In this week’s edition, we analyze the top three short-term government bond funds. This type of mutual fund invests in government-backed securities that have maturities of five years or less and are suited for wealth preservation and current income generation. These funds are vehicles that are not chasers of growth or high yields. Backed by the U.S. government, the bond holdings are considered safe investments that have the lowest yield of default among all other types of bonds. At least 90% of these funds’ portfolios are allocated in bonds that are backed by the U.S. government or U.S. government agencies.

Our breakdown of each fund includes key aspects such as one-year performance, fund expenses, dividend yields, portfolio duration, and management teams to give you an overview of how these funds hold up against their peers.

Be sure to check out the Short-term government bond funds page to find out more about the other funds in this category as well.

Trending Funds

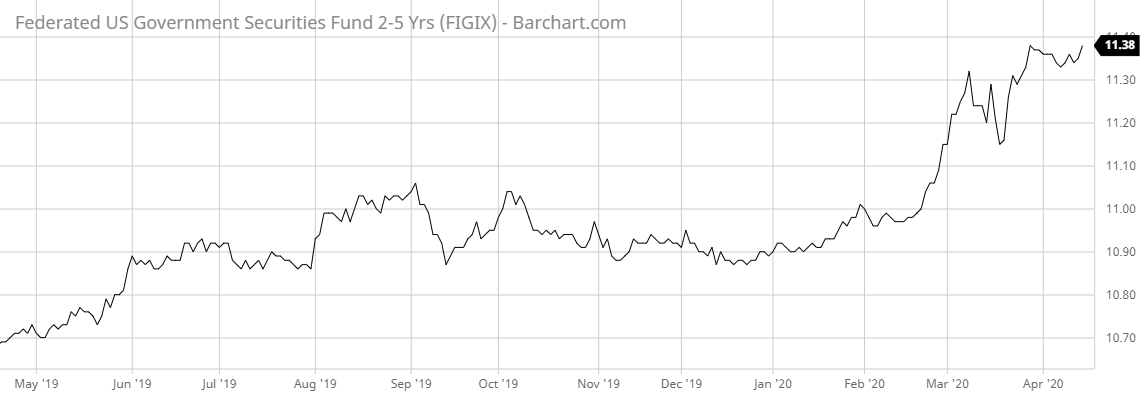

1. Federated U.S. Government Securities Fund 2-5 Year Service Shares (FIGIX)

FIGIX has a stellar one-year return of 8.49% and a 10-year return of 1.71%. As a bond fund, it pays out monthly dividends and has a taxable-equivalent SEC 30-day yield currently listed at 0.23%. The gross expense ratio of 0.92% puts it on the higher end compared to its peers though investors should expect to see bigger-than-average returns to make up for the difference.

The fund invests in short- to intermediate-term debt obligations of the U.S. government and associated agencies. The fund may also use derivative contracts or hybrid securities to hedge against interest rate risk and portfolio duration. It is benchmarked to the 3-5 Year U.S. Treasury Index and seeks to mimic or beat its performance.

The fund has been managed by J. Andrew Kirschler, a vice president, senior investment analyst, and portfolio manager since July 2013. Later in May 2017, Todd Abraham, CFA – senior vice president, senior portfolio manager, and head of government/mortgage-backed fixed income group joined the team.

Two-to-fiveyear securities make up 82.8% of the portfolio’s weight with 15.9% dedicated to securities with maturities greater than five years and 1.3% in securities with maturities of two years or less. The weighted average effective duration of the portfolio is 3.7 years.

Learn more about different Portfolio Management concepts here.

Fidelity’s FFXSX comes with a one-year return of 6.69% and a 10-year return of 1.74%. The relatively low expense ratio of 0.45% is on the lower-middle end for similar funds and ensures that investors get the most for their investment. Dividends come by way of a 30-day yield of 0.31% as well.

The investment strategy of the fund is to generate a high level of current income while also providing a wealth preservation aspect. The fund invests at least 80% of its assets in U.S. government securities and repurchase agreements to accomplish this objective. The fund is benchmarked to the Bloomberg Barclays U.S. 1-5 Year Government Bond Index.

The fund is co-managed by Franco Castagliuolo and Sean Corcoran.

The portfolio primarily consists of U.S. Treasuries at 78.80% of its weight. It also contains some exposure to other asset types with 7.88% in collateralized mortgage obligations (CMOs) and 3.99% in mortgage backed security (MBS) Pass-Through. Its average duration comes out to be 2.64 years.

Find out the funds suitable for your portfolio by using our free Screener.

The third fund on our list is SNGVX with a one-year return of 5.75% and a 10-year return of 2.15% – the best long-term performance on our list. The expense ratio of 0.80% is moderately high compared to other similar funds but it compensates for this with a high 30-day dividend yield of 2.55%.

The investment strategy of the fund is similar to Fidelity’s in that it seeks to generate high current income while also prioritizing safety of principal. It invests in pass-through securities including many government-backed mortgage agencies. The fund’s benchmark is the Bloomberg Barclays Intermediate Government Bond Index

The fund is co-managed by Bryce A. Doty, a vice president, who has been managing the fund since 1995, and Mark H. Book, a vice president and portfolio manager, who joined the team in 2002.

The fund’s portfolio consists mostly of government-backed mortgage agency debt obligations with just 2.22% invested in U.S. treasury bonds stripped principal payments. It comes with an average portfolio duration of 2.40 years.

Want to know more about portfolio rebalancing? Click here.

The Bottom Line

Our expert analysis of the top three will give you insight so you know which best short-term government bond fund keeps your portfolio protected against a changing interest rate environment, generates steady income, and preserves wealth during highly volatile markets.

And don’t forget to visit our News section to catch up with the latest news about mutual fund performance.

Note: Data as of April 15, 2020