Last week was once again all about inflation, with the latest CPI figures being released. The monthly inflation rate in the US was steady at 0.2% for July, matching analyst expectations.

The reading did manage to push the annual inflation rate higher to 3.2%. However, the number was below forecasts of 3.3%. This helped boost the major equity index averages and reverse the week’s initial downtrend as investors began to ponder a pause in interest rate hikes. A slight increase in initial jobless claims for the week ending August 5 to 248,000, which was above forecasts, also helped the markets. Early in the week poor export data from China as well as a series of credit rating downgrades for banks, sent the Dow Jones Industrial Average (DJIA) lower. Consumers seem bullish about economic prospects, with the University of Michigan consumer sentiment report staying at highs not seen since the end of the pandemic. A combination of softening inflation and a still-robust labor market are helping to boost consumer confidence in the economy.

Next week, investors will get their chance to pick the Federal Reserve’s brain with the release of the latest FOMC meeting minutes on Wednesday. Policymakers at the Fed have expressed their willingness to monitor a variety of data– covering everything from labor market conditions, headline inflation, and even financial and international developments– in their decision-making process. That’s a lot to follow and the meeting minutes should provide some clarity as to what the central bank is thinking going forward on its path to possible future rate hikes. Among key data to be released next week, on Tuesday we’ll get to see July’s retail sales numbers, with analysts expecting the month-over-month number to come in at 0.4%, following a 0.2% jump seen last month. On Wednesday, building permit data for July is expected to rise slightly, to a seasonally- adjusted annual rate of 1.457 million. Housing starts— or the beginning of physical construction– are also expected to post a sudden increase in July. Finally, labor conditions are expected to stay robust, with the latest weekly jobless numbers expected to clock in close to last week’s figures.

