October’s ghoulish reputation was in full effect last week, with all major averages fluctuating.

Although major averages like the Dow Jones, S&P 500, and NASDAQ declined initially during the week, they staged a late recovery Friday afternoon. A growing concern was rising bond yields, as both 10-year and 30-year U.S. Treasury yields hit new multi-year highs last week on the idea that the Fed will again be forced to raise interest rates. Unexpected jumps in both the Manufacturing PMI, which clocked in at 49, and the JOLTS report, which showed the economy once again had more than 9 million available jobs, set the stage for renewed rate hike expectations. While the ADP employment change showed limited jobs growth in September, the official non farm payrolls report revealed a big surge, with 336,000 jobs added. This was roughly double the market estimates and the strongest job gain in eight months, pointing to a resilient labor market despite the central bank’s tightening efforts. While the unemployment rate stayed steady at 3.8%, labor force participation continued to skirt all-time highs. These data combined to put continued pressure on bond prices and high growth areas of the market, including tech stocks.

Once again, next week will see investors focused on inflation. The latest annual inflation rate increased for the second straight month to 3.7% in August, beating estimates and showing that the economy is still moving along nicely. Analysts expect the trend to continue on Thursday when September’s CPI number is expected to rise to 3.8% on an annualized basis. Any increase above this could send stocks lower as the Fed will most likely increase rates further. Investors will also get a window into the Fed’s thinking with the release of the latest FOMC meeting minutes on Wednesday. While there has been some disagreement among the governors, the Fed’s dot-plot showed the likelihood of one more increase this year. A bullish consumer economy will mostly factor into the Fed’s decision, with the University of Michigan consumer sentiment report expected to clock in around 68 for the month of October, roughly around the same level reported in September.

Investment Strategy Scorecard

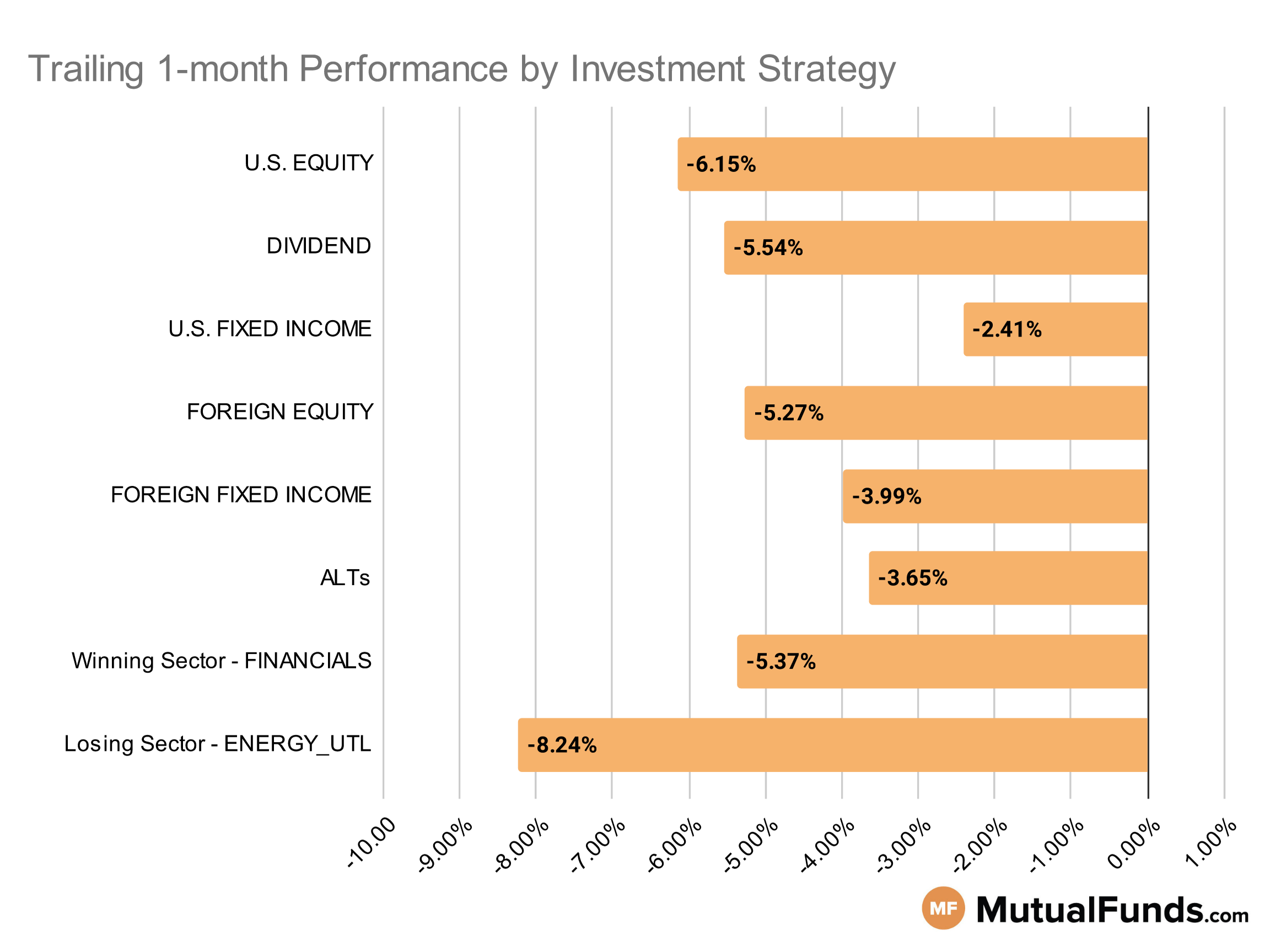

Overall, the U.S. stock markets were down for the rolling month.

