Stocks continued to exhibit data-driven volatility this week.

Initially, the major benchmarks trended lower as the yield on the 10-year U.S. Treasury hit 5%, a mark not seen in over 16 years. By midweek, stocks rebounded on the back of strong earnings and M&A activity. For instance, oil & gas giant Chevron agreed to buy smaller rival Hess in an all-stock deal for $53 billion. However, good data turned out to be bad in terms of the potential for another interest rate hike. The latest GDP report saw the U.S. economy grow by a seasonally and inflation-adjusted annual rate of 4.9% in Q3, more than double the Q2 pace and well ahead of market estimates of 1.1%. Durable goods orders for September also more than tripled estimates, reversing a negative trend seen over the last few months. Personal spending and income figures also grew at a decent rate in September. As did the Fed’s favorite inflationary metric, the CORE PCE Price Index, which clocked in at 0.3% in September – the most seen in four months. Many investors took this as a sign that the Fed may still hike rates before the end of the year. This sent high-growth sectors such as tech and healthcare lower by the end of the week.

Next week the focus will be again on the U.S. central bank. On Wednesday afternoon, the Federal Open Market Committee (FOMC) will once again make its decisions on benchmark interest rates. Given the mixed data showing both a growing economy and moderating inflation, many investors predict the Fed will hold rates steady at 5.5% at this meeting. However, Fed Chair Jerome Powell has continued to express that the central bank may move depending on how the data changes. Some of that key data will be released next week, including the latest JOLTS report on Wednesday morning. The number of available jobs surged in August and is expected to stay strong in September. The same could be said for non-farm payroll figures, which also unexpectedly jumped by 336,000 in September. On Friday, analysts expect October’s report to show an addition of just 190,000 jobs, likely keeping the official unemployment rate at 3.8%. Additionally, on Friday the ISM Services PMI for October is predicted to hover around 53.6, similar to what was reported for September.

