Fixed income investors have a lot of choices these days to build their portfolios. The world of IOUs has quickly grown from bread-and-butter bonds to include a variety of more complex asset classes and security types. And in many instances, these other fixed income asset classes can provide plenty of high yields and even capital appreciation.

One of these happens to be mezzanine debt or junior credit.

Falling under the private credit banner, mezzanine debt offers investors many benefits through its combined bond/equity structure. This can include high yields and better long-term returns than other forms of esoteric bonds, all without taking on too much additional risk. For fixed income seekers, mezzanine debt could be an interesting choice for their portfolios.

A Different Form of Private Capital

The Great Recession turned the lending world on its head. Thanks to the wide-sweeping Dodd-Frank Wall Street Reform and Consumer Protection Act, the types of lending activities that banks could enter into are now limited. But the demand for capital never ceases. To that end, a variety of non-bank lenders have emerged, including pension funds, private equity players, insurance funds, and even mom-and-pop investors.

The concept of private credit was born.

When most investors think of private credit, they think of senior loans. Senior loans are typically tied to physical assets such as pipelines, factory equipment, accounts receivable or even intellectual property. That provides a bit of safety to the bonds during bankruptcy proceedings. The ‘senior’ in senior loans means loan-holders are paid first if a company defaults.

However, senior loans aren’t the only fish in the private credit sea. Another choice is mezzanine debt.

Mezzanine debt is a junior form of debt that is just above equity but below senior loan-holders in the capital structure. It blends the line between the two pieces of the capital structure. Unlike senior loans—which are backed by the value of the firm’s asset—mezzanine debt is backed by the value of its cash flows. Also, unlike senior loans, which tend to feature floating coupon payments, mezzanine debt is typically fixed rate. Moreover, the payments are interest only until repayment, which have longer timelines than most senior loans. Additionally, mezzanine debt interest can be repaid in cash, in equity or a combination of both.

Businesses often choose mezzanine debt for a variety of reasons. This can include not wanting to lose too much control via an equity raise or failing to secure additional credit facility from a bank.

Benefits for Investors

So why should investors care about junior credit and mezzanine debt? How can it benefit a fixed income portfolio? It turns out, in a lot of ways.

For starters, how about high yields? Because the debt is unsecured—unlike senior loans—and is strictly based on the firm’s historic and future predicted cash flows, mezzanine debt comes with higher initial coupon payments than senior loans or traditional corporate bonds, typically in the range of 12% to 20%. This doesn’t include the potential for additional pay-in-kind equity warrants, which are usually in the 2% to 4% range.

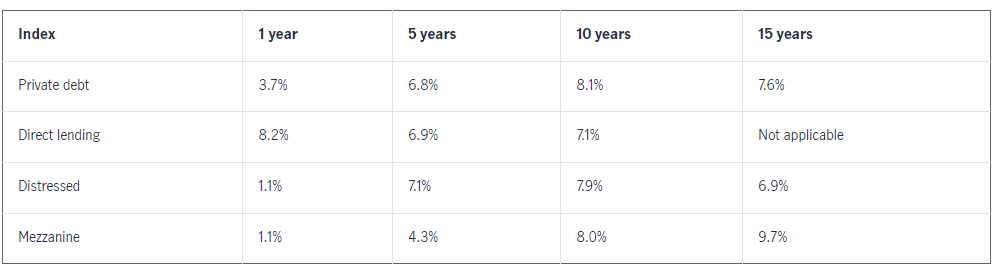

Those warrants and equity kickers serve a valuable purpose when it comes to total returns. The extra equity mezzanine investors receive can help on the capital appreciation front as the business takes off or even IPOs. As a result, mezzanine debt has been one of the best performers of all private credit types over the long haul. This table from Manulife highlights the debt forms strong returns over 5-, 10-, and 15-year periods.

Source: Manulife

Part of that return may also come from various risk controls and the mezzanine’s de-risking over time. Mezzanine debt is often used for a special purpose—like a buyout—rather than simply to raise funds. Many firms will often have senior debt capacity that is built up over time to refinance a mezzanine loan before maturity. The long-term timeline of a mezzanine loan allows these types of special events to take hold, play out, and generate capital to help build credit to refinance. Over time, the borrower of a mezzanine loan gets less risky.

Additionally, Manulife highlights mezzanine’s ability to weather downturns. The debt form was one of the best-performing IOUs during the Great Recession and has historically provided plenty of income during recessions. 1

Getting Into the Middle

With mezzanine debt offering high yields and plenty of outsized returns, investors may want to consider the debt form for their portfolios. Private equity and institutional investors certainly have. According to alternatives index and data provider Preqin, there was 55% year-on-year increase in mezzanine fundraising in 2023. And with rates high and lending becoming tight for senior loans, analysts expect the number of funds and mezzanine loan deals to continue moving higher.

So how to get exposure? Well, this is the tricky part. Unless you’re an accredited investor, accessing a mezzanine debt fund is pretty much impossible. But there are ways to get around that and hold mezzanine debt.

One could be via a collateralized loan obligation (CLO) ETF. CLOs are essentially a ‘package’ of loans that are placed into a single security. Many CLOs are made up of senior and mezzanine loans.

Another could be to bet on the direct lenders themselves. Business development companies (BDCs) are non-bank lenders that provide capital to businesses. Often these include mezzanine debt. While it isn’t a perfect solution—as this exposes investors to equity risk—BDCs often have very high yields, many times in the double digits.

Mezzanine Debt-Focused ETFs

These ETFs were selected based on their exposure to mezzanine debt directly via collateralized loan obligations (CLOs) or via business development companies (BDCs) and are sorted by YTD total return, which ranges from 2.1% to 4.9%. They have assets under management between $113M and $7.5B and expenses between 0.20% and 11.17%. They are currently yielding between 6% and 11.4%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| BIZD | VanEck BDC Income ETF | $1.03B | 4.9% | 11.4% | 11.17% | ETF | No |

| JBBB | Janus Henderson B-BBB CLO ETF | $375.15M | 3.6% | 7.6% | 0.50% | ETF | Yes |

| CLOI | VanEck CLO ETF | $284.91M | 2.7% | 6% | 0.40% | ETF | Yes |

| CLOA | BlackRock AAA CLO ETF | $113.69M | 2.2% | 6.09% | 0.20% | ETF | Yes |

| JAAA | Janus Henderson AAA CLO ETF | $7.46B | 2.1% | 6.2% | 0.22% | ETF | Yes |

In the end, mezzanine debt is an interesting portfolio addition if you can get your hands on it. While the above methods aren’t perfect, they do provide some exposure to the fixed income asset class. As it continues to grow in size, more options for adding mezzanine debt to a portfolio should grow as well.

The Bottom Line

There are many different varieties of fixed income assets and mezzanine debt could be one of the best. Offering a middle placement in the capital stack, this junior debt provides plenty of high yields and high returns, while providing de-risking opportunities as time goes on.

1 Manulife (July 2023). Mezzanine financing can shine when macro clouds loom