Rebound. That could be the best way to describe the last year of returns for the broader bond market. After 2022’s Federal Reserve induced rout, bonds bounced back in a big way last year, producing some of the best returns in decades. And in those strong total returns, bonds faced yield compression and price appreciation.

The question is now, after all the rallying, do fixed income assets have any value left?

The answer may be a resounding yes. According to J.P. Morgan, several tailwinds and factors could help propel bonds to produce strong returns this year. And while bonds may not be a screaming value like before, they are still assets worth owning and trading for low valuations.

A Big Surge Higher

Truth be told, 2022 is a year that bond investors would love to forget. Surging inflation—the highest since the 1980s—caused the Federal Reserve to act quickly. The central bank raised rates to 5.5% over a series of months. With their inverse relationships, returns for a variety of bonds were poor.

In fact, 2022 was the worst year for bonds in over 250 years of data. You’d have to go all the way back to the Napoleonic Wars to find a worse return. All in all, the main bond benchmark—the Bloomberg Aggregate Bond Index (Agg)—lost more than 13%. But some areas of the bond market did worse. For example, U.S. 30-year bonds lost more than 39.2% in 2022.

But the markets rarely stay down for long. After simply trudging along during the first half of 2023, stocks and bonds rebounded sharply by the end of the year. The Agg managed to produce a strong 8.5% return. Even the sleepy and staid municipal bond sector managed to generate an 8.8% annual return. This bested the average annual return on the S&P 500 since 2000 by over two full percentage points.

That surge in prices sent yields lower. Over the last six months, the 10-year Treasury bond has seen its yield decline by 100 basis points.

The problem is some market pundits and investors have started to surmise that bonds may not be a good buy anymore after such a historic run-up. A lot of growth and expectations have been built into bonds and those assumptions may not come true. Investors looking toward bonds for similar returns may be let down.

Plenty of Tailwinds

Playing the other side of that equation is investment bank J.P. Morgan. According to the investment manager, bonds are still very much a value and can offer some good gains in the new year. Part of that has to do with the potential of the Fed to actually engineer its soft landing and the ability of bonds to protect if it does not.

For starters, economic data has started to return to pre-COVID levels. However, monetary policy has not. JPM reports that the Fed is ‘very focused’ on not staying too tight for too long. This supports a growth over inflation mindset. Recessionary risk isn’t off the table, but it has certainly been reduced.

As a result, JPM now predicts the Fed will cut around 200 basis points over the next two years to settle benchmark rates at 3.5%. This would push the 10-year yield lower to 3.75%, down from the over 4% it is today. 1

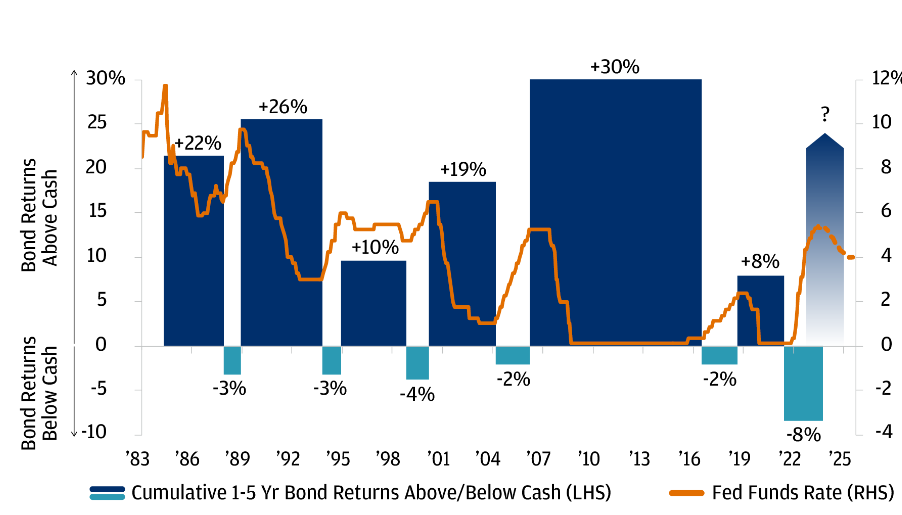

Looking at historical data, that should help on bond returns, even after the rally. Looking at returns when the Fed cuts or raises rates, JPM estimates bonds could still see more gains in the tank. This chart from their private bank shows the potential and historical returns when the Fed funds rate rises or is cut.

Source: J.P. Morgan Private Bank

Based on previous cutting cycles, bonds could have the potential to rally 30% or more.

This is true if the economy enters a recession and the Fed is forced to act very quickly. Under that scenario, bonds are very cheaply valued versus equity markets, which are pricing in a lot of growth.

