While the markets were technically open for the Columbus/ Indigenous People’s Day holiday last week, trading volume remained low.

The surprise Hamas attack on Israel helped break the 10-year U.S. Treasury’s yield surge early in the trading week. A wave of dealmaking activity, including ExxonMobil Corp’s massive $60 billion agreement to acquire Pioneer, helped spur a rally in stocks. This bullish move in equities occurred despite a sudden uptick in inflation, with the annual CPI reading clocking in at 3.7% for September, exceeding estimates and ending its downtrend. The FOMC meeting minutes also painted a mixed picture, but gave investors what they had expected, with the Fed willing to raise rates at least one more time this year. The number of Americans applying for unemployment benefits remained unchanged for the week ending October 7, remaining at historically low levels and highlighting the strength of the labor market. However, consumers may finally be feeling the pinch once again amidst an uncertain economic environment, with the University of Michigan consumer sentiment report dropping to 63 in October 2023, down from 68.1 in September and the lowest reading in five months.

Heading into next week, we’ll get some critical data on the state of the economy. Leading off this deluge will be the release of the latest retail sales data on Tuesday. Consumer spending has been strong, with month-over-month numbers jumping 0.6% in August, handily beating a 0.2% estimate. Analysts expect the trend to continue and see retail sales growing 0.3% in September. Elsewhere, the latest manufacturing production data on Tuesday is expected to report a month-over-month decline of 0.1%, showing the rise in borrowing costs and slowing business spending taking hold. Monthly building permits and housing start data on Wednesday are also expected to continue their decline as mortgage costs surge to the highest point in decades. Finally, throughout the week, investors will be keen to monitor the speeches from several Fed governors, including chair Jerome Powell, on key policy matters. Analysts expect no new news from Powell, anticipating him to signal the continued potential for rate hikes as inflation remains strong.

