- The rate of daily new cases of coronavirus globally has continued to edge up. On July 2, the U.S. registered the highest daily increase since the pandemic started, showing that the authorities’ response has been ineffective. The U.S. now has recorded more than 3 million people infected with the coronavirus, 1.3 million of whom have recovered. Brazil, which decided not to implement lockdown measures, is now second with 1.6 million cases, followed by India and Russia.

- Business sentiment across the world has recovered strongly, as most developed economies have gradually reopened. European manufacturing and services purchasing managers’ indexes rose again. France switched to positive territory in both manufacturing and services PMI, while Germany’s manufacturing and services PMI increased but both were in contraction mode. Europe-wide manufacturing PMI advanced from 39.4 in May to 46.9 in June, while services PMI recovered from 30.5 to 47.3.

- U.S. manufacturing PMI was within a whisker of reaching positive territory at 49.6, up from 39.8. U.S. services PMI improved from 37.5 to 46.7.

- The U.S. economy shrank 5% in the first quarter, as largely expected, although the real contraction is forecast to happen in the current quarter as the coronavirus pandemic weighs in.

- U.S. unemployment claims for the week ended June 26 came in at 1.4 million, higher than the 1.3 million expected by economists. The same number of claims was reported in the prior week.

- Chinese manufacturing PMI continued to improve in June, rising from 50.4 to 50.9, marking the fourth consecutive month of positive readings. Meanwhile, China’s non-manufacturing PMI reached a four-month record of 54.4.

- The U.S. economy added a solid 4.8 million jobs in June, considerably better than analysts’ estimates of 3 million. This is the second consecutive monthly increase after a dreadful April, when the economy lost more than 20 million jobs. In May, the U.S. economy added 2.7 million jobs. The U.S. unemployment rate fell from 14.7% to 11.1%. On the downside, average hourly earnings have continued to drop for the second consecutive month, by 1.2% in June.

- The Federal Reserve released the minutes from its mid-June meeting, revealing that policymakers believe interest rates will remain low until the economy gets back to normal. Members of the monetary policy committee think the Central Bank should strengthen forward guidance by clearly spelling out the conditions under which it will maintain its ultra-accommodative monetary policy.

- In Europe, the ECB dodged a bullet after the Bundesbank decided to continue the asset-buying program despite the constitutional court saying the QE might be illegal and unconstitutional. The German court effectively passed the decision-making to the Bundesbank, which found itself in an awkward position as it decided to support the ECB despite criticizing the asset purchase program for years.

We provide this report on a fortnightly basis. To stay up to date with mutual fund market events, come back to our news page here.

