This week, a variety of factors continued to push and pull the major market indices.

Strong bullish earnings numbers from chipmaker Nvidia helped boost stocks mid-week as investors embraced growth stocks. Additionally, a big 5.2% decline in month-over-month durable goods orders and poor earnings from several key retailers helped fuel the idea that the Fed would pause interest rate hikes. Further adding fuel to the fire was August’s final reading of University of Michigan’s consumer sentiment report, which dropped to 69.5 from 71.2 reported in July. However, at the central bank’s annual Jackson Hole symposium, the message was mixed. While several governors expressed the idea that the Fed may pause rate hikes, chair Jerome Powell mentioned that two months of declining data wasn’t enough to stop the pace of rate hikes and that more work was needed. This sent stocks lower at the tail end of the week.

The last trading week of August will be a particularly busy week for investors. Among the key data points to be released next week is the latest JOLTS report on Tuesday. Despite slippage over the last few months, the JOLTS report has remained robust, with the number of available jobs still well above 9 million. July’s report is expected to marginally dip to around 9.57 million available jobs, compared to 9.58 million reported in June. The slight fall in the number of available jobs might have more to do with hiring rather than jobs disappearing from the market. On Wednesday, the private hiring trend is also expected to show resilience, as August’s reading of ADP’s employment change report is expected to come in around 210,000 following an unexpected surge to 324,000 seen in July. On Thursday, we’ll get to see the latest personal spending and income data, which are expected to grow by 0.4% and 0.3%, respectively. On Friday, the official unemployment rate is predicted to remain steady and come in at 3.5%, indicating the robustness of the labor market despite rising interest rates.

