Driven by their tax-free interest and current high yields, municipal bonds have continued to be in the spotlight. More investors have continued to add the bond variety to their portfolios to take advantage of these benefits. And, increasingly, they are choosing so-called general obligation (GO) bonds. Issued by state and local governments, these bonds are backed by the taxing authority of municipalities, giving them an aura of safety.

But just how safe are they when compared to other municipal bond varieties?

According to investment manager Thornburg, perhaps not as safe as investors think. While they feature lower rates of default, the carnage tends to be worse when they do have issues. For investors building out their municipal bond portfolios, it pays to be diversified.

The More Popular Municipal Bond Category

Historically, municipal bonds have been a preferred stomping ground for the rich and high-net-worth investors. Issued by local and state governments to help fund public projects or municipal government operations, munis – for the most part – are free from federal taxes. In some instances, they are free from state and local taxes as well. This has resulted in more and more investors of all income bands quickly discovering their benefits.

But, like many corners of the bond sector, not all municipal bonds are the same. They basically fall within two broad categories: revenue-backed bonds and GO bonds.

Despite being just 28% of the $3.8 trillion municipal bonds market, GO bonds are the most popular among retail investors and tend to be what we think of when we define municipal bonds. GO bonds are issued by state or local governments whose repayment is driven by these entities’ taxing authorities. This differs from revenue bonds whose repayment is driven by the cash flows of a specific project.

As such, GO bonds have long been the top choice for many municipal bond investors. The ability for the State of Texas or the City of Anaheim to raise taxes to cover their bonds adds a level of safety and reduced risk to these bonds.

Less Safe Than We Think

There is data to support the idea that GO bonds are safe for investors – chief of which are their default rates and credit ratings.

Looking at credit ratings, 62% of all general government bonds, which includes GO bonds, are rated investment grade (Aa3 or higher), while only 41% of revenue bonds have that rating. The flip side is that less than 6% of GO bonds are in the Baa category, which is one notch above junk. That number is over 18% for revenue bonds. 1

As for defaults, GO bonds rarely go bust. Looking at all the municipal bond defaults from 1970 to 2020, less than a quarter of them have been GO bonds. Again, the taxing authority of the state or city has helped keep those defaults low.

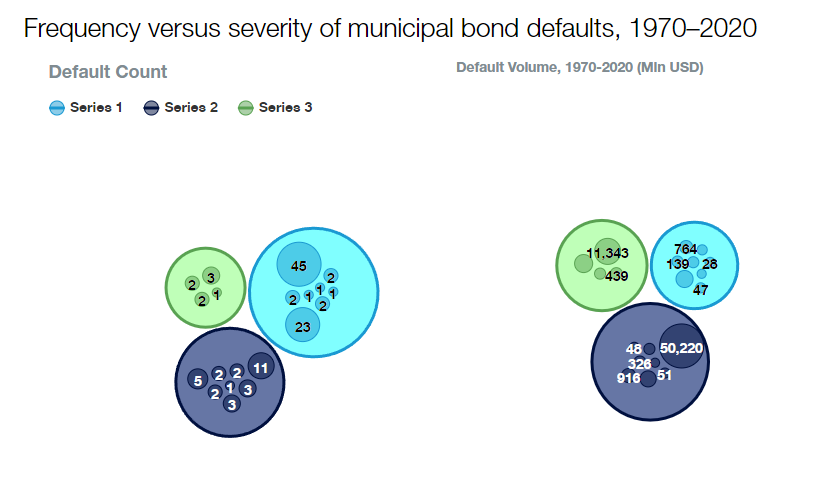

But according to Thornburg, this has led investors into a false sense of security, because when GO bonds do default, they really go boom. This is because the dollar amount of the defaults are much greater. Even though they comprised less than a quarter of all defaults, GO bonds were responsible for over 75% of the dollar volume or value of the defaults. This chart shows the magnitude of the defaults. The group of circles on the left shows the number of defaults within the various muni categories GO bonds (dark gray), utility bonds (green) and competitive enterprises (blue). But you can see by the circles on the right that the dollar amount of GO bond defaults has been relatively greater than the other 2 categories.