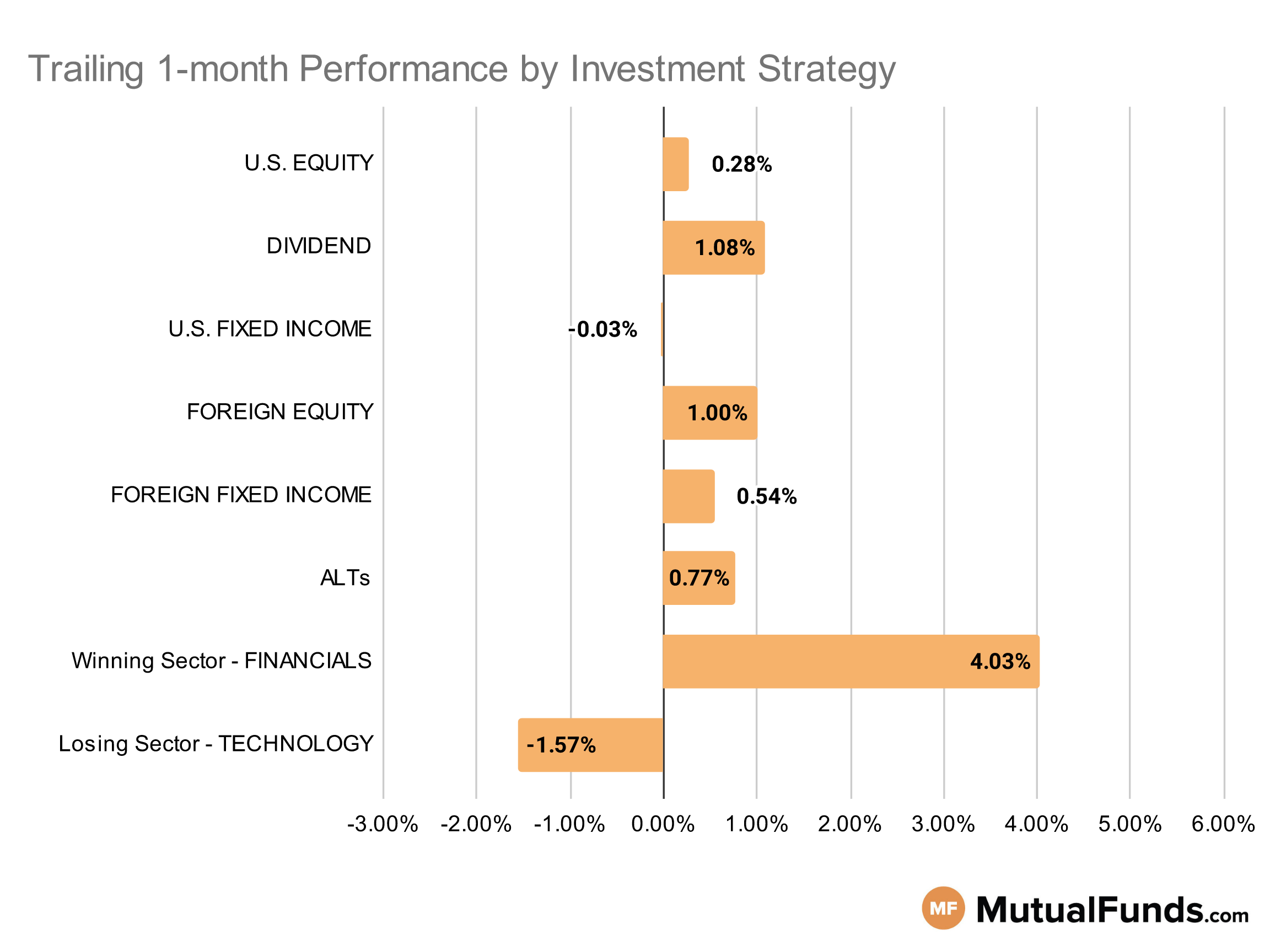

Given this economic backdrop, let us see how this impacts the performance of various investment strategies.

Investment Strategy Scorecard

Regional banking and commodity strategies performed well over the last trailing month. Meanwhile, healthcare and longer-duration bond strategies continued to struggle.

U.S Equity Strategies

In U.S. equities, value strategies, especially those focused on small-cap companies, continue to perform better than their growth counterparts.

Winning

- Bridgeway Omni Small-Cap Value Fund (BOSVX) , up 6.97%

- Undiscovered Managers Behavioral Value Fund (UBVLX), up 5.14%

- Dimensional U.S. Targeted Value ETF (DFAT) , up 3.12%

- Invesco S&P SmallCap 600 Revenue ETF (RWJ), up 2.66%

Losing

- iShares Russell Mid-Cap Growth ETF (IWP) , down -2.58%

- First Trust US Equity Opportunities ETF (FPX), down -2.98%

- Voya Index Solution 2045 Portfolio (ISVLX) , down -8.48%

- Voya U.S. Stock Index Portfolio (INGIX), down -8.49%

Dividend Strategies

When it comes to dividend income, high yielding and small-cap focussed strategies came up on top while low-volatility and international market focussed strategies struggled.

Winning

- Invesco High Yield Equity Dividend Achievers™ ETF (PEY) , up 6.06%

- ProShares Russell 2000 Dividend Growers ETF (SMDV), up 5.42%

- Vanguard Equity Income Fund (VEIRX) , up 2.12%

- Fidelity® Equity Income Fund (FEIKX), up 2.01%

Losing

- First Trust Dow Jones Global Select Dividend Index Fund (FGD) , down -0.42%

- Matthews Asia Dividend Fund (MIPIX), down -0.66%

- Legg Mason Low Volatility High Dividend ETF (LVHD) , down -0.92%

- BlackRock Equity Dividend Fund (MKDVX), down -2%

U.S. Fixed Income Strategies

In US fixed income, strategies focused on finding differentiated income opportunities performed well, while longer duration bond strategies continued to struggle.

