At the same time, rising interest rates have put pressure on many regional banks holding Treasuries on their balance sheet. Silicon Valley Bank’s collapse caused a short-lived acute crisis, but the long-term impact could manifest in less credit availability. And that could further increase the likelihood of a recession over the next year.

Within this macroeconomic backdrop, dividend funds offer a unique opportunity. Unlike bonds, stock prices of high quality dividend paying companies don’t necessarily move inversely to interest rates, so they could be insulated from further downside if rates continue to rise. Meanwhile, dividend stocks tend to be more financially stable compared to growth stocks, potentially buffering them during a market downturn.

At the same time, dividend stocks could help generate income in excess of inflation, enabling individuals relying on fixed-income to adapt to the rising cost of living. Many of the best dividend-paying opportunities exist in energy-focused Master Limited Partnerships (MLPs) and Real Estate Investment Trust (REITs). Both of these sectors generate income independent of the broader economy, creating a safer potential income stream.

In this edition, we look at trending Dividend Funds investors may want to consider to boost income and improve safety.

Be sure to check out the Dividend Funds page to learn more about the other funds within this investment theme as well.

Top Performing Dividend Funds

The MainGate MLP (AMLPX) comes in first place with a 9.06% return and 5.96% yield over the past 12 months. With a 1.69% expense ratio, the fund offers a middle-of-the-road dividend yield and expense ratio.

The $800 million fund invests in Master Limited Partnerships (MLPs). By identifying factors influencing an MLP’s distributed cash flow, the fund managers seek opportunities that minimize risk and maximize yield. Meanwhile, the fund’s diversified portfolio spreads risk across geographies, industries, and cap structures.

Currently, the fund’s portfolio consists of about 20 energy securities, including Western Midstream Partners LP (12.61%), Targa Resources Corp. (12.42%), MPLX LP Partnership Units (12.18%), and Energy Transfer LP (10.66%). These holdings have a lower price-earnings ratio and more substantial historical earnings growth than the category average.

Want to know more about portfolio rebalancing? Click here.

Source: BarChart.com.

2. Invesco SteelPath MLP Alpha Plus Fund (MLPLX)

The Invesco SteelPath MLP Alpha Fund (MLPLX) comes in second with an 8.70% return and 6.62% yield over the past 12 months. With a 2.64% expense ratio, the fund is the most expensive – but highest-yielding – option on our list.

Like the previous fund on our list, this $180 million fund invests in midstream MLPs, focused on processing, storing, and transporting hydrocarbons. The portfolio managers take a granular bottom-up approach focusing on stable cash flows and durability across various commodity-price environments.

Currently, the fund holds a concentrated portfolio of about 20 securities, including Equity Transfer (18.28%), Targa Resources (17.91%), MPLX (17.62%), Western Midstream Partners (17.53%), and Enterprise Product Partners (13.58%). The average price-earnings ratio is below the category average, but so is the long-term earnings and sales growth.

Find funds suitable for your portfolio using our free Fund Screener.

Source: BarChart.com.

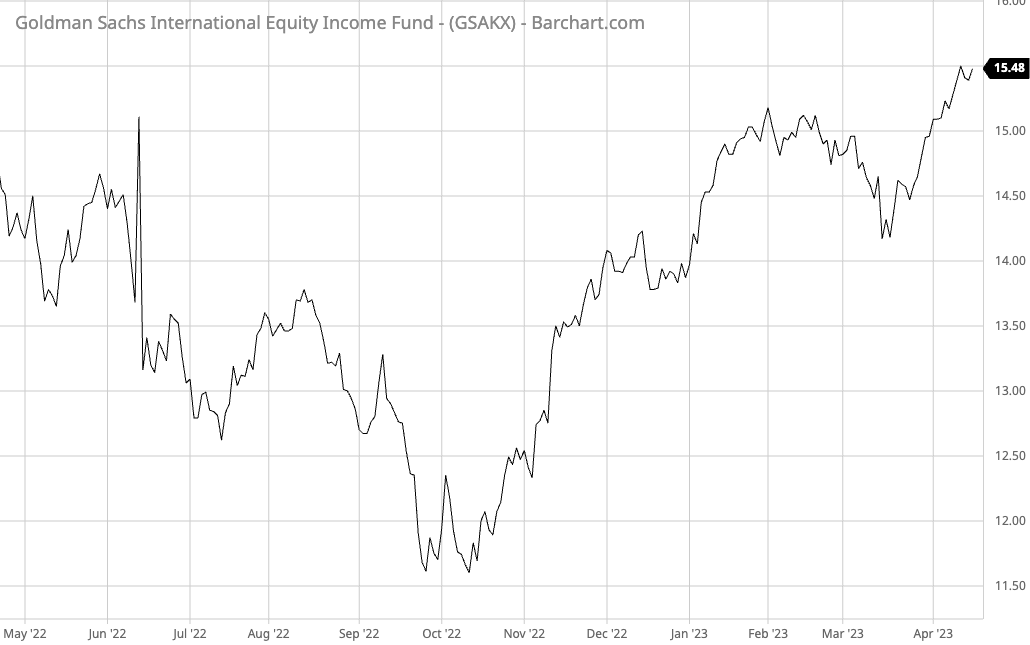

3. GS International Equity Income Fund (GSAKX)

The GS International Equity Income Fund (GSAKX) comes in third place with a 5.55% return and a 1.84% yield over the past 12 months. With a 1.19% expense ratio, the fund is the cheapest option but also the lowest-yielding fund on our list.

As its name suggests, the $780 million fund invests in international equities with an income focus. But unlike many international funds, the managers focus on companies rather than countries, building the portfolio one company at a time. At the same time, they try to balance yield with quality to reduce volatility while maximizing income.

Currently, the portfolio consists of 37 securities located primarily in Europe (78.3%) and weighted toward financials (23.1%), consumer staples (15.1%), health care (12.8%), and industrials (10.9%). The largest holdings include names like Koninklijke (4.1%), Nestle SA (3.9%), Shell plc (3.7%), and Rio Tinto plc (3.5%).

Learn more about different Portfolio Management concepts here.

Source: BarChart.com.

The Bottom Line

Want to generate high income without undertaking too much risk? Check out our complete Best High Dividend Model Portfolio.

All data as of April 17, 2023.

Methodology:

MutualFunds.com analyzes the search patterns of our visitors every two weeks to find the top trending funds. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

First, we select the top trending theme from more than 200 themes listed on MutualFunds.com based on the percentage increase in monthly viewership. Then, we choose the top three funds with the highest one-year trailing total returns from the top trending theme. To ensure funds’ quality and staying power, we only look at those mutual funds with a minimum of $100 million in assets and a track record of at least three years.

We also remove those mutual funds closed to new investors and unavailable for investment outside registered accounts such as retirement or 529.

Fund performances are reported based on trailing 12-month total returns.