With limited trading hours on Monday and the Independence Day holiday last Tuesday, stocks spent much of the shortened week trending lower on the back of an unfavorable interest rate outlook and strong economic data.

As expected, the latest FOMC meeting minutes showed that the majority of Fed officials favored keeping rates steady at the last meeting. But the minutes also underscored the need for a 0.25% hike at the next meeting and that more hikes could be necessary if inflation continues to run above 2%. Stocks sank on the meeting minutes and continued to fall, with the Dow Jones Industrial Average dropping 350 points as strong economic news strengthened the Fed’s case for rate hikes. The latest ISM services PMI report, Job Openings and Labor Turnover Survey (JOLTS), and non-farm payroll figures all pointed to a slowing, yet still strong economy. Adding fuel to the fire was the latest ADP report, which showed the private sector in the U.S. added 497,000 jobs in June, well ahead of 267,000 jobs added in May and more than double the market estimate of 220,000 jobs.

After the shortened trading week, next week will see investors battling against the current foe of the moment– inflation. Driven by lower energy prices, the consumer price index (CPI) declined to 4.0% on an annualized basis in May 2023, the lowest reading since March 2021. Analysts expect the number to continue dropping, hitting just 3.2% for June when it is released on Wednesday. This could provide the much-needed proof that the Fed’s path of rate hikes is working to cool the economy. The annual core inflation rate, which excludes volatile items like food and energy, is also expected to decline to 5% in June compared to 5.3% in May. Meanwhile, on Thursday analysts expect the Producer Price Index (PPI) for June to rise slightly by 0.1%, after an unexpected 0.3% dip registered in May. Consumers are predicted to take the drop in prices to heart, with the University of Michigan preliminary consumer sentiment reading for July expected to hit 64.5 on Friday, following a previous reading of 64.4.

