While the market was open for the observed Veterans Day holiday, many investors took the day off and as a result, volume was low during the last trading session of the week.

However, that didn’t stop stocks from experiencing volatility. Markets were unnerved by comments from Fed chairman Jerome Powell along with layoff news from several key fintech companies. Both PayPal and Block announced layoffs as consumers have continued to use alternative means of payment. Through his comments, Powell reiterated that despite the recent pause in interest rates, the Fed could still raise rates again if appropriate and if inflation doesn’t cool to meet their target goal of 2%. Moreover, Powell also stated that the FOMC had not discussed any rate cuts yet. Meanwhile, initial jobless claims clocked in lower than expected, while consumer sentiment remained high. These factors added fuel to the possibility that the Fed still was willing to raise rates, with the CME FedWatch Tool currently projecting a 10% probability of a 0.25% hike during the next FOMC meeting in December.

Next week, investors will be right back into the thick of it with the latest inflation report. The consumer price index (CPI) has started trending higher, causing many investors to worry that the Fed will continue to raise rates after its recent pause. However, analysts now expect that on Tuesday we’ll see evidence that higher rates are finally taking their toll, bringing down inflation from 3.7% in September to 3.3% in October. Those higher rates are predicted to have an effect on October’s retail sales, which analysts think will be flat when they’re revealed on Wednesday after unexpectedly surging last month. Likewise, on Wednesday, producer prices via the PPI report are also expected to have risen marginally in October. On Thursday, the Energy Information Agency (EIA) will release several key storage and production figures for various energy commodities including crude oil, heating oil, and gasoline. Finally, housing data will be released on Friday, with both building permits and housing starts forecasted to see declines as mortgage rates hit highs not seen in decades.

