First, we select the top trending category from more than 200 categories listed on MutualFunds.com based on the percentage increase in monthly viewership. Then, we choose the top three funds with the highest one-year trailing total returns from the top trending category. To ensure funds’ quality and staying power, we only look at those mutual funds with a minimum of $100 million in assets and a track record of at least three years. We also remove those mutual funds closed to new investors and not available for investment outside registered accounts such as retirement or 529.

In this edition, we take a closer look at trending Micro-Cap Equity Funds for investors.

The S&P 500 rose nearly 27% last year, marking a stellar year for the markets, but the Russell Microcap Value Index rose an even greater 38%. Despite the outperformance, micro-cap stocks continue to trade at more reasonable valuations than their larger counterparts. For instance, the Russell Microcap Index has a price-book value of 2.17x and a forward P/E of 14.04x compared to 4.6x and 23.93x for the Russell 2000 index. As a result, investors may want to take a closer look at micro-cap stock funds.

Our breakdown of each fund includes vital aspects, such as one-year performance, performance from inception, fund expenses, investment strategy, and management team’s profile, to give you an overview of how these funds hold up against their peers.

Be sure to check out the Micro-Cap Equity Funds page to find out more about the other funds in this category as well.

Trending Funds

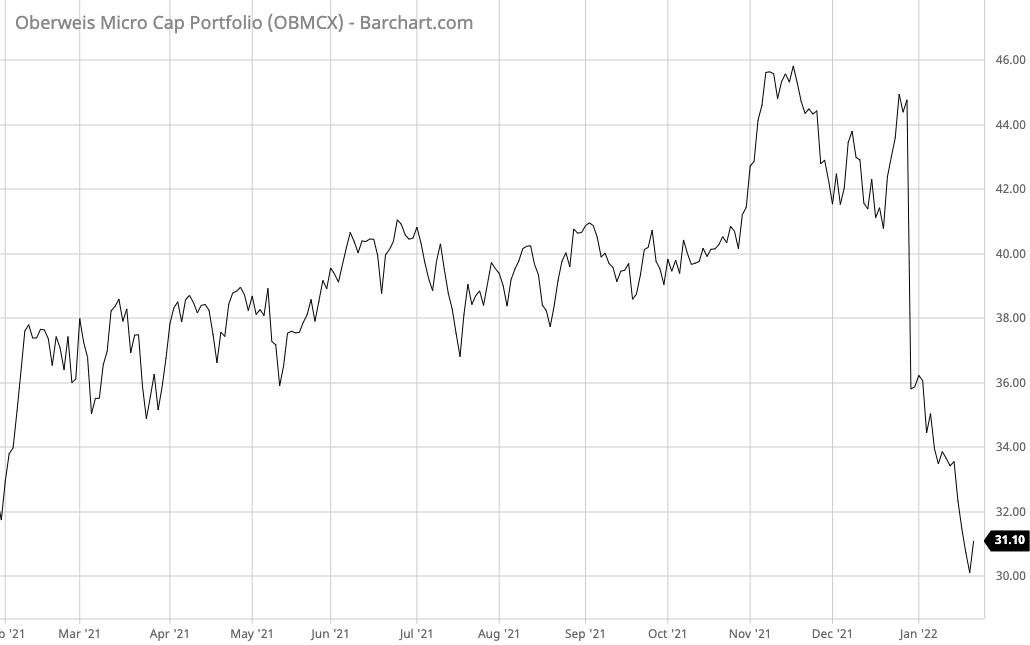

The Oberweis Micro-Cap Fund (OBMCX) comes first on this week’s list. It provided an exceptional trailing one-year return of 14.73% with a 1.59% expense ratio and no yield, making it the top performing fund on the list with a middle-of-the-road expense ratio.

The fund invests at least 80% of its net assets in securities in micro-cap growth stocks with significant positive earnings surprises or positive earnings estimate revisions, suggesting upside potential. Then, after employing a disciplined 17-step fundamental research process, the fund selects a conviction-weighted portfolio of 60 to 120 stocks.

A team of six portfolio managers runs the fund, but James W. Oberweis and Kenneth S. Farsalas are the two primary managers with an average tenure of 13.4 years. Mr. Oberweis, CFA, MBA, has over 20 years of experience with the fund and serves as President of the larger Oberweis Asset Management business.

The fund’s portfolio consists of about 80 micro-cap companies diversified across multiple industries, including Information Technology (31.4%), Consumer Discretionary (24.5%), Producer Durables (17.6%), and Healthcare (13.2%). The largest holdings are Axelis Technologies (3.3%), Veritiv Corp. (2.7%), and ChannelAdvisor Corporation (2.4%).

Want to know more about portfolio rebalancing? Click here.

Source: Barchart.com.