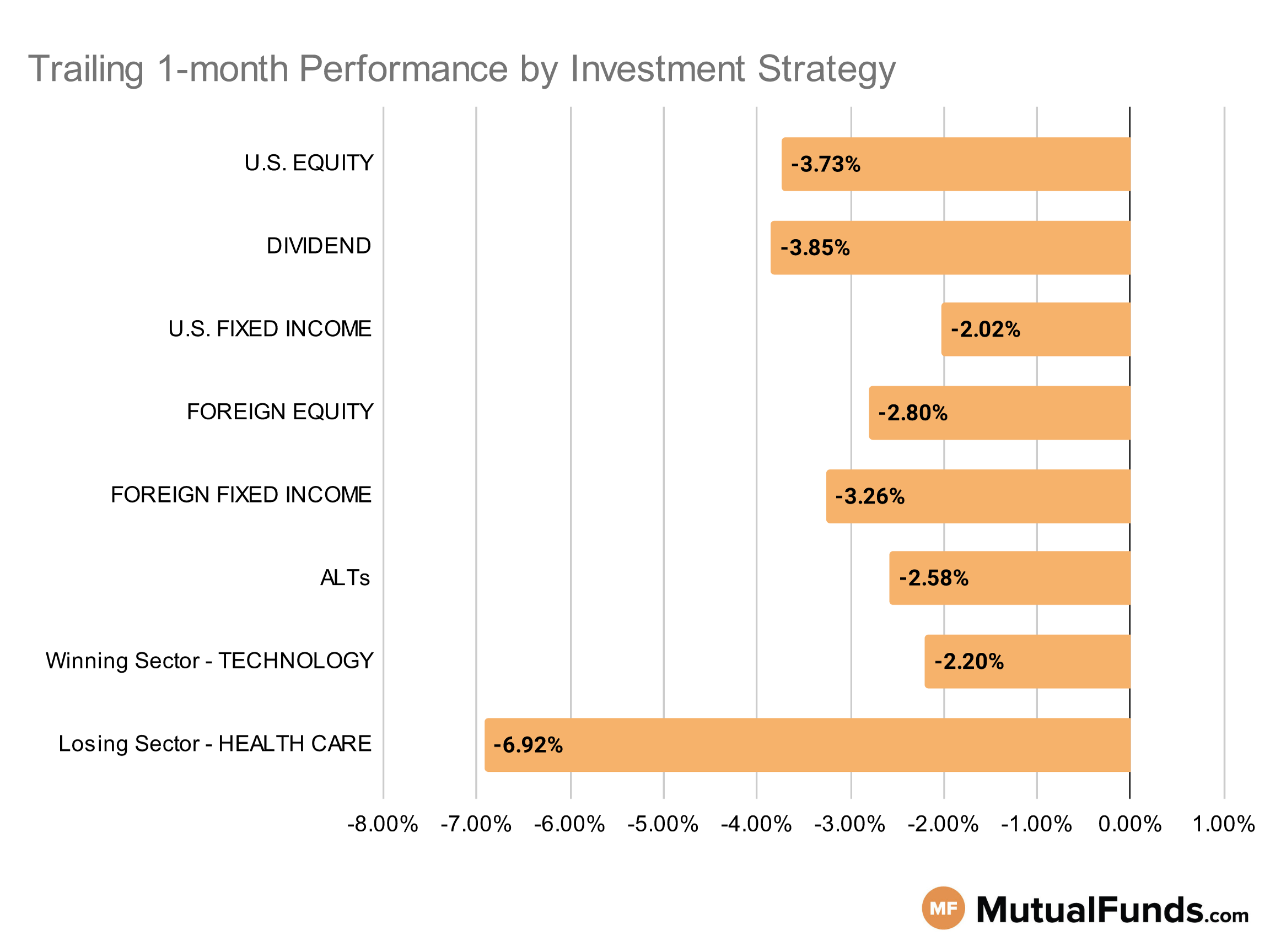

Investment Strategy Scorecard

Overall, the U.S. stock markets were mostly down for the rolling month.

Strategies focused on shorting long-term U.S. treasuries and healthcare stocks gained traction over the rolling month, while cannabis and clean energy-focused strategies continued to struggle.

U.S Equity Strategies

None of the key U.S equity strategies managed to post any significant gains over the trailing one month, with several growth strategies continuing with their struggles.

Winning

- John Hancock Funds III U.S. Growth Fund (JSGAX) , up 0.05%

Losing

- Fidelity® Large Cap Growth Enhanced Index Fund (FLGEX), down -0.27%

- Schwab U.S. Large-Cap Growth ETF™ (SCHG) , down -0.65%

- Fidelity® Nasdaq Composite Index® ETF (ONEQ), down -1.34%

- iShares Russell 2000 Growth ETF (IWO) , down -7.36%

- iShares Micro-Cap ETF (IWC), down -7.91%

- JPMorgan Small Cap Growth Fund (PGSGX) , down -9.78%

- Wasatch Ultra Growth Fund (WAMCX), down -10.49%

Dividend Strategies

None of the key dividend strategies posted positive performance over the trailing month.

Losing

- Thornburg Investment Income Builder Fund (TIBAX) , down -1.49%

- BlackRock Global Dividend Portfolio (BIBDX), down -2.09%

- FlexShares Quality Dividend Index Fund (QDF) , down -2.27%

- WisdomTree U.S. Quality Dividend Growth Fund (DGRW), down -2.88%

- Columbia Flexible Capital Income Fund (CFCYX) , down -5.23%

- Columbia Dividend Opportunity Fund (RSDFX), down -5.52%

- ALPS Sector Dividend Dogs ETF (SDOG) , down -6.46%

- Invesco S&P Ultra Dividend Revenue ETF (RDIV), down -7.24%

U.S. Fixed Income Strategies

In US fixed income, strategies to short US long-term treasuries performed better than traditional long-only fixed income strategies over the rolling one month.