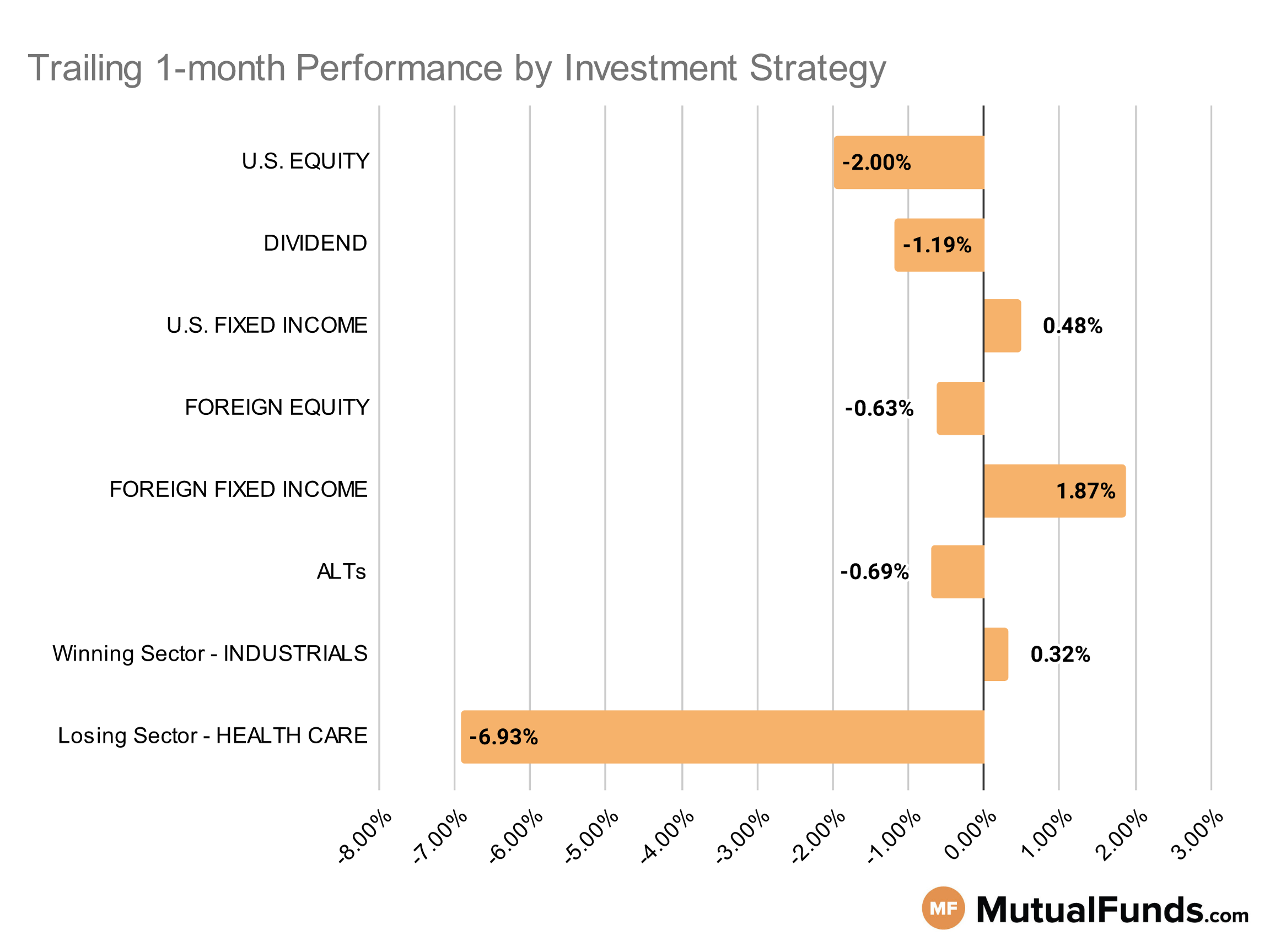

Given this economic backdrop, let us see how this impacts the performance of various investment strategies.

Investment Strategy Scorecard

Overall, the U.S. stock markets were slightly up for the rolling month.

Strategies focused on blockchain, gold, defense, and emerging markets outperformed others for the rolling month. Meanwhile, clean energy and small-cap growth focussed strategies continued to struggle.

U.S Equity Strategies

Large-cap growth strategies reversed course and outperformed especially their small-cap counterparts.

Winning

- Invesco Dynamic Large Cap Growth ETF (PWB) , up 2.87%

- MainStay Winslow Large Cap Growth Fund (MLRTX), up 2.57%

- Columbia Large Cap Growth Fund (GEGTX) , up 2.5%

- iShares Morningstar Growth ETF (ILCG), up 0.77%

Losing

- iShares Micro-Cap ETF (IWC) , down -5.67%

- iShares Russell 2000 Growth ETF (IWO), down -6.22%

- Virtus KAR Small-Cap Growth Fund (PXSGX) , down -10.42%

- Gabelli Small Cap Growth Fund (GABSX), down -11.38%

Dividend Strategies

Several dividend strategies reversed course and posted small gains over the rolling month, with some dividend growth strategies outperforming several sector-focused dividend strategies.

Winning

- Nuveen Santa Barbara Dividend Growth Fund (NSBFX) , up 0.98%

- Nuveen Dividend Growth Fund (NSBRX), up 0.95%

- WisdomTree U.S. Quality Dividend Growth Fund (DGRW) , up 0.59%

- O’Shares U.S. Quality Dividend ETF (OUSA), up 0.4%

Losing

- DWS CROCI Equity Dividend Fd (KDHSX) , down -2.89%

- ALPS Sector Dividend Dogs ETF (SDOG), down -3.03%

- WisdomTree U.S. High Dividend Fund (DHS) , down -3.16%

- HCM Dividend Sector Plus Fund (HCMNX), down -4.04%

U.S. Fixed Income Strategies

In US fixed income, certain muni bond strategies emerged as winners while convertible bond strategies struggled.

