With the new year underway, investors seem pleased this week and sent stocks mostly higher.

Tech stocks surged, with Microsoft briefly overtaking Apple as the world’s largest company. The recent merger between Hewlett Packard (NYSE:HPE) and Juniper (NYSE:JNPR) also helped boost the tech sector. Arguably, the biggest driver of gains was the latest inflation data, which rose by 0.3% in December, in-line with market expectations. This drove the overall inflation rate slightly higher to 3.4%. While the number did throw some cold water on the Fed’s potential to cut interest rates at its next meeting, it still showed that inflation may be under control. Investors took that in stride and drove stocks up during the week.

Heading into the middle of January, investors will be treated to a slew of consumer data. Consumers have appeared to clamp down on spending, boosting the Fed’s potential to start cutting interest rates. On Wednesday, month-over-month retail sales data for December is expected to stay the same at a 0.3% increase, matching November’s figures. Would-be homeowners have also felt the pinch, with housing starts and building permit data once again expected to show continued declines, clocking in at 1.45M and 1.478M, respectively in December. Consumers remain concerned about their situation, with Friday’s University of Michigan Consumer Sentiment Report expected to hit 69 in January. That’s down from 69.7 recorded in December. However, a bright spot could continue to be the healthy labor market with initial unemployment claims predicted to skirt 205,000 for the week ending January 13, roughly in-line with previous recordings.

Given this economic backdrop, let us see how this impacts the performance of various investment strategies.

Investment Strategy Scorecard

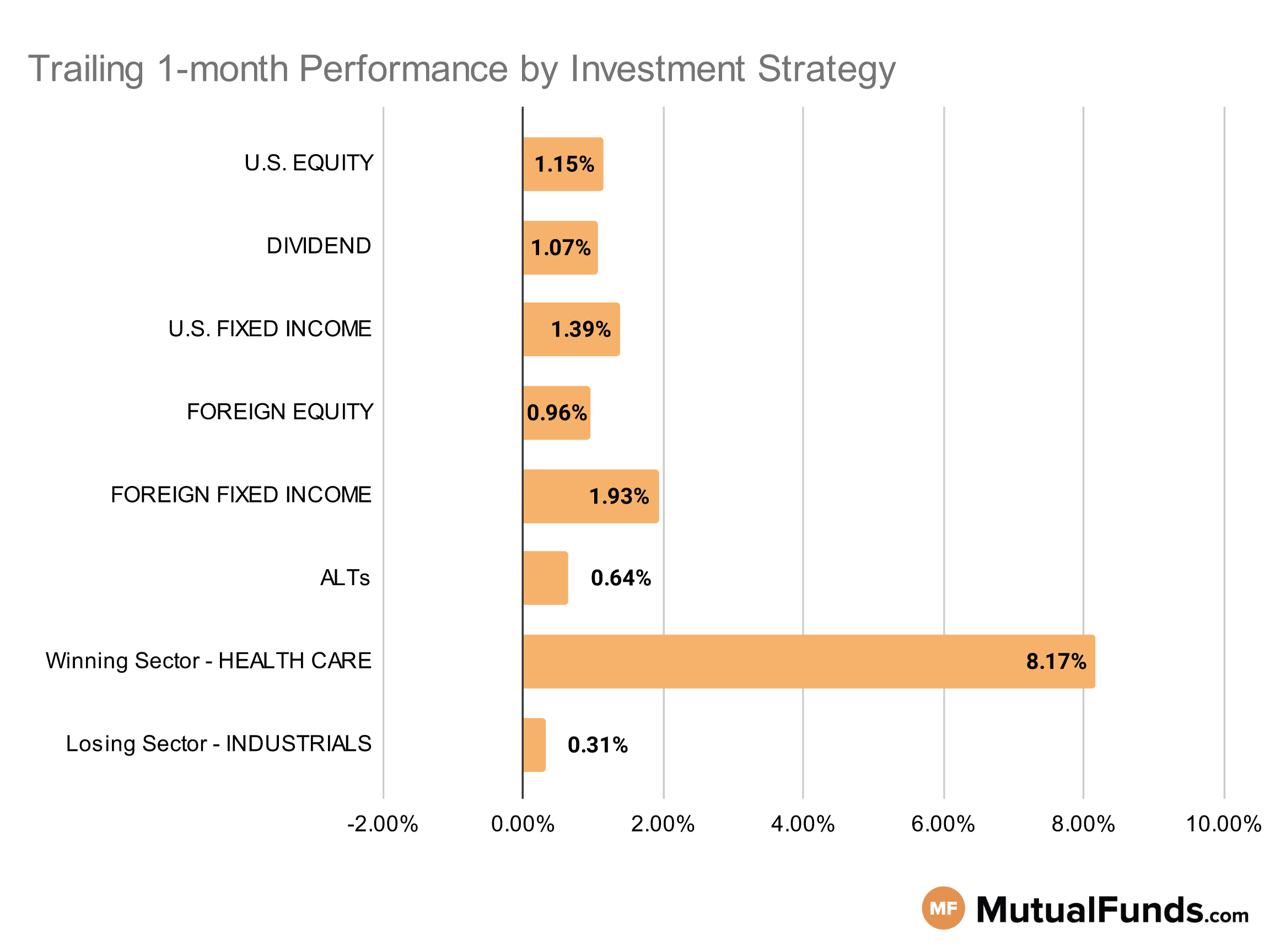

Overall, the U.S. stock markets continued their winning spree for the rolling month.

Growth focused strategies, especially biotechnology and cannabis, posted some of the strongest performances over the rolling month. Meanwhile, tactical/concentrated and large cap growth strategies struggled.

