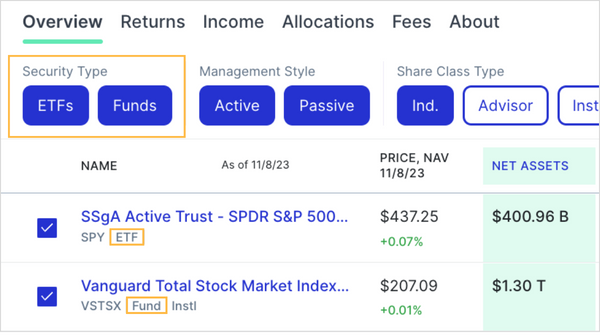

In a dynamic investment landscape, having the right tools is paramount. With that in mind, we’ve made a significant update to our 300+ screener tables. You can now experience the convenience of viewing ETFs and Mutual Funds side by side, optimizing the depth and breadth of your research.

A Single Interface with Multiple Perspectives

Our screener tables have long been a go-to resource for investors. But now, with the inclusion of both ETFs and Mutual Funds in a consolidated view, your research process has never been easier.

With this integrated approach, comparing and contrasting ETFs with Mutual Funds is a breeze. Whether you’re zeroing in on cost, assessing performance trajectories, or balancing asset allocation, this tool provides a more comprehensive perspective.

With a few clicks, quickly contrast a leading tech ETF against a top-performing tech mutual fund. Or, as you map out a retirement strategy, effortlessly weigh the merits of dividend-centric ETFs against robust, income-driven Mutual Funds. This integrated approach means that such comparisons are not only possible but also intuitive and efficient.

Investment research is as much an art as it is a science. With our newly enhanced screener tables, we aim to simplify the process while amplifying the depth of your insights. Dive into this feature on MutualFunds.com and reshape your investment strategy with confidence and clarity.