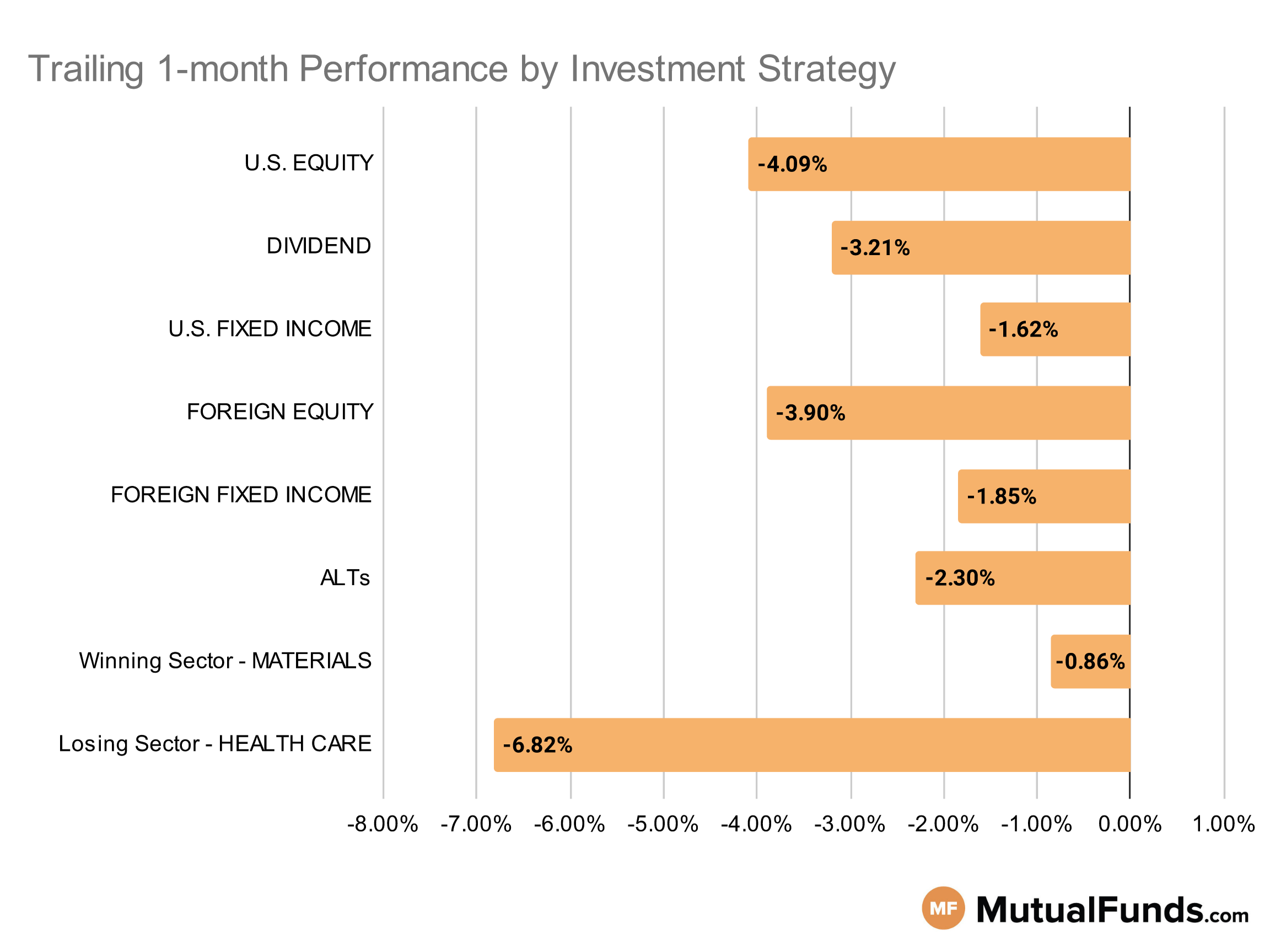

Given this economic backdrop, let us see how this impacts the performance of various investment strategies.

Investment Strategy Scorecard

Overall, the U.S. stock markets were down for the rolling month.

Strategies focused on shorting long-term U.S. treasuries continue to outperform other strategies for the rolling month. While gold strategies emerged as winners over the rolling month, cannabis and small-cap growth strategies struggled.

U.S Equity Strategies

None of the key U.S equity strategies managed to post any gains over the trailing month, with several growth strategies continuing with their struggles.

Losing

- Aberdeen US Equity II Fund (CCPCX) , down -1.07%

- T. Rowe Price Large-Cap Growth Fund (TRLGX), down -1.54%

- Schwab U.S. Large-Cap Growth ETF™ (SCHG) , down -2.65%

- Invesco Dynamic Large Cap Growth ETF (PWB), down -2.73%

- iShares Russell 2000 Growth ETF (IWO) , down -6.81%

- iShares Micro-Cap ETF (IWC), down -7.19%

- Wasatch Ultra Growth Fund (WAMCX) , down -10.29%

- Gabelli Small Cap Growth Fund (GABSX), down -13.16%

Dividend Strategies

None of the key dividend strategies posted positive performance over the trailing month.

Losing

- Vanguard Dividend Growth Fund (VDIGX) , down -1.58%

- Principal Global Diversified Income Fund (PGBAX), down -1.83%

- Legg Mason Low Volatility High Dividend ETF (LVHD) , down -2.29%

- WisdomTree U.S. Quality Dividend Growth Fund (DGRW), down -2.37%

- Franklin Equity Income Fund (FREIX) , down -4.65%

- Invesco BuyBack Achievers ETF (PKW), down -4.7%

- Invesco S&P Ultra Dividend Revenue ETF (RDIV) , down -4.75%

- Matthews Asia Dividend Fund (MIPIX), down -5.11%

U.S. Fixed Income Strategies

In US fixed income, startegies to short US long term treasuries continued to perform better than long only fixed income strategies over the rolling month.