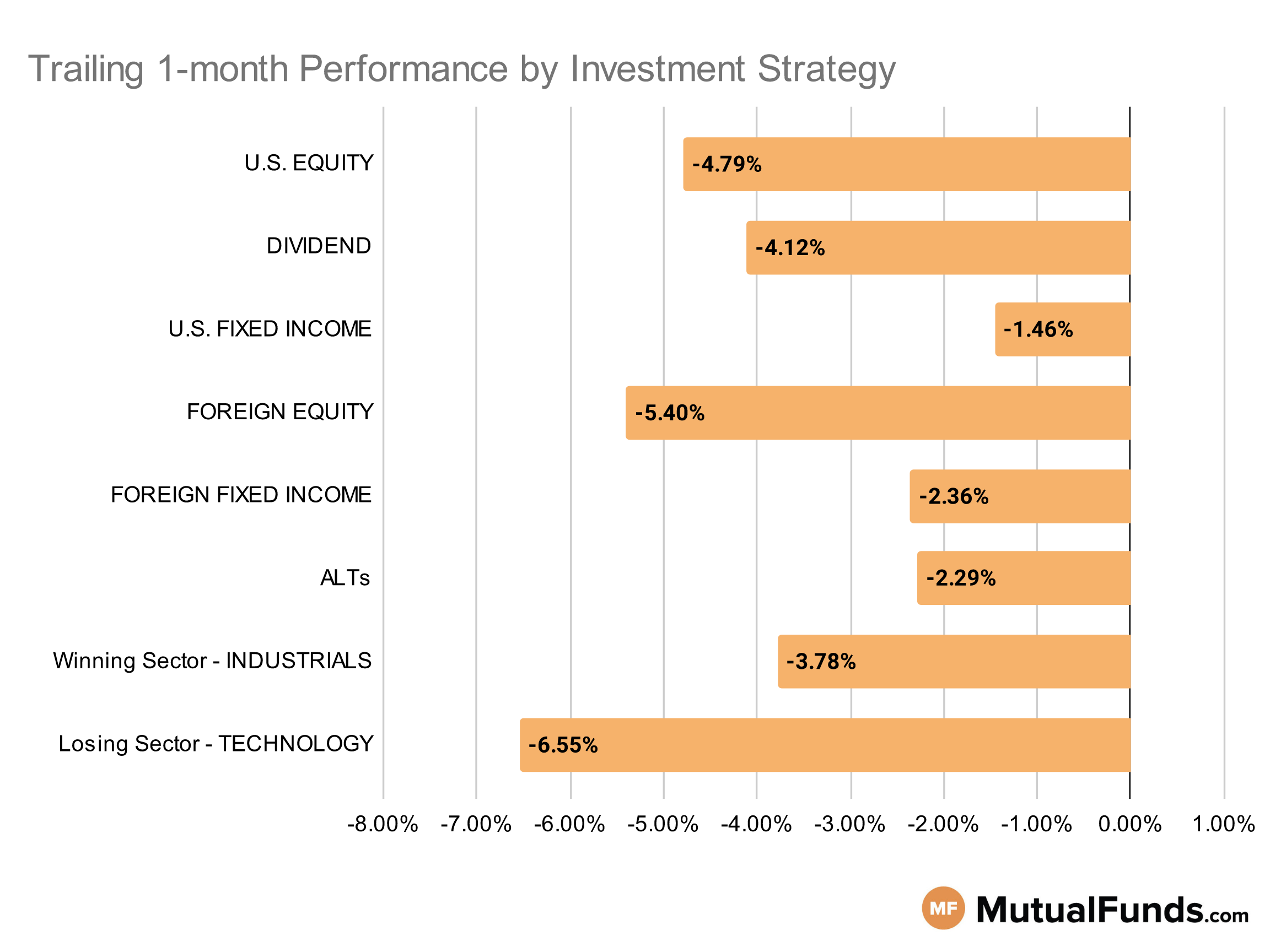

Given this economic backdrop, let us see how this impacts the performance of various investment strategies.

Investment Strategy Scorecard

Overall, major market indices remained in red over the last trailing month.

While strategies to take short position in tech stocks and long-duration treasuries along with long position in uranium worked, several growth strategies suffered over the last trailing month.

U.S Equity Strategies

None of the key U.S. equity strategies posted positive performance over the last trailing month. However, value strategies posted minimal loss, while growth strategies struggled.

Losing

- BlackRock Event Driven Equity Fund (BILPX) , down -0.31%

- BNY Mellon Dynamic Value Fund (DRGVX), down -1.76%

- Franklin LibertyQ U.S. Equity ETF (FLQL) , down -3.49%

- iShares Core S&P U.S. Growth ETF (IUSG), down -3.52%

- iShares Russell 2000 Growth ETF (IWO) , down -6.78%

- First Trust US Equity Opportunities ETF (FPX), down -7.59%

- Morgan Stanley Institutional Fund, Inc. Growth Portfolio (MSEGX) , down -13.63%

- Lazard US Equity Concentrated Portfolio (LEVOX), down -16.42%

Dividend Strategies

None of the dividend strategies posted gains over the last trailing month. However, high yielding and diversified strategies were better able to minimize losses compared to low volatility and sector specific strategies.

Losing

- Invesco High Yield Equity Dividend Achievers™ ETF (PEY) , down -0.2%

- Principal Global Diversified Income Fund (PGBAX), down -1.35%

- JPMorgan Equity Premium Income Fund (JEPRX) , down -2.52%

- iShares Core High Dividend ETF (HDV), down -2.59%

- Janus Henderson Global Equity Income Fund (HFQAX) , down -5.33%

- Invesco S&P Ultra Dividend Revenue ETF (RDIV), down -6.51%

- HCM Dividend Sector Plus Fund (HCMNX) , down -6.94%

- Legg Mason Low Volatility High Dividend ETF (LVHD), down -7.07%

U.S. Fixed Income Strategies

In US fixed income, long-duration strategies continued to suffer.

