With the first quarter now nearly done, some significant trends are starting to emerge that could continue throughout the year. This is particularly true in the fixed income sector. While all bonds seem to be offering high yields and strong return aspects after the last few years of routing, some might be better than others. The question is which ones and how do we choose?

State Street has the answer.

The asset manager’s latest missive on the bond market shows three distinct trends and fixed income asset classes that could perform well in the new year. The best part is these asset classes can be easily added to a portfolio via ETFs.

The Set-up

According to State Street, the current economic environment is an interesting one for investors to navigate, especially those looking toward fixed income. That’s because a combination of macro and micro events is taking place at the same time.

For starters, we all know the Federal Reserve and its interest rate policy has been playing chicken with investors. To fight surging inflation, the Fed raised rates to levels not seen in decades. That has benchmark rates now sitting at 5.5%. The issue is what comes next.

The Fed has paused, which has historically meant a cut is in the works. However, inflation has been stubborn and the Fed can’t seem to make the leap to cutting rates. The high interest rate environment has also started to impact economic growth. But the impact hasn’t started a recession as there are pockets of strength still around.

This has created an interesting and perhaps difficult environment for bond investors to navigate. But the asset manager does have a few suggestions of where to find pockets of strength and good returns as this environment plays out.

Short-Term Sovereigns

‘Higher for longer’ has quickly become the rallying cry for bond investors. The inaction of the Fed—as well as other central banks in the developed world—with regard to cutting rates has benefited those investors in cash and ultra-short-term bonds. However, when the cuts come—and they will—those investors will suffer and find lower returns.

This is due to reinvestment risk. The nature of cash and cash-like bonds is that when the cuts happen, these bonds will feel the effects instantly. When investors try to move out on the curve, longer-dated bonds will have already gone up in price and reduce their yields. The idea is to get ahead of this fact and add duration today.

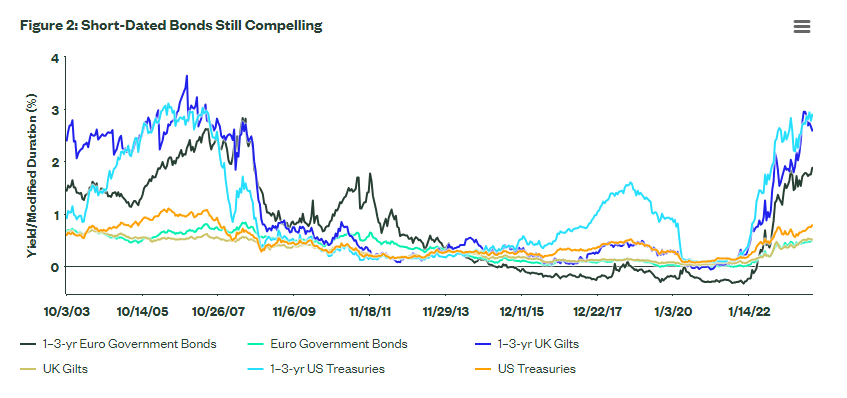

The answer to State Street is to focus on short-term sovereigns’ bonds. Sovereigns are issued by governments such as the United States, the U.K. or the Eurozone. These offer the safety of cash, but by going out a few years—say, one to three years—investors can lock in a higher yield today to prepare for the cut tomorrow. At the same time, they are still as good and liquid as cash. This chart shows the current higher yields on a range of sovereign issues. 1

Source: State Street

And while there are plenty of opportunities in this market, State Street recommends U.S. Treasuries as the best place for investors to tread to capture the effect.

Emerging Market Debt

After investors have their safety under wraps, returns should be on their minds. And one of the most compelling opportunities for returns according to the investment bank could be emerging market bonds (EMBs).

For one thing, yields on EMBs are now at very high levels. Thanks to volatility, high rates on cash, and overall flights to safety over the last year, EMBs are now paying 5.69% for investment-grade and 11.7% for high-yield debt. The interesting thing is that those high yields mask improved credit quality.

