First, we select the top trending category from more than 200 categories listed on MutualFunds.com based on the percentage increase in monthly viewership. From the top trending category, we select the top three funds with the highest one-year trailing total returns. To ensure the quality and staying power of funds, we only look at those mutual funds with a minimum of $250 million in assets and a track record of at least 1 year. We also remove those mutual funds that are closed to new investors and are not available for investment outside registered accounts such as retirement or 529 accounts.

In this week’s edition, we analyze the top three trending Commodity Funds. These types of funds specialize in commodities like agricultural goods or metals but do not take physical possession of these assets. Instead, they use derivative contracts in order to speculate on the increase or decrease in the value of various commodity prices. Funds may be mixed and invest in many different commodities or focused on one type.

The economy generally follows a pattern with stocks, bonds, interest rates and commodity prices. When stocks lag, bonds usually follow suit while interest rates conversely rise. Commodities do well when there’s high market volatility but interest rates aren’t high enough to justify heavy fixed income investing. With interest rates still relatively low, investor interest in commodities is rising quickly.

Our breakdown of each fund includes key aspects such as 1-year performance, fund expenses, investment style and management teams to give you an overview of how these funds hold up against their peers.

Be sure to check out the Commodity Funds page to find out more about the other funds in this category as well.

Trending Funds

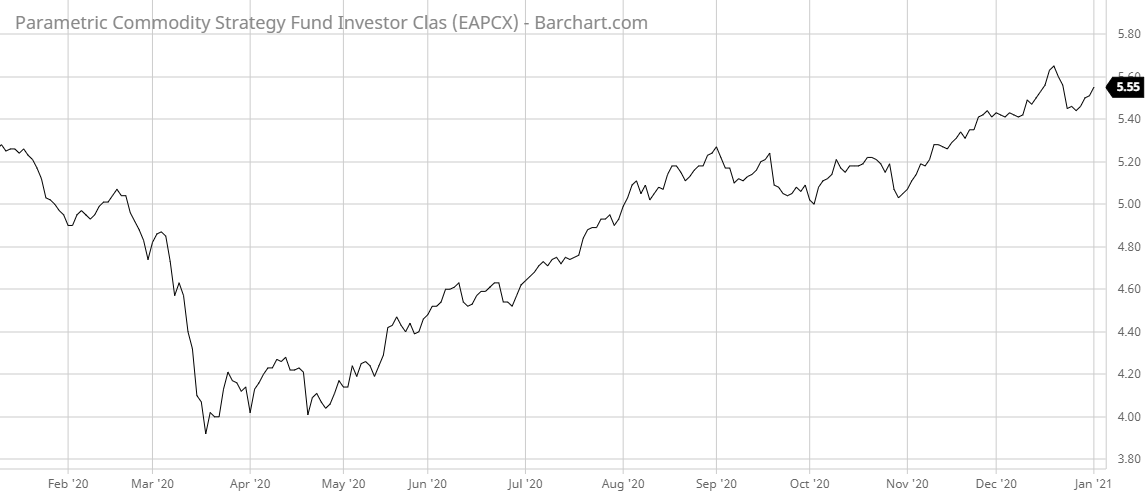

1. Eaton Vance Parametric Commodity Strategy Investor Fund (EAPCX)

Taking the number one spot on our list this week is Eaton Vance’s Parametric Commodity Strategy fund (EAPCX). It generated a trailing 1-year total return of 7.73%. It carries an expense ratio of 0.96%.

The investment strategy of the fund is to invest in commodity-linked derivatives which are backed by a portfolio of fixed-income securities. It uses assets such as commodity index-linked swap agreements, futures and commodity linked notes to gain exposure to commodities without having to take physical ownership. It uses the Bloomberg Commodity Index Total Return as its benchmark portfolio.

The primary portfolio manager of the fund is listed as Thomas C. Seto, who has been managing the fund since May 2011. He is assisted by Gregory J. Liebl, a portfolio manager who takes care of Parametric’s proprietary and non-discretionary commodity strategies.

The top five weights in the fund’s commodity portfolio are agriculture 26.66%, energy 25.32%, industrial metals 24.64%, precious metals 17.05% and livestock 6.30%.

Learn more about different Portfolio Management concepts here.

