity® Select Semiconductors Portfolio (FSELX), up 9.76%

Losing

- John Hancock Regional Bank Fund (FRBAX), down -7.27%

- American Beacon ARK Transformational Innovation Fund (ADNYX), down -8.78%

- Invesco China Technology ETF (CQQQ), down -17.16%

- VanEck Rare Earth/Strategic Metals ETF (REMX), down -22.65%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietary system to scan through thousands of relevant mutual funds and ETFs. Fund performance data is calculated for the trailing one month, based on the change in NAV.

Here is a summary of the different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed-income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.