First, we select the top trending category from more than 200 categories listed on MutualFunds.com based on the percentage increase in monthly viewership. Then, we choose the top three funds with the highest one-year trailing total returns from the top trending category. To ensure funds’ quality and staying power, we only look at those mutual funds with a minimum of $100 million in assets and a track record of at least three years. We also remove those mutual funds closed to new investors and not available for investment outside registered accounts such as retirement or 529.

In this edition, we take a closer look at trending Target Date 2045 Funds for investors.

Target date retirement funds are an excellent all-in-one option for retirement portfolios. They generally follow a predetermined glide path from aggressive equity to conservative fixed income as retirement approaches. After the target retirement date, they prioritize maximizing current income above capital appreciation.

Be sure to check out the Target Date 2045 Funds page to find out more about the other funds in this category as well.

Trending Funds

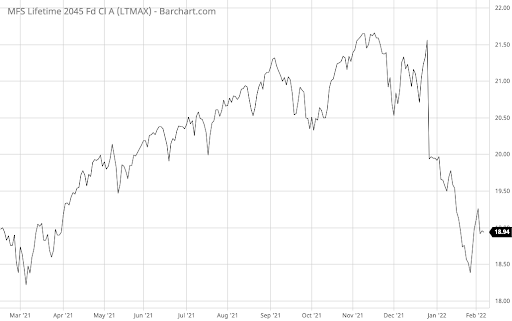

The MFS® Lifetime® 2045 Fund (LTMAX) comes first on this week’s list. It provided an exceptional trailing one-year return of 13.61% with a 0.83% expense ratio and a 4.98% yield, making it the top-performing and highest yielding fund on the list.

The fund seeks a high level of total return consistent with its asset allocation until the approximate retirement year 2045. After that date, the fund will seek total return through a combination of current income and capital appreciation.

Joseph Flaherty, Jr. and Natalie Shapiro manage the fund alongside a team of quantitative professionals. Mr. Flaherty has nine years with the portfolio, whereas Ms. Shapiro has three years.

The fund’s portfolio consists of 56.38% U.S. stocks, 27.00% international stocks, 9.75% specialty securities, and 6.88% bonds. Within the fixed income portfolio, the fund holds 37.22% U.S. government bonds, 20.71% BBB-rated debt, and 11.16% A-rated debt. The fund’s equity portfolio is concentrated in information technology (19.50%), industrials (12.82%), and financials (12.5%) with a median market cap of $38.9 billion.

Want to know more about portfolio rebalancing? Click here.

Source: Barchart.com.

2. Mutual of America 2045 Retirement Fund (MURMX)

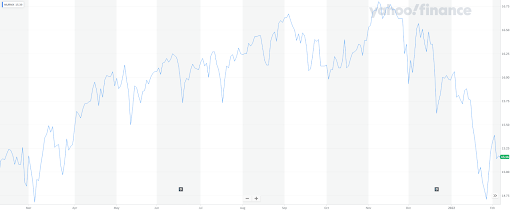

The Mutual of America 2045 Retirement Fund (MURMX) comes in second. It offered a 10.89% trailing one-year return, 0.34% expense ratio, and a 1.82% yield, making it the cheapest and lowest yielding fund on the list.

The fund is designed for investors expecting to retire or begin withdrawing assets around 2045. Under normal circumstances, the asset allocation changes over time based on a predetermined glide path as it approaches the retirement date. The fund can have 45% (+/- 10%) of its assets in equity funds at its target date.

Joseph R. Gaffoglio and Jamie A. Zendel co-manage the fund. Mr. Gaffoglio has eight years in strategy and 14 years of industry experience, serving as Executive Vice President of Mutual of America. Ms. Zendel has one year of experience in strategy and eight years of industry experience, serving as VP of Mutual of America.

The fund’s portfolio consists of 86% equity funds and 14% fixed income funds. These funds hold 68.86% U.S. equities, 17.95% international equities, and 11.67% fixed income products. Within the equity portfolio, the fund has exposure to 18.89% technology, 15.12% financial services, 12.65% healthcare, and 12.33% industrials.

Find funds suitable for your portfolio using our free Fund Screener.

Source: Yahoo Finance

3. MassMutual RetireSMART by JPMorgan 2045 Fund (MMKAX)

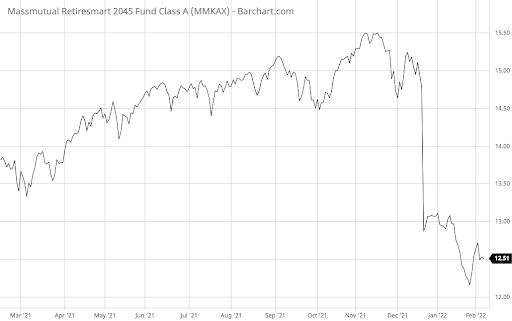

The MassMutual RetireSMART by JPMorgan 2045 Fund (MMKAX) rounds out the list. It provided a 9.99% trailing one-year return, a 1.10% expense ratio, and a 2.23% yield, making it the most expensive and lowest returning fund on the list.

The fund seeks total return through asset allocation, which becomes more conservative over time. As the fund approaches its target retirement date, its objectives shift to seeking current income and some capital appreciation. Most of the fund’s assets are invested in underlying funds managed by JPMorgan, MML Advisors, or their affiliates.

Frederick Schulitz, Daniel Oldroyd, and Silvia Trillo co-manage the fund. Mr. Schulitz has the longest tenure at 11.8 years and serves as Investment Director and Portfolio Manager. Before joining MassMutual, Mr. Schulitz held Director positions at Prudential Retirement and ING.

The fund has 54.89% exposure to U.S. equities, 38.24% exposure to international equities, and 4.73% exposure to fixed income. Within its equity portfolio, the fund has 16.06% exposure to technology, 15.5% exposure to financial services, and 13.05% exposure to healthcare.

Learn more about different Portfolio Management concepts here.

Source: Barchart.com

The Bottom Line

Want to generate high income without undertaking too much risk? Check out our complete list of Best High Yield Stocks.

Note: Data as of February 3, 2022.