Municipal bonds have garnered a lot of attention in recent months. Thanks to their high yields and tax advantages, many investors across various different income levels have been drawn to their benefits. With this rising demand amid slowing supplies, muni bonds have become a star performer this year as well, with many investment-grade munis now trading above par values.

But investors may want to ignore the premiums.

It turns out that buying municipal bonds at premiums is actually a very good idea. With strong cash flow and the ability to avoid key tax traps, premium muni bonds might be the only way to buy the bond sector.

Par vs. Market Value

When investors buy a bond, they are essentially lending money to an entity. In exchange for that money, the entity pledges to pay the investors’ interest. Where it gets interesting is that at the end of a certain time period, the issuing entity promises to repay the bondholder their initial investment back. This is called the face or par value of the bond.

For the vast bulk of bonds – zeros & TIPS aside – this amount doesn’t change. Assuming the issuer doesn’t default, investors know that they will get this amount back at the maturity date. As long as they buy the bond at issuance and hold it, that is.

The thing is, most investors don’t buy a bond when issued and hold it to maturity. They buy and sell them throughout the year. This is the bond’s market value and it’s a function of supply/demand. A bond that is trading above par is said to be trading at a premium, while a bond trading below par is considered trading at a discount. Remember, the issuing entity is only required to pay the par back at maturity. So, if you buy a bond with a face value of $10,000 for $10,500, you’ll only receive the $10,000 back when it expires.

With that in mind, many investors try to buy bonds below par for embedded gains.

Thinking Twice In Muni-Land

But it turns out, this golden rule of buying low and holding till high may not work across all bond types. In fact, in the municipal bonds market it may be better to buy securities at a premium to par.

That’s because the tax code creates a little bit of a reversal with regards to munis versus other bonds. Normally, interest from bonds is taxed at a person’s ordinary income rate and capital gains are taxed at lower rates. For munis, the relationship is flipped. A $1 worth of income from a muni is worth more than $1 of price appreciation. That’s because munis are free from federal taxes and, in some instances, state and local taxes as well. Interest is worth more than gains on an after-tax basis for munis.

Moreover, capital gains are a little weird when it comes to munis. That’s thanks to the so-called De Minimis Tax Rule, an obscure section of the Internal Revenue Code that determines whether or not gains on the sale of a muni bond can be treated as ordinary income or capital gains. The IRS formula uses par value minus full years to maturity x 0.25% to determine the threshold. For many higher income individuals, buying munis at a discount to par can actually work against them when it comes to selling or holding that muni till maturity.

Then there is cash flow to consider. In many instances, munis trading at premiums to par may actually provide higher cash flow than those trading at discounts.

Munis are considered long-dated bonds, with maturities of 10, 15-20 and 30 years. And because a state or local government has slightly more default risk than the Federal government, munis offer higher yields than Treasuries. This combination provides an interesting effect when it comes to cash flow.

Remember, interest rates were basically zero for nearly 15 years. This sent many investors into anything with a higher yield – including long-dated munis – causing them to trade at premiums to par. Because muni investors tend to buy & hold and prefer those at premiums due to the De Minimis Tax Rule, many premium munis didn’t drop by as much as the Fed raised interest rates. That’s because investors are able to take the higher cash flow from these premium munis and reinvest them in now higher-yielding securities.

Another thing to remember is that muni issuance – particularly longer-dated bonds – is down. Many state and local governments have been issuing shorter-term bonds to make sure they don’t lock themselves in at high rates for the long term.

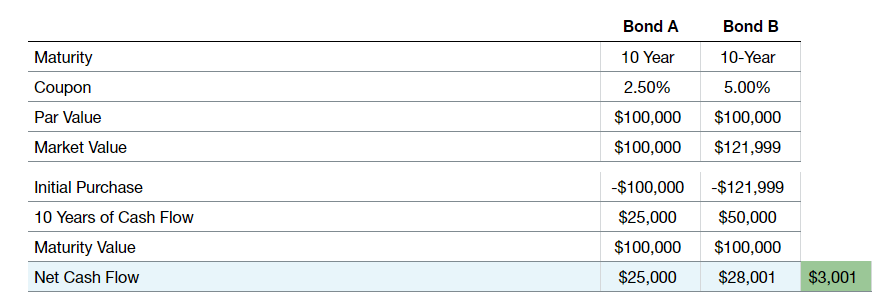

This chart from Thornburg underscores how investors may win out by buying a premium bond over the life of the bond.

Source: Thornburg

Going Premium With Your Munis

All in all, investors tend to like bonds at discounts to par as it creates a sort of price floor for their returns. However, it makes sense to buy munis at a premium. Both the tax effects and potentially higher cash flows from older and premium priced bonds make it worth it.

Getting those premium bonds could be as easy as running a screener and focusing on those trading above par. Running an analysis of comparing cash flow and returns is critical to finding put if the premium is worth it.

If that sounds a lot like too much work, it can pay to go with the muni manager that incorporates this into their analysis. Buying a passive vehicle like the Vanguard Tax-Exempt Bond Index Fund may not be the best strategy.

Fidelity, PIMCO, Nuveen and Thornburg have expressed that they try to focus on munis that trade at premiums in many of their respective investment vehicles. Choosing an active fund like the PIMCO Intermediate Municipal Bond Active Exchange-Traded Fund or Fidelity Municipal Income Fund could be the best way to score premium bonds, higher cash flow and avoid De Minimis tax headaches from your muni bond holdings.

Premium Muni Bond ETFs & Mutual Funds

| Ticker | Name | AUM | YTD Total Ret (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|

| PFMIX | PIMCO Municipal Bond Fund Institutional Class | $2.12B | 3% | 0.45% | MF | Yes |

| FTABX | Fidelity® Tax-Free Bond Fund | $2.91B | 2.2% | 0.46% | MF | Yes |

| MUNI | PIMCO Intermediate Municipal Bond Active ETF | $1B | 2.2% | 0.35% | ETF | Yes |

| TSSAX | Thornburg Strategic Municipal Income A | $309M | 2.1% | 1.26% | MF | Yes |

| FHIGX | Fidelity® Municipal Income Fund | $4.54B | 2% | 0.46% | MF | Yes |

| MBND | SPDR Nuveen Municipal Bond ETF | $43.1M | 1% | 0.40% | ETF | Yes |

Ultimately, premiums may not be a bad thing at all when it comes to muni bonds. In fact, they should be preferred. Whether investors trust a dedicated manager or go it alone, they may want to think twice when it comes to bonds being above par.

The Bottom Line

Interest in munis has exploded in recent months due to their tax benefits and high yields. That has many investors thinking twice about the premiums in the sector. However, they shouldn’t worry. Munis with prices above par value may actually be a great deal for their portfolios and cash flow.