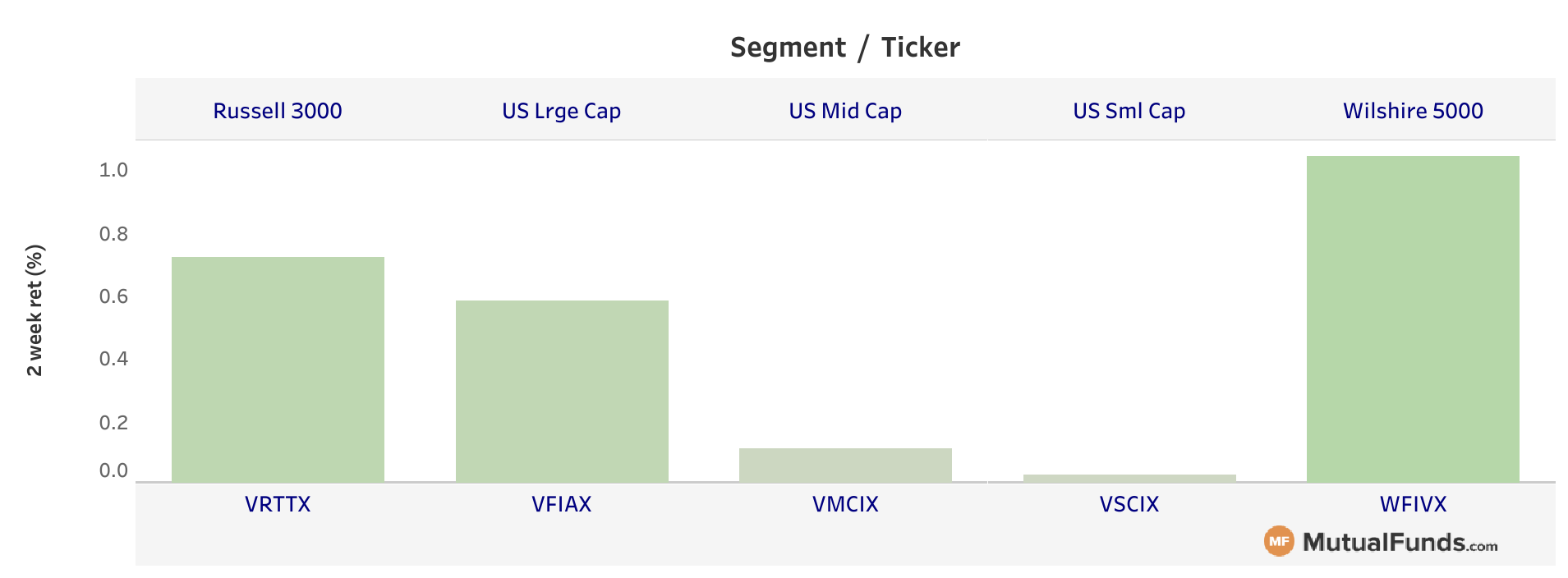

U.S. Broad Indices

- Markets continued their feeble recovery.

- Wilshire’s broad U.S. market index fund (WFIVX) rose more than 1% during the past two weeks, representing the best performance from the pack.

- Meanwhile, Vanguard’s small-cap index fund (VSCIX) was the worst performer with a small rise of 0.03%, after topping the list in the last scorecard.

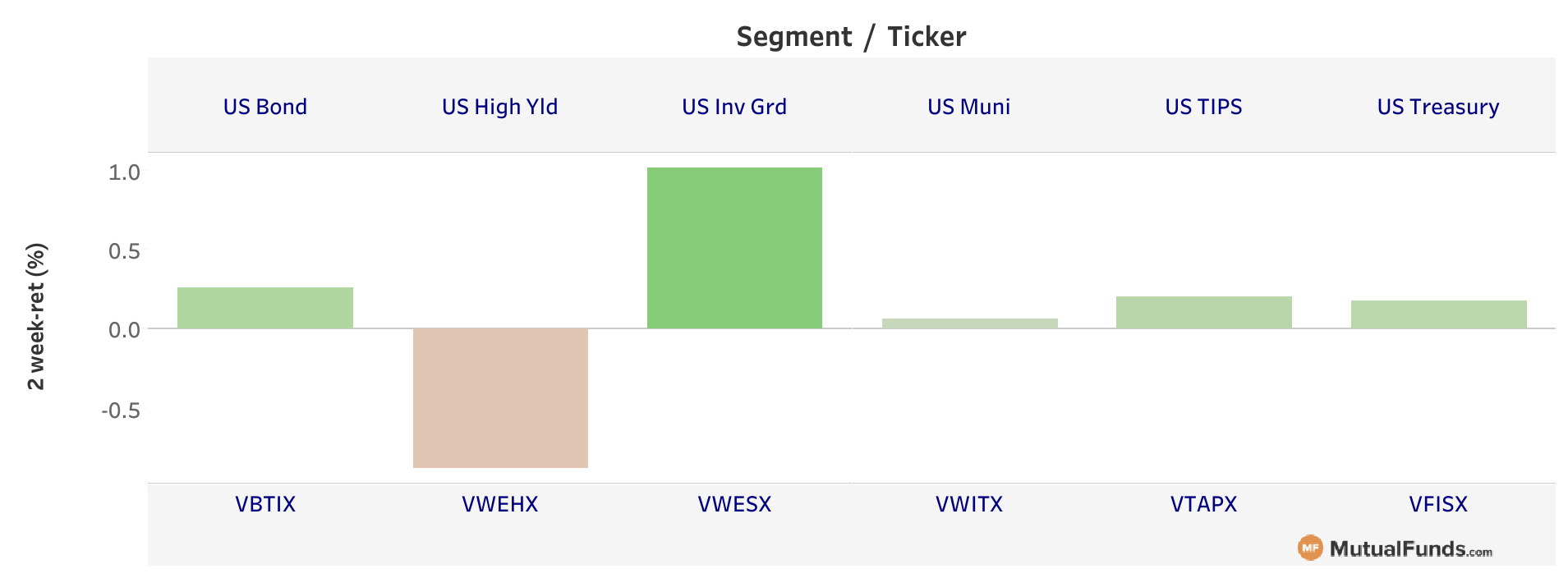

Fixed Income

- Fixed income assets were all up, with one exception.

- Vanguard’s junk corporate bond fund (VWEHX) is the only loser from the pack, down 0.9%.

- Vanguard’s investment grade bonds fund (VWESX) is the best performer again with an advance of 1.2%.