U.S Equity Strategies

Several small-cap growth strategies continue to outperform their larger counterparts over the trailing month.

Winning

- Wasatch Ultra Growth Fund (WAMCX) , up 7.54%

- Brown Capital Management Small Company Fund (BCSIX), up 6.87%

- iShares Micro-Cap ETF (IWC) , up 4.67%

- iShares S&P Small-Cap 600 Growth ETF (IJT), up 4.22%

- Goldman Sachs Equal Weight U.S. Large Cap Equity ETF (GSEW) , up 2.54%

- First Trust US Equity Opportunities ETF (FPX), up 0.67%

Losing

- Mercer US Large Cap Equity Fund (MLCGX) , down -33.64%

- Lazard US Equity Concentrated Portfolio (LEVOX), down -43.03%

Dividend Strategies

Several dividend strategies, including buyback, continue to post strong performances over the rolling month.

Winning

- Invesco BuyBack Achievers ETF (PKW) , up 4.07%

- Schwab U.S. Dividend Equity ETF™ (SCHD), up 3.82%

- BlackRock Equity Dividend Fund (MKDVX) , up 3.57%

- Principal Small-MidCap Dividend Income Fund (PMDIX), up 3.49%

- First Trust Value Line® Dividend Index Fund (FVD) , up 1.18%

- Legg Mason Low Volatility High Dividend ETF (LVHD), up 0.95%

Losing

- Cullen High Dividend Equity Fund (CHDEX) , down -5.65%

- Sterling Capital Equity Income Fund (BEGIX), down -5.66%

U.S. Fixed Income Strategies

In US fixed income, long duration bond focused strategies continued to post positive performances over the rolling month.

Winning

- PIMCO StocksPLUS® Long Duration Fund (PSLDX) , up 3.93%

- Ivy High Income Fund (WHIAX), up 3.76%

- Invesco CEF Income Composite ETF (PCEF) , up 3.17%

- PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund (LTPZ), up 2.92%

Losing

- iShares Core International Aggregate Bond ETF (IAGG) , down -2.17%

- Mercer Opportunistic Fixed Income Fund (MOFIX), down -3.45%

- ProShares Short 20+ Year Treasury (TBF) , down -3.7%

- Calamos Market Neutral Income (CVSIX), down -3.74%

Foreign Equity Strategies

Among foreign equities, Japanese and Saudi Arabian strategies outperformed Chinese and Taiwanese counterparts for the rolling month.

Winning

- Matthews Japan Fund (MJFOX) , up 5.73%

- iShares MSCI Saudi Arabia ETF (KSA), up 5.18%

- Lord Abbett Developing Growth Fund (LADVX) , up 5.03%

- WisdomTree India Earnings Fund (EPI), up 4.7%

Losing

- Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR) , down -6.28%

- MFS International Intrinsic Value Fund (MGIAX), down -9%

- iShares MSCI Taiwan ETF (EWT) , down -9.82%

- Invesco Oppenheimer International Growth Fund (OIGIX), down -9.92%

Foreign Fixed Income Strategies

Total return and emerging market debt strategies posted some of the best performances in the foreign fixed income space.

Winning

- Ashmore Emerging Markets Total Return Fund (EMKIX) , up 3.07%

- PIMCO Emerging Markets Local Currency and Bond Fund (PELPX), up 2.76%

- VanEck Emerging Markets High Yield Bond ETF (HYEM) , up 2.58%

- iShares International Treasury Bond ETF (IGOV), up 2.5%

- SPDR® Bloomberg Barclays Emerging Markets Local Bond ETF (EBND) , up 1.94%

- iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB), up 1.69%

- Stone Harbor Emerging Markets Debt Fund (SHMDX) , up 0.85%

Losing

- Invesco International Bond Fund (OIBIX), down -0.23%

Alternatives

Among alternatives, contrarian and preferred stock strategies posted strong results over the rolling month, while managed futures and commodities continued to struggle.

Winning

- ETFMG Alternative Harvest ETF (MJ) , up 9.76%

- Janus Henderson Contrarian Fund (JCNCX), up 6.09%

- Virtus InfraCap U.S. Preferred Stock ETF (PFFA) , up 4.89%

- Fidelity® Contrafund® Fund (FCNKX), up 4.51%

Losing

- Invesco DB Commodity Index Tracking Fund (DBC) , down -2.61%

- Invesco DB Agriculture Fund (DBA), down -5.17%

- Swan Defined Risk Fund (SDRIX) , down -9.74%

- AQR Managed Futures Strategy Fund (AQMIX), down -10.04%

Sectors

Among the sectors healthcare strategies, especially those focused on biotechnology and cannabis, continue to post strong results, while strategies focused on large cap growth were in red.

Winning

- AdvisorShares Pure US Cannabis ETF (MSOS) , up 21.97%

- Fidelity Advisor® Biotechnology Fund (FBTAX), up 13.77%

- SPDR® S&P Biotech ETF (XBI) , up 12.97%

- Fidelity® Select Biotechnology Portfolio (FBIOX), up 12.3%

Losing

- KraneShares CSI China Internet ETF (KWEB) , down -5.63%

- Invesco China Technology ETF (CQQQ), down -8.88%

- MassMutual Blue Chip Growth Fund (MBCZX) , down -15.61%

- MassMutual Select Blue Chip Growth Fund (MBGFX), down -18.48%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietary system to scan through thousands of relevant mutual funds and ETFs. Fund performance data is calculated for the trailing one month, based on the change in NAV.

Here is a summary of the different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed-income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.