When it comes to the high-yield bond space, high-yield corporate bonds have certainly earned their “junk” moniker. Filled with high default rates, volatility, and potential payback complications, investors treading here truly are taking on plenty of risk. But high-yield municipal bonds may tell a different story.

They may not be that risky at all.

The high-yield municipal sector comes in many flavors, each with its own set of rules and covenants. But the thing is, certain investors are still able to get very high yields at lower risk than their corporate rivals. In the end, high munis may not be that risky at all.

Revenue-Backed Bonds

When investors think about municipal bonds, they often think about general obligation (GO) bonds. Here, the State of New York or the City of Houston issues debt to help fund their operations. The ability to repay these bonds is directly tied to the municipality’s ability to tax, either through payroll, property, sales, use or other means.

However, there is another side of the muni market.

These are project-backed municipal bonds. These bonds are issued to fund essential services that are financially independent from the city, county or state they serve. Generally, they are not GO bonds and are paid for via the revenues generated by the project.

Some examples of these project-based bonds include health care, which include hospitals to nursing homes; education and charter schools, both public and private schools; transportation and toll roads, including mass transit, light-rail, bridges, and highways; tobacco settlement bonds; and utilities, including sewer, water, and electric. Other revenue bonds include funding for stadiums, convention centers, and Tribal gaming facilities.

Because these bonds are not backed by the taxing authority of a state, but by the revenues they generate, they do carry more risk than a general obligation bond. As such, they feature higher yields than GO bonds. That gives them the high yield moniker.

High Yield Doesn’t Mean Higher Risk

However, higher yields doesn’t mean higher risks. In fact, it’s quite the opposite. Looking at default rates, high-yield munis are pretty steady as they go.

According to Moody’s, 6.94% of all high-yield municipal bonds defaulted within 10 years of their issuance between 1970 and 2021. This compares to 0.9% of investment-grade municipal bonds during that time. By comparison to investment-grade munis, high-yield munis may be considered ‘junk.’ But that’s not the case when looking at high-yield or investment-grade corporate bonds. In that time frame, nearly 30% of high-yield corporate bonds defaulted. Meanwhile, the lowest tier of investment-grade corp. bonds have a long-term default rate of 5.5%. 1

Those lower default rates are due to a variety of factors. These include the essential services demand of their revenue generation. But many high-yield munis also have other provisions for payback. According to asset manager Nuveen, many high-yield munis issued in recent times come with various covenants designed to support bondholders. This includes first liens on the property or assets, revenue pledges, and even limited tax revenue pledges. Here, property taxes and even sales taxes from the area around the project are pledged to support the bond’s repayment.

If it’s not the bonds or projects themselves, where does the perception of risk come from when it comes to high-yield muni bonds? According to Nuveen, it might be the liquidity factor. Truth be told, municipal bonds of all stripes hardly trade. They are very much a ‘buy and hold’ investment, with mostly institutional investors like pensions or endowments doing the buying. However, headline risks can shake up the sector, particularly high-yield munis. Because of the lack of overall liquidity and the fact that munis trade on the over-the-counter markets, prices for high-yield munis can dramatically shift.

