All eyes were on the Federal Reserve last week with its latest interest rate decision.

As expected, the Fed kept rates steady at 5.5%. But investors sent stocks higher after the Fed started to talk about rate cuts in the new year. Thanks to slowing growth and moderating job gains, the Fed estimates that it will have about 75 bps worth of cuts in 2024. The news led investors to buy growth stocks as well as bonds to lock in yields. Those potential rate cuts were buoyed by just a slight 0.1% rise to the CPI in November, bringing the year-over-year change to 4%, in line with estimates. Producers’ prices were flat in November, as indicated by the latest PPI report. Meanwhile, consumers are likely still spending big this holiday season. Analysts had worried that retail sales would see a decline, but the figure for November increased by 0.3%. This is bullish news ahead of the critical holiday spending season. With the Fed’s news in tow, stocks finished the week higher as growth could once again be on the menu.

After the massive FOMC decision, next week investors will get another window into the possibility of rate cuts with the Fed’s favorite metric of inflation, core Personal Consumption Expenditures (PCE) . The metric rose by just 0.2% last month and has been trending lower. Next Friday, analysts estimate that the pace of price increases for consumer goods will stay steady and rise by 0.2% again in November. An equal or lower figure for core PCE could provide enough wiggle room for the Fed to start cutting rates next year. Also on investors’ and the Fed’s radar will be personal spending and income data on Friday. These metrics have been soft in recent weeks in contrast to a robust labor market. Both are expected to increase by 0.3% and 0.2%, respectively in November. Perhaps the clearest sign for the Fed’s path of rates will be the final GDP figures on Thursday. After growing 3.1% in the second quarter, the economy is expected to grow by 5.2% in Q3. While good, it may be enough for the Fed to keep rates higher for a bit longer before it starts cutting.

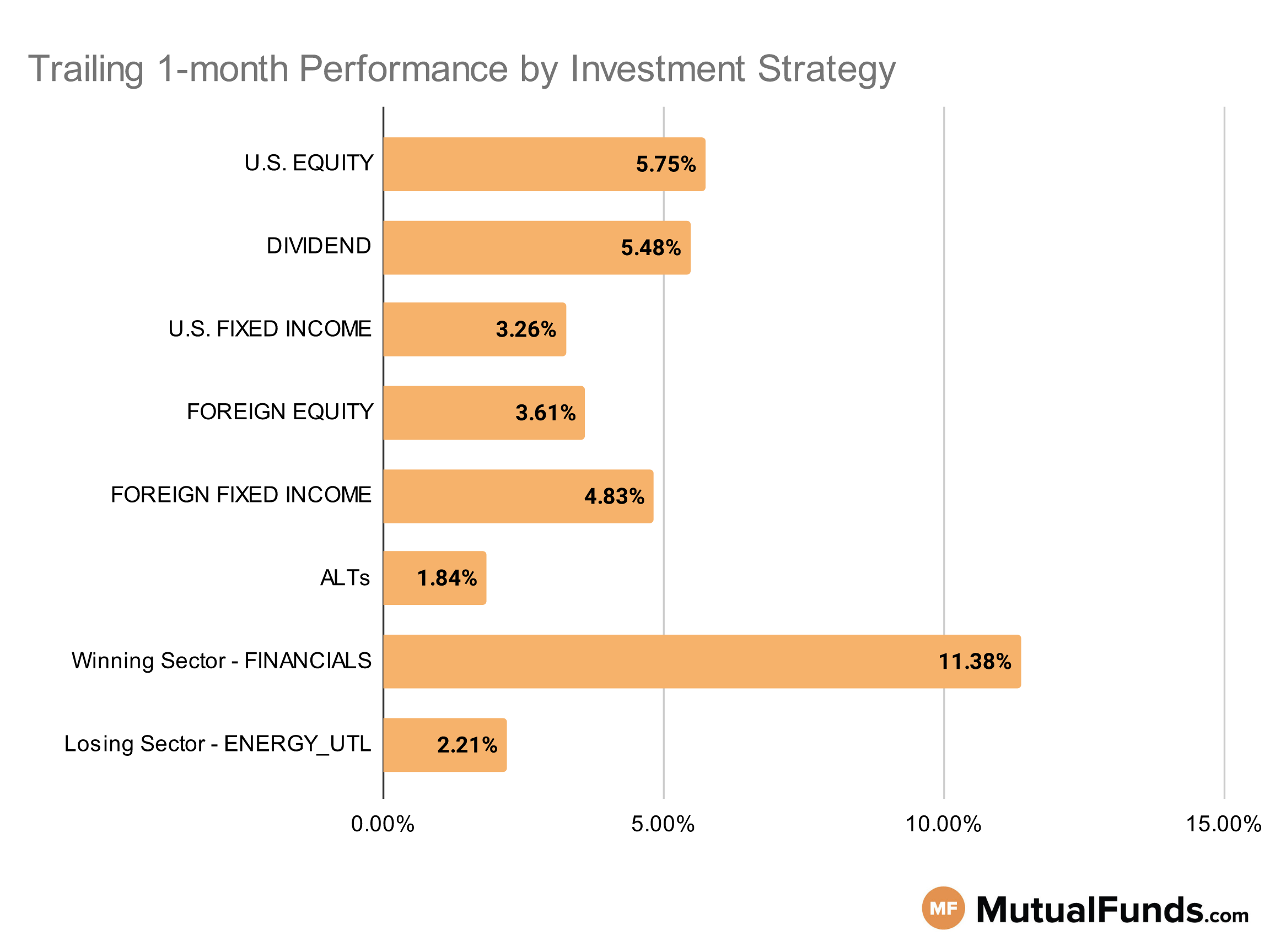

Given this economic backdrop, let us see how this impacts the performance of various investment strategies.

