For investors, the municipal bond market has been a tough nut to crack over the last year. Yields remain at highs and the tax benefits are a huge draw to the sector. And yet, muni bonds haven’t lived up to their potential. So far, the sector has been treading water as investors weigh the Fed’s continued path of tightening.

But, according to Blackrock, that may be changing this summer.

Already, returns have started to climb and several tailwinds may make munis a wonderful choice for portfolios heading into the back-half of the year. All in all, munis may be ready for a summer rebound.

A Mixed May, But a Strong June

After last year’s drubbing, the municipal bond sector had all the hallmarks of being a top asset class amid fixed income sectors. But, so far, the promise hasn’t lived up to expectations. The S&P Municipal Bond Index has been mixed all year, ebbing and flowing. For example, in May, the index fell by 0.75%, while in June it only gained about 0.89%. Year-to-date total returns, which includes coupon payments, is only a slight 2.52% for the index. That’s actually a little lower than the return for Treasury bonds this year.

The mixed returns for the sector have continued to be caused by the Federal Reserve and its path of rate tightening.

Typically, munis are long bonds with maturity dates 10, 15 or 30 years down the road. With that, they are sensitive to interest rate movements. As the Fed has continued to hike, investors have fled the sector, causing lower returns on the year. It’s muni’s strong yields that have been able to keep the sector afloat in 2023. Also, the Fed pausing on its path of tightening this June explains the slight rebound.

Better Conditions Ahead

Despite the mixed returns for the sector year-to-date, munis could be heading out of the spring doldrums and finally seeing some strong returns heading into the summer and back half of the year. This is the gist from a new missive from Blackrock. According to the asset manager, a series of tailwinds have the ability to start a rebound in muni prices and returns.

For starters, issuance is way down.

States and local governments are thinking twice about launching any new muni bonds. With rates moving higher, their interest expenses will be higher as well. Thanks to budget surpluses and an influx of cash in their rainy day funds, many municipalities simply don’t need to. According to Blackrock, about $36 billion worth of new munis were launched in June. So far, for all of 2023, only $171 billion worth of new muni bonds have been launched. 1

While that may seem like a lot, it’s actually pretty low. June’s issuance was about 8% below the five-year average and year-to-date figures represent a 14% year-over-year decline. All in all, the muni sector is now in a net negative supply situation.

The positive is that muni demand has started to pick up. Blackrock’s data shows that demand for munis in June outpaced supplies by $2 billion. This followed May’s oversubscribed demand of $3 billion. All in all, new muni issuance was oversubscribed by 4.0x on average.

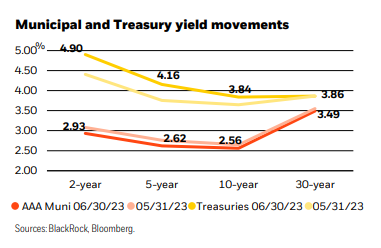

At the same time, muni bond’s yields are starting to converge on Treasury bonds, particularly on the long end. You can see the convergence in this chart from the asset manager.

Source: Blackrock, Bloomberg

The thing is, when looking at taxable equivalent yields, munis are actually ahead. According to Blackrock that will spur additional demand as investors take advantage of the tax benefits.

The combination of lower issuance with rising demand creates the right kind of supply/demand imbalance that should help the sector perform well over the rest of the year. Better still is that dropping inflation rates could prompt the Fed to pause for a longer period than predicted, which would light a real fire under the sector and only enhance its potential gains.

Buying the Muni Summer Rebound

With the supply/demand imbalances starting to grow, munis should be a wonderful asset class to own for the back half of the year. Investors may want to consider the fixed income asset class for their portfolios. Blackrock suggests focusing on longer-dated munis as they will have the most demand and benefit from the tailwinds. Likewise, investors should focus on quality over more speculative muni bonds.

When it comes to finding long-dated munis, pickings tend to be slim. Among index funds, the VanEck Long Muni ETF is the only dedicated fund that focuses on the sector. The ETF has an effective duration of 10 years and holds bonds with an average maturity of 24 years. For that, investors get a 3.65% yield. For an active touch, the Vanguard Long-Term Tax-Exempt Fund Investor Shares remains one of the best funds, while Blackrock’s own Strategic Municipal Opportunities Fund is a go-anywhere muni fund and follows the asset manager’s framework.

As for betting on quality, two interesting options could be the Baird Quality Intermediate Municipal Bond Fund and Nuveen Quality Municipal Income Fund. Both bet on the top few tiers of muni bond credit ratings. It should be noted that the Nuveen fund is a closed-end fund (CEF) and can currently be had for a 14% discount to its NAV.

Active & Passive Long-Dated Muni Bond Funds

| Ticker | Name | AUM | YTD Price Ret (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|

| MLN | VanEck Long Muni ETF | $345.4M | 2.7% | 0.24% | ETF | No |

| VWLTX | Vanguard Long-Term Tax-Exempt Fund | $731.6M | 2% | 0.17% | MF | Yes |

| MUB | iShares National Muni Bond ETF | $32.9B | 1.6% | 0.07% | ETF | No |

| BMBIX | Baird Quality Intermediate Municipal Bond Fund Class Institutional | $1.35B | 0.6% | 0.3% | MF | Yes |

| MAMTX | Blackrock Strategic Municipal Opp Fd Of Blackrock Muni Series Tr Institutional Shares | $3.86B | -0.1% | 0.55% | MF | Yes |

| NAD | Nuveen Quality Municipal Income Fund | $3.049B | -5.7% | 2.02% | CEF | Yes |

Even if investors simply select a broader, intermediate-dated muni fund, the supply/demand imbalance should still exist and create plenty of gains for the rest of the year. All in all, munis’ summer rebound will benefit the entire sector.

The Bottom Line

Municipal bonds had everything going for them at the start of the year. However, they have stalled, thanks to the Fed’s interest rate plans. But, according to Blackrock, the sector is poised for a big rebound this summer. Supply/demand imbalances and high tax-free yields will help the sector show strong returns through the third and fourth quarter. Investors should consider adding them to their portfolios.

1 Blackrock (July 2023). Municipals deliver on seasonal expectations