First, we select the top trending category from more than 200 categories listed on MutualFunds.com based on the percentage increase in monthly viewership. Then, we choose the top three funds with the highest one-year trailing total returns from the top trending category. To ensure funds’ quality and staying power, we only look at those mutual funds with a minimum of $100 million in assets and a track record of at least three years. We also remove those mutual funds closed to new investors and unavailable for investment outside registered accounts such as retirement or 529. Fund performances are reported based on trailing 12-month total returns.

In this edition, we look closely at trending Small-Cap Growth Equity Funds for investors.

The S&P 500 index posted a respectable year-to-date increase of approximately 5.3%, but the S&P 600 Small Cap index has outperformed with a 6.7% return. This trend has resulted in a net inflow of $4.2 billion into small-cap U.S. mutual funds and ETFs, making it the second most popular choice after international stock funds. One of the main attractions for investors is the comparatively modest valuations of the S&P 600, which is currently trading at 13.8x earnings in contrast to the S&P 500’s 17.6x earnings. Moreover, many of these companies have been buying back their own stock, which could help close the valuation gap.

Be sure to check out the Small-Cap Growth Equity Funds page to learn more about the other funds in this category as well.

Trending Funds

The Kinetics Small Cap Opportunities Fund (KSCOX) comes in first place with a 16.07% return over the past 12 months. With a 1.64% expense ratio and no yield, the fund is the most expensive option on today’s list.

The $450 million fund invests in fundamentally undervalued small-cap companies with the potential to expand to higher valuations through revaluation, growth, or a combination of the two. In particular, the fund managers target companies with substantial barriers to entry, long product lifecycles, and sound capital structures.

As of December 31, 2022, the fund held more than half of its assets (51%) in Texas Pacific Land Corp. (TPL), which moved sharply higher through December 2022 before turning lower in early 2023. The fund’s other significant positions included Civeo Corp. (4.4%), CACI International Inc. (3.6%), and DREAM Unlimited Corp. (3.4%).

Want to know more about portfolio rebalancing? Click here.

Source: Barchart.com.

2. Oberweis Micro-Cap Fund (OBMCX)

The Oberweis Micro-Cap Fund (OBMCX) comes in second place with a 13.80% trailing 12-month return. With a 1.48% expense ratio and no yield, the fund is in the middle of the road when it comes to expenses.

The $230 million fund invests in microcap stocks with improving growth characteristics. In particular, the fund managers screen for positive earnings surprises and revisions, employ a 17-step fundamental research process to find attractive opportunities, and build a diversified (low-correlation) portfolio of between 60 and 120 stocks.

As of December 31, 2022, the fund was most heavily weighted in information technology (31.5%), producer durables (18.5%), healthcare (14.0%), and consumer discretionary (12.1%). The most significant holdings include Axcelis Technologies (4.1%), Aehr Test Systems (3.8%), Veritiv Corp. (2.8%), and Lantheus Holdings Inc. (2.2%).

Find funds suitable for your portfolio using our free Fund Screener.

Source: Barchart.com.

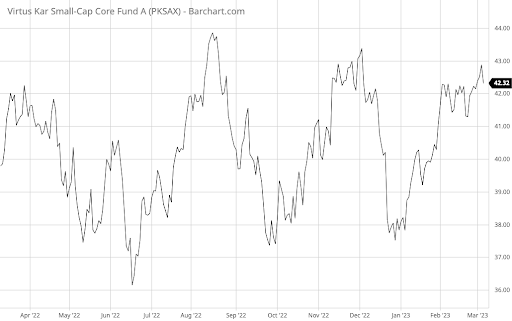

3. Virtus KAR Small-Cap Core Fund (PKSAX)

The Virtus KAR Small-Cap Core Fund (PKSAX) comes in third place with an 11.80% trailing 12-month return. With a 1.25% expense ratio and a 0.16% yield, the fund is the least expensive and highest-yielding option on today’s list.

The five-star $1.1 billion fund seeks to generate attractive risk-adjusted long-term returns by investing in small-cap stocks with durable competitive advantages, excellent management, lower financial risk, and strong growth trajectories.

As of December 30, 2022, the fund held a concentrated portfolio weighted toward industrials (41.89%), financials (25.00%), and information technology (13.03%). The most significant holdings include EMCOR Group Inc. (6.75%), FTI Consulting Inc. (6.64%), Simpson Manufacturing Co. Inc. (5.19%), and Primarica Inc. (5.12%).

Learn more about different Portfolio Management concepts here.

Source: Barchart.com.

The Bottom Line

Want to generate high income without undertaking too much risk? Check out our complete Best High Dividend Model Portfolio.

All data as of March 1, 2023.