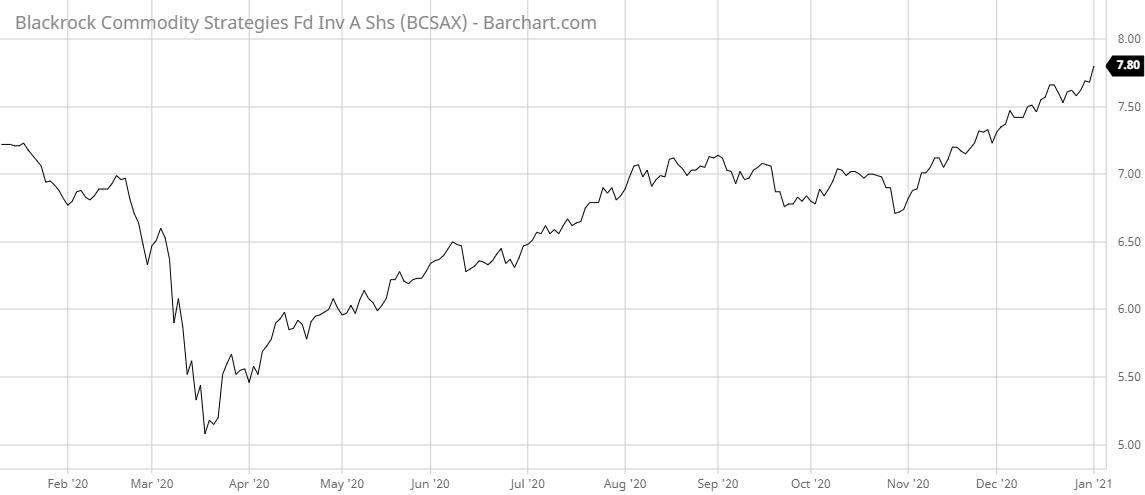

2. BlackRock Commodity Strategies Investor A Fund (BCSAX)

The runner-up fund this week is from a name that most investors are very familiar with in the mutual fund industry – BlackRock. The company’s Commodity Strategies fund (BCSAX) produced a 1-year total return of 6.65%. The net expense ratio of 0.97% makes it the highest fee-wise on our list.

The investment strategy of the fund is to split the weight of the portfolio to attain a 50% mix of derivative-based commodity contracts and a 50% mix of equities that are tied to underlying commodity values. It is benchmarked to the Bloomberg Commodity Index Total Return.

The principal portfolio manager of the fund is Robert Shimell, director and investment strategist at BlackRock, who has been managing the fund since October 2011. He is assisted by Hannah Johnson, vice president at BlackRock; Alastair Bishop, managing director within BlackRock’s Active Equity Group; and Elliott Char, vice president at BlackRock.

The funds portfolio is split into two categories: equities and commodities. The top five equity holdings are Chevron 1.93%, Royal Dutch Shell PLC 1.49%, Newmont Corp 1.47%, Total 1.42% and Barrick Gold 1.20%. The top commodity holdings are in agriculture 36.96%, energy 26.33%, industrial metals 22.25% and precious metals 14.50%.

Find out the funds suitable for your portfolio by using our free Screener.

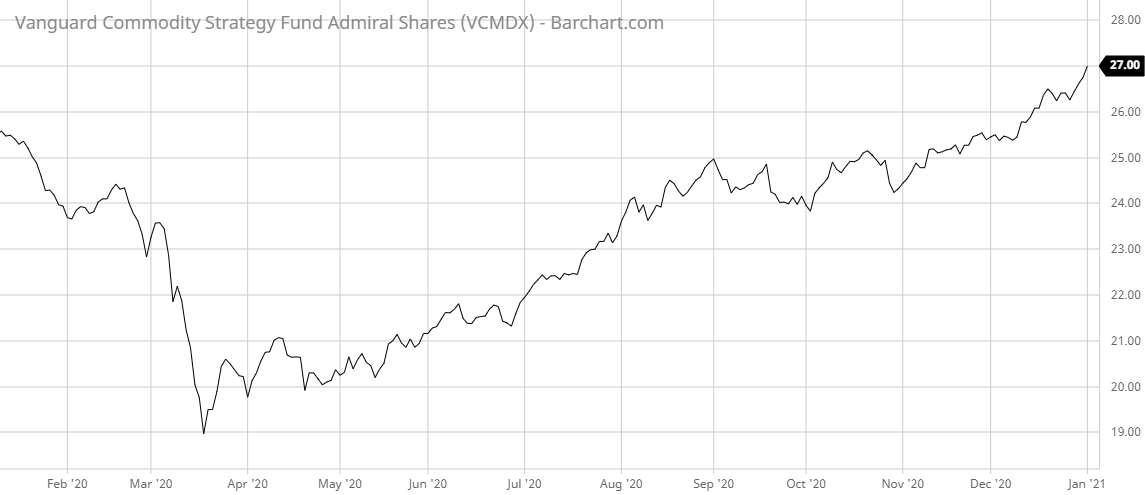

3. Vanguard Commodity Strategy Admiral (VCMDX)

The final fund this week is Vanguard’s Commodity Strategy fund (VCMDX). It produced a 1-year total return of 5.07%. Like most of Vanguard’s mutual funds, it carries a low 0.20% expense ratio.

The investment strategy the fund uses is to invest in commodity-linked derivatives, which are backed by a portfolio of fixed-income securities. Up to 25% of the fund may be used to invest in other commodity-linked assets as well. It is benchmarked to the Bloomberg Commodity Index Total Return.

Joshua C. Barrickman, CFA, principal of Vanguard and head of Vanguard’s Fixed Income Indexing Americas and Anatoly Shtekhman, CFA, portfolio manager at Vanguard have been managing the fund since June 2019. They are assisted by Fei Xu, CFA, portfolio manager at Vanguard.

The top five holdings in the fund’s portfolio by weight are energy 24.90% , grains 24.60%, precious metals 19.30%, industrial metals 18.80% and livestock 5.20%.

Want to know more about portfolio rebalancing? Click here.

The Bottom Line

Make sure to visit our News section to catch up with the latest news about mutual fund performance.

Note: Data as of December 31, 2020.