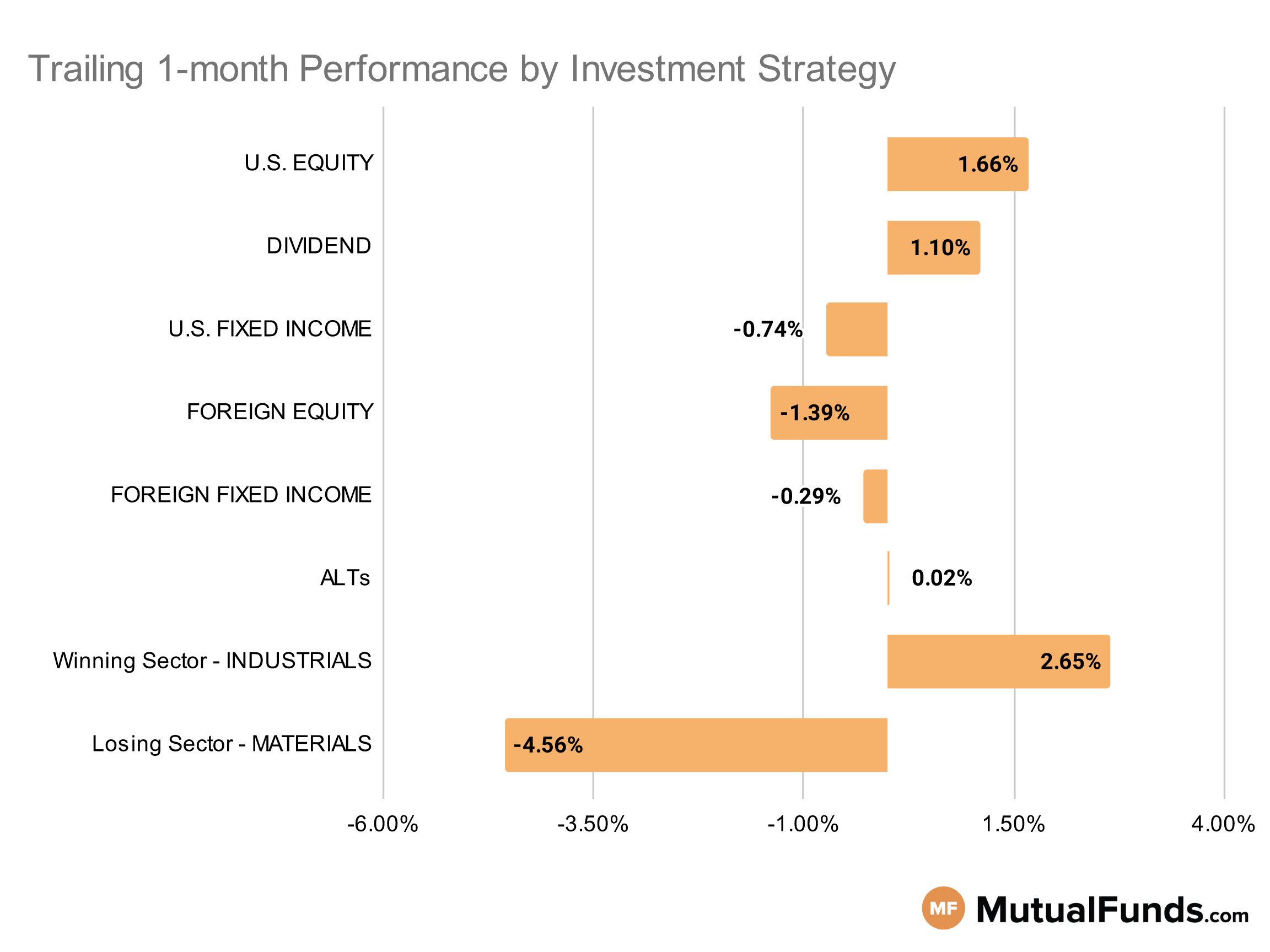

Given this economic backdrop, let us see how this impacts the performance of various investment strategies.

Investment Strategy Scorecard

Technology and industrial equity strategies performed well over the last trailing month. Meanwhile, precious metals like platinum and gold strategies continued to struggle.

U.S Equity Strategies

In U.S. equities, growth strategies continued to outperform value-focused strategies.

Winning

- Virtus KAR Mid-Cap Core Fund (VMACX) , up 4.79%

- HCM Tactical Growth Fund (HCMDX), up 4.65%

- iShares Morningstar Growth ETF (ILCG) , up 3.59%

- Schwab U.S. Large-Cap Growth ETF™ (SCHG), up 3.39%

Losing

- iShares Russell 2000 Value ETF (IWN) , down -1.32%

- Alger Small Cap Focus Fund (AGOZX), down -2.98%

- Columbia Small Cap Value Fund II (CRRRX) , down -3.02%

- iShares Micro-Cap ETF (IWC), down -3.22%

Dividend Strategies

When it comes to dividend income, sector and quality focused strategies came up on top while global dividend strategies struggled.

Winning

- HCM Dividend Sector Plus Fund (HCMNX) , up 4.49%

- WisdomTree U.S. Quality Dividend Growth Fund (DGRW), up 3.29%

- Amana Mutual Funds Trust Income Fund (AMANX) , up 3.07%

- Invesco BuyBack Achievers ETF (PKW), up 3.03%

Losing

- Matthews Asia Dividend Fund (MIPIX) , down -1.32%

- ProShares Russell 2000 Dividend Growers ETF (SMDV), down -3.69%

- Janus Henderson Global Equity Income Fund (HFQAX) , down -3.75%

- First Trust Dow Jones Global Select Dividend Index Fund (FGD), down -3.83%

U.S. Fixed Income Strategies

In US fixed income, strategies focused on convertible and floating rate debt emerged as winners, while longer duration debt strategies struggled.

