Inflation is coming down from its highs in July of last year, but it’s still well above the Federal Reserve’s target rate of two percent. If you’re relying on investment income, you may find it challenging to generate enough income to offset the impact of inflation.

Rising interest rates have sent bond yields higher, making them more attractive to income investors. But since a bond’s price is inverse to its yield, future rate increases could send bond prices even lower. At the same time, the stock market continues to produce outsized returns and offers better long-term performance than bonds on a risk-adjusted basis.

Investors seeking more income without turning to bonds may want to look at actively managed dividend funds. In particular, the highest yielding funds tend to focus on non-U.S. markets, higher yielding subsets of the U.S. market, or strategies offering incrementally higher yields.

In this edition, we look at trending Dividend Funds you can leverage to capitalize on these kinds of opportunities.

Be sure to check out the Dividend Funds page to explore all mutual funds, index ETFs, and active ETFs that can provide you exposure to this theme.

Trending Funds

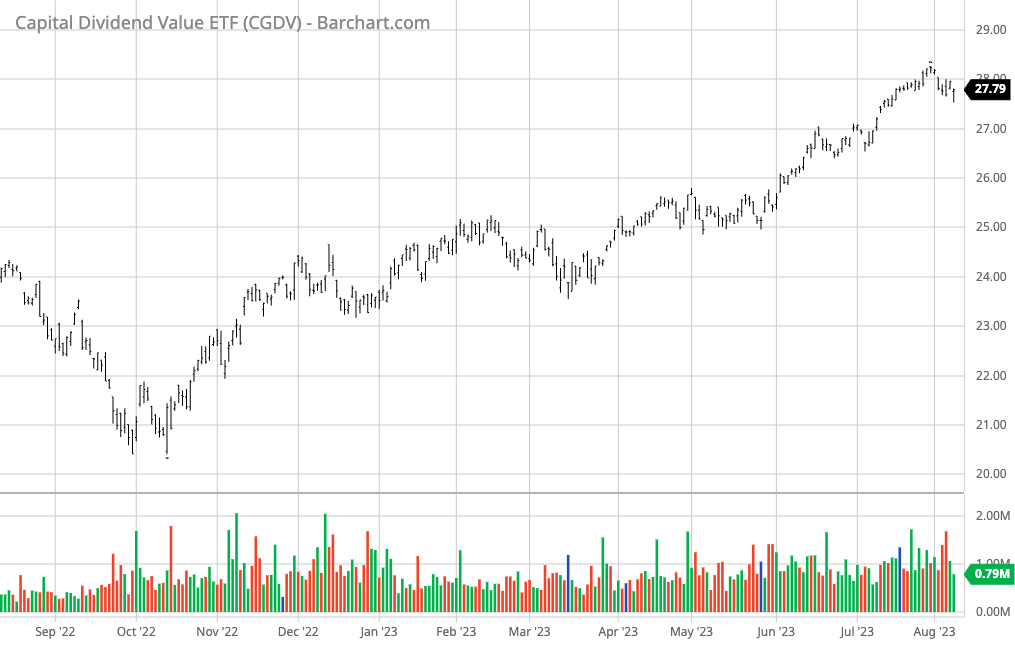

1. Capital Group Dividend Value ETF (CGDV)

The Capital Group Dividend Value ETF (CGDV) is the top performing fund on today’s list with a 20.61% return over the past 12 months. But with its 1.58% yield and 0.33% expense ratio, the fund is the lowest-yielding option, although it has the lowest expense ratio.

The $2.9 billion ETF seeks to produce consistent income that exceeds the average yield of the S&P 500 by focusing on companies that pay dividends (at least 80% of its portfolio) or have the potential to pay dividends. While the fund invests primarily in large U.S. dividend stocks with market capitalizations of more than $4 billion, up to 10% of assets may be invested in large-cap stocks outside the U.S. or some smaller companies.

Currently, the fund’s portfolio consists of approximately 50 stocks concentrated in industrials (20.4%), information technology (19.3%), and healthcare (12.1%). The largest individual holdings include Broadcom Inc. (6.3%), Microsoft Corp. (5.7%), and Carrier Global Corp. (5.1%). Meanwhile, about 10% of the portfolio is located outside the U.S., including Canada (2.9%) and Europe (2.9%).

Source: BarChart.com.