Strategies to short long-term U.S. treasuries and technology stocks gained traction over the rolling month, while clean energy and growth-focused strategies struggled.

U.S Equity Strategies

None of the key U.S equity strategies posted positive performance over the trailing one month, with several growth strategies struggling.

Losing

- Aberdeen US Equity II Fund (CCPCX) , down -2.19%

- Royce Special Equity Fund (RSQCX), down -2.52%

- Schwab U.S. Large-Cap Growth ETF™ (SCHG) , down -5.14%

- Pacer Trendpilot™ US Large Cap ETF (PTLC), down -5.31%

- First Trust US Equity Opportunities ETF (FPX) , down -8.57%

- iShares Russell 2000 Growth ETF (IWO), down -8.58%

- Wasatch Ultra Growth Fund (WAMCX) , down -12.31%

- Fidelity® SAI U.S. Value Index Fund (FSWCX), down -12.67%

Dividend Strategies

None of the key dividend strategies posted positive performance over the trailing month.

Losing

- Thornburg Investment Income Builder Fund (TIBAX) , down -2.96%

- First Eagle Global Income Builder Fund (FEBIX), down -3.77%

- ProShares S&P MidCap 400 Dividend Aristocrats ETF (REGL) , down -4.29%

- SPDR® S&P International Dividend ETF (DWX), down -4.78%

- Franklin Equity Income Fund (FREIX) , down -6.62%

- HCM Dividend Sector Plus Fund (HCMNX), down -8.17%

- Invesco High Yield Equity Dividend Achievers™ ETF (PEY) , down -8.37%

- Invesco S&P Ultra Dividend Revenue ETF (RDIV), down -8.44%

U.S. Fixed Income Strategies

In US fixed income, startegies to short US long term treasuries performed better than traditional long only fixed income strategies over the rolling one month.

Winning

- ProShares Short 20+ Year Treasury (TBF) , up 8.36%

- iShares Floating Rate Bond ETF (FLOT), up 0.59%

- Touchstone Ultra Short Duration Fixed Income Fund (SSSGX) , up 0.22%

- DFA One Year Fixed Income Portfolio (DFIHX), up 0.2%

Losing

- PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund (LTPZ) , down -7.7%

- iShares 20+ Year Treasury Bond ETF (TLT), down -8.22%

- PIMCO Extended Duration Fund (PEDPX) , down -12.03%

- Vanguard Extended Duration Treasury Index Fund (VEDIX), down -12.63%

Foreign Equity Strategies

None of the major foreign equity strategies managed to post gains over the rolling month. However, Indian equity strategies managed to limit the losses.

Losing

- iShares India 50 ETF (INDY) , down -0.35%

- iShares MSCI India ETF (INDA), down -0.43%

- Fidelity® SAI International Value Index Fund (FIWCX) , down -3.33%

- Columbia Overseas Value Fund (COSZX), down -3.34%

- EMQQ The Emerging Markets Internet & Ecommerce ETF (EMQQ) , down -8.55%

- Baillie Gifford International Growth Fund (BGEUX), down -8.95%

- iShares MSCI Mexico ETF (EWW) , down -9.76%

- Lord Abbett Developing Growth Fund (LADVX), down -10.51%

Foreign Fixed Income Strategies

None of the foreign fixed income strategies posted positive performance over the trailing one month, with emerging market debt local currency strategies struggling the most.

Losing

- VanEck Emerging Markets High Yield Bond ETF (HYEM) , down -2.12%

- T. Rowe Price International Bond Fund (PAIBX), down -2.52%

- Janus Henderson Developed World Bond Fund (HFARX) , down -2.7%

- SPDR® Bloomberg Barclays International Treasury Bond ETF (BWX), down -2.72%

- SPDR® Bloomberg Barclays Emerging Markets Local Bond ETF (EBND) , down -4.9%

- Payden Emerging Markets Bond Fund (PYEIX), down -4.98%

- VanEck J.P. Morgan EM Local Currency Bond ETF (EMLC) , down -5.28%

- Eaton Vance Emerging Markets Local Income Fund (EEIIX), down -5.78%

Alternatives

Among alternatives, cannabis-focused strategies performed better than gold and contrarian strategies.

Winning

- American Beacon AHL Managed Futures Strategy Fund (AHLYX) , up 1.49%

- Abbey Capital Futures Strategy Fund (ABYIX), up 1.44%

- IQ Merger Arbitrage ETF (MNA) , up 0.1%

Losing

- Invesco Variable Rate Preferred ETF (VRP), down -2.13%

- Janus Henderson Contrarian Fund (JCNCX) , down -8.55%

- Fidelity® Select Gold Portfolio (FSAGX), down -8.55%

- VanEck Vectors Agribusiness ETF (MOO) , down -9.08%

- ETFMG Alternative Harvest ETF (MJ), down -12.83%

Sectors

Among the sectors, strategies to short tech stocks gained momentum. Clean energy strategies continued to struggle.

Winning

- ProShares Short QQQ (PSQ) , up 4.31%

- Global X Uranium ETF (URA), up 3.78%

- Fidelity® Select Health Care Services Portfolio (FSHCX) , up 2.85%

Losing

- Putnam Global Health Care Fund (PHSYX), down -2.27%

- Fidelity® Real Estate Investment Portfolio (FRESX) , down -12.04%

- American Beacon ARK Transformational Innovation Fund (ADNYX), down -12.42%

- ALPS Clean Energy ETF (ACES) , down -21.23%

- Invesco WilderHill Clean Energy ETF (PBW), down -21.36%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietary system to scan through thousands of relevant mutual funds and ETFs. Fund performance data is calculated for the trailing one month, based on the change in NAV.

Here is a summary of the different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.