Winning

- Pioneer AMT Free Municipal Fund (PBMFX) , up 2.46%

- BlackRock High Yield Municipal Fund (MAYHX), up 2.22%

- PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund (LTPZ) , up 2.11%

- SPDR® Nuveen Bloomberg Barclays Municipal Bond ETF (TFI), up 1.61%

Losing

- Invesco CEF Income Composite ETF (PCEF) , down -1.06%

- Miller Convertible Bond Fund (MCIFX), down -2.14%

- iShares Convertible Bond ETF (ICVT) , down -2.57%

- AlphaCentric Income Opportunities Fund (IOFCX), down -5.13%

Foreign Equity Strategies

Brazilian equity strategies continued to post better performance unlike Chinese equity strategies, which continued to struggle.

Winning

- iShares MSCI Brazil ETF (EWZ) , up 3.92%

- iShares Latin America 40 ETF (ILF), up 3.77%

- PGIM Jennison International Opportunities Fund (PWJQX) , up 3.22%

- Delaware Emerging Markets Fund (DEMRX), up 2.06%

Losing

- Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR) , down -2.98%

- DFA International Value Portfolio (DFIVX), down -3.56%

- KraneShares Bosera MSCI China A ETF (KBA) , down -3.68%

- Lord Abbett Developing Growth Fund (LADVX), down -7.06%

Foreign Fixed Income Strategies

Emerging market bond strategies emerged as winners over the rolling month, reversing course from the last few weeks.

Winning

- Ashmore Emerging Markets Total Return Fund (EMKIX) , up 4.45%

- Fidelity Advisor® New Markets Income Fund (FNMIX), up 3.97%

- VanEck J.P. Morgan EM Local Currency Bond ETF (EMLC) , up 2.68%

- SPDR® Bloomberg Barclays Emerging Markets Local Bond ETF (EBND), up 1.94%

- Eaton Vance Emerging Markets Debt Opportunities Fund (EIDOX) , up 0.82%

- Janus Henderson Developed World Bond Fund (HFARX), up 0.69%

- VanEck Emerging Markets High Yield Bond ETF (HYEM) , up 0.46%

- SPDR® Bloomberg Barclays International Treasury Bond ETF (BWX), up 0.38%

Alternatives

Among alternatives, preferred stock and low volatility strategies outperformed others while certain agriculture and contrarian strategy-focused strategies struggled.

Winning

- Invesco DB Agriculture Fund (DBA) , up 2.69%

- PIMCO Preferred and Capital Securities Fund (PFPNX), up 1.95%

- Fidelity® SAI U.S. Low Volatility Index Fund (FSUVX) , up 1.59%

- iShares Currency Hedged MSCI Japan ETF (HEWJ), up 1.52%

Losing

- Columbia Convertible Securities Fund (COVRX) , down -3.53%

- Janus Henderson Contrarian Fund (JCNCX), down -4.76%

- VanEck Vectors Agribusiness ETF (MOO) , down -6.47%

- ETFMG Alternative Harvest ETF (MJ), down -13.53%

Sectors

Among the sectors, blockchain and gold strategies continued to outperform others, while clean energy strategies continued to struggle.

Winning

- Amplify Transformational Data Sharing ETF (BLOK) , up 8.63%

- GraniteShares Gold Trust (BAR), up 5.22%

- Putnam Global Technology Fund (PGTYX) , up 3.99%

- Fidelity® Select Defense & Aerospace Portfolio (FSDAX), up 3.67%

Losing

- Fidelity® Select Medical Technology and Devices Portfolio (FSMEX) , down -10.01%

- Eventide Healthcare & Life Sciences Fund (ETAHX), down -13.72%

- Invesco WilderHill Clean Energy ETF (PBW) , down -19.03%

- First Trust NASDAQ® Clean Edge® Green Energy Index Fund (QCLN), down -19.73%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietary system to scan through thousands of relevant mutual funds and ETFs. Fund performance data is calculated for the trailing one month, based on the change in NAV.

Here is a summary of the different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed-income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.