Municipal bonds have long been a favorite spot for investors looking to score tax-free income. Issued by states and local governments to fund their daily activities or special projects, munis are generally free from federal taxes and sometimes state/local taxes as well. This makes them a prime stopping ground for taxable accounts and high income individuals.

But not all muni bonds are tax-free. In fact, there’s a whole sector of taxable municipal bonds out there.

And right now, trends are pointing toward the taxable muni market’s sector. For investors looking for income and potential appreciation, these trends make the taxable muni sector an interesting bet going forward.

Taxable Municipal Bonds

Typically, munis are used by investors to generate tax-free income. With the exception of investors subjected to alternative minimum taxes, muni interest income is generally free from Uncle Sam’s grasp. And if you play your cards right, state and local taxes as well. These bonds form the backbone of the nearly $4 trillion muni market.

But there’s a small portion of the muni market that falls under the taxable umbrella.

Back in 1986, the federal government enacted legislation that limited the kinds of activities that states and local governments could use tax-exempt munis to fund. As a result, many states started issuing taxable bonds to fund these projects and programs. Later in 2009, taxable muni bonds saw a huge uptick in issuance as President Obama created the Build America Bond program through the American Recovery and Reinvestment Act.

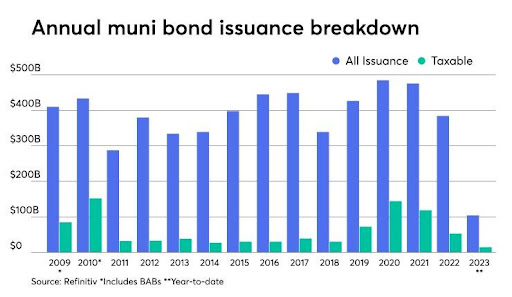

The biggest uptick and issuance of taxable munis came in recent years. The Tax Cuts & Job Act of 2017 included legislation that prohibited cities, states, and other municipalities from issuing tax-free bonds to restructure their existing debts. As the act became law, issuance of taxable munis exploded. You can see by this chart using Refinitiv data that more than $170 billion of taxable munis were issued in 2020 alone.

Source: Bond Buyer

Favourable Market Conditions for Taxable Munis

The interesting thing to note about that chart has been the recent decline in taxable muni bond issuance. And it turns out that’s a good thing, if you’re looking for higher income and the potential gains.

Because of the Fed’s recent path of higher rates, a variety of states and local governments have stopped refinancing existing bonds. Why lock in a higher rate and pay more interest when you could keep your existing bonds and pay less until they mature? With that, taxable issuance from states has fallen very fast, very quickly. Last year, issuance of taxable munis hit just $52 billion, a year-over-year decline of 56.4%. So far year-to-date, issuance is down 40% of just $14 billion in total taxable bonds.

This has constricted supplies of taxable munis on the market. Muni buyers are generally large institutional investors—pension funds, insurance companies, endowments, etc.—and they tend to hold them until they mature. This is true for taxable munis as well.

With that, taxable muni returns have outpaced a wide variety of other fixed income asset classes year-to-date. The Bloomberg Taxable Municipal Bond Index managed to return 5.21% during the first quarter. This was the second-best first quarter return in the history of the index and only came within inches of the all-time record. Since the index’s low of October 2022 when the Fed started raising rates, the index has managed to produce a staggering 11.39%. 1

So why should investors care? Two words: yields and taxes.

Yes, taxable munis are taxable… when it comes to federal taxes. However, they are tax-exempt from state taxes from the issuing state. For investors in high-tax states like California or Connecticut, there’s still plenty of value to be had in the tax savings, especially when you consider the next point.

Because of the lack of federal tax savings, taxable munis often trade at higher yields than regular munis. Moreover, because there is more ‘risk’ in buying a bond from Texas than the Feds, they trade at higher yields than Treasuries. For investors in higher tax brackets, taxable munis can offer much better after-tax yields than traditional munis, Treasuries, and corporate bonds. Lower tax bracket investors can make out as well given the high starting yields and potential state tax benefits.

And now with supplies getting constrained, investors have a rare chance to not only get strong yields/income, but also the potential for capital appreciation.

Ways to Get Taxable Muni Exposure

With $1.54 billion in assets, the Invesco Taxable Municipal Bond ETF is the largest fund targeting the sector. The passively managed ETF tracks the ICE BofAML U.S. Taxable Municipal Securities Plus Index and holds a variety of taxable muni debt, including Build America Bonds and other refinanced debt. In total, there are just under 700 different bonds, with California, Texas, and New York comprising about half of its assets. The ETF has strong trading volumes and currently yields a juicy 5.08%. The ETF is up more than 1.7% year-to-date.

Because of the small size of the market, many fund issuers have rolled their taxable muni funds into broader or high-yield muni vehicles. That means investors who want pure exposure may need to think outside the box. The Guggenheim Taxable Municipal Bond & Investment Grade Debt Trust is a closed-end fund (CEF). That is, it has a fixed number of shares. Right now, shares are trading at a slight 3% premium to their net asset value. However, investors may want to consider paying the price. The CEF yields a juicy 9.87%. Another top CEF choice is the BlackRock Taxable Municipal Bond Trust.

Finally, investors may want to consider the MainStay MacKay U.S. Infrastructure Bond Fund. While the name may be confusing, remember, Build America Bonds were originally designed to spur infrastructure spending. Since then, the mutual fund has expanded into a variety of taxable muni bonds and could be a great addition in the space.

Taxable & Build America Bond Funds

| Ticker | Name | AUM | YTD Price Ret (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|

| BAB | Invesco Taxable Municipal Bond ETF | $1.534B | 2.3% | 0.28% | ETF | No |

| MGOIX | MainStay MacKay U.S. Infrastructure Bond Fund Class I | $574.9M | 1.2% | 0.6% | MF | Yes |

| GBAB | Guggenhm Txble Mcpl Bnd & Invt Gd Dt Trt | $367M | -0.8% | 1.34% | CEF | Yes |

| NBB | Nuveen Taxable Municipal Income Fund | $499M | -2.3% | 2.63% | CEF | Yes |

| BBN | Blackrock Taxable Municipal Bond Trust | $1.109B | -4.3% | 1.84% | MF | Yes |

The Bottom Line

Taxable municipal bonds are currently offering high yields and the chance for capital appreciation. With issuance starting to stall, demand for these bonds has exploded from a variety of investors. With higher yields than Treasuries and regular munis, as well as having some tax benefits, it’s easy to understand why they’ve trended higher. For investors, adding a swath of taxable munis makes perfect sense in the current environment.

1 Nuveen (May 2023). Taxable municipal bonds:recovery gaining steam