Last week, earnings season began with a bang. Leading off the week were the banks, whose results were better than expected and indicated that the banking crisis was over for many of the largest institutions.

Technology shares also surged, with Microsoft and NVIDIA hitting new all-time highs as large-cap tech has once again become an investor favorite. This set the wheels in motion for the Dow Jones Industrials Average (DJIA), which rose on Thursday for the ninth straight trading session – its longest winning streak since 2017. Adding fuel to that fire was mixed economic data. Month-over-month retail sales increased 0.2% in June, below market estimates of 0.5% but continuing the streak of consecutive steady sales increases. Meanwhile, building permits slipped from their recent highs and came in lower than expected. Both manufacturing and industrial production figures also slipped more than expected. However, investors seemed unmoved by the weakening data. With the Fed’s rate decision next week, key economic data points matching the central bank’s expectations could help keep rates unchanged for another FOMC meeting.

Next week will once again feature the Federal Reserve prominently in the spotlight with its latest interest rate decision. During the last FOMC meeting, nearly all the governors voted to keep rates the same as it would allow more time for economic data to show if previous hikes are working. With inflation falling, but still above the current 2% target, the FedWatch tool predicts another 0.25% hike during the next meeting on Wednesday. However, there is still a chance that the Fed could pause again given the slowing economic data and softening inflation figures. More weakness may be seen in manufacturing and housing data in the coming days. Although Tuesday’s latest reading of the Richmond Manufacturing Index is expected to rise to -2 in July from -7 recorded in June, it would continue to indicate contraction for the seventh consecutive month. Meanwhile, month-over-month new home sales in June are expected to show a decline of 4% on Wednesday. Durable goods orders on Thursday are also expected to show muted growth of 0.6% in June, down from May’s 1.7% reading. However, the consumer economy is expected to be one of the few bright spots. Both personal spending and income are expected to rise by 0.3% and 0.4%, respectively in June when they are reported on Friday.

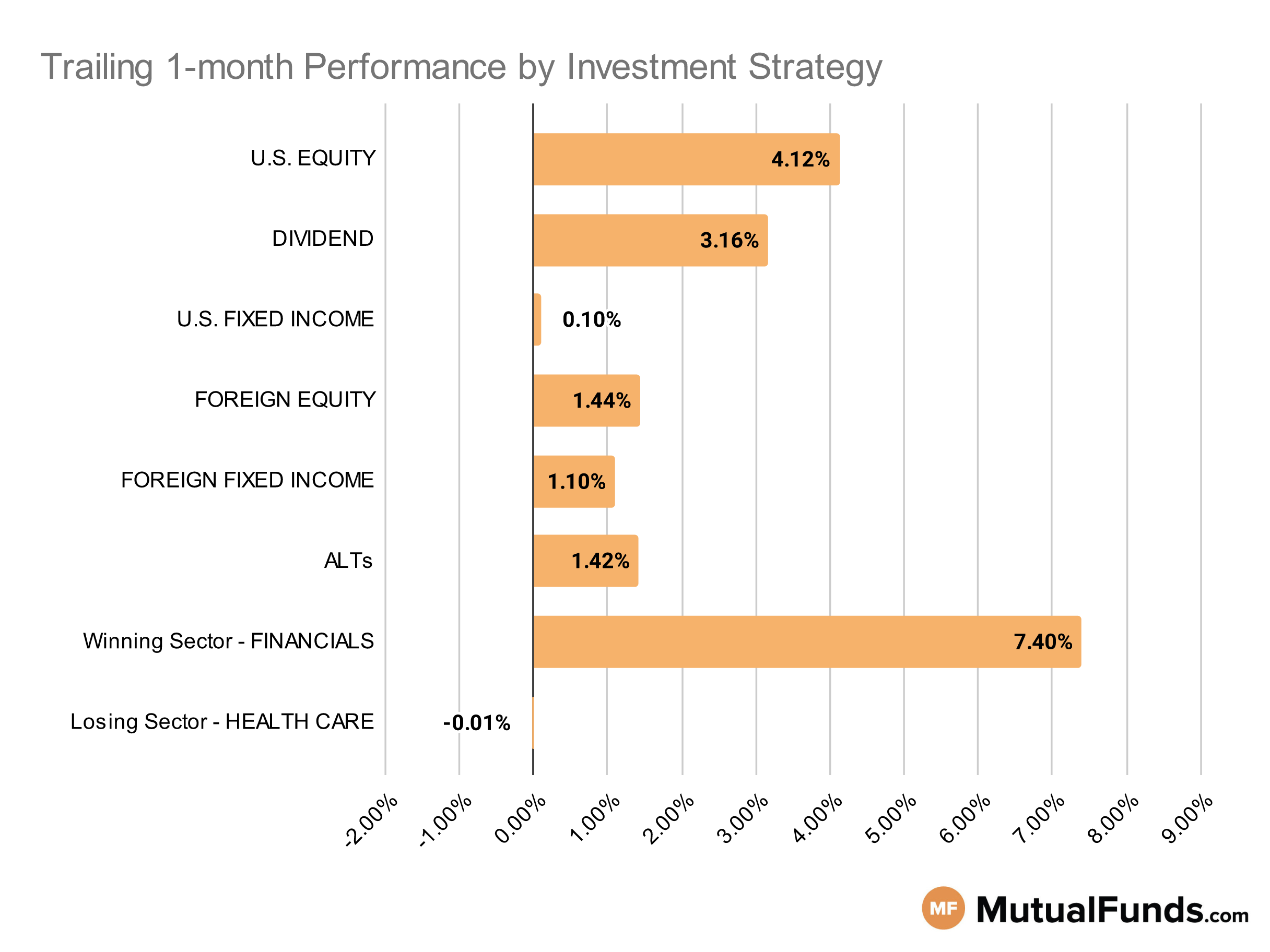

Given this economic backdrop, let us see how this impacts the performance of various investment strategies.