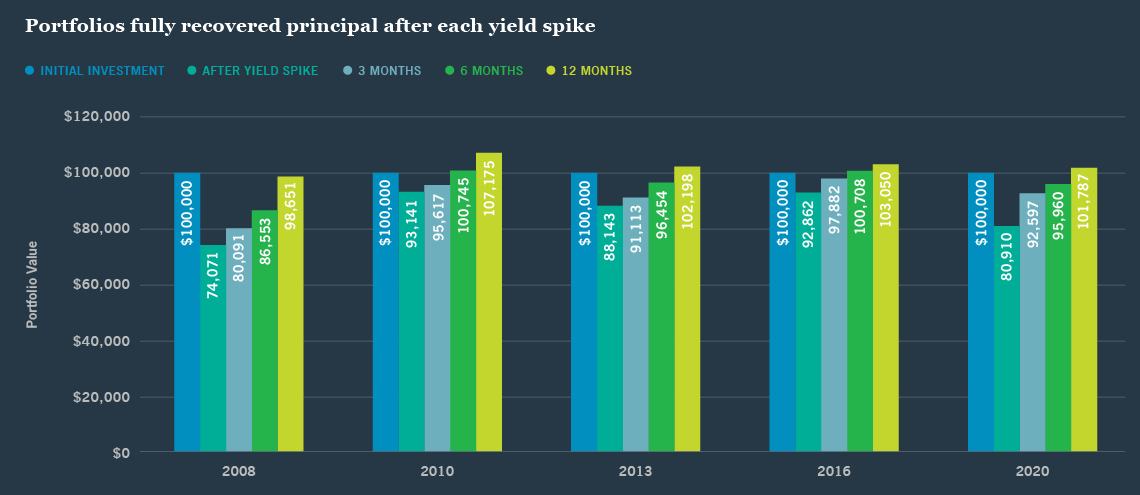

However, these shifts in price are often short-lived. This chart from the asset manager shows that after initial yield spikes/price sell-offs, high-yield munis quickly rebound. For example, during the credit crisis of 2008, high-yield municipal prices fell dramatically. However, the vast bulk of the sector continued to pay interest and principal during that time.

Source: Nuveen

According to Nuveen, it’s the overall perception of risk that gives high-yield munis a bad rap. But in reality they aren’t as risky as many investors think. Loan covenants, steady revenue generation, and rock-bottom default rates are hallmarks of the bond sector.

Adding Some High-Yield ‘Risk’

Now, there is one potential downside to high-yield municipal bonds and that’s taxes. Munis are prized for their ability to provide federal and sometimes state tax-free interest. However, high-yield munis don’t always count and can be subjected to the so-called alternative minimum tax (AMT). But thanks to continued changes to the AMT, the number of taxpayers that are subjected to the system has dropped to roughly just 250,000 Americans. So, most of us won’t have to worry and still can enjoy high tax-free yields.

Getting exposure to high-yield muni bonds is easy, if you choose a broad approach and let someone else do the buying. As Nuveen noted, it’s the lack of liquidity that gives high-yield bonds their risk in the short term. Buying individual muni bonds is a very tough thing to do. As a result, using a fund or ETF to gain exposure is the only game in town.

But luckily, several choices exist and investors have opportunities to add a swath of high-yield munis and their less risky yields to their portfolios. Adding these funds to a taxable account allows investors to take advantage of the asset class and it’s ‘less risk.’

High-Yield Municipal Bond ETFs

These funds were selected based on their exposure to the high-yield municipal bond market and are sorted by year-to-date total return, which ranges from 0.5% to 1.2%. They have assets under management between $82M and $2.9B and expenses between 0.32% to 1.82%. They are currently yielding between 2.9% and 4.7%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| HYMB | SPDR® Nuveen Bloomberg High Yield Municipal Bond ETF | $2.52B | 1.2% | 4.3% | 0.35% | ETF | No |

| XMPT | VanEck CEF Muni Income ETF | $238M | 1.2% | 4.5% | 1.82% | ETF | No |

| HYMU | BlackRock High Yield Muni Income Bond ETF | $82M | 1.2% | 4.3% | 0.35% | ETF | No |

| FMHI | First Trust Municipal High Income ETF | $573M | 1% | 4% | 0.7% | ETF | Yes |

| SHYD | VanEck Short High Yield Muni ETF | $328M | 0.9% | 2.9% | 0.35% | ETF | No |

| HYD | VanEck High Yield Muni ETF | $2.9B | 0.8% | 4% | 0.32% | ETF | No |

| JMHI | JPMorgan High Yield Municipal ETF | $175M | 0.5% | 4.7% | 0.49% | ETF | Yes |

In the end, high-yield municipal bonds have a bad reputation, as they are often lumped in with regular junk bonds. However, high yield in this case doesn’t mean extra risk. In fact, the sector can be just as steady as regular investment-grade munis and corporate bonds. With that, investors have a real opportunity to add some meaningful yield to their portfolios.

The Bottom Line

When investors see the words ‘high yield’, they immediately think of high risk. But for high-yield municipal bonds, nothing is further from the truth. The sector isn’t as risky as many investors think thanks to steady revenues and loan covenants. With that, investors have a chance to buy good yields at low prices.

1 Moody’s (July 2023). US municipal bond defaults and recoveries, 1970-2022