2. Royce Micro-Cap Fund (RYOTX)

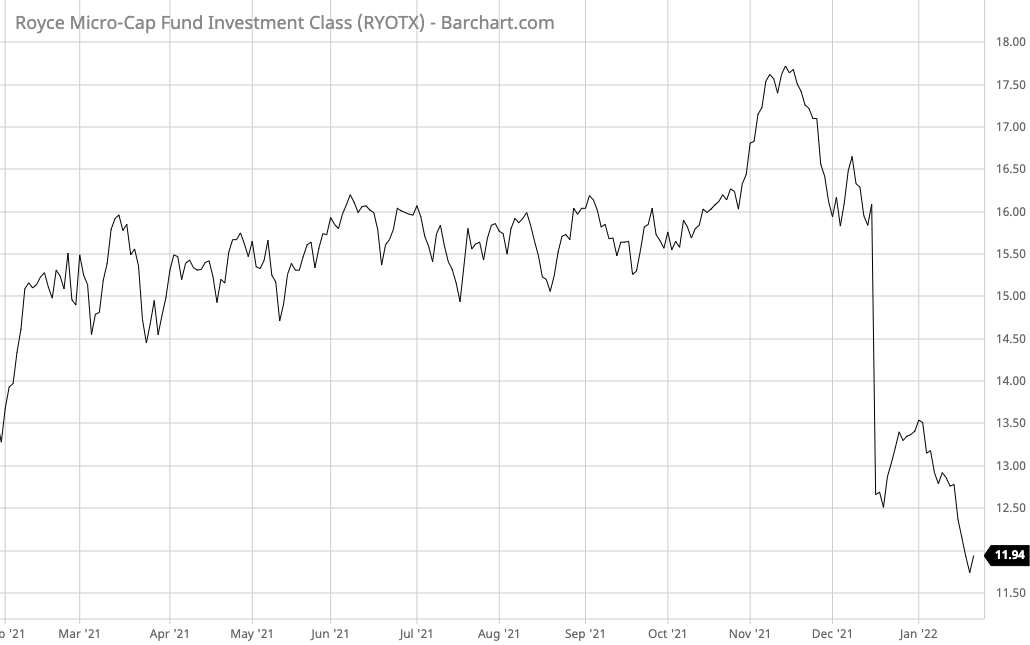

The Royce Micro-Cap Fund (RYOTX) comes in second place. It offered a 5.54% trailing one-year return, 1.24% expense ratio, and no yield, making it the least expensive fund on the list.

The fund is one of the oldest open-end funds dedicated to investing in micro-cap stocks with solid fundamentals or selling at prices that don’t reflect their potential. Over the past one-, three-, five-, and 20-year periods, the fund outperformed the Russell Microcap Index with a 91% active share.

Brendan Hartman and Jim Stoeffel co-manage the fund with eight and six years of experience, respectively. Mr. Hartman and Mr. Stoeffel previously co-founded and managed a hedge fund for Rebus Partners.

The fund’s portfolio consists of about 130 securities diversified across Information Technology (25.4%), Industrials (23.4%), Financials (12.6%), Health Care (12.2%), and Consumer Discretionary (12%). The most prominent positions include Photronics (1.2%), Citi Trends (1.2%), B. Riley Financial (1.2%), and Axcelis Technologies (1.2%).

Find funds suitable for your portfolio using our free Fund Screener.

Source: Barchart.com.

3. Wasatch Micro Cap Value Fund (WAMVX)

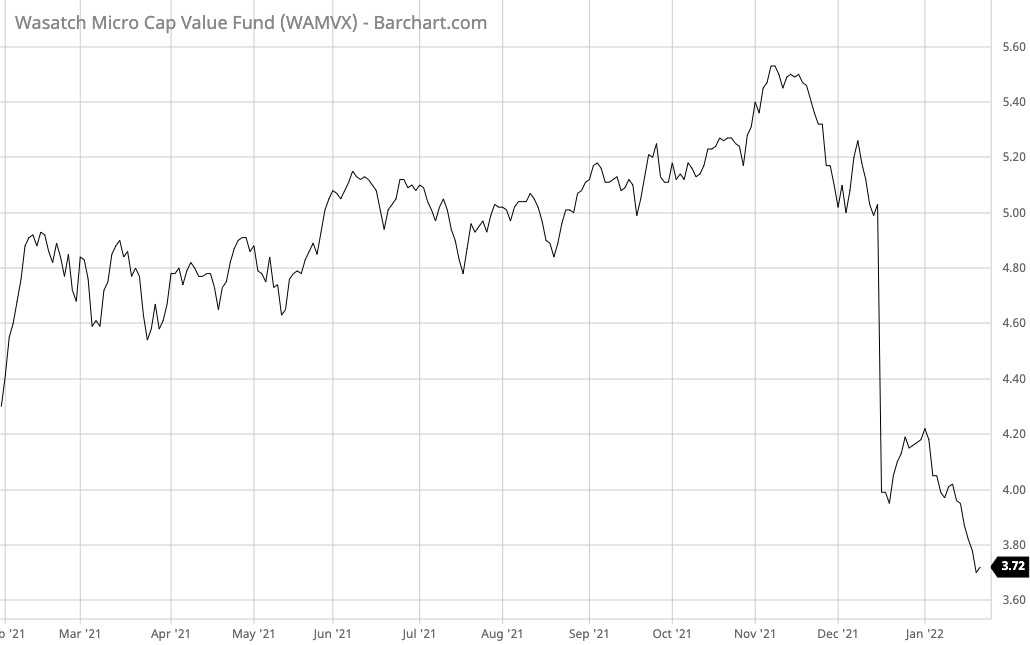

The Wasatch Micro Cap Value Fund (WAMVX) rounds out the list. It provided a 4.86% trailing one-year return with a 1.74% expense ratio and no yield, making it the most expensive fund on the list.

The fund seeks out undervalued micro-cap companies with future growth potential, including both multiple expansion and earnings growth. In particular, the management team seeks out undiscovered growth, value momentum, graduating class, and fallen angel micro-cap stocks.

Brian Bythrow manages the fund with 18 years of experience at the helm.

The fund’s portfolio consists of about 90 stocks diversified across Information Technology (25%), Industrials (19.3%), Financials (17.2%), Health Care (12.9%), and Consumer Discretionary (11.9%). The most significant holdings include JDC Group AG (2.8%), Skyline Champion Corp. (2.1%), and Full House Resorts Inc. (1.6%).

Learn more about different Portfolio Management concepts here.

Source: Barchart.com.

The Bottom Line

Want to generate high income without undertaking too much risk? Check out our complete list of Best High Yield Stocks.

Note: Data as of January 20, 2022.