Winning

- ProShares Short 20+ Year Treasury (TBF) , up 6.69%

- Thompson Bond Fund (THOPX), up 0.52%

- DFA Two Year Global Fixed Income Portfolio (DFGFX) , up 0.51%

- WisdomTree Floating Rate Treasury Fund (USFR), up 0.44%

Losing

- PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund (LTPZ) , down -6.12%

- iShares 20+ Year Treasury Bond ETF (TLT), down -6.19%

- Vanguard Extended Duration Treasury Index Fund (VEDIX) , down -8.55%

- PIMCO StocksPLUS® Long Duration Fund (PSLDX), down -8.57%

Foreign Equity Strategies

None of the key foreign equity strategies posted positive performance over the last trailing month. However, Indian and Mexican equity strategies posted minimal losses, while Swedish equity strategies continued to struggle.

Losing

- WisdomTree India Earnings Fund (EPI) , down -0.53%

- iShares MSCI Mexico ETF (EWW), down -1.48%

- Vanguard Emerging Markets Government Bond Index Fund (VGAVX) , down -2.23%

- GQG Partners Emerging Markets Equity Fund (GQGIX), down -2.34%

- iShares MSCI South Korea ETF (EWY) , down -9.41%

- Franklin International Growth Fund (FNGZX), down -10.01%

- Artisan Developing World Fund (APHYX) , down -10.08%

- iShares MSCI Sweden ETF (EWD), down -10.58%

Foreign Fixed Income Strategies

None of the key foreign debt strategies posted positive results over the last trailing month. However, in terms of minimizing losses, emerging market debt strategies continue to post better performance compared to international treasury strategies.

Losing

- DFA World ex U.S. Government Fixed Income Portfolio (DWFIX) , down -0.36%

- Eaton Vance Emerging Markets Debt Opportunities Fund (EIDOX), down -1.18%

- VanEck Emerging Markets High Yield Bond ETF (HYEM) , down -1.43%

- iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB), down -2.65%

- PIMCO International Bond Fund Unhedged (PFUNX) , down -3.41%

- T. Rowe Price International Bond Fund (PAIBX), down -3.67%

- iShares International Treasury Bond ETF (IGOV) , down -3.79%

- SPDR® Bloomberg Barclays International Treasury Bond ETF (BWX), down -3.93%

Alternatives

Among alternatives, managed futures focused strategy continued its winning streak over the last month, while gold strategies continued to be on the losing end.

Winning

- AQR Managed Futures Strategy Fund (AQMIX) , up 4.18%

- Catalyst/Millburn Hedge Strategy Fund (MBXAX), up 1.48%

- IQ Merger Arbitrage ETF (MNA) , up 0.87%

- WisdomTree Japan Hedged Equity Fund (DXJ), up 0.48%

Losing

- SPDR® S&P Global Natural Resources ETF (GNR) , down -6.6%

- VanEck Vectors Agribusiness ETF (MOO), down -7.16%

- Janus Henderson Contrarian Fund (JCNCX) , down -7.75%

- Fidelity® Select Gold Portfolio (FSAGX), down -8.37%

Sectors

Among the sectors, strategies to short tech stocks and go long on uranium worked. However, mortgage REIT strategies struggled.

Winning

- ProShares Short QQQ (PSQ) , up 5.41%

- Global X Uranium ETF (URA), up 3.36%

- Stone Ridge High Yield Reinsurance Risk Premium Fund (SHRIX) , up 1.81%

- Fidelity® Select Energy Portfolio (FSENX), up 1.09%

Losing

- Fidelity® Select Medical Technology and Devices Portfolio (FSMEX) , down -8.99%

- American Beacon ARK Transformational Innovation Fund (ADNYX), down -14%

- Invesco Solar ETF (TAN) , down -21.88%

- iShares Mortgage Real Estate Capped ETF (REM), down -25%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietary system to scan through thousands of relevant mutual funds and ETFs. Fund performance data is calculated for the trailing one month, based on the change in NAV.

Here is a summary of the different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.