MutualFunds.com analyzes the search patterns of our visitors every two weeks to find the top trending funds. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

First, we select the top trending category from more than 200 categories listed on MutualFunds.com based on the percentage increase in monthly viewership. From the top trending category, we select the top three funds with the highest one-year trailing total returns. To ensure the quality and staying power of funds, we only look at those mutual funds with a minimum of $250 million in assets and a track record of at least three years. We also remove those mutual funds that are closed to new investors and are not available for investment outside registered accounts such as retirement or 529 accounts.

In this week’s edition, we analyze the top three U.S. large cap value equity funds. These U.S.-based investment funds focus on large cap equities with a market capitalization of more than $2 billion. These funds also focus on identifying value stocks to hold in their portfolios that generally provide dividends or favor income-based investment strategies.

Our breakdown of each fund includes key aspects such as one-year performance, fund expenses, investment style, and management teams to give you an overview of how these funds hold up against their peers.

Be sure to check out the U.S. Large Cap Value Equity Funds page to find out more about the other funds in this category as well.

Trending Funds

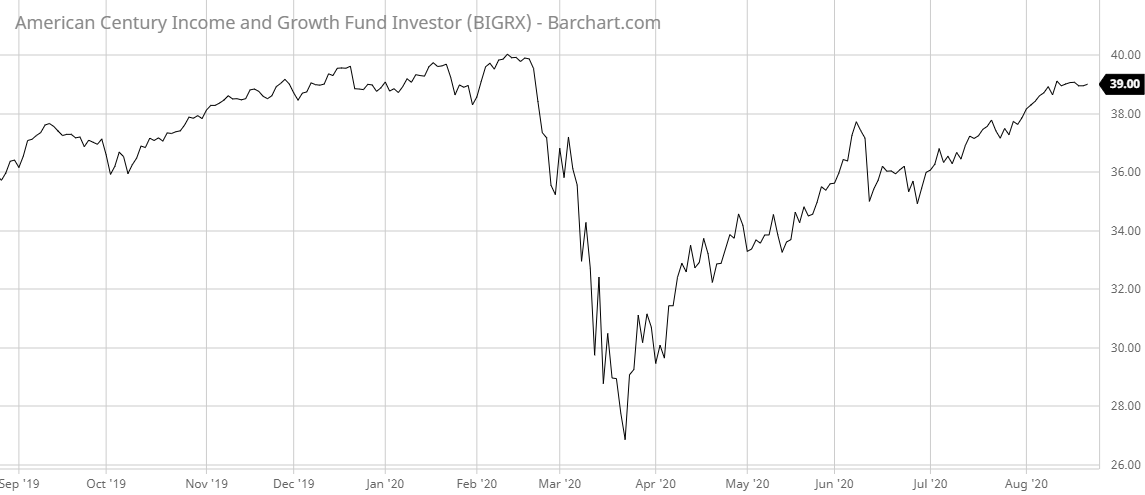

1. American Century Investments Income & Growth Inv (BIGRX)

The top fund on our list this week is the Income & Growth fund (BIGRX) by American Century Investments. Note that the fund name is set to change as of September 25 to the Disciplined Core Value Fund. It comes with a strong trailing one-year total return of 10.43%. The relatively low expense ratio of 0.67% puts it on the low end compared to similar mutual fund types.

The investment strategy of the fund is to select U.S.-based stocks with a market capitalization of at least $2 billion through a quantitative analytical process. Management then identifies stocks that fit with its definition of value stocks by looking at its valuation, quality, growth, and overall sentiment. The fund uses the Russell 1000 Value Index as its benchmark portfolio.

The fund is co-managed by Yulin Long, Ph.D., CFA, vice president and portfolio manager at American Century Investments, and Steven Rossi, CFA, FRM, a portfolio manager.

The fund’s portfolio currently holds 170 different equities with the top five listed as Apple (6%), Microsoft (5%), Amazon (5%), Alphabet (3%), and Johnson & Johnson (2%). The top five sector weights include information technology (28%), health care (15%), consumer discretionary (10%), industrials (10%), and communication services (9%).

Learn more about different Portfolio Management concepts here.

At number two on our list, the Equity Income Fund (DQIRX) from BNY Mellon comes with a trailing one-year total return of 8.12%. The 0.78% expense ratio is average compared to similar fund types.

The fund’s investment strategy is listed as focusing on dividend-yielding stocks and preferring investment techniques that provide income. Management uses a selection methodology that includes computer modeling techniques, fundamental analysis, and risk management. The portfolio is benchmarked to the S&P 500 Index.

The fund’s portfolio is co-managed by Chris Yao, Peter Goslin, CFA, director and senior portfolio manager at Mellon Capital, and Syed A. Zamil, CFA, managing director and global investment strategist at Mellon Capital, with the latter two being primarily responsible for portfolio investment decisions.

The top five holdings in the fund’s portfolio are Apple (6.53%), Microsoft (5.85%), Amazon (4.97%), AT&T (3.69%), and Bristol-Myers Squibb (3.28%). The top five sector weights are listed as information technology (26.68%), health care (13.55%), communication services (12.20%), consumer staples (11.41%), and consumer discretionary (8.59%).

Find out more about the funds suitable for your portfolio by using our free Screener.

Rounding out this week’s top three list is the Multi-Manager Value Strategies Fund (CZMVX) by Columbia ThreadNeedle Investments. It has a trailing one-year total return of 3.99%. It has an expense ratio of 0.74%, placing it solidly in the middle of the pack compared to its peers.

The fund’s strategy is stated as investing primarily in common stocks, preferred stocks, or convertible securities. Up to 20% of the fund may be invested in debt instruments while up to 25% may be invested in overseas securities. It is benchmarked to the Russell 1000 Value Index.

The fund has been managed by Jed S. Fogdall, Co-Head of Portfolio Management and Vice President of Dimensional since December 2013. Other managers include Charles Bath, CFA and Austin Hawley, CFA, among others.

The top five stocks held in the fund’s portfolio of 420 securities include Comcast (2.18%), JPMorgan Chase (2.10%), Chevron (2.08%), Abbott Laboratories (2.04%), and Procter & Gamble (1.84%). The top five sector weights are financials (19.88%), health care (15.05%), information technology (14.09%), industrials (10.24%), and consumer staples (9.56%).

Want to know more about portfolio rebalancing? Click here.

The Bottom Line

Our expert analysis of the top three will give you insight so you know what is the best U.S. Large Cap Value Equity Fund that fits your portfolio needs. And don’t forget to sign up for our free newsletter to get the latest insights on mutual funds.

Make sure to visit our News section to catch up with the latest news about mutual fund performance.

Note: Data as of August 13, 2020