Winning

- iShares Convertible Bond ETF (ICVT) , up 1.82%

- ProShares Short 20+ Year Treasury (TBF), up 1.64%

- John Hancock Funds Floating Rate Income Fund (JFIIX) , up 1.47%

- Loomis Sayles Senior Floating Rate and Fixed Income Fund (LSFAX), up 1.36%

Losing

- SPDR® Portfolio Long Term Treasury ETF (SPTL) , down -2.81%

- iShares 10-20 Year Treasury Bond ETF (TLH), down -3.08%

- American Funds Strategic Bond Fund (ANBFX) , down -3.38%

- Vanguard Extended Duration Treasury Index Fund (VEDIX), down -3.53%

Foreign Equity Strategies

Among foreign equity strategies, Indian equity strategies continue to perform well, while Singapore and European equity strategies lost ground.

Winning

- WisdomTree India Earnings Fund (EPI) , up 4.08%

- iShares MSCI India ETF (INDA), up 3.12%

- GQG Partners Emerging Markets Equity Fund (GQGIX) , up 2.43%

- Morgan Stanley Institutional Fund, Inc. Global Franchise Portfolio (MSGFX), up 2.22%

Losing

- Royce International Premier Fund (RYIPX) , down -4.72%

- Matthews Asia Growth Fund (MPACX), down -4.85%

- Xtrackers MSCI Europe Hedged Equity ETF (DBEU) , down -6.17%

- iShares MSCI Singapore ETF (EWS), down -6.25%

Foreign Fixed Income Strategies

Among foreign debt, while emerging market debt strategies posted marginal gains, developed market and international government bond strategies struggled.

Winning

- Eaton Vance Emerging Markets Debt Opportunities Fund (EIDOX) , up 1.62%

- American Funds Emerging Markets Bond Fund (EBNFX), up 1.31%

- VanEck Emerging Markets High Yield Bond ETF (HYEM) , down -0.17%

- VanEck J.P. Morgan EM Local Currency Bond ETF (EMLC), down -0.48%

Losing

- SPDR® Bloomberg Barclays Emerging Markets Local Bond ETF (EBND) , down -0.86%

- SPDR® Bloomberg Barclays International Treasury Bond ETF (BWX), down -1.07%

- DFA World ex U.S. Government Fixed Income Portfolio (DWFIX) , down -1.91%

- Janus Henderson Developed World Bond Fund (HFARX), down -3.01%

Alternatives

Among alternatives, managed futures and volatility focused strategies continue to outperform. On the other end, gold strategies lost ground.

Winning

- AQR Managed Futures Strategy Fund (AQMIX) , up 3.9%

- SPDR® Russell 1000 Low Volatility Focus ETF (ONEV), up 3.39%

- Janus Henderson U.S. Managed Volatility Fund (JRSDX) , up 2.89%

- VictoryShares US 500 Volatility Wtd ETF (CFA), up 2.68%

Losing

- American Funds Mortgage Fund® (CMFAX) , down -2.78%

- Invesco S&P SmallCap Low Volatility ETF (XSLV), down -4.74%

- Xtrackers MSCI EAFE Hedged Equity ETF (DBEF) , down -6.28%

- Fidelity® Select Gold Portfolio (FSAGX), down -8.25%

Sectors

Among the sectors, blockchain and transportation equity strategies emerged as the primary winners over the last trailing month. However, platinum strategies continued to struggle.

Winning

- Amplify Transformational Data Sharing ETF (BLOK) , up 15.4%

- First Trust Nasdaq Transportation ETF (FTXR), up 10.03%

- Vanguard Industrials Index Fund (VINAX) , up 4.8%

- Fidelity® Select Semiconductors Portfolio (FSELX), up 4.72%

Losing

- First Eagle Gold Fund (FEGIX) , down -6.53%

- Sprott Gold Equity Fund (SGDLX), down -9.28%

- Aberdeen Standard Physical Palladium Shares ETF (PALL) , down -12.14%

- Aberdeen Standard Physical Platinum Shares ETF (PPLT), down -12.2%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietory system to scan through thousands of relevant mutual funds and ETFs. To ensure quality and adequate track record, the system places a minimum threshold on net assets of $100 million. Fund performance data is calculated for the trailing one month, based on change in NAV.

Here is a summary of different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.