First, we select the top trending category from more than 200 categories listed on MutualFunds.com based on the percentage increase in monthly viewership. Then we choose the top three funds with the highest one-year trailing total returns from the top trending category. To ensure a fund’s quality and staying power, we only look at mutual funds with a minimum of $100 million in assets and a track record of at least three years. We also remove mutual funds closed to new investors and not available for investment outside registered accounts such as retirement or 529s.

In this edition, we take a closer look at trending California Municipal Bond Funds for investors.

Municipal bonds provide a way for investors to earn tax-free interest income. With the Biden administration looking to raise taxes on the wealthy, these bonds have become increasingly popular for high net worth investors. California is the largest issuer of municipal bonds, making these funds one of the fastest-growing subsets of fixed income.

Our breakdown of each fund includes vital aspects, such as one-year performance, performance from inception, fund expenses, investment strategy and the fund’s management team’s profile, to give you an overview of how these funds hold up against their peers.

Be sure to check out the California Municipal Bond Funds page to find out more about the other funds in this category as well.

Trending Funds

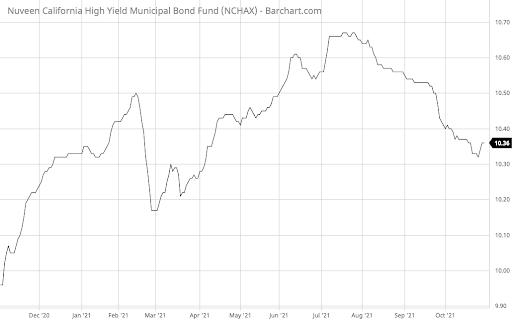

The number one fund on this week’s list is the Nuveen California High Yield Municipal Bond Fund (NCHAX). It provided an exceptional trailing one-year total return of 7.90% with a 1.09% expense ratio and 3.45% yield, making it the most expensive and highest-yielding fund on the list.

The fund primarily invests in muni bonds that pay interest exempt from federal and California personal income tax. In particular, the managers focus on high-yield bonds that offer attractive value in terms of yield, prices, credit quality, liquidity and future prospects. The fund also employs leverage through inverse floating rate securities issued in tender option bond transactions to enhance yield and duration.

The fund is managed by John V. Miller, CFA, who leads Nuveen’s municipal fixed income strategic direction and investment perspectives. Mr. Miller is a frequent guest on CNBC, Bloomberg Television and Fox Business News and quoted in the Wall Street Journal, Barron’s, Bloomberg News and Morningstar, and has a 16-year tenure.

The fund’s portfolio holds more than 760 bonds with an above-average duration of 11.25 years and an average credit rating of BB, making it higher yielding than the category average. As a result, investors may experience more interest rate and default risk, although the yields are significantly higher than the other funds on the list.

Want to know more about portfolio rebalancing? Click here.

Source: BarChart.com

2. BlackRock California Municipal Opportunities Fund (MDCMX)

The BlackRock California Municipal Opportunities Fund (MDCMX) comes in second place. It generated a one-year trailing return of 6.37% with a 0.58% expense ratio and a 1.76% yield, making it the lowest cost and lowest-yielding fund on the list.

The fund primarily invests in California muni bonds through a flexible investment approach that seeks to manage interest rate and credit risk while providing a compelling combination of attractive tax-advantaged income, returns and meaningful downside potential.

The fund is managed by five portfolio managers with an average tenure of 12.7 years. The longest-running fund manager is Walter O’Connor, CFA, a Managing Director and Co-Head of the Municipal Funds team who has been with the fund for nearly 30 years.

The fund’s portfolio consists of 300 bonds with an effective duration of 4.78 years and a 126% annual turnover. Unlike the previous fund, it holds bonds with an average credit rating of A, with 80% of its portfolio in AA-rated or higher bonds. The lower duration also means that the fund may be less sensitive to changes in interest rates.

Find funds suitable for your portfolio using our free Fund Screener.

Source: BarChart.com

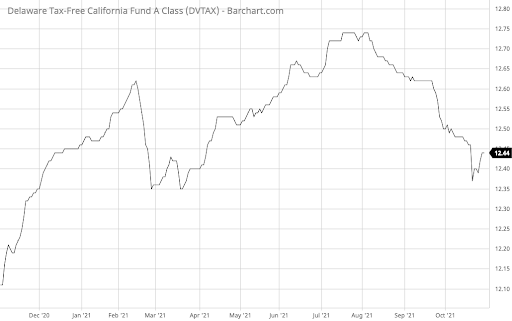

3. Delaware Tax-Free California Fund (DVTAX)

The Delaware Tax-Free California Fund (DVTAX) rounds out the list. It has a one-year trailing return of 5.46% with a 0.82% expense ratio and a 2.88% yield, putting it in the middle of the road in terms of expense and yield.

The fund’s experienced management team leverages a disciplined, bottom-up, research-driven process to power an income-driven, risk-controlled strategy.

The fund is managed by Greg Gizzi, Steve Czepiel and Jake van Roden, who have an average tenure of 9.1 years. Mr. Czepiel, Senior Vice President, Head of Municipal Bonds Portfolio Management and Senior Portfolio Manager, is the longest-running manager with a 14-year tenure.

The fund holds just over 150 bonds with an average duration of 5.54 years and an average credit rating of BB. As a result, the fund offers an attractive yield comparable to the first fund on our list with the lower interest rate risk of the second fund.

Learn more about different Portfolio Management concepts here.

Source: BarChart.com

The Bottom Line

Want to generate high income without undertaking too much risk? Check out our complete list of Best High Yield Stocks.

Note: Data as of October 27, 2021.