First, we select the top trending category from more than 200 categories listed on MutualFunds.com based on the percentage increase in monthly viewership. Then, we choose the top three funds with the highest one-year trailing total returns from the top trending category. To ensure funds’ quality and staying power, we only look at those mutual funds with a minimum of $100 million in assets and a track record of at least three years. We also remove those mutual funds closed to new investors and unavailable for investment outside registered accounts such as retirement or 529. Fund performances are reported based on trailing 12-month total returns.

Many fixed-income investors seek the right combination of value and credit quality. With high inflation and a potential recession on the horizon, corporate bonds have become riskier, particularly with their tight credit spreads. However, government-supported mortgage-backed securities (MBS) trade at compelling yields with a near-zero convexity, offering attractive yields with less interest rate risk.

Of course, some recent weakness in MBS stems from the SVB-led banking crisis. Many investors expect the FDIC to sell off its MBS holdings over the coming months, while other struggling regional banks could do the same to clean up their balance sheets. But for investors, the sell-off could create bargains in a market where credit quality isn’t an issue. As a result, investors may want to consider MBS funds.

In this edition, we look closely at trending Mortgage-Backed Funds investors may want to consider for their fixed-income allocations.

Be sure to check out the Mortgage-Backed Funds page to learn more about the other funds in this category as well.

Trending Funds

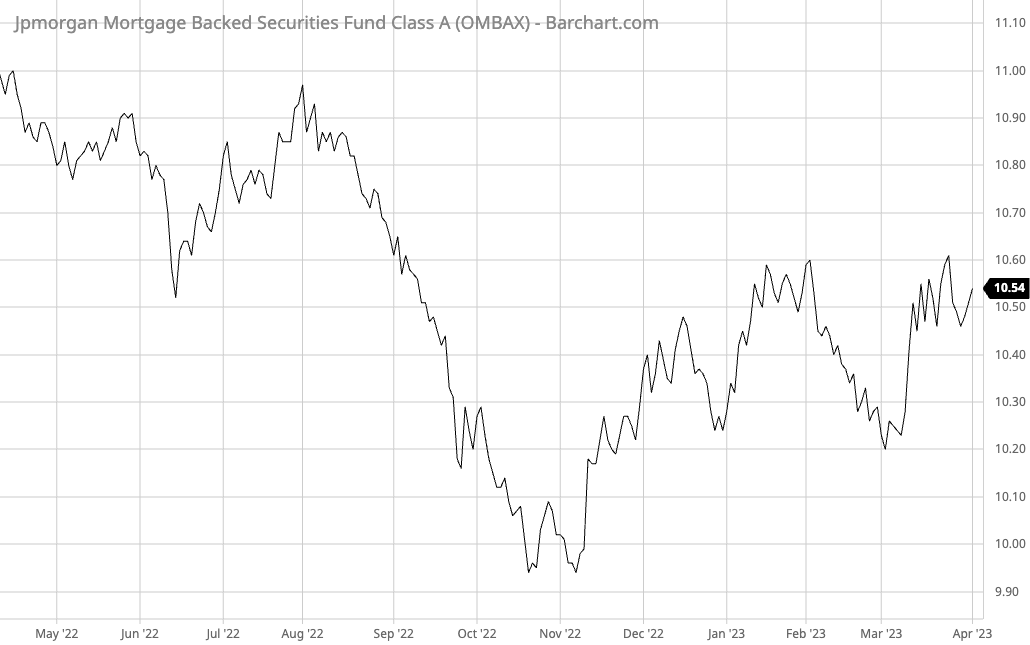

The JPMorgan Mortgage-Backed Securities Fund (OMBAX) comes in first place with a -3.55% return over the past 12 months. With a 0.65% expense ratio and a 2.26% yield, the fund is middle-of-the-road in terms of expense and yield on today’s list.

The $4 billion fund holds a debt securities portfolio backed by agency and non-agency residential and commercial mortgage pools. As an active fund, the managers seek market sectors and individual securities that it believes will perform well over time. The goal is to enhance long-term, risk-adjusted financial returns.

Currently, the portfolio consists of about 2,200 securities with an average duration of 5.57 years and a 4.94% net yield to maturity. The portfolio includes 70% agency mortgages, 12% non-agency mortgages, 11.5% Treasuries, and 10% commercial mortgage-backed securities. And from a credit standpoint, nearly 80% is AAA, and about 9% is BBB.

Want to know more about portfolio rebalancing? Click here.

Source: Barchart.com.

2. Voya GNMA Income Fund (LEXNX)

The Voya GNMA Income Fund (LEXNX) comes in second place with a -4.69% return over the past 12 months. With a 0.84% expense ratio and 2.47% yield, the fund is the most expensive on today’s list.

The $1.3 billion fund invests in Ginnie Mae (GNMA) securities, which are historically the highest-yielding securities backed by the U.S. government. By investing in maturities of more than one year, the fund managers seek to deliver attractive income and return capable of withstanding the impact of volatile interest rates and mortgage prepayments.

Currently, the fund’s portfolio of about 860 securities has an average duration of 6.48 years. Moreover, unlike the previous fund, these holdings are almost entirely AAA-rated, making them more suitable as a Treasury substitute within an asset allocation.

Find funds suitable for your portfolio using our free Fund Screener.

Source: Barchart.com.

3. Vanguard Mortgage-Backed Securities Index Fund (VMBSX)

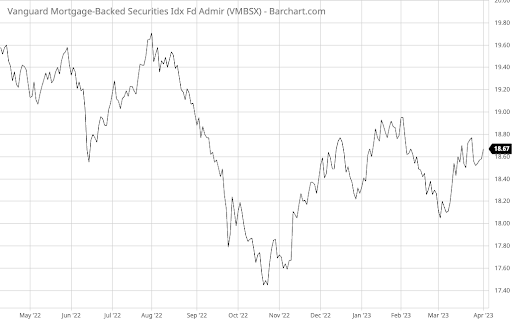

The Vanguard Mortgage-Backed Securities Index Fund (VMBSX) comes in third place with a -4.75% return over the past 12 months. With a 0.07% expense ratio and 2.53% yield, the fund is the cheapest and highest-yielding option on today’s list.

The $15.6 billion fund invests in a broad range of mortgage-backed securities, including GNMA, FNMA, and FHLMC securities. As an index fund, VMBSX may keep costs lower and provide broad exposure, but managers may be less able to react to market changes.

Currently, the portfolio holds about 1,000 securities with a 7.1-year average duration and a 4.5% average yield to maturity. The portfolio is split about evenly between 5-10 year maturities and 10-15 year maturities with a 4.7% allocation to 1-5 year securities.

Learn more about different Portfolio Management concepts here.

Source: Barchart.com.

The Bottom Line

Want to generate high income without undertaking too much risk? Check out our complete Best High Dividend Model Portfolio.

All data as of March 29, 2023.