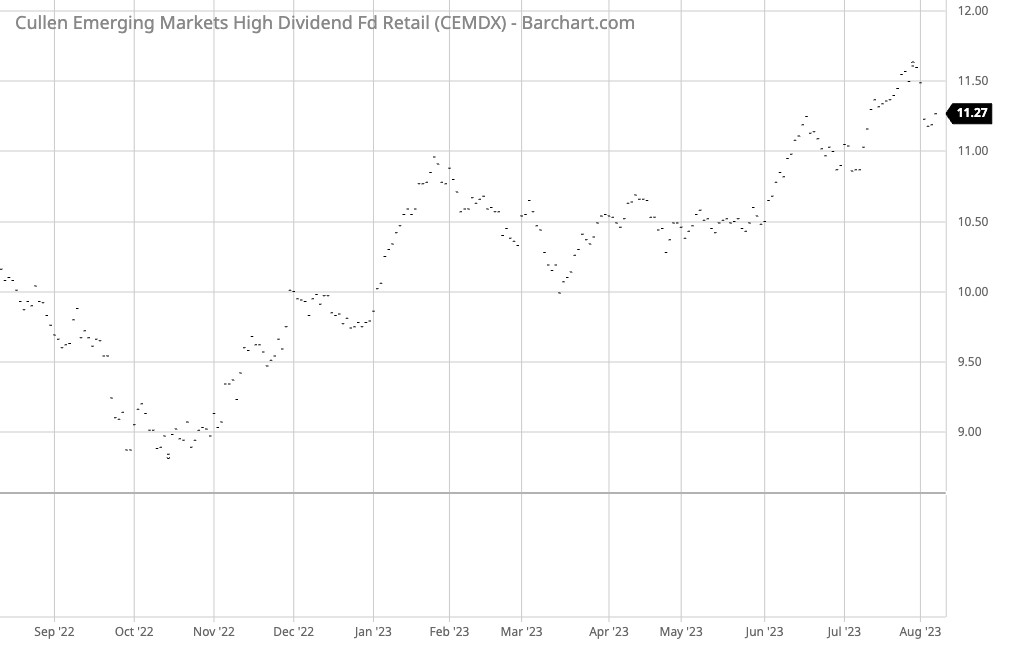

2. Cullen Emerging Markets High Dividend Fund (CEMDX)

The Cullen Emerging Markets High Dividend Fund (CEMDX) comes in second place with a 19.56% return over the trailing 12-month period. And with its 3.75% yield and 1.25% expense ratio, the fund offers a middle-of-the-road yield and expense ratio, too.

The nearly $500 million mutual fund focuses on emerging market stocks with high current dividends and reasonable valuations. In particular, the fund managers aim to build a concentrated portfolio of 50 to 70 companies with low price-earnings ratios and growing dividends while analyzing geopolitical risks and macroeconomic forecasts for changes in sentiment. Finally, the managers also assess factors like price momentum and governance.

Currently, the portfolio features just over 50 companies concentrated in financials (23.9%), information technology (23%), and industrials (11.3%). Unlike the previous fund on our list, CEMDX includes exposure to numerous emerging markets, including Taiwan (18.7%), China (17.2%), India (15.5%), and Mexico (9.5%), among others. The largest holdings include names like Taiwan Semiconductor (4.3%) and Samsung (4.0%).

Source: BarChart.com.

3. InfraCap MLP ETF (AMZA)

The InfraCap MLP ETF (AMZA) rounds out the list with a 19.05% return over the past 12 months. With an 8.17% yield and 1.64% expense ratio, the fund offers the highest yield but at the highest cost.

The $300 million fund provides exposure to midstream master limited partnerships (MLPs) with an emphasis on high current income. In addition, the company leverages modest leverage of 20% to 30% to enhance MLP beta, and options strategies are used to provide a source of income. Meanwhile, security selection focuses on company-level fundamental analysis and technical factors instead of market capitalization.

Given the limited equity universe, the fund has a highly concentrated portfolio with oversized positions in Plains All American Pipeline LP (19.73%), Energy Transfer LP (17.97%), Enterprise Product Partners (17.79%), and MPLX LP (13.44%). As a result, investors may have less sector- and company-level diversification compared to the other options on our list.

Source: BarChart.com.

The Bottom Line

Dividend funds enable investors to achieve more income without turning toward the bond market, which could be risky if the Federal Reserve continues to increase interest rates. These funds enable investors to maintain exposure to equities—providing attractive capital gains potential—while generating more income than conventional dividend stocks and funds.

Data as of August 3, 2023.

Methodology

MutualFunds.com analyzes the search patterns of our visitors every two weeks to find the top trending funds. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

First, we select the top trending theme from more than 200 themes listed on MutualFunds.com based on the percentage increase in monthly viewership. Then, we choose the top three funds with the highest one-year trailing total returns from the top trending theme. To ensure funds’ quality and staying power, we only look at those funds with a minimum of $100 million in assets and a track record of at least one year.

When considering mutual funds, we ignore funds that are either closed to new investors or are unavailable for investment outside registered accounts such as retirement or 529.

Fund performances are reported based on trailing 12-month total returns.