First, we select the top trending category from more than 200 categories listed on MutualFunds.com based on the percentage increase in monthly viewership. From the top trending category, we select the top three funds with the highest one-year trailing total returns. To ensure the quality and staying power of funds, we only look at those mutual funds with a minimum of $100 million in assets and a track record of at least three years. We also remove those mutual funds that are closed to new investors and are not available for investment outside registered accounts such as retirement or 529 accounts.

In this week’s edition, we examine the best multi-strategy funds for investors. These funds contain a diversified portfolio, including equities and fixed income products, to maximize risk-adjusted returns no matter how markets perform. The primary objective of multi-strategy funds is to generate positive returns regardless of where the economy is in the business cycle. That means holding a diversified portfolio of securities that includes equities from multiple sectors, fixed income products like bonds and treasuries, and other alternative assets like commodities, real estate, and currencies.

Our breakdown of each fund includes key aspects such as one-year performance, fund expenses, investment strategy, and management team to give you an overview of how these funds hold up against their peers.

Be sure to check out the Multi-Strategy Funds page to find out more about the other funds in this category as well.

Trending Funds

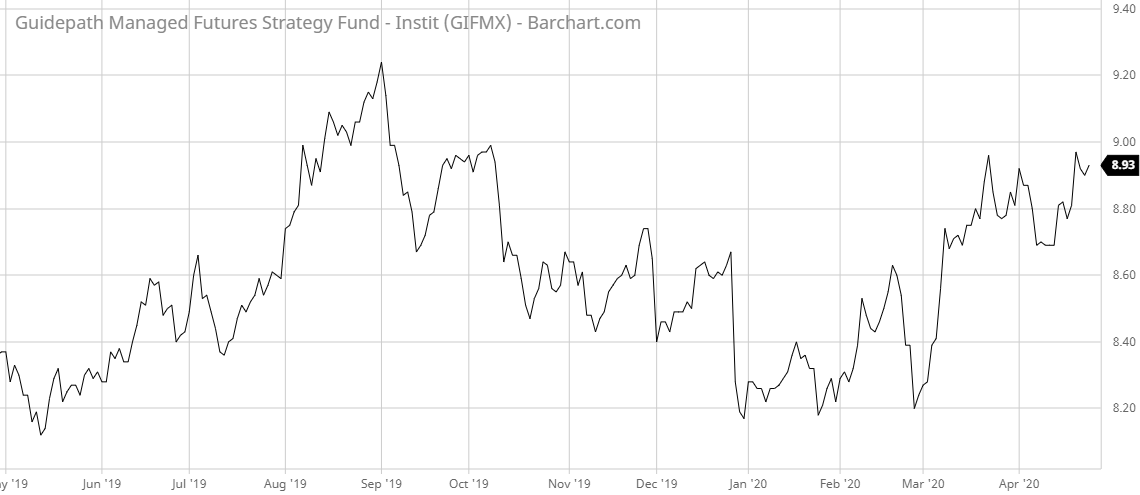

1. GuidePath Managed Futures Strategy Fund (GIFMX)

The top fund in our list this week is GIFMX, which comes with a stellar one-year return of 12.14%. While the expense ratio of 1.30% might seem higher than what investors are used to seeing, it is comparable to other similar fund types.

The fund’s investment strategy is to maximize gains in any market environment. To accomplish this goal, it uses a mixture of equities, bonds, commodities, and currencies and engages in leveraged contracts, including derivatives such as futures. The sub-advisor of the fund relies on quantitative models to identify price trends across different asset classes for various time frames. There are no geographic restrictions and the fund can take both ‘long’ and ‘short’ exposure to an underlying asset class if there are potential opportunities. It uses the Credit Suisse Managed Futures Liquid TR USD as its benchmark index.

The fund lists six portfolio managers; however, since April 2018, Kathryn M. Kaminski has been the lead manager of the fund. She is the Chief Research Strategist at AlphaSimplex and leads research initiatives, focusing on portfolio construction and risk management.

The fund’s portfolio contains a mixture of equities, giving it a broad exposure to all market sectors: 43.55% of its holdings are in large cap stocks while mid-cap stocks constitute 8.97% and small cap stocks make up less than 1%.

Learn more about different portfolio management concepts here.

Taking the number two spot in our list is EARAX, which generated a one-year return of 1.41%. A 1.34% expense ratio puts it solidly in the middle of the pack of multi-strategy funds.