Winning

- ProShares Short 20+ Year Treasury (TBF) , up 8.61%

- iShares Floating Rate Bond ETF (FLOT), up 0.59%

- DFA One Year Fixed Income Portfolio (DFIHX) , up 0.2%

- Invesco Senior Floating Rate Fund (OOSAX), up 0.15%

Losing

- PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund (LTPZ) , down -8.62%

- iShares 20+ Year Treasury Bond ETF (TLT), down -8.66%

- PIMCO Extended Duration Fund (PEDPX) , down -12.8%

- Vanguard Extended Duration Treasury Index Fund (VEDIX), down -13.24%

Foreign Equity Strategies

Sweeden and Taiwan-focused strategies managed to post marginal gains over the trailing month, while Mexico and Saui Arabia-focused strategies struggled.

Winning

- iShares MSCI Sweden ETF (EWD) , up 2.75%

- iShares MSCI Taiwan ETF (EWT), up 0.55%

- Fidelity® Emerging Asia Fund (FSEAX) , up 0.29%

- Fidelity Advisor® Emerging Asia Fund (FEAAX), up 0.25%

Losing

- Artisan International Small-Mid Fund (APHJX) , down -6.94%

- iShares MSCI Saudi Arabia ETF (KSA), down -7.01%

- iShares MSCI Mexico ETF (EWW) , down -7.59%

- Lord Abbett Developing Growth Fund (LADVX), down -9.22%

Foreign Fixed Income Strategies

None of the foreign fixed income strategies posted gains over the trailing one month, with emerging market debt local currency strategies struggling the most.

Losing

- Invesco International Bond Fund (OIBIX) , down -1.65%

- Eaton Vance Emerging Markets Debt Opportunities Fund (EIDOX), down -1.87%

- VanEck Emerging Markets High Yield Bond ETF (HYEM) , down -2.12%

- iShares International Treasury Bond ETF (IGOV), down -2.68%

- SPDR® Bloomberg Barclays Emerging Markets Local Bond ETF (EBND) , down -3.93%

- iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB), down -4.22%

- Eaton Vance Emerging Markets Local Income Fund (EEIIX) , down -4.35%

- Stone Harbor Emerging Markets Debt Fund (SHMDX), down -5.18%

Alternatives

Among alternatives, some managed futures and market-neutral strategies posted gains. However, cannabis-based strategies continued to post losses.

Winning

- AQR Managed Futures Strategy Fund (AQMIX) , up 1.87%

- Victory Market Neutral Income Fund (CBHAX), up 1.3%

Losing

- IQ Merger Arbitrage ETF (MNA) , down -0.16%

- Xtrackers MSCI EAFE Hedged Equity ETF (DBEF), down -0.48%

- Fidelity® Select Gold Portfolio (FSAGX) , down -5.45%

- Janus Henderson Contrarian Fund (JCNCX), down -6.68%

- VanEck Vectors Agribusiness ETF (MOO) , down -7.22%

- ETFMG Alternative Harvest ETF (MJ), down -23.53%

Sectors

Among the sectors, healthcare and semiconductor strategies outperformed cannabis and clean energy-focused strategies.

Winning

- Fidelity® Select Health Care Services Portfolio (FSHCX) , up 3.09%

- KraneShares Global Carbon ETF (KRBN), up 2.38%

- VanEck Vectors Semiconductor ETF (SMH) , up 1.89%

- Goldman Sachs MLP Energy Infrastructure Fund (GLPSX), up 1.82%

Losing

- Eventide Healthcare & Life Sciences Fund (ETAHX) , down -11.53%

- American Beacon ARK Transformational Innovation Fund (ADNYX), down -12.43%

- ALPS Clean Energy ETF (ACES) , down -16.8%

- AdvisorShares Pure US Cannabis ETF (MSOS), down -18.45%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietary system to scan through thousands of relevant mutual funds and ETFs. Fund performance data is calculated for the trailing one month, based on the change in NAV.

Here is a summary of the different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed-income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.