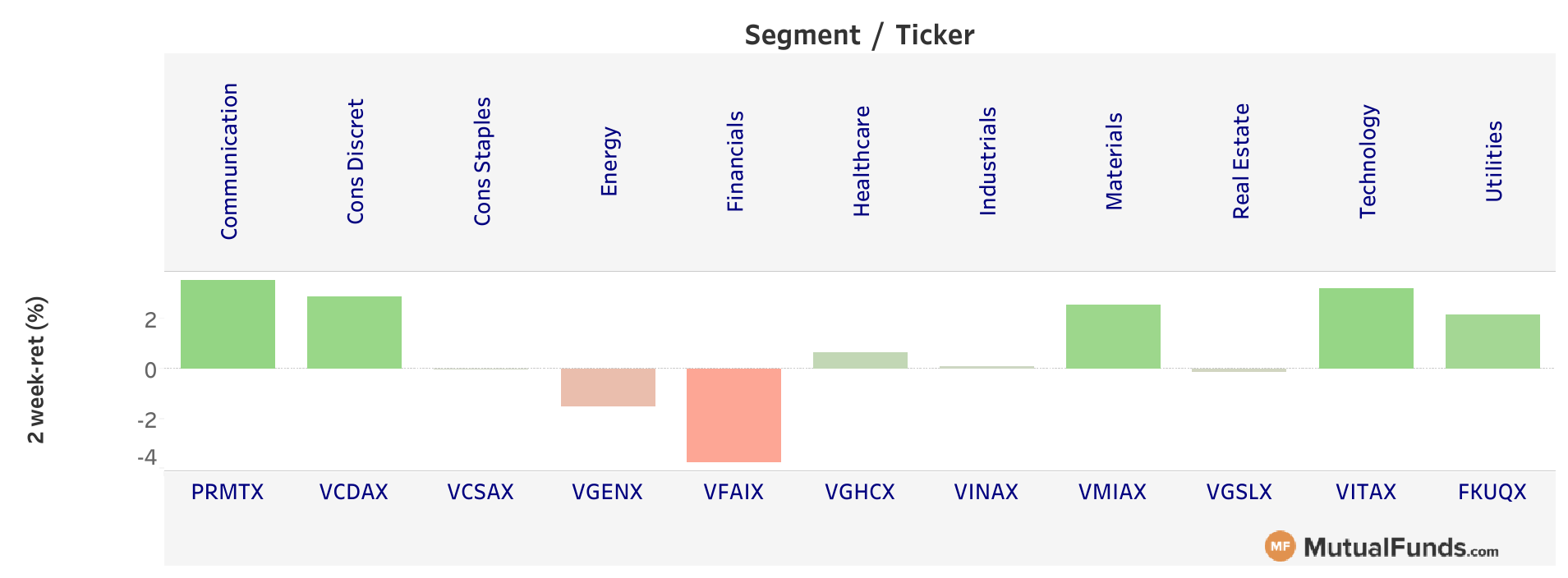

Major Sectors

- Performance in major sectors was mixed.

- Vanguard’s financial sector fund (VFAIX) was by far the worst performer these past two weeks, shedding 3.7%.

- At the same time, T. Rowe’s communication sector fund (PRMTX) gained 3.5%, becoming the best-performing fund.

