Rising interest rates have increased borrowing costs for consumers and businesses. While tech companies helped the S&P 500 index lock in gains this year, many other sectors have experienced sharp declines. For instance, over the past 52 weeks, real estate, basic materials, energy, and utility sectors each fell by double-digit percentages.

In this edition, we look at trending Value Equity Funds you can leverage to better navigate the bear market and reduce risk.

Be sure to check out the Value Equity Funds page to explore all mutual funds, index ETFs, and active ETFs that can provide you exposure to this theme.

Top Performing Value Funds

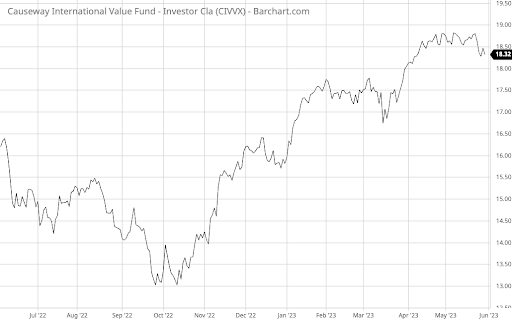

The Causeway International Value Fund (CIVVX) is the top-performing fund on our list, with a 15.2% return over the past 52 weeks. With a 1.13% net expense ratio and 1.29% yield, the fund is middle-of-the-road in cost and yield.

The $6.3 billion fund invests in companies in developed countries outside the U.S. that pay dividends or repurchase their shares. When building the portfolio, the fund managers use a bottom-up stock selection process based on fundamental research, focusing on mid- to large-cap value stocks capable of adding diversification to a U.S. portfolio.

Currently, the portfolio consists of 64 companies across the U.K. (27.3%), France (13.9%), Germany (9.0%), and other countries. These holdings have a weighted average market cap of $72.4 billion and span industrials (18.5%), financials (18.0%), healthcare (14.8%), consumer staples (12.8%), information technology (12.3%), and other sectors.

Source: BarChart.com.

2. Oakmark International Small Cap Fund (OAKEX)

The Oakmark International Small Cap Fund (OAKEX) comes in second place with a 10.7% return over the past 12 months. However, with a 1.34% expense ratio and a 1.19% yield, the fund is the highest cost option on today’s list.

While it also has an international twist, the $400 million fund focuses on small-cap companies. The fund managers identify growing international businesses at attractive prices. Then, after establishing a position, the managers patiently wait for the gap between the price and intrinsic value to close, with the goal of creating significant long-term value for shareholders.

Currently, the fund’s portfolio consists of 61 equities with a median market cap of about $3 billion. These companies are spread across the globe, including the U.K. (19.8%), Germany (11.8%), and Sweden (9.6%). In terms of sector diversification, the holdings span industrials (31.1%), financials (20.5%), consumer discretionary (11.6%), and other sectors.

Source: BarChart.com.

3. Capital Group Dividend Value ETF (CGDV)

The Capital Group Dividend Value ETF (CGDV) rounds out our list with a 5.21% return over the past 12 months. And with a 0.33% expense ratio and 1.49% yield, the fund is the lowest cost and highest-yielding option on our list.

With a focus on U.S. rather than international equities, the $2.2 billion fund seeks to produce consistent income that exceeds the average yield of the S&P 500. The fund managers focus on financially-strong companies capable of paying dividends across economic environments, meaning that most of its holdings qualify as value stocks as well.

Currently, the fund’s portfolio consists of 49 U.S.-focused equities with only 5.9% international exposure. These companies are concentrated in industrials (19.8%), information technology (16.3%), and healthcare (14.0%), including mainstream U.S. companies like General Electric Co. (5.8%), Broadcom Inc. (5.5%), and Microsoft Corp. (5.5%).

Source: BarChart.com.

The Bottom Line

All data as of May 26, 2023.

Methodology

MutualFunds.com analyzes the search patterns of our visitors every two weeks to find the top trending funds. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

First, we select the top trending theme from more than 200 themes listed on MutualFunds.com based on the percentage increase in monthly viewership. Then, we choose the top three funds with the highest one-year trailing total returns from the top trending theme. To ensure funds’ quality and staying power, we only look at those mutual funds with a minimum of $100 million in assets and a track record of at least one year.

We also remove those mutual funds closed to new investors and unavailable for investment outside registered accounts such as retirement or 529.

Fund performances are reported based on trailing 12-month total returns.