Winning

- ProShares Short 20+ Year Treasury (TBF) , up 4.28%

- City National Rochdale Fixed Income Opportunities Fund (RIMOX), up 1.69%

- Fidelity Advisor® New Markets Income Fund (FNMIX) , up 1.47%

- iShares Core International Aggregate Bond ETF (IAGG), up 0.9%

Losing

- SPDR® Portfolio Long Term Treasury ETF (SPTL) , down -3.37%

- iShares 20+ Year Treasury Bond ETF (TLT), down -4.14%

- Vanguard Extended Duration Treasury Index Fund (VEDIX) , down -5.92%

- PIMCO Extended Duration Fund (PEDPX), down -5.97%

Foreign Equity Strategies

Among foreign equity strategies, emerging market strategies performed well, while Saudi Arabian, Japanese and Taiwanese equity strategies lost ground.

Winning

- EMQQ The Emerging Markets Internet & Ecommerce ETF (EMQQ) , up 7.75%

- WisdomTree China ex-State-Owned Enterprises Fund (CXSE), up 5.2%

- VanEck Emerging Markets Fund (EMRYX) , up 4.34%

- Baillie Gifford International Growth Fund (BGEUX), up 3.91%

Losing

- iShares MSCI Taiwan ETF (EWT) , down -1.58%

- T. Rowe Price Japan Fund (RJAIX), down -2.39%

- iShares MSCI Saudi Arabia ETF (KSA) , down -3.52%

- Lord Abbett Developing Growth Fund (LADVX), down -7.78%

Foreign Fixed Income Strategies

In US fixed income, strategies focused on finding differentiated income opportunities performed well, while longer-duration bond strategies continued to struggle.

Winning

- ProShares Short 20+ Year Treasury (TBF) , up 4.28%

- City National Rochdale Fixed Income Opportunities Fund (RIMOX), up 1.69%

- Fidelity Advisor® New Markets Income Fund (FNMIX) , up 1.47%

- iShares Core International Aggregate Bond ETF (IAGG), up 0.9%

Losing

- SPDR® Portfolio Long Term Treasury ETF (SPTL) , down -3.37%

- iShares 20+ Year Treasury Bond ETF (TLT), down -4.14%

- Vanguard Extended Duration Treasury Index Fund (VEDIX) , down -5.92%

- PIMCO Extended Duration Fund (PEDPX), down -5.97%

Alternatives

Among alternatives, commodity focused strategies continued their winning streak over the last month.

Winning

- iShares S&P GSCI Commodity-Indexed Trust (GSG) , up 7.09%

- PIMCO CommoditiesPLUS® Strategy Fund (PCLAX), up 6.38%

- iShares GSCI Commodity Dynamic Roll Strategy ETF (COMT) , up 5.96%

- PIMCO Commodity Real Return Strategy Fund (PCRIX), up 3.76%

Losing

- VanEck Preferred Securities ex Financials ETF (PFXF) , down -1.43%

- BlackRock Commodity Strategies Portfolio (BCSAX), down -4.7%

- BlackRock Tactical Opportunities Fund (PCBAX) , down -4.95%

- ETFMG Alternative Harvest ETF (MJ), down -5.2%

Sectors

Among the sectors, regional banking and energy strategies posted solid performances over the last trailing month. However, healthcare equity strategies struggled.

Winning

- SPDR® S&P Regional Banking ETF (KRE) , up 12.54%

- John Hancock Regional Bank Fund (FRBAX), up 12.12%

- SPDR® S&P Bank ETF (KBE) , up 10.85%

- Fidelity® Select Energy Portfolio (FSENX), up 7.43%

Losing

- Eventide Healthcare & Life Sciences Fund (ETAHX) , down -5.34%

- American Beacon ARK Transformational Innovation Fund (ADNYX), down -8.2%

- Invesco DWA Healthcare Momentum ETF (PTH) , down -9.99%

- AdvisorShares Pure US Cannabis ETF (MSOS), down -17.82%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietary system to scan through thousands of relevant mutual funds and ETFs. To ensure quality and an adequate track record, the system places a minimum threshold on net assets of $100 million. Fund performance data is calculated for the trailing one month, based on the change in NAV.

Here is a summary of the different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.