First, we select the top trending category from more than 200 categories listed on MutualFunds.com based on the percentage increase in monthly viewership. Then, we choose the top three funds with the highest one-year trailing total returns from the top trending category. To ensure funds’ quality and staying power, we only look at those mutual funds with a minimum of $100 million in assets and a track record of at least three years. We also remove those mutual funds closed to new investors and unavailable for investment outside registered accounts such as retirement or 529.

In this edition, we look closely at trending Connecticut Municipal Bond Funds. Municipal bonds have been a bright spot in the battered bond market. In recent weeks, some muni bonds have offered an 8% taxable equivalent yield and a 1.35 yield ratio to Treasuries. These levels haven’t been seen since the Taper Tantrum in 2013, making the asset class worth a second look for income-focused investors. And in particular, Connecticut residents may want to check out the bonds on today’s list.

Be sure to check out the Connecticut Municipal Bond Funds page to find out more about the other funds in this category as well.

Trending Funds

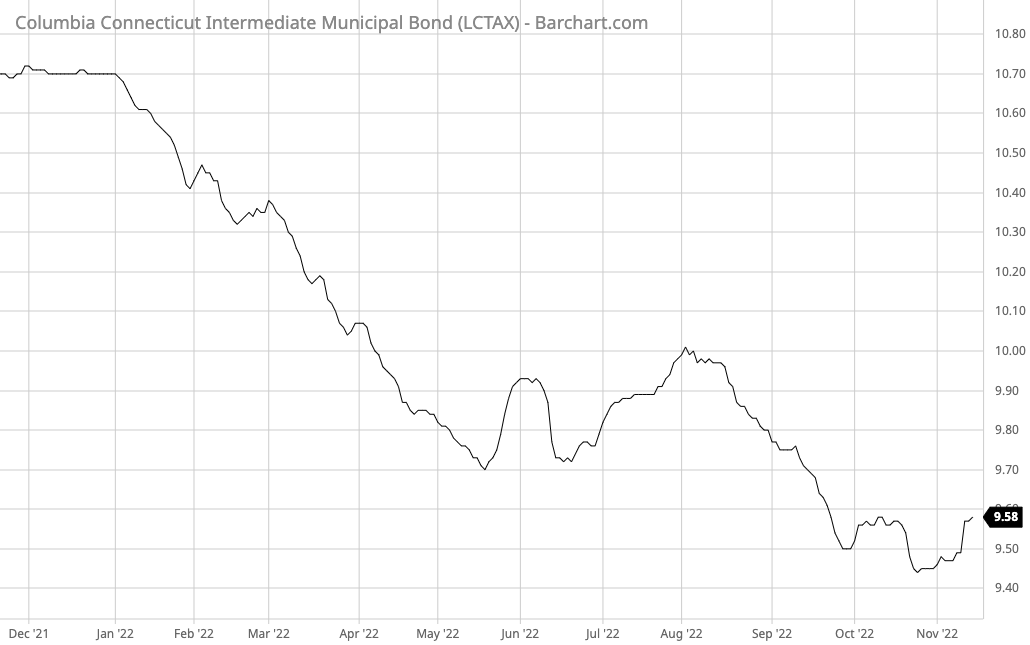

The Columbia Connecticut Intermediate Municipal Bond Fund (LCTAX) took first place with an 8.8% decline over the past 12 months. And with a 0.81% expense ratio and 2.12% yield, the fund sits in the middle of the road regarding cost and yield.

The fund seeks to generate income exempt from federal and Connecticut income tax. The portfolio managers rely on fundamental credit research and a bottom-up security selection process to uncover attractive investment opportunities. And these opportunities tend to be in the intermediate portion of the yield curve, lowering interest rate risk.

The fund holds nearly 80 municipal bonds in its portfolio, making it the most concentrated fund on our list. Currently, its most significant holdings include general obligation bonds (24%), hospital revenue bonds (11.8%), and education revenue bonds (10.6%). And in terms of credit quality, about 88% of these bonds are rated A or higher.

Want to know more about portfolio rebalancing? Click here.

Source: Barchart.com.

2. Eaton Vance Connecticut Municipal Income Fund (ETCTX)

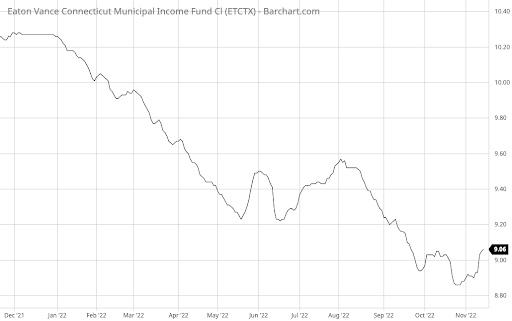

The Eaton Vance Connecticut Municipal Income Fund (ETCTX) comes in second place with a 10.01% drop over the trailing 12-month period. And with a 0.69% expense ratio and a 2.47% yield, the fund offers the highest yield on today’s list.

The fund provides exposure to the Connecticut municipal bond market, seeking to provide shareholders with current income exempt from federal income tax and state personal income tax. The portfolio managers apply a proprietary credit research process to build their portfolios, focusing on intermediate-duration bonds to limit interest rate risk.

The fund holds over 100 bonds, making it more diverse than the previous fund, although it has a relatively high 31% turnover. Currently, its most prominent holdings include general obligations bonds (29.36%) and education-focused revenue bonds (20.62%). And in terms of credit quality, about 86% of the portfolio is in A or higher-rated bonds.

Find funds suitable for your portfolio using our free Fund Screener.

Source: Barchart.com.

3. Fidelity Connecticut Municipal Income Fund (FICNX)

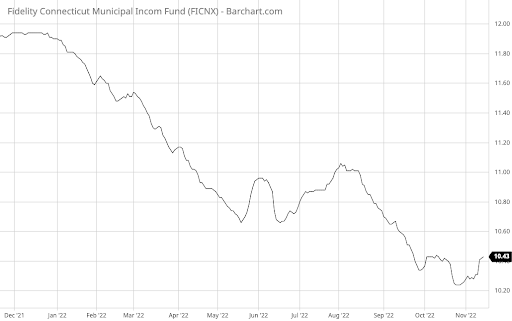

The Fidelity Connecticut Municipal Income Fund (FICNX) comes in third place with a 10.57% drop over the past 12 months. And with a 0.48% expense ratio and 2.37% yield, the fund is the cheapest option on today’s list.

The fund seeks a high level of current income exempt from federal income tax and Connecticut personal income tax. The portfolio managers invest at least 80% of assets in investment-grade muni securities and engage in transactions that have a leveraging effect on the fund. And like the other funds on today’s list, they focus on intermediate-duration bonds.

The fund holds a portfolio of just over 400 bonds, making it the broadest portfolio on today’s list. Currently, the portfolio consists of 49% general obligations bonds and 42% revenue bonds. Within the revenue bond segment, the fund focuses on healthcare (15.3%), higher education (14.4%), and special taxes (9.9%).

Learn more about different Portfolio Management concepts here.

Source: Barchart.com.

The Bottom Line

Want to generate high income without undertaking too much risk? Check out our complete Best High Dividend Model Portfolio.