Looking at the make-up of major EMB indexes, the number of issuers in the top tiers of credit quality for both high-yield and investment-grade have increased. Upgrades and improved cash flows of the underlying issuers have simply improved the make-up of the indexes. In investment-grade, Gulf states backed by petro-revenue have been the top bond issuers, while in higher yield, default events from troubled nations have already occurred.

Overall, investors have the opportunity to score some very good yields with strong credit quality in EMBs.

Get Ready for High-Yield Credit

State Street’s third recommendation plays into the U.S. high-yield and junk bond market. Thanks to the bond rout of 2022 and first half of 2023, high-yield bonds are now actually high yield again. Today, yields for junk bonds are close to 8%. That’s a good starting point for investment. And like EMBs, the credit quality of major high-yield indexes has become stronger.

However, caution is still warranted. State Street does expect defaults and issuers to face trouble as the ‘higher for longer’ environment persists and those firms needing to refinance are forced to deal with a higher cost of funding. That means investors shouldn’t just buy broader bond indexes here. Or at least not yet.

State Street suggests being active with their high’yield purchases to take advantage of value/compelling credit opportunities or waiting until the tide turns to buy broader index funds in the sector.

Playing State Street’s Recommendations

With the current market environment giving investors a lot to think about, it makes sense to try following whatever trends are being thrown their way. To that end, State Street’s advice seems very actionable at the moment. Luckily, it’s easy to adapt a fixed income portfolio to follow their recommendations.

There are numerous ETFs that cover short-term U.S. Treasuries, emerging market debt, and active high-yield bonds, including several from State Street. For example, investors can use the SPDR Portfolio Short-Term Treasury ETF, SPDR Bloomberg Emerging Markets USD Bond ETF, and SPDR Blackstone High Income ETF to quickly add the asset’s classes to a portfolio. The idea is to use these asset classes to complement a core portfolio of bonds, step out of cash into short-term Treasury funds, and add a bit of spice with the high yield and EMBs.

Ultimately, these asset classes should provide some of the best returns throughout the year and offer great plays in the current environment, no matter what the Fed throws investors’ way.

ETFs to Play State Street's Recommendations

These funds were selected based on their ability to tap into short-term Treasury bonds, emerging market debt, and junk bonds at a low cost. They are sorted by their YTD total return, which ranges from -0.44% to 0.80%. They have expense ratios between 0.03% and 1.02% and have assets under management between $135M and $26B. They are currently yielding between 3.6% and 8.1%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| HYBL | SPDR® Blackstone High Income ETF | $136.42M | 0.8% | 8.1% | 0.70% | ETF | Yes |

| EMB | iShares J.P. Morgan USD Emerging Markets Bond ETF | $14.44B | 0.3% | 5% | 0.39% | ETF | No |

| SHY | iShares 1-3 Year Treasury Bond ETF | $25.71B | 0.1% | 3.6% | 0.15% | ETF | No |

| VGSH | Vanguard Short-Term Treasury Index Fund | $24.63B | 0.1% | 4% | 0.04% | ETF | No |

| SPTS | SPDR® Portfolio Short Term Treasury ETF | $5.42B | 0.1% | 4.3% | 0.03% | ETF | No |

| VWOB | Vanguard Emerging Markets Government Bond Index Fund | $4.41B | -0.1% | 6% | 0.20% | ETF | No |

| HYLS | First Trust Tactical High Yield ETF | $1.47B | -0.1% | 6.5% | 1.02% | ETF | Yes |

| EMHC | SPDR Bloomberg Emerging Markets USD Bond ETF | $351.5M | -0.44% | 4.5% | 0.23% | ETF | No |

The Bottom Line

The current market environment is an interesting one for investors to navigate, particularly when it comes to fixed income. However, State Street has some recommendations for portfolios. Thanks to several trends and tailwinds, short-term Treasuries, emerging market debt, and selective high-yield bets could pay off big for investors.

1 State Street (December 2023). Fixed Income Outlook 2024: Bonds Take Center Stage