The best part is that it’s not just the U.S. that is experiencing similar trends with regard to fixed income. J.P. Morgan’s Private Bank shows that overseas, the European Central Bank and developed European economy is facing similar trends toward rate cutting.

Playing the Value in Fixed Income

After experiencing the highest risk-free rate on cash in over 15 years and one of the best bond rallies in recent memory, fixed income assets still have potential. But investors need to be swift in boosting their exposure. JPM cites that reinvestment risk is real and they need to get out ahead of turn.

This means extending their durations in their portfolios.

For investors in cash, short-term bonds—those with maturities of one to three years—could prove to be a low-volatility way to lock in high yields. While they yield slightly less than cash today, they’ll keep those yields tomorrow. Conversely, T-bills and cash will be the first to see their yields drop.

For investors looking more tactically, longer-duration bonds could be big winners. The 10-year and even 30-year bonds could offer real value and yield as the Fed cuts. In the meantime, investors still have plenty of opportunity to make money on the carry and coupon clip until it does cut.

Short-Term Bond ETFs

These ETFs are selected based on their ability to tap into short-term duration bonds at a low cost. They are sorted by their one-year total return, which ranges from 1.9% to 5.2%. Their expense ratio ranges from 0.03% to 0.55%, while they yield between 2.1% and 4.6%. They have AUM between $730M and $58B.

| Ticker | Name | AUM | 1-year Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| DFSD | Dimensional Short-Duration Fixed Income ETF | $1.55B | 5.2% | 2.8% | 0.17% | ETF | Yes |

| SPSB | SPDR Portfolio Short Term Corporate Bond ETF | $7.3B | 5.1% | 4.6% | 0.04% | ETF | No |

| FSIG | First Trust Limited Duration Investment Grade Corporate ETF | $731M | 5.0% | 4.6% | 0.55% | ETF | Yes |

| LDUR | PIMCO Enhanced Low Duration Active ETF | $989M | 4.4% | 4.6% | 0.51% | ETF | Yes |

| BSV | Vanguard Short-Term Bond ETF | $58B | 3.2% | 2.9% | 0.04% | ETF | No |

| SHY | iShares 1-3 Year Treasury Bond ETF | $26B | 3.0% | 3.5% | 0.15% | ETF | No |

| SCHO | Schwab Short-Term U.S. Treasury ETF | $12.4B | 2.8% | 4.6% | 0.03% | ETF | No |

| SUB | iShares Short-Term National Muni Bond ETF | $8.8B | 1.9% | 2.1% | 0.07% | ETF | No |

Investment-Grade Bond ETFs

These funds were selected based on their exposure to investment-grade bonds at a low cost and are sorted by one-year total return, which ranges from 2.8% to 6.9%. They have expenses of 0.03% to 0.25% and yields from 2.8% to 5.1%. They have assets under management between $880M and $59B.

| Ticker | Name | AUM | 1-year Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| NEAR | BlackRock Short Duration Bond ETF | $3.18B | 6.9% | 4.6% | 0.25% | ETF | Yes |

| LQD | iShares iBoxx $ Investment Grade Corporate Bond ETF | $27.9B | 5.3% | 4.3% | 0.14% | ETF | No |

| SPBO | SPDR Portfolio Corporate Bond ETF | $886M | 5.1% | 5.1% | 0.03% | ETF | No |

| VCLT | Vanguard Long-Term Corporate Bond ETF | $6.44B | 4.1% | 4.4% | 0.04% | ETF | No |

| VTEB | Vanguard Tax-Exempt Bond ETF | $29.3B | 3.3% | 3.1% | 0.05% | ETF | No |

| BSV | Vanguard Short-Term Bond ETF | $58.8B | 3.2% | 2.9% | 0.04% | ETF | No |

| GOVT | iShares U.S. Treasury Bond ETF | $23.2B | 0.5% | 2.8% | 0.05% | ETF | No |

| SPTS | SPDR Portfolio Short Term Treasury ETF | $5.82B | 2.8% | 4.1% | 0.03% | ETF | No |

In the end, the fixed income sector still has plenty to offer investors. The surge was wonderful for bond investors. Now there still is plenty of return potential to be had as the Fed actually does its job and reduces interest rates.

The Bottom Line

After a historic decline, bonds rallied by an historic amount. Now, many analysts have questioned if bonds are overvalued. The answer may be a resounding no. There is still more room for fixed income assets to surge as the Fed cuts and returns to normalcy. To that end, expanding your duration and adding bonds to your portfolio makes sense.

1 J.P. Morgan (January 2024). Is there still value in fixed income??