First, we select the top trending category from more than 200 categories listed on MutualFunds.com based on the percentage increase in monthly viewership. From the top trending category, we select the top three funds with the highest one-year trailing total returns. To ensure the quality and staying power of funds, we only look at those mutual funds with a minimum of $250 million in assets and a track record of at least three years. We also remove those mutual funds that are closed to new investors and are not available for investment outside registered accounts such as retirement or 529 accounts.

In this week’s edition, we analyze the top three U.S. small-cap growth equity funds. As the name implies, U.S. small-cap growth equity funds have a very narrow focus. These funds typically invest at least 80% of their assets in U.S. small-cap stocks with a market capitalization of $5 billion or less and are considered growth stock investments. Stock selection criteria are irrespective of market sector and include any companies that are expected to grow earnings at an above-average rate.

Our breakdown of each fund includes key aspects such as one-year performance, fund expenses, investment style, and management teams to give you an overview of how these funds hold up against their peers.

Be sure to check out the U.S. Small-Cap Growth Funds page to find out more about the other funds in this category as well.

Trending Funds

1. Wasatch Ultra Growth Fund (WAMCX)

The number one U.S. small-cap growth equity fund on our list this week is WAMCX. It comes with a phenomenal trailing one-year total return of 39.56% and doesn’t disappoint in the long run either with a 10-year return of 18.86%. The 1.25% expense ratio means it has the lowest fees out of the three funds listed here.

The fund uses bottom-up analysis in its investment strategy to identify U.S. companies with market capitalizations of $5 billion or less. It typically holds from 70 to 90 equity positions in its portfolio. The fund is benchmarked to the Russell 2000 Growth Index.

The lead portfolio manager of the fund is listed as John Malooly, CFA, and he has been managing the fund since January 2012.

The top five sector weights in the fund’s portfolio are health care (36.2%), information technology (26.3%), industrials (9.4%), consumer discretionary (9.0%), and consumer staples (5.7%). Currently, the top five holdings in the fund’s portfolio are Freshpet (3.3%), Five9 (2.6%), Paylocity Holding Corp. (2.4%), Tandem Diabetes Care (2.4%), and Ollie’s Bargain Outlet Holdings (2.3%).

Learn more about different Portfolio Management concepts here..

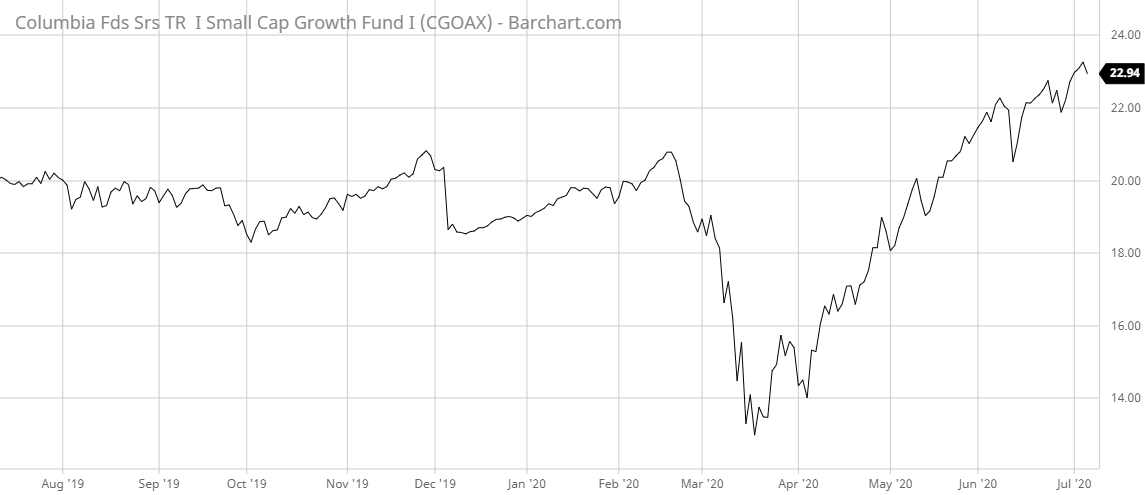

The Small Cap Growth Fund I (CGOAX) from Columbia is the second pick for our list. It has an impressive trailing one-year total return of 28.06%. The expense ratio of 1.31% places it in the middle of the fee range compared to its peers.

The investment strategy of the fund is to hold stocks that have the potential for long-term, above-average earnings growth. It selects stocks from the S&P 600 SmallCap Index that have market caps between $47.5 million and $7 billion. It can invest up to 20% of its assets in overseas securities as well. The fund uses the Russell 2000 Growth Index as its benchmark.

Wayne Collette, CFA, a senior portfolio manager for Columbia Threadneedle Investments, has been managing the fund since February 2006. He is supported by Lawrence Lin, CFA, vice president and senior portfolio manager for Columbia Threadneedle Investments, and Daniel Cole, senior portfolio manager for Columbia Threadneedle Investments.

The top five sector weights in the fund’s portfolio are health care (35.81%), information technology (19.06%), industrials (17.75%), consumer discretionary (16.21%), and financials (3.80%). The top five stock holdings include Planet Fitness Class A (3.16%), Avalara (2.95%), Bio-Techne (2.82%), Etsy (2.74%), and Eldorado Resorts (2.69%).

Find out about the funds suitable for your portfolio by using our free Screener.

Our final contender in our top three list this week is the Baron Discovery Fund (BDFFX). It comes with a trailing one-year total return of 18.93%. It has a moderately priced expense ratio of 1.35%.

The investment strategy of the fund is to select stocks from the Russell 2000 Growth Index that have a market capitalization of up to $2.5 billion and have the potential for above-average earnings growth. Like the other funds on our list, it uses the Russell 2000 Growth Index as its benchmark.

The fund is co-managed by Laird Bieger, vice president and portfolio manager, and Randolph Gwirtzman, vice president and portfolio manager. They have been managing the fund since September 2013.

The top five sector weights in the fund’s portfolio are health care (32.74%), technology (24.71%), industrials (18.71%), real estate (6.55%), and financial services (6.45%). The top five holdings in the portfolio are Kinsale Capital Group (4.05%), Emergent BioSolutions (3.51%), Mercury Systems (3.45%), Americold Realty Trust (3.35%), and Qualys (3.19%).

Want to know more about portfolio rebalancing? Click here.

The Bottom Line

And don’t forget to visit our News section to catch up with the latest news about mutual fund performance.

Note: Data as of July 2, 2020