Winning

- ProShares Short 20+ Year Treasury (TBF) , up 4.95%

- T. Rowe Price U.S. Limited Duration TIPS Index Fund (TLDTX), up 0.54%

- American Century Short Duration Inflation Protection Bond Fund (APOGX) , up 0.5%

- PIMCO 1-5 Year U.S. TIPS Index Exchange-Traded Fund (STPZ), up 0.46%

Losing

- iShares 20+ Year Treasury Bond ETF (TLT) , down -4.66%

- Invesco CEF Income Composite ETF (PCEF), down -5.65%

- Vanguard Extended Duration Treasury Index Fund (VEDIX) , down -7.53%

- PIMCO StocksPLUS® Long Duration Fund (PSLDX), down -7.77%

Foreign Equity Strategies

None of the key foreign equity strategies managed to post any significant gains over the trailing one month

However Brazilian and Chinese equity strategies managed to limit losses, unlike international small-cap equity strategies that lost ground.

Winning

Losing

- Fidelity® China Region Fund (FHKCX) , down -0.45%

- PGIM Jennison International Opportunities Fund (PWJQX), down -0.86%

- Schwab International Small-Cap Equity ETF™ (SCHC) , down -6.45%

- iShares MSCI EAFE Small-Cap ETF (SCZ), down -6.81%

- Artisan International Small-Mid Fund (APHJX) , down -8.52%

- Wasatch International Growth Fund® (WAIGX), down -9.4%

Foreign Fixed Income Strategies

None of the foreign fixed income strategies posted significant gains over the trailing month, with emerging market debt strategies struggling the most.

Winning

- Ashmore Emerging Markets Total Return Fund (EMKIX) , up 0.22%

Losing

- Invesco International Bond Fund (OIBIX), down -0.24%

- iShares International Treasury Bond ETF (IGOV) , down -1.13%

- VanEck J.P. Morgan EM Local Currency Bond ETF (EMLC), down -1.21%

- VanEck Emerging Markets High Yield Bond ETF (HYEM) , down -1.74%

- iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB), down -2.2%

- MFS Emerging Markets Debt Fund (MEDIX) , down -2.86%

- John Hancock Funds Emerging Markets Debt Fund (JEMIX), down -3.67%

Alternatives

Among alternatives, some managed futures strategies continued to post marginal gains. However, agriculture and cannabis-based strategies continued to struggle.

Winning

- PIMCO TRENDS Managed Futures Strategy Fund (PQTIX) , up 1.38%

- AQR Managed Futures Strategy Fund (AQMIX), up 1.29%

- Invesco DB Agriculture Fund (DBA) , up 0.83%

Losing

- Aberdeen Standard Bloomberg All Commodity Strategy K-1 Free ETF (BCI), down -0.14%

- Lord Abbett Convertible Fund (LCFVX) , down -4.34%

- Janus Henderson Contrarian Fund (JCNCX), down -6.87%

- VanEck Vectors Agribusiness ETF (MOO) , down -7.62%

- ETFMG Alternative Harvest ETF (MJ), down -25.86%

Sectors

Among the sectors, gold strategies outperformed, while cannabis and clean energy strategies continued to struggle.

Winning

- Amplify Transformational Data Sharing ETF (BLOK) , up 4.57%

- Aberdeen Standard Gold ETF Trust (SGOL), up 4.51%

- Fidelity® Select Defense & Aerospace Portfolio (FSDAX) , up 3.2%

- Sprott Gold Equity Fund (SGDLX), up 2.68%

Losing

- Eventide Healthcare & Life Sciences Fund (ETAHX) , down -9.37%

- Fidelity® Select Medical Technology and Devices Portfolio (FSMEX), down -9.82%

- ALPS Clean Energy ETF (ACES) , down -18.84%

- AdvisorShares Pure US Cannabis ETF (MSOS), down -30.41%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietary system to scan through thousands of relevant mutual funds and ETFs. Fund performance data is calculated for the trailing one month, based on the change in NAV.

Here is a summary of the different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed-income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.