Source: Thornburg

Because of this, investors can’t always assume that GO bonds will keep them safe. Moreover, recent examples have underscored that not all general obligation bonds will keep their promises.

Both Detroit’s and Puerto Rico’s recent defaults are examples. During these default periods, both entities stopped paying on their GO bonds but still made 100% payments on their water, sewer, and other essential services bonds. In the case of Detroit, the city tried to treat its GO bondholders as “unsecured” creditors, and because the bankruptcy was settled out of court, no legal precedent was set determining if GO bondholders could be treated as such. At the same time, Puerto Rico reneged on the “constitutional priority” of its GO bonds, choosing to safeguard the essential needs of its residents. GO bondholders took significant haircuts in both scenarios.

These two major defaults have thrown a lot of risk onto the world of GO bonds in terms of future defaults and just how bondholders will be treated. While defaults don’t happen as often, when they do, things for bondholders could be very ugly indeed. As such, the market has been repricing risk amid the muni space in recent years. Revenue bonds have historically been higher yielding, and they still are. However, the spread between GO bonds and revenue bond yields has continued to drop in recent years.

Repricing GO Risk

For investors, Thornburg’s missive on GO bonds and their mispriced risk is certainly food for thought. There are some hidden dangers, and when things do go bust, investors may be without a life preserver. Overall, GO bonds may not be the best place for investors to park all their money when it comes to allocating to municipal bonds. This idea is only strengthened when you consider that many revenue bonds in recent years have come with extra provisions to help support their payments, including the backing of revenue with certain taxes.

Perhaps the only good news is that the vast bulk of investors use ETFs and mutual funds to get their muni exposure. Major muni indices, such as the ICE AMT-Free US National Municipal Index or Bloomberg Municipal Managed Money 1-25 Years Index, have about 50% to 60% of their holdings in GO bonds. This diversification among various muni types should help limit losses even if there is a major Detroit- or Puerto Rico-styled blowup.

But for investors who do hold individual muni bonds, they may want to seriously consider what they hold, and perhaps go broad via an ETF or fund.

Municipal Bond ETFs

These ETFs were selected based on their exposure to municipal bonds at a low cost. They are sorted by their 1-year total return, which ranges from 0.5% to 2.5%. They have expense ratios between 0.05% to 0.65% and assets under management between $930M to $34B. They are yielding between 1.7% and 3.4%.

| Ticker | Name | AUM | 1-year Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| FMB | First Trust Managed Municipal ETF | $1.8B | 2.5% | 3.2% | 0.65% | ETF | Yes |

| MUNI | PIMCO Intermediate Municipal Bond Active ETF | $1B | 2.4% | 3.4% | 0.35% | ETF | Yes |

| MUB | iShares National Muni Bond ETF | $34B | 1.4% | 3% | 0.05% | ETF | No |

| SUB | iShares Short-Term National Muni Bond ETF | $8.8B | 1.4% | 2.1% | 0.07% | ETF | No |

| VTEB | Vanguard Tax-Exempt Bond ETF | $29B | 1.3% | 3.1% | 0.05% | ETF | No |

| DFNM | Dimensional National Municipal Bond ETF | $933M | 1% | 2.9% | 0.19% | ETF | Yes |

| SHM | SPDR Nuveen Bloomberg Short Term Municipal Bond ETF | $3.9B | 0.5% | 1.7% | 0.20% | ETF | No |

All in all, GO bonds have long been the “safe choice” for municipal bond investors. Thanks to their tax-backed nature, defaults are rare. However, Thornburg’s research shows that GO bonds can default – and when they do, it’s a big failure. This is a risk that many investors are not considering when they buy these bonds. The answer is to be diversified and perhaps take a look at revenue-backed bonds for added diversification.

Bottom Line

Municipal bonds have surged in popularity in recent years. Much of that popularity has been squarely focused on GO bonds due to their taxing ability. However, investors may not want to get too complacent. There are big risks to consider when choosing the GO bond route for municipal bond exposure. Defaults do happen – and when they do, it’s a very big issue for GO bondholders.

1 Thornburg (March 2023). Are General Obligation Bonds the Safest Municipal Bonds?