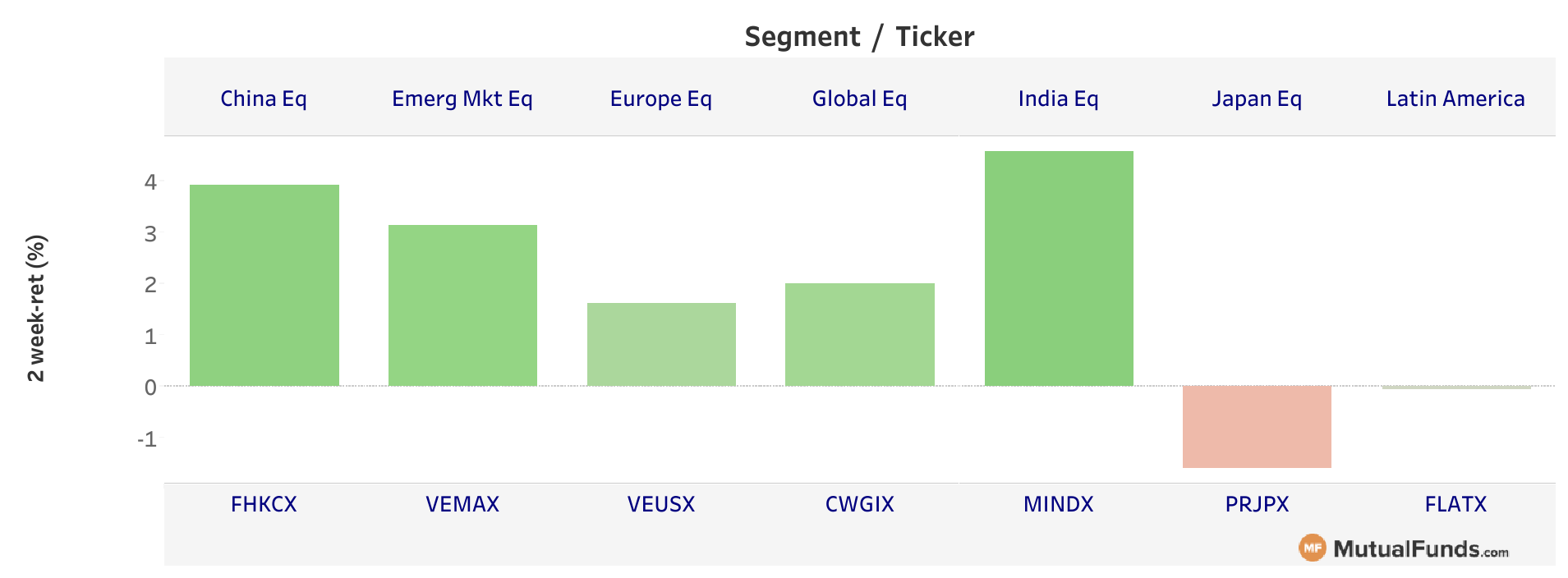

Foreign Equities

- Foreign equities were rather mixed.

- Despite experiencing a high number of COVID-19 infections, India (MINDX) is the best-performing market from outside the U.S., up 4.6% over the past two weeks.

- Meanwhile, T. Rowe Price’s Japanese fund (PRJPX) is the worst performer from the pack by far, with a loss of 1.6%.

Alternatives

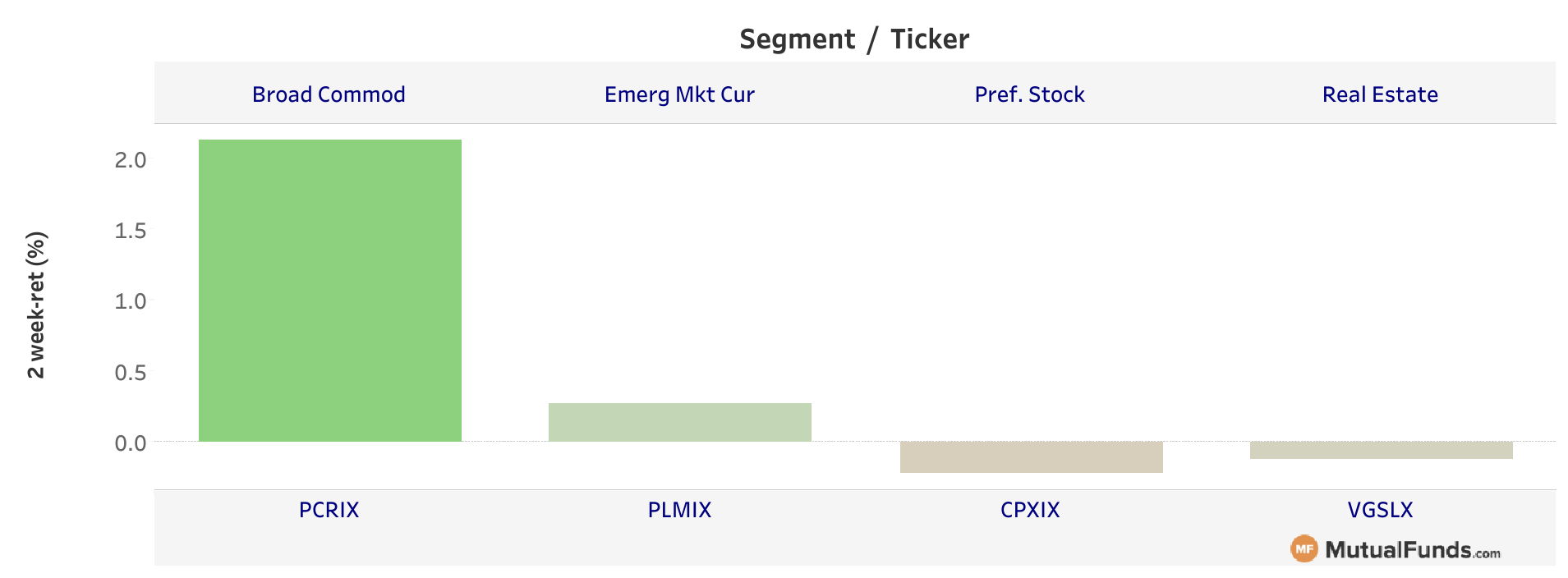

- Alternative assets posted a mixed performance.

- Pimco’s broad commodities fund (PCRIX) gained 2.1% for the past two weeks, resulting in the best performance for the past two weeks.

- Meanwhile, Cohen and Steers’ preferred securities fund (CPXIX) again shed 0.2%, representing the worst performance from the pack.

The Bottom Line

Be sure to sign up for your free newsletter here to receive the most relevant updates.

Fund returns data is reported for the period between June 19 and July 2.