First, we select the top trending category from more than 200 categories listed on MutualFunds.com based on the percentage increase in monthly viewership. Then, we choose the top three funds with the highest one-year trailing total returns from the top trending category. To ensure a fund’s quality and staying power, we only look at mutual funds with a minimum of $100 million in assets and a track record of at least three years. We also remove mutual funds closed to new investors and unavailable for investment outside registered accounts such as a retirement or a 529 plan.

In this edition, we look closely at trending Floating Rate Corporate Bond Funds, which typically hold bank loans and similar assets. These assets are somewhat more resistant to principal risk thanks to collateral backing the loans, while the floating rate coupon helps mitigate some interest rate risk. As a result, they may provide a compelling option in today’s market, characterized by high interest rate and credit risk.

Be sure to check out the Floating Rate Corporate Bond Funds page to find out more about the other funds in this category as well.

Trending Funds

The Payden Floating Rate Fund (PYFRX) comes in first place with a 0.70% return over the trailing 12-month period. With a 0.72% expense ratio and 5.08% yield, the fund is the cheapest and highest-yielding fund on today’s list.

The fund managers focus on opportunistic exposure to short-term, high-yield corporate issues. In particular, they focus on BB and high single-B-rated loans to balance risk and yield. With about $150 million in net assets, the fund is small enough to buy loans and get meaningful new issuance allocations – a challenge for larger funds.

Currently, the fund holds about 80% of its portfolio in bank loans, 10% in corporate bonds, and the remainder in asset-backed securities and cash. The largest holdings include issuers like Tropicana, Scientific Games International and Aggreko. In terms of credit risk, approximately 46% of these bonds are BB-rated and 35% are B-rated.

Want to know more about portfolio rebalancing? Click here.

Source: Barchart.com.

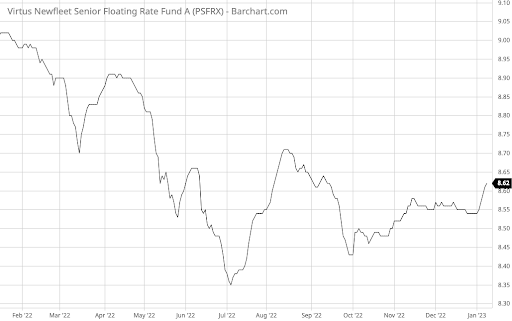

2. Virtus Newfleet Senior Floating Rate Fund (PSFRX)

The Virtus Newfleet Senior Floating Rate Fund (PSFRX) comes in second with a 0.22% loss over the past 12 months. With a 0.94% expense ratio and a 4.58% yield, the fund stands in the middle of the road in terms of yield and expense.

The fund managers apply a disciplined, time-tested investment process focused on managing risk and capturing valuation opportunities with strong income attributes. In particular, they leverage a top-down and bottom-up analysis, evaluating relative industry attractiveness and individual security and company credit risk.

Currently, the portfolio consists primarily of bank loans spread across various sectors, including information technology (13.19%), healthcare (10.91%), services (9.00%) and manufacturing (6.10%). The fund managers also hold a sizable 8.80% cash position, citing the lack of compensation by lower-rated credits in the current environment.

Find funds suitable for your portfolio using our free Fund Screener.

Source: Barchart.com.

3. Fidelity Advisor Floating Rate High Income Fund (FFRAX)

The Fidelity Advisor Floating Rate High Income Fund (FFRAX) comes in third place with a 0.44% drop over the past 12 months. With a 0.97% expense ratio and 4.75% yield, the fund is the highest-cost option on today’s list.

The fund managers employ a diversified leveraged loan strategy focused on investing primarily in loans that banks have made to non-investment grade companies. In particular, they seek companies with strong balance sheets and collateral coverage, high free cash flow, manageable capital structures and improving credit profiles.

Currently, the fund’s portfolio consists primarily of term and revolving loans with B (59.73%), BB (23.35%) and NR (10.53%) credit profiles. Some of the fund’s largest holdings include Great Outdoors Group, Asurion, Caesars Resort Collection, IntelSat Jackson Holdings and AthenaHealth Group Inc., which account for 7.82% of the portfolio value.

Learn more about different Portfolio Management concepts here.

Source: Barchart.com.

The Bottom Line

Want to generate high income without undertaking too much risk? Check out our complete Best High Dividend Model Portfolio.

All data as of January 5, 2023.