The fund uses an opportunistic approach in its investment strategy to identify what sectors are outperforming globally and allocate its holdings as needed. It uses macroeconomic top-down analysis to spot investments and may use equities, bonds, and other fixed income products to achieve its stated purpose. It seeks to mimic a weighted mixed performance of the Bloomberg Barclays U.S. Aggregate Bond Index (60%) and the MSCI ACWI Index (40%).

The fund is primarily managed by Richard Bernstein who has been the lead portfolio manager since the fund’s inception in September 2011. Bernstein is founder, CEO, and CIO of Richard Bernstein Advisors LLC. He is supported by Matthew Griswold, CFA, director of investments at Richard Bernstein Advisors LLC and Henry Timmons, CFA, director of ETFs at Richard Bernstein Advisors LLC.

As is the case with multi-strategy funds, its portfolio holdings are diverse. Equities comprise 35.6% of its holdings, which is broken down into U.S. equities (21.0%) and non-U.S. equities (14.6%). The largest weight is held in fixed income assets at 59.6% and weighted mostly in U.S. treasuries at 46.2% while 11.9% is in securitized mortgages. Finally, cash holdings are listed at 4.8%.

Find out more about the funds suitable for your portfolio by using our free Screener.

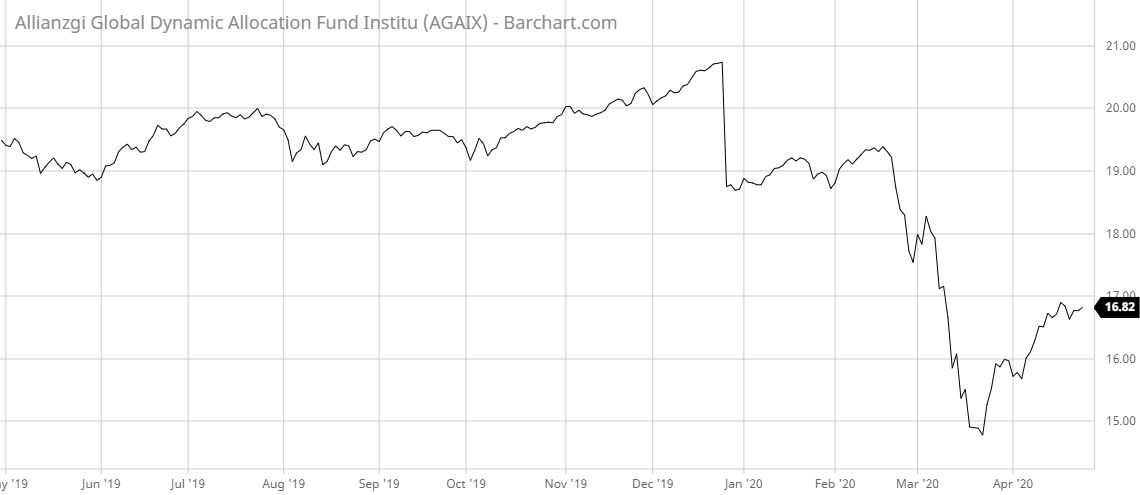

The last fund in this week’s list is Allianz’s Global Dynamic Allocation Fund (AGAIX). While it shows a relatively poor one-year performance of -4.03%, its 10-year performance of 4.34% makes it a solid long-term pick-up for investors. The fund’s relatively low expense ratio of 0.74% combined with its strong SEC yield of around 2.5% makes it an attractive pick-up for income-oriented investors as well.

The investment strategy of the fund is similar to other multi-strategy funds in that it seeks out opportunities regardless of asset class. It specializes in generating positive returns for investors by selectively holding securities and assets in varying sectors as needed. It is benchmarked to the Bloomberg Barclays Long Credit Bond Index.

The longest serving manager of the fund is Claudio Marsala, a director with Allianz Global Investors, who has been managing the fund since January 2015. Paul Pietranico, CFA, a director with Allianz Global Investors and a member of the Multi-Asset U.S. team, joined the team in October 2016 along with Michael Heldmann, CFA, a senior portfolio manager and head of best styles North America with Allianz Global Investors.

Unlike the other multi-strategy funds listed, the Allianz fund holds less than 1% in equities, preferring bond and fixed income products instead. Its portfolio is primarily in corporate bond holdings (34.85%), with swaps (24.99%) and government-related securities (19.20%).

Want to know more about portfolio rebalancing? Click here.

The Bottom Line

And don’t forget to visit our News section to catch up with the latest news about mutual fund performance.

Note: Data as of April 23, 2020