Technology, communication services, and consumer discretionary stocks helped push the S&P 500 up nearly 20% since January. But these sectors also have the highest price-earnings ratios heading into a possible economic slowdown as rising rates threaten growth. So, a growing number of investors are hedging their bets with a middle ground between growth and value.

Healthcare stocks rose a paltry 2.43% since the beginning of the year, but trade at less than half the price-earnings ratio of technology stocks. Meanwhile, their 12% annual earnings growth since the mid-1980s is the fastest of any sector—even technology. And aging populations, richer consumers, and new breakthroughs offer unique staying power.

A series of strong earnings reports has helped healthcare stocks re-enter the investor conversation. For example, UnitedHealth Group shares soared after second quarter revenue and adjusted earnings surpassed Wall Street expectations despite rising medical costs.

In this edition, we look at trending Healthcare Funds you can leverage to capitalize on opportunities outside of the U.S.

Be sure to check out the Healthcare Sector Funds page to explore all mutual funds, index ETFs, and active ETFs that can provide you exposure to this theme.

Trending Funds

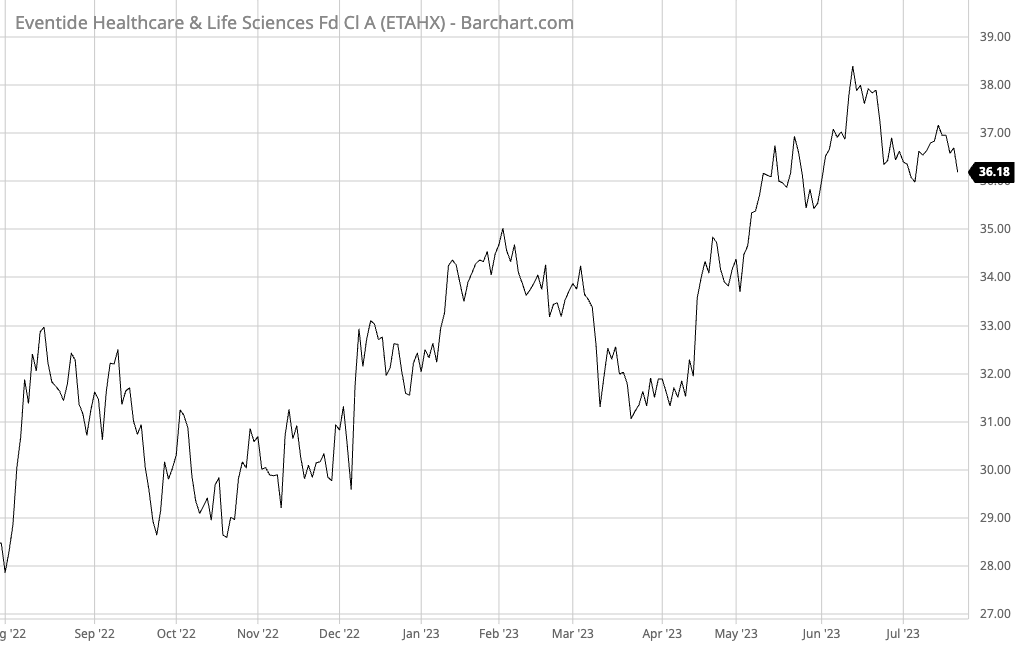

1. Eventide Healthcare & Life Sciences Fund (ETAHX)

The Eventide Healthcare & Life Sciences Fund (ETAHX) comes in first place with a 29.72% trailing 12-month return. But with a 1.56% expense ratio, the actively-managed fund is also the most expensive option on today’s list.

With $1.76 billion in assets under management, the fund represents Eventide’s ‘best ideas’ for long-term capital appreciation in the healthcare and life sciences sectors (80%) and drug-related industries (25%). In addition, the fund managers may invest up to 15% into illiquid securities, which could translate to more opportunities than conventional index funds.

Currently, the fund holds 67.47% biotech, 9.51% healthcare equipment, and 4.74% pharmaceutical companies. These are primarily (79.06%) based in North America, but also include exposure to Europe (7.49%) and Asia (2.09%).

Source: BarChart.com.

2. Janus Henderson Global Life Sciences Fund (JFNAX)

The Janus Henderson Global Life Sciences Fund (JFNAX) comes in second place with a 14.21% trailing 12-month return. With a 0.98% expense ratio, the actively-managed fund is middle of the road in terms of expense on our list.

With $4.85 billion in assets under management, the fund seeks to harness the rapid innovation in healthcare to generate returns by investing in companies addressing unmet medical needs or those that seek to make the healthcare system more efficient. As a result, it invests in more insurance and drug-focused companies than the previous fund.

Currently, the fund holds a portfolio of 128 companies, including companies like UnitedHealth Group Inc. (6.12%), AstraZeneca plc (4.23%), and Eli Lilly & Co. (3.67%).

Source: BarChart.com.

3. First Trust NYSE Arca Biotech ETF (FBT)

The First Trust NYSE Arca Biotech ETF (FBT) rounds out the list with a 12.34% 12-month return. With a 0.56% expense ratio, the passively-managed fund offers the cheapest healthcare exposure on today’s list.

The $1.4 billion fund tracks an equal dollar weighted index measuring a cross-section of companies in the biotech industry that are primarily involved in the use of biological processes to develop products or provide services. These include companies focused on recombinant DNA, molecular biology, genetic engineering, monoclonal antibodies, and genomics.

Since the portfolio is equal dollar weighted, investors have diverse exposure to a concentrated portfolio of 30 companies. These include well-known biotech companies like Biogen Inc., Amgen Inc., and United Therapeutics Corp.

Source: BarChart.com.

The Bottom Line

Healthcare stocks offer investors a middle ground between growth and value. The funds on our list provide an excellent starting point for exposure to the sector, whether through an actively-managed mutual fund or an equal weight index fund.

All data as of July 20, 2023.

Methodology

MutualFunds.com analyzes the search patterns of our visitors every two weeks to find the top trending funds. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

First, we select the top trending theme from more than 200 themes listed on MutualFunds.com based on the percentage increase in monthly viewership. Then, we choose the top three funds with the highest one-year trailing total returns from the top trending theme. To ensure funds’ quality and staying power, we only look at those funds with a minimum of $100 million in assets and a track record of at least one year.

When considering mutual funds, we ignore funds that are either closed to new investors or are unavailable for investment outside registered accounts such as retirement or 529.

Fund performances are reported based on trailing 12-month total returns.