Investment Strategy Scorecard

Overall, the U.S. stock markets continued their upward trajectory for the rolling month.

Innovative technology, regional banking and long-duration bond strategies continue to post some of the strongest performances over the rolling month. Meanwhile, commodity (including oil) strategies continued to struggle.

U.S Equity Strategies

Several growth strategies continued to post positive performances over the trailing month.

Winning

- Morgan Stanley Institutional Fund, Inc. Growth Portfolio (MSEGX) , up 18.17%

- Wasatch Ultra Growth Fund (WAMCX), up 15.96%

- iShares Micro-Cap ETF (IWC) , up 12.79%

- iShares S&P Small-Cap 600 Value ETF (IJS), up 12.59%

- iShares Core S&P U.S. Growth ETF (IUSG) , up 3.87%

- Invesco Dynamic Large Cap Growth ETF (PWB), up 3.47%

Losing

Dividend Strategies

Several dividend strategies, including large cap, mid/small cap, and international, posted positive performances over the rolling month.

Winning

- Invesco S&P Ultra Dividend Revenue ETF (RDIV) , up 16.66%

- ALPS Sector Dividend Dogs ETF (SDOG), up 11.16%

- Principal Small-MidCap Dividend Income Fund (PMDIX) , up 9.75%

- John Hancock Funds II Equity Income Fund (JIEMX), up 7.74%

- SPDR® S&P International Dividend ETF (DWX) , up 4.92%

- O’Shares U.S. Quality Dividend ETF (OUSA), up 4.92%

Losing

U.S. Fixed Income Strategies

In US fixed income, long-duration bond-focused strategies continued to post solid performances over the rolling month.

Winning

- Vanguard Extended Duration Treasury Index Fund (VEDIX) , up 15.92%

- PIMCO StocksPLUS® Long Duration Fund (PSLDX), up 14.85%

- SPDR® Portfolio Long Term Corporate Bond ETF (SPLB) , up 10.77%

- iShares 20+ Year Treasury Bond ETF (TLT), up 10.31%

Losing

- T. Rowe Price U.S. Limited Duration TIPS Index Fund (TLDTX) , down -2.37%

- iShares Floating Rate Bond ETF (FLOT), down -2.53%

- GMO Opportunistic Income Fund (GMOLX) , down -3.37%

- ProShares Short 20+ Year Treasury (TBF), down -9.49%

Foreign Equity Strategies

Emerging markets, Swedish and Mexican equity strategies outperformed Chinese equity strategies.

Winning

- iShares MSCI Sweden ETF (EWD) , up 13.12%

- Grandeur Peak International Stalwarts Fund (GISOX), up 11.42%

- Lord Abbett Developing Growth Fund (LADVX) , up 10.48%

- iShares MSCI Mexico ETF (EWW), up 10.4%

Losing

- Matthews Pacific Tiger Fund (MAPTX) , down -4.32%

- Fidelity® China Region Fund (FHKCX), down -4.47%

- KraneShares Bosera MSCI China A ETF (KBA) , down -6.17%

- WisdomTree China ex-State-Owned Enterprises Fund (CXSE), down -7.37%

Foreign Fixed Income Strategies

Emerging market bond strategies continued to post some of the best performances in the foreign fixed income space.

Winning

- TCW Emerging Markets Income Fund (TGEIX) , up 6.68%

- John Hancock Funds Emerging Markets Debt Fund (JEMIX), up 6.5%

- iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB) , up 6.09%

- iShares International Treasury Bond ETF (IGOV), up 5.71%

- SPDR® Bloomberg Barclays Emerging Markets Local Bond ETF (EBND) , up 3.48%

- VanEck J.P. Morgan EM Local Currency Bond ETF (EMLC), up 2.54%

- Eaton Vance Emerging Markets Debt Opportunities Fund (EIDOX) , up 1.9%

- DFA World ex U.S. Government Fixed Income Portfolio (DWFIX), up 1.57%

Alternatives

Among alternatives,gold and low volatility strategies emerged as winners over the rolling month, while commodities continued to struggle.

Winning

- Fidelity® Select Gold Portfolio (FSAGX) , up 9.3%

- Invesco S&P SmallCap Low Volatility ETF (XSLV), up 7.89%

- SPDR® Russell 1000 Low Volatility Focus ETF (ONEV) , up 7.11%

- Franklin Convertible Securities Fund (FCSZX), up 6.43%

Losing

- Invesco DB Commodity Index Tracking Fund (DBC) , down -4.68%

- iShares S&P GSCI Commodity-Indexed Trust (GSG), down -5.19%

- Fidelity® Series Commodity Strategy Fund (FCSSX) , down -5.97%

- DFA Commodity Strategy Portfolio (DCMSX), down -6.26%

Sectors

Among the sectors technology and regional banking strategies continued to post strong results, while oil strategies continued to struggle.

Winning

- Amplify Transformational Data Sharing ETF (BLOK) , up 29.03%

- American Beacon ARK Transformational Innovation Fund (ADNYX), up 24.06%

- ARK Fintech Innovation ETF (ARKF) , up 23.52%

- John Hancock Regional Bank Fund (FRBAX), up 17.97%

Losing

- United States Oil Fund, LP (USO) , down -7.61%

- KraneShares Global Carbon ETF (KRBN), down -7.79%

- MassMutual Blue Chip Growth Fund (MBCZX) , down -16.23%

- MassMutual Select Blue Chip Growth Fund (MBGFX), down -19.05%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietary system to scan through thousands of relevant mutual funds and ETFs. Fund performance data is calculated for the trailing one month, based on the change in NAV.

Here is a summary of the different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed-income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.