Investment Strategy Scorecard

Technology and financial sector strategies performed well over the last trailing month. Meanwhile, palladium and Chinese strategies struggled.

U.S Equity Strategies

In U.S. equities, value strategies performed better than some growth strategies, reversing a recent trend.

Winning

- Brown Advisory Small-Cap Fundamental Value Fund (BAUAX) , up 8.05%

- Fidelity Advisor® Value Strategies Fund (FSLSX), up 7.78%

- Invesco S&P SmallCap 600 Revenue ETF (RWJ) , up 6.82%

- Dimensional U.S. Targeted Value ETF (DFAT), up 6.67%

Losing

- BNY Mellon Research Growth Fund, Inc. (DWOCX) , down -1.43%

- Voya U.S. Stock Index Portfolio (INGIX), down -6.06%

Dividend Strategies

When it comes to dividend income, buyback and mid-cap strategies came up on top while global strategies struggled.

Winning

- Invesco BuyBack Achievers ETF (PKW) , up 6.45%

- Principal Small-MidCap Dividend Income Fund (PMDIX), up 5.98%

- WisdomTree U.S. MidCap Dividend Fund (DON) , up 5.6%

- Nuveen Dividend Value Fund (FAQIX), up 4.97%

Losing

- Janus Henderson Global Equity Income Fund (HFQAX), down -0.97%

U.S. Fixed Income Strategies

In US fixed income, strategies focused on convertible debt continues to win, while long-term Treasury strategies struggled.

Winning

- iShares Convertible Bond ETF (ICVT) , up 2.94%

- PIMCO StocksPLUS® Long Duration Fund (PSLDX), up 2.43%

- Invesco CEF Income Composite ETF (PCEF) , up 2.34%

- Fidelity Advisor® New Markets Income Fund (FNMIX), up 1.9%

Losing

- SPDR® Portfolio Long Term Treasury ETF (SPTL) , down -1.5%

- iShares 20+ Year Treasury Bond ETF (TLT), down -1.56%

- PIMCO Extended Duration Fund (PEDPX) , down -1.94%

- Vanguard Extended Duration Treasury Index Fund (VEDIX), down -2.9%

Foreign Equity Strategies

Among foreign equity strategies, Italian and Indian equity strategies performed well, while European and Chinese equity strategies lost ground.

Winning

- iShares MSCI Italy ETF (EWI) , up 5.65%

- iShares India 50 ETF (INDY), up 4.77%

- Oakmark International Fund (OANEX) , up 4.46%

- Oakmark International Small Cap Fund (OAZEX), up 4.46%

Losing

- Matthews Asian Growth and Income Fund (MACSX) , down -1.22%

- Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR), down -1.35%

- Fidelity® China Region Fund (FHKCX) , down -1.56%

- Xtrackers MSCI Europe Hedged Equity ETF (DBEU), down -2.82%

Foreign Fixed Income Strategies

Among foreign debt, several emerging market debt strategies continue to post positive results.

Winning

- American Funds Emerging Markets Bond Fund (EBNFX) , up 2.71%

- PIMCO Emerging Markets Local Currency and Bond Fund (PELPX), up 2.22%

- iShares International Treasury Bond ETF (IGOV) , up 1.28%

- VanEck J.P. Morgan EM Local Currency Bond ETF (EMLC), up 1.14%

Losing

- Janus Henderson Developed World Bond Fund (HFARX) , down -0.26%

- Stone Harbor Emerging Markets Debt Fund (SHMDX), down -0.85%

Alternatives

Among alternatives, agribusiness and low-volatility focused strategies emerged as winners over the last month. On the other end, strategies focused on heding exposure to EAFE (Europe, Australasia, and the Far East) equities continue to struggle.

Winning

- VanEck Vectors Agribusiness ETF (MOO) , up 5.43%

- SPDR® Russell 1000 Low Volatility Focus ETF (ONEV), up 5.39%

- Fidelity® Select Gold Portfolio (FSAGX) , up 5.29%

- Janus Henderson Contrarian Fund (JCNCX), up 4.46%

Losing

- iShares Currency Hedged MSCI EAFE ETF (HEFA) , down -1.49%

- BlackRock Commodity Strategies Portfolio (BCSAX), down -3.7%

- BlackRock Tactical Opportunities Fund (PCBAX) , down -3.72%

- Xtrackers MSCI EAFE Hedged Equity ETF (DBEF), down -4.14%

Sectors

Among the sectors, blockchain and oil services equity strategies continue their winning streak over the last trailing month. However, palladium, healthcare and Chinese equity strategies struggled.

Winning

- Amplify Transformational Data Sharing ETF (BLOK) , up 21.55%

- VanEck Oil Services ETF (OIH), up 20.95%

- John Hancock Regional Bank Fund (FRBAX) , up 9.23%

- Fidelity® Select Brokerage & Invmt Mgmt Portfolio (FSLBX), up 8.52%

Losing

- Fidelity® Select Biotechnology Portfolio (FBIOX) , down -1.86%

- Eventide Healthcare & Life Sciences Fund (ETAHX), down -3.53%

- Invesco China Technology ETF (CQQQ) , down -4.99%

- Aberdeen Standard Physical Palladium Shares ETF (PALL), down -7.78%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietary system to scan through thousands of relevant mutual funds and ETFs. To ensure quality and an adequate track record, the system places a minimum threshold on net assets of $100 million. Fund performance data is calculated for the trailing one month, based on